Leggett & Platt

A boring company with a boring business model

What is Leggett & Platt?

According to their annual report, Leggett & Platt LEG 0.00%↑ is:

Leggett & Platt, Incorporated ("Leggett & Platt," "Company," "we," "us," or "our"), a pioneer of the steel coil bedspring, has become an international diversified manufacturer that conceives, designs, and produces a wide range of engineered components and products found in many homes and automobiles.

(...) our operations are organized into 15 business units, which are divided into seven groups under our three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products.

In other words Leggett & Platt designs and manufactures components for bed, furniture, automobiles, etc…

It’s an industrial company, though unlike other industrial like 3M, LEG 0.00%↑ is not nearly as high profile, and it doesn’t generally sell its products to consumers. Indeed the company is primarily a supplier of components that other companies then use to manufacture their own products.

If you think about a mattress, and how it’s made of, you can get a clear picture of where LEG 0.00%↑ fits in, it makes the springs that keep the mattress springy!

This is fundamentally a B2B business, and so I wouldn’t expect most consumers to be aware of the company and the brand, even if a significant portion of the population has used their products regularly.

Business

Strategy

The company is very open about its strategy and its business, which is always something to celebrate!

If you haven’t yet, I heavily recommend that you take a good look at the company factbook which you can find here.

They go really in depth on the numbers of each segment, and the companies strategy and a whole lot of other interesting information.

The companies latest update, in august 2022 is also quite interesting, though much of that information is already in the factbook.

So, what is the company's strategy? What are their priorities?

In short their top priority is to foster organic growth of their core businesses, followed by maintaining their dividend policy that has led them to become a dividend king. With what is left over they fund strategic acquisitions that meet their criteria, and finally they repurchase stock.

But of course, that’s all very generic and doesn’t really tell you much about what exactly they are doing, isn’t it?

Let’s take a look at a couple of examples of specific segments that $LEG operates, and see how they fit with this, shall we?

Leggett & Platts hydraulic Cylinders Group is the segment of the business that deals in manufacturing engineered hydraulic cylinders that are used in mobile equipment applications.

This is a fairly large addressable market of around $5 Billion, with plenty of different customers, and even more competitors, both small to mid-sized manufacturers and large OEM providers.

The company wants to expand this business in 2 main ways:

Expanding the business with existing customers as they seek to outsource more of their hydraulic cylinder production and grow their international presence

Increase penetration in current and adjacent hydraulic cylinder markets

The company already operates factories for this type of product in the US, UK and India, so they are fairly well positioned to quickly respond to changes in the demand from those markets. This global footprint allows them to have a quick turnaround and JIT delivery, which helps give them a strong reputation for quality and reliability when new customers want to give them a chance.

Of course this is only a small part of a segment, but if you’ll read their factbook they outline where each segment fits in their portfolio, and the individual strategy for each of the parts.

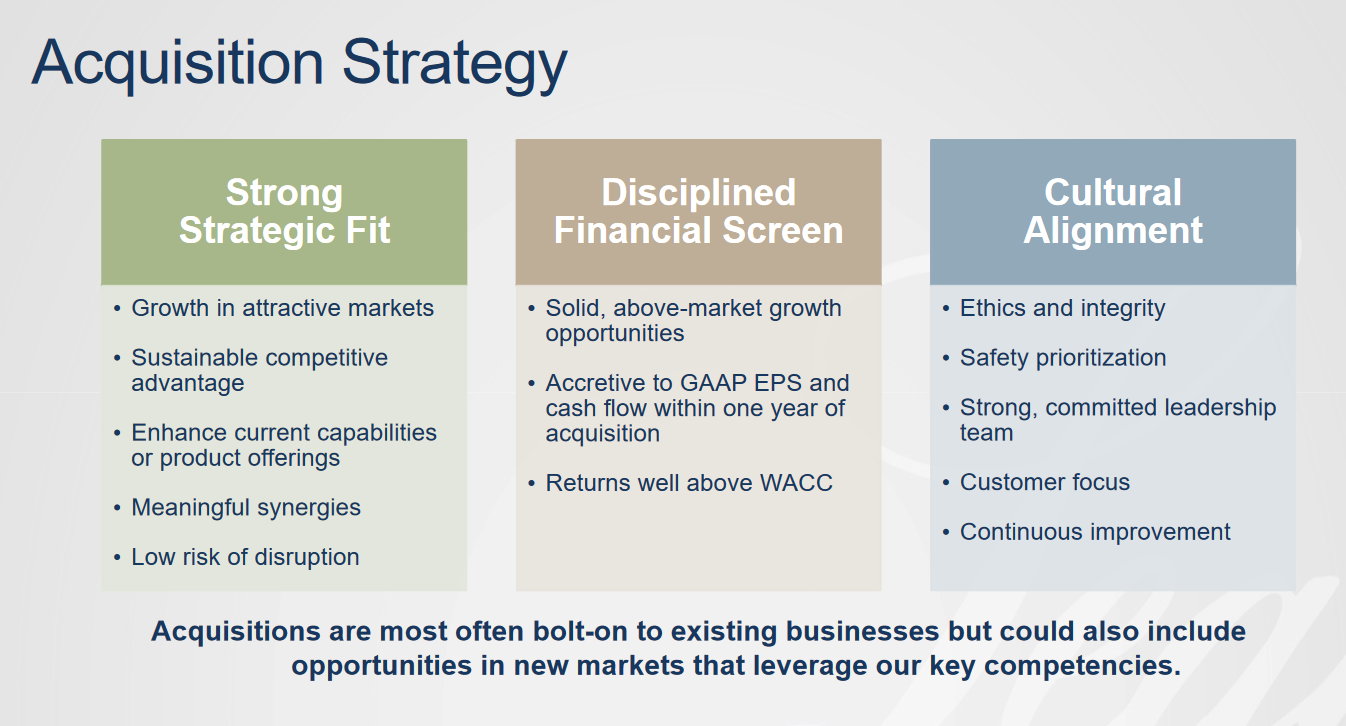

A similar clarity was shown when it comes to their acquisition strategy:

In short, it’s clear that when they look at acquisitions they fundamentally try to see where a prospective acquisition would fit in their portfolio, and try to bolt it on to that segment.

They’re looking for growth, competitive advantages, synergies, and above all an attractive return and cultural alignment to reduce the chances of the acquisition going bad.

I like this!

It’s clear that the company is conservative and wants to make sure that any acquisitions ultimately benefit the shareholders, and that’s exactly what any investor would want in a business.

Reporting Segments

Like we discussed just now the business has 3 main segments, and those segments in turn are divided into individual product types.

They have dozens of them, so there’s no point in going into detail on each one (though I definitely recommend checking them out here!).

Let’s talk a bit about their 3 main segments though:

Bedding products

Furniture, Flooring & Textile Products

Specialized products

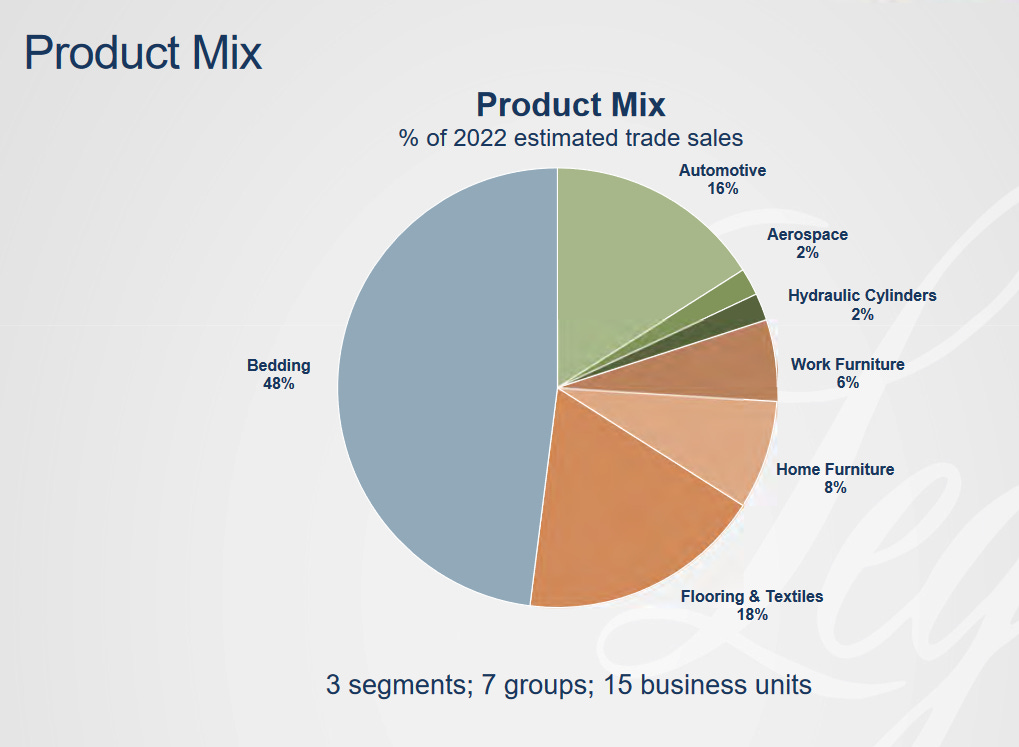

Of these 3 segments the largest by far is the bedding segment with around 40% of net sales coming from that, followed by furniture at 32% and finally Specialized at only 20%.

Historically the specialized segment had substantially higher EBIT margins when compared to the others, but more recently the margins have converged onto a steady 12%.

This isn’t really good, since i generally prefer high margin companies, but it’s important to realize that the company in operating in a highly competitive commodity market with hundreds of thousands of possible competitors.

Under those circumstances it’s natural that the business is slightly weaker.

Finally we can have a look at the product mix within these segments, and we can see that here the bedding segment continues to dominate.

That said, the automotive industry, furniture, flooring, etc.. shows that the company is still widely diversified across industries and products, even with the similarities in the production process of

Geographical Diversification

The company is primarily focused in the US market both in terms of production and sales:

In terms of international production and sales, the specialized segment is the largest contributor with around 85% of sales for that segment originating internationally.

This shows in terms of the production facilities:

And of course international sales have been growing over the past few years, going from $1.2 Billion in 2015 to $1.8 Billion in 2021.

Most of the sales there come from Europe, followed by China and finally Mexico and Canada.

Management

Mr. Dollof is the company's chief executive officer having been appointed in January 2022. He has been with the company since 2000, having served in a number of roles prior to becoming CEO.

He served as Chief Operating Officer, as President of the Bedding Products as well as President of the Specialized products and & Furniture products.

It’s clear that he is a “Company man” who made his way up the ladder, and is familiar with every segment of the business.

For a company like LEG 0.00%↑ I like this sort of thing, this is a mature company that isn’t exactly in need of any disruption, so a person who has been with the company for 20 years, who is intimately familiar with every aspect of it, makes a suitable candidate for CEO.

Generally speaking I don’t think 10 months is enough time to accurately evaluate the performance of a CEO, so I’ll hold my tongue for now.

When it comes to insider buying trends, there are none.

Once again, I don’t put much stock in insider selling, and in any case these sales have been at prices substantially above where we are now, so even if they were due to careful valuations on the part of the insiders who sold… I doubt they apply as much at the current prices.

Risks

Internal Risks

This is a mature market with little in the way of growth outside of competition

The company has significant restrictive covenants in its credit facility which restrict the operation of the business

It’s fundamentally a low margin business, with high competition and little in the way of brand power.

External Risks

Supply chain disruptions cause issues with the JIT model under which the firm operates

There is a 90 day exposure to commodity prices before the company is able to adjust prices, leaving them exposed to some commodity inflation

Some of its business is reliant on the enforcement of anti-dumping regulations which are out of the companies control

Fundamental Data

Income Statement

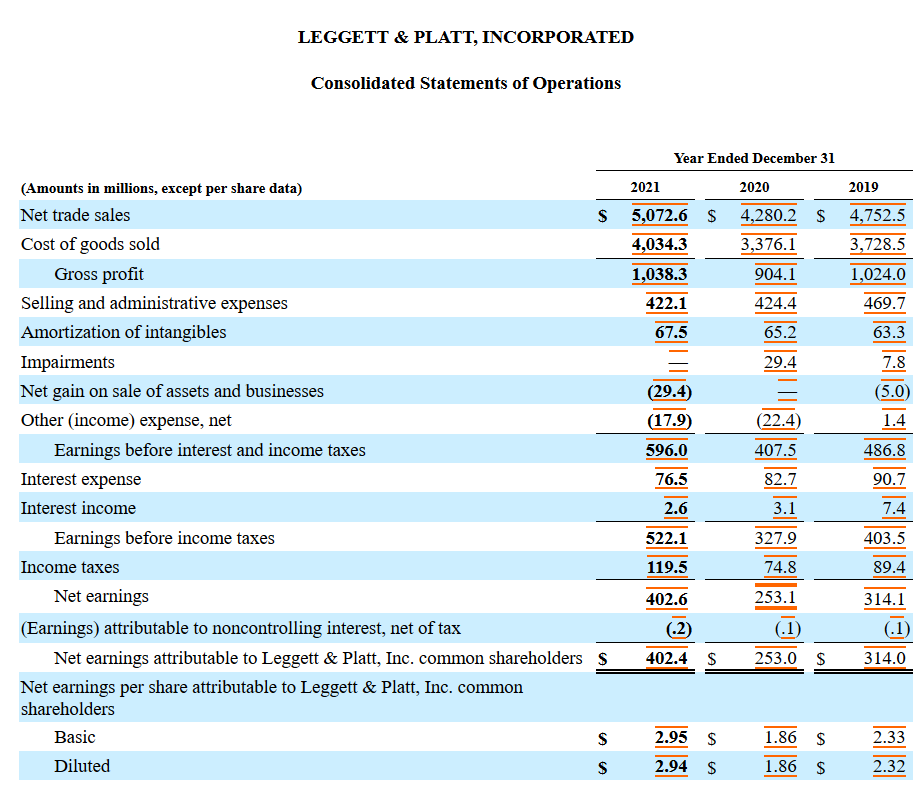

Here we see the issue, the small pre-tax profit margins that plague this type of business is something that I really dislike.

Additionally it’s clear that the company was hit by covid, and revenues decreased substantially in 2020, and though it recovered in 2021 I’m not too convinced that recovery will be permanent.

Revenue Growth

And here we see the big problem with LEG 0.00%↑, the lack of revenue growth over the past decade.

They’ve grown revenue at around 4% per year, and operational income by around 6%, both of which aren’t bad, but are also substantially below what we would expect for a bull market.

It’s not bad, but it’s not anything particularly good.

Margins and Earnings

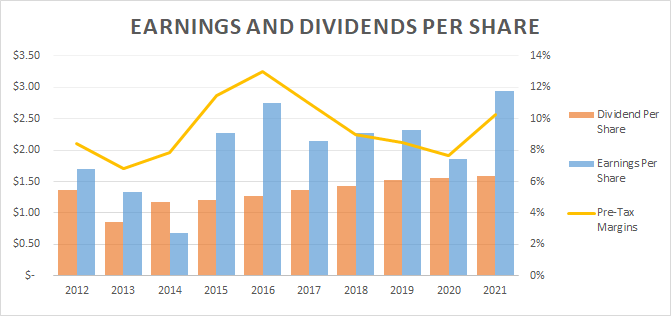

Earnings have more or less tracked the operating income growth, and stand at around 6% CAGR over the last decade.

This is about in line with the long term market average, which is actually quite good considering we are talking about a mature company in a highly competitive and mature industry.

Balance Sheet

Shareholder Equity

Overall the company has maintained a fairly steady book value per share, and the slight growth in assets has primarily come from retaining earnings and since 2018 the increase in debts and other types of liabilities.

I’m not currently too worried about their balance sheet, even despite the increase in liabilities because…

Debt Schedule

The company maintains a priority of having an investment grade credit rating, which allows them to keep a $1.2 Billion revolving credit facility.

With a long history of strong operating cash flow which exceeded capital expenditures + dividends in 32 of the past 33 years, it’s clear the company can make good on its commitments.

In terms of debt maturity profile I don’t really see much to worry about at this time:

It’s clear that with the substantial cash and ability to generate that cash, the company's debt profile doesn’t really have any significant cliffs anytime soon.

Shareholder Returns

The company is heavily committed to return capital to shareholders by investing in profitable businesses and using the proceeds to return cash to shareholders.

Buybacks

Buybacks are not the primary method in which the company returns capital, but they do conduct them whenever they have any extra cash without a good acquisition on the horizon.

This is fine with me, and it’s honestly my preferred way of capital return strategy.

Dividends

The company is a dividend king with 51 years of annual dividend increases, and a target payout of around 50% of net earnings.

Their current payout ratio is around 60%, so it’s clear that they will need to either increase their earnings, or slow down their dividend increases in order to bring that back down to the target.

That said, 60% payout ratio is pretty standard and I’m not concerned that they will cut the dividend anytime soon.

Strengths and Weaknesses

Strengths:

Diversified business with a strong reputation and wide customer base (except for the bedding segment)

Longstanding history of returning capital to shareholders

Solid balance sheet without any debt cliffs

Weaknesses

Mature industry with little in the way of organic growth

Vulnerable to commodity prices

Heavy exposure to their bedding segment (though otherwise diversified)

Valuation

Key Ratios

Overall these ratios are fine, neither particularly good nor particularly bad.

The pre-tax margins are low, which isn’t great, and so is the revenue growth. Earnings growth is surprisingly good, but still nothing to write home about.

I do like the return on assets and return on equity, though even there it isn’t anything out there.

It’s clear to me that LEG 0.00%↑ isn’t a particularly good or bad company, which is fine! I don’t necessarily only invest in fantastic companies on the up and up!

Standard Valuations

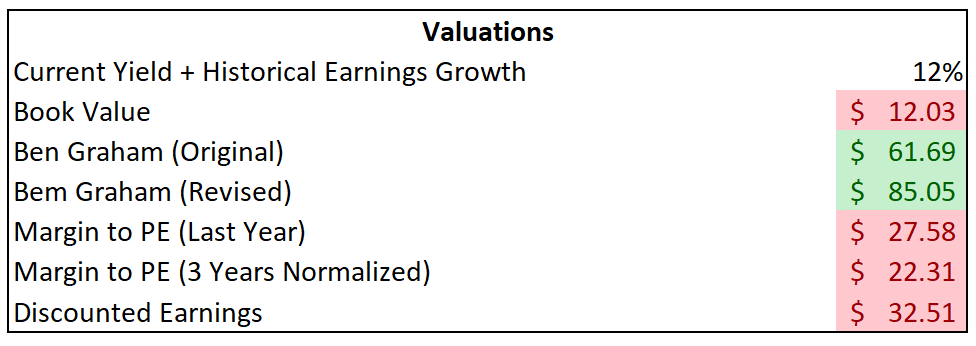

Other than the Ben Graham methods, the other valuations seem to be fairly consistent, and below the current share price.

As always I tend to favor the Margin to PE method, and that gives me a value between $22 and $28, the Discounted earnings method is a bit more positive and goes as high as $32.

The true value is probable somewhere in between those values.

Safe Purchase Value

As always I favor an average of those valuation methods to get the Average long term value of around $40, which when we add in our standard 30% margin of safety we get a safe purchase price of around $28.

If we can buy the company at that price, we will be buying at a 9.6 PE, and with a 6.3% dividend yield, which seems quite nice to me!

Investment Thesis

Key Points

Solid mature company with a consistent business model

Has issues with low margins

The Dividend will continue to increase, and there will be occasional share buybacks

Responsible management team with a cautious approach on growing the business

Not a great company, but also not at risk of bankruptcy

Decision

Honestly, I like the company.

I like the management team, I like the strategy, I like the business.

This isn’t a “home run” type company, and I don’t expect to make tons of money on it, but at the current price I don’t think investors will do too poorly.

The business is stable, and easily understandable so there are no issues there, and this definitely isn’t a “turnaround play” like others.

It’s just a solid boring company that will continue to do its business for the foreseeable future and pay out its dividends.

Right now, I’m not buying it, it’s still a bit too pricey and I’m still re-balancing my portfolio (it’s been taking a while!), but when I’m done re-balancing, or if the company keeps trading down, I’ll certainly consider it.

My current stance: HOLD

What about you? Do you own Leggett & Platt? Let me know in the poll below!