A Look Back at Realty Income

The Monthly Dividend Company

It”s been a little over a year now since I wrote up my thesis on O 0.00%↑ Realty Income, a Real Estate Investment Trust that is famous among dividend investors for its regularly increasing monthly dividend payments.

The company has been one of my oldest holds in the portfolio, and I first bought into it back in 2020. Since then I have kept receiving regular dividend payments, and those payments have regularly increased on a quarter by quarter basis.

If you’ like to read my original review that I published last year, you can find it here:

For now though, Let’s take a look at what has happened since…

The Thesis

The first thing we need to take into consideration is to see what I thought about the company, and what my thesis for the investment was:

Revenue and earnings will remain stable

The company will maintain its A credit ratings

The company will continue to expand into Europe

Dividends will continue to be paid, and increased at regular intervals

The management team will continue to hold capital returns as a goal

They will maintain their existing debt/equity capital allocation strategy

How has this held up?

Let’s take it point by point:

Revenue and earnings will remain stable

Their annual report for 2022 has come out recently, so we can simply check it!

This seems to have played out as expected with the revenue per share increasing from $5.02 in 2021 to $5.46 in 2022.

This is pretty good, though it’s important to note that they have been substantially diluting shareholders in the past few years, having almost doubled their outstanding shares since 2020.

Still, net income per share as well as revenues per share and operating income per share have all increased in 2022, and so it seems that so far this dilution has been accretive.

The company will maintain its A credit ratings

The company has continued to maintain A credit ratings and is an investment grade REIT.

Overall, this has helped them maintain a comparatively lower cost of capital when compared to their competitors.

The company will continue to expand into Europe

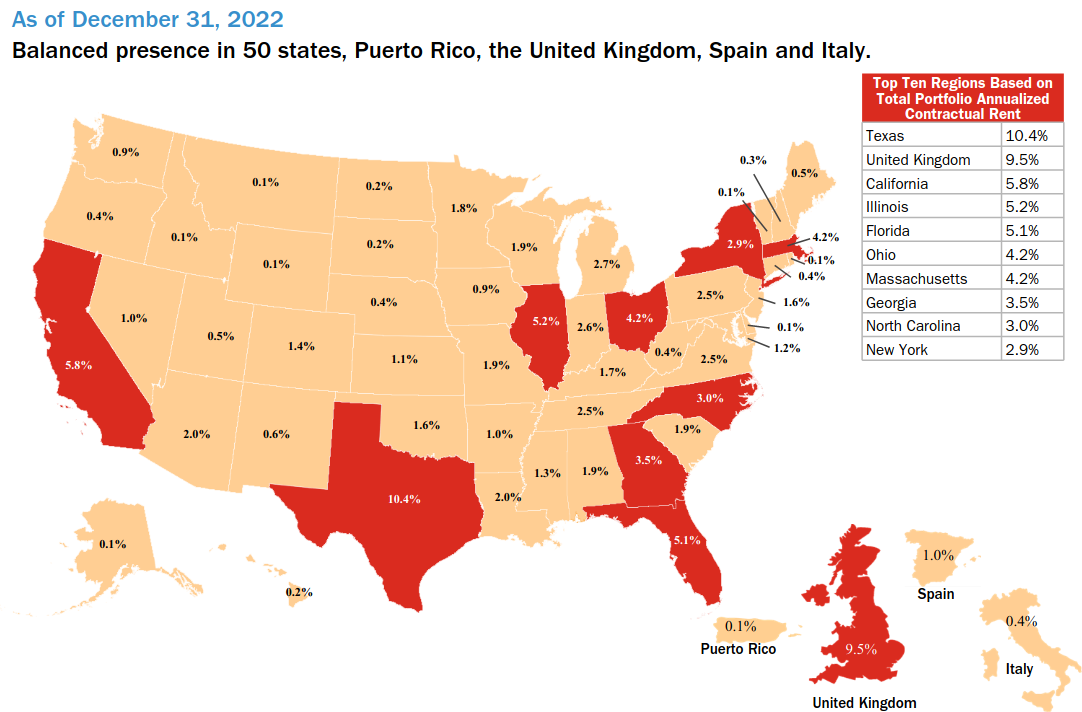

The company has continued to expand into Europe, having opened their first property in Italy during the year.

Overall their european holdings have grown to about 11% of total revenues, and while those revenues are still mainly concentrated in the UK, I fully expect that their expansion accross the atlantic will continue.

Dividends will continue to be paid, and increased at regular intervals

The company has continued to increase its regular monthly dividend, and shows no indication to change its dividend policy in the near future.

The management team will continue to hold capital returns as a goal

The company continues to view dividend returns as sacrosanct, and remains positive about the companies ongoing ability to make due on its commitments.

They will maintain their existing debt/equity capital allocation strategy

They have continued their existing capital allocation strategy, and nothing has meaningfully changed here.

The future

Overall the company has met expectations in terms of business performance, and per share numbers have more or less followed inflation.

I’m not too concerned with the companies ability to continue collecting rents, and they certainly have a decent growth strategy.

The problem is again, the valuation.

The company is trading at over 10 times revenues, and continues to pay out more than its net income. While I understand that many investors ignore net income in favor of FFO or AFFO, I am not the sort of person that thinks ignoring something as crucial as depreciation and amortization is a good thing.

Given the high PE (and even high price/FFO ratio), I can’t really justify continuing to invest in the company.

At the same time I don’t want to sell a company that is reliable, and is paying me growing dividends…

I will continue to hold my existing 100 shares, and continue to receive the dividends the company is paying out but I don’t think I will add any more at these prices.

Current Stance: HOLD

What about you? Where do you stand on O 0.00%↑ ?