Meta

A structural failure in corporate governance.

What is Meta?

According to their latest annual report, Meta META 0.00%↑ is:

Our mission is to give people the power to build community and bring the world closer together. All of our products, including our apps, share the vision of helping to bring the metaverse to life.

(...)

We report financial results for two segments: Family of Apps (FoA) and Reality Labs (RL). For FoA, we generate substantially all of our revenue from selling advertising placements to marketers. Ads on our platforms enable marketers to reach people based on a variety of factors including age, gender, location, interests, and behaviors. Marketers purchase ads that can appear in multiple places including on Facebook, Instagram, Messenger, and third-party applications and websites. RL generates revenue from sales of consumer hardware products, software and content.

There was a whole lot of fluff in between there that I had to cut out in order to get to the actual important bit.

Meta is an ad company, with a small Virtual Reality hardware business attached to it.

That’s it.

Anything else about giving “people the power to build community and bring the world closer together” is just a way to get people on the platform that they can leverage to generate ad revenue.

I can’t seem to find any investor presentation to showcase the business strategy, but this letter from the founder and CEO Mark Zuckerberg is interesting if you would like to learn more about where they are going with the metaverse, and the reasons why they’ve rebranded the company and are going all in on this new business.

Additionally, they talk about this extensively in their annual meeting, which you can look at here.

This is a very significant change in strategy, and it’s interesting that it comes off the back of increasing regulatory scrutiny over Meta, which has already lead to failed acquisitions, as well as meaningful platform changes that have hampered its core ad business.

The idea here is supposed to be to use the metaverse to create a platform owned entirely by facebook, where they will be able to more clearly leverage their control to benefit their business. In a way it’s supposed to be similar to the way Google owns Android…

But the question is, is the metaverse the way to do it? Their core product in the metaverse so far has been hardware, rather than the social software they are normally known for, and so that represents a big shift in the skill set required.

Additionally, it’s not clear how the software portion of the metaverse will be monetized, though its likely that tracking and ads will be a major component there.

To be quite frank, I don’t buy any of this.

I think this move to “the metaverse” is nothing more than a wildly irresponsible mid-life crisis being driven by a CEO who is unwilling to transition the company from a high-growth to a low-growth strategy.

This is quite frankly a clear example of massive problems with the company's corporate governance, and those problems stem directly from the existence of multiple share classes allowing specific individuals to exert undue influence on the company's direction, without suffering the full negative impact of those decisions.

I want to be clear here from the get go.

Meta META 0.00%↑ is uninvestable.

And the reason it's uninvestable is not Mark Zuckerberg, but the shareholder structure that he is leveraging to maintain a level of control that is not in line with the costs faced by the decisions he takes.

Yes, the ad business is under threat, and the regulatory scrutiny is concerning, but neither of those are anywhere close to the deathblow that is a structurally flawed shareholder structure.

This is a shareholder structure that has already screwed over a co-founder, and the inclusion of the company in the S&P500 quite frankly showcases a major failure, irresponsibility and lack of care on the part of Standard & Poors.

Because of that, no matter what, I will not be investing in the company, but it’s still interesting to examine the business, and see how it works.

So, let’s do that.

Business

Strategy

As we mentioned before, Meta is an ad business focused primarily on tracking people and subsequently using the information they collect and process to offer customers the ability to advertise their products to specific people.

This tracking doesn’t just happen on their platforms, like facebook and Instagram, but also outside of their platforms. They use a number of ways of accomplishing this, from inserting specific functionality and APIs that allow other websites and companies to integrate their websites with facebook systems.

For example if you were to visit a news website, it’s likely that the website will have a “share” button that allows you to share the article you’re reading to facebook. This share button, by its very presence, allows facebook to track you whenever you visit that website.

In the same way, they have a dominant position in mobile apps, with the advertising functionalities and monetization strategies of most apps supporting facebook ads… and subsequently tracking.

This ability to track users and subsequently sell them ads is a major contributor to their revenue, and is what has allowed them to grow so big.

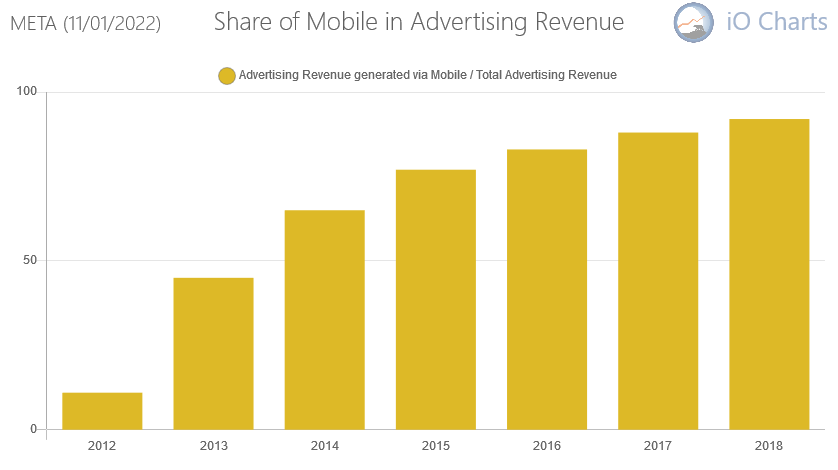

As you can see, their advertising business provides them with substantially all of their revenue, with the bulk of that revenue coming from mobile users.

Their transition to the Metaverse has so far not meaningfully changed the revenue distribution, with the non-advertising business primarily making its money via the sale of consumer hardware, software and content.

Reporting Segments

The company reports its financial results in two segments:

Family of Apps

Reality Labs

While the Reality Labs segment only has one major unit, the Family of Apps segment has 4 key pillars that are worth talking about:

Facebook. Facebook helps give people the power to build community and bring the world closer together. It's a place for people to share life's moments and discuss what's happening, nurture and build relationships, discover and connect to interests, and create economic opportunity. They can do this through News Feed, Stories, Groups, Watch, Marketplace, Reels, Dating, and more.

Instagram. Instagram brings people closer to the people and things they love. Instagram Feed, Stories, Reels, Video, Live, Shops, and messaging are places where people and creators can express themselves and push culture forward through photos, video, and private messaging, and connect with and shop from their favorite businesses.

Messenger. Messenger is a simple yet powerful messaging application for people to connect with friends, family, groups, and businesses across platforms and devices through chat, audio and video calls, and Rooms.

WhatsApp. WhatsApp is a simple, reliable, and secure messaging application that is used by people and businesses around the world to communicate and transact in a private way.

These segments each correspond to a specific app, and in general those apps are social networks with a specific focus, though often overlapping.

For example both Messenger and WhatsApp are chat application, and both Facebook and Instagram are more traditional social networks (though there Instagram leans more towards pictures, rather than sharing content).

As mentioned before, the bulk of revenues come from the Family of Apps segment, with Reality labs currently being nothing more than a rounding error.

Geographical Diversification

Meta operates everywhere in the world, and the only reason why its user-base acquisition has been faltering in the past few years is primarily because…

They already have everyone in the world using their products.

Indeed if we take a look at their Monthly Active Users we can see that it follows essentially the same distribution as the worldwide population.

This lack of places to grow into is a key part of the reason I think it’s well past time for companies to stop trying to be a Growth Company, and start focusing on returning capital to shareholders.

There are diminishing returns to growth, and quite frankly I fail to see how they can capture any more markets.

It’s clear Mr. Zuckerberg feels the same too, otherwise he wouldn’t be trying so hard to manufacture a new market with the Metaverse!

This leads to their ongoing efforts to downsize their firm.

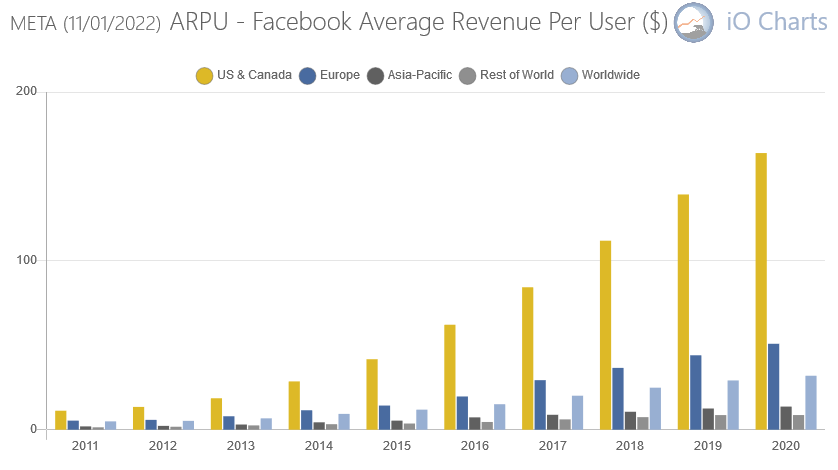

In general though, revenues per user are tilted towards the US and Canada, likely as a result of the significantly more developed internet advertising market in those countries, as well and a higher level of wealth that supports and makes such a developed advertising market possible.

Management

The found and CEO of Meta is Mark Zuckerberg, and in addition to founding the company, due to the multiple share classes that the business is structured into he has been able to maintain a controlling position in the company, even when his economic exposure to the business is quite a bit smaller.

Unsurprisingly for someone who made such a structure, he has a history of screwing over partners like we discussed earlier, and even in the current day he has regularly sold shares (though not control) while conducting ill advised and overpriced buybacks.

I want to be clear here, on an operational level, up until now, he has been a great CEO, managing a successful and growing business in an exceptional way.

He is a fantastic growth CEO, and many company would be well served with someone like him at the helm.

He has been smeared in the media, and undeservingly so, and i want to make it clear that my views here are not due to some antipathy towards him personally, or the business he built, or the business models he chose, or some poorly received comments he made.

My problem is the incentive structure he created and benefits from.

No CEO, no matter how good, is worth the problems that come with a structurally flawed shareholder structure, and the poor incentives that come with it. His treatment of his partners and investors too should serve as a warning to any would-be investors.

And as a general rule, his employees and management team follow his lead, even in selling the companies shares:

I don’t like this. I don’t like any of this.

Risks

Internal Risks

Structurally flawed Shareholder structure

Ill advised metaverse strategy that is burning a lot of cash

External Risks

Regulatory concerns

Limited growth path

Fundamental Data

Income Statement

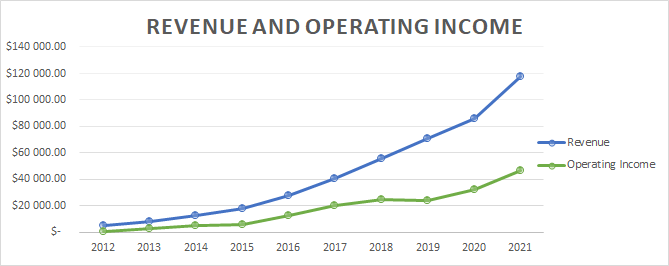

Overall the revenue and earnings growth is fantastic, and it’s clear that the company has a great underlying business.

Their margins are high, and growth is through the roof, all of the things investors should look for!

I don’t think growth will continue at this pace in the future, but the margins seem sustainable as long as they quit spending cash on the metaverse… So not too likely.

Revenue Growth

As we can see here, the company has grown their revenues at a whopping 42% CAGR over the past 10 years!

This is insanely good, and the fact that profits have come along with the revenue growth just proves that the companies underlying business economics are great!

Margins and Earnings

And these increased revenues have translated directly into earnings per share!

Too bad none of those earnings have found their way to the pockets of the shareholders via dividends!

Balance Sheet

This is a great balance sheet!

No debt, lots of cash on hand!

The company is in no danger of going bankrupt, and the 14% return on assets is fantastic, and showcases how this is an asset light business that doesn’t need a lot of stuff to generate revenues.

Indeed if you take away the company's cash, you can see a clearer return on invested capital, which is quite frankly fantastic.

Shareholder Equity

The book value of the company has consistently increased over time, and the bulk of its liabilities are what I call operational liabilities, that is, liabilities inherent to running a business.

This is good!

Debt Schedule

Much like what we saw with T. Rowe Price, Meta has no debt.

It’s very hard to go bankrupt when you have no debt.

I love this, and it’s a massive green flag to every investor!

It’s too bad there are so many red ones, including this recent issuance of a $10 billion bond in order to blow all in putting legs on a discount second life character.

Shareholder Returns

The company is not at all focused on returning capital to shareholders. Indeed, in aggregate it hasn’t returned any capital to shareholders throughout its lifespan.

Buybacks

Where to start here?

On the bright side the company has been buying back shares, spending $44 billion on those buybacks in 2021 alone!

Too bad they have been buying back shares at vastly overvalued multiples which resulted in billions in buybacks being wasted.

Overall the amount of shares bought back hasn’t even made up for the number of shares issued as stock based compensation since the company went public.

This is quite frankly a criminal misallocation of shareholders capital.

Dividends

The company does not pay dividends, even when it really, really should!

This is a company with stable and growing cash flows, that has been trading at elevated multiples, but instead of paying out a stable and growing dividend, it just has been squandering that cash on overpriced buybacks and a bad growth plan.

Strengths and Weaknesses

Strengths:

Solid and high margin core business

High potential for growth in revenues outside the US

Weaknesses

Lack of will to return capital to shareholders

History of poor capital allocation

Valuation

Key Ratios

Overall every single one of these ratios are fantastic, and any company would be happy to have them!

On a regular company without significant and structural issues with corporate governance this would be a huge green flag.

Standard Valuations

And of course, the fantastic ratios and historical performance result in equally fantastic valuations.

Like always I tend to favor the margin to PE method, though in this case the discounted earnings method might be more appropriate.

Regardless, all values (except the book value) are substantially above where the business is currently trading at.

Safe Purchase Value

And here we see a safe purchase value of $938 for a company that is trading at under $90.

This is a 90% discount that I would love to take advantage of if only there wasn’t a massive corporate governance problem that is making this company uninvestable.

Yes, I am salty about it.

This is a great company at a great price that is being wholly hamstrung by its corporate structure.

Investment Thesis

Key Points

The companies revenue growth is fantastic, but will likely not continue going forward

The companies margins are great

The company has little to no debt

The company is asset light

The underlying economics of the business is great, and will likely continue to generate earnings into the future

The company has significant and structural corporate governance issues

The company is blowing cash on an ill advised growth strategy

The company does not return cash to shareholders

Decision

There’s not doubt in my mind that this is a high quality company with a solid business model that has a bright future ahead of it.

It’s trading at a significant discount as to what it should be trading… were it not for the massive governance issues.

I highly recommend checking out this video by professor Damodaran about this issue.

I have no intention of buying the business because of it.

I have no intention of partnering with people who design structurally flawed shareholder structures, so that they can benefit from those flaws.

Current Stance: SELL

You may have another view, I don’t blame you, but this business is not for me, or you.

This business is for Mark Zuckerberg.

Let me know in the comments below!