Key Data

Ticker Symbol: $5911

Price: ¥2662

Market Cap: ¥109 Billion

Forward Dividend: ¥85.00

Dividend Yield: 3.2%

Payout Ratio: 30%

Areas of operation: Worldwide - Japan Focus

Sector: Industrials - Engineering & Construction

Business

Yokogawa Bridge Holdings (YBHD) $5911 is a Japanese holding company dealing in the Engineering & Construction industry with a particular focus on bridge building and engineered structures. With their headquarters and primary operating Area in Japan, the company is nonetheless a world leader in bridge building.

In their overseas business the company is focused on ODA construction in fast-growing regions from southeast Asia to the African continent. Recently the Nile river Bridge in South Sudan was successfully completed after three construction stoppages due to civil war and the spread of COVID-19.

Some of the world's most technologically advanced and largest bridges have been built by Yokogawa, including:

Stonecutters Bridge in Hong Kong, the world's largest composite cable-stayed bridge

Tenjo Bridge, Japan's largest solid-rib arch bridge

Kurushima Kaikyo Bridge, the world's first triple suspension bridge

Akashi Kaikyo Bridge, the world's longest suspension bridge

The Rainbow Bridge, a major Tokyo landmark (which I distinctly remember crossing when I visited!)

Nonetheless the company does not only operate a monolithic bridge business, but has instead diversified to ancillary businesses where their expertise building bridges can be leveraged to great effect.

They have 4 main segments:

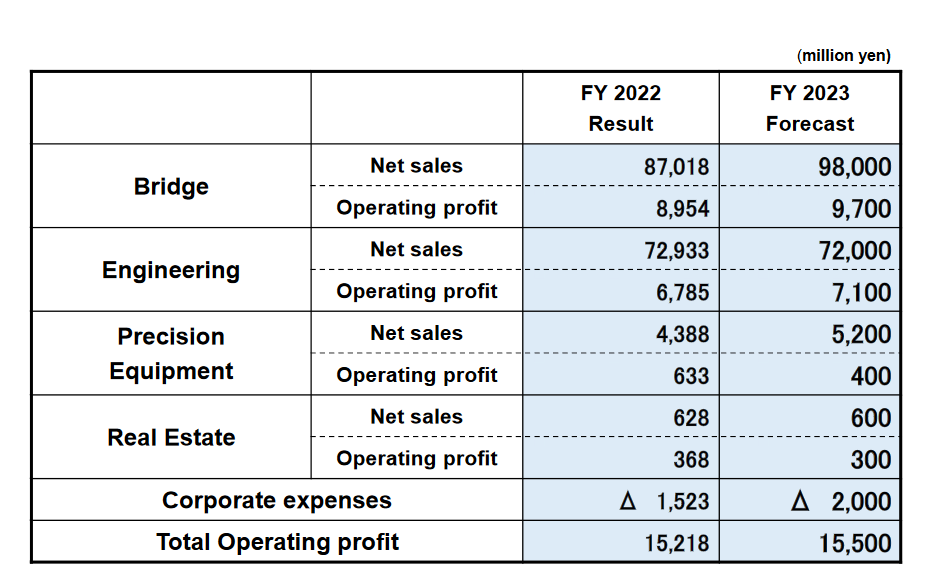

The first 2 segments are the bread and butter of the business, with the Precision Equipment Business and the Real Estate Business being sideshows with comparatively little revenues and profits.

As you can see the legacy Bridge business corresponds to almost 59% of the current revenues, followed by Engineering with 38%, and the remaining equipment and real estate business being effectively rounding errors.

As a result I will be focusing my analysis on the Engineering and Bridge segments, and simply state that the Precision Equipment and Real Estate businesses, while profitable and fitting well with the rest of the business, are fundamentally a sideshow primarily serving to take advantage of the technology and processes developed for the other parts of the business.

Both the Precision Equipment and the Real Estate businesses are unlikely to be viable companies in their own right, and function better as small outgrowths of the company.

The bridge and Engineering businesses however…

Bridge Business

The company is a pioneer in steel bridges in japan, and has been developing cutting-edge technologies related to it for 115 years now.

The bridge business consists of 3 smaller businesses:

New Bridge Construction - Revenues of 57 600 Million Yen

Maintenance - Revenues of 26 700 Million Yen

Overseas Business - Revenues of 2 600 Million Yen

As you can see there’s about a 70/30 split in terms of revenues when it comes to New projects, and ongoing maintenance for existing projects. That said the maintenance business will continue to grow faster than the new bridge construction with new orders coming in and additional maintenance and upgrading projects being expected through fiscal 2030.

This is something that attracts me because on a fundamental basis these maintenance contracts serve as a significant competitive advantage, in several different ways:

Provides continuous, long-term revenues that are highly sticky

Increases points of contact with clients to enable upgrade opportunities

Maintains visibility with clients allowing additional sales opportunities

In a way the maintenance business provides a suitable long-tail and ongoing revenue that provides a buffer to the traditional “boom-and-bust” cycle that most construction companies are susceptible to.

That being said the long term prospects for this business are not that great, and the bridge business is not the core growth engine for the company:

Engineering Business

The real growth is coming in the Engineering business!

The Engineering business has 3 smaller businesses:

Engineered Structure System - Revenues of 54 500 Million Yen

Civil Engineering - Revenues of 10 000 Million Yen

Architecture, Machinery and Steel Structure - Revenues of 8 100 Million Yen

The engineered structure system and the civil engineering businesses are the key growth engines of the company with the focus of the sixth management plan falling squarely on driving increased revenue growth from these 2 sub-segments.

These 2 segments take advantage of the existing Yokogawa bridge technologies and bring them to new areas of business where they can be useful, namely in the construction of highly complex large pillar-free factories and warehouses for the engineered structure system, and tunnel segments and off-shore and port structures for the civil engineering, and finally moveable building systems, steel frameworks for high rise buildings.

These are highly complex and technologically advanced buildings and systems, which form the groundwork of modern industrial processes and additionally have the possibility to provide ongoing long term maintenance contracts and opportunities similar to the bridge maintenance sub-segment.

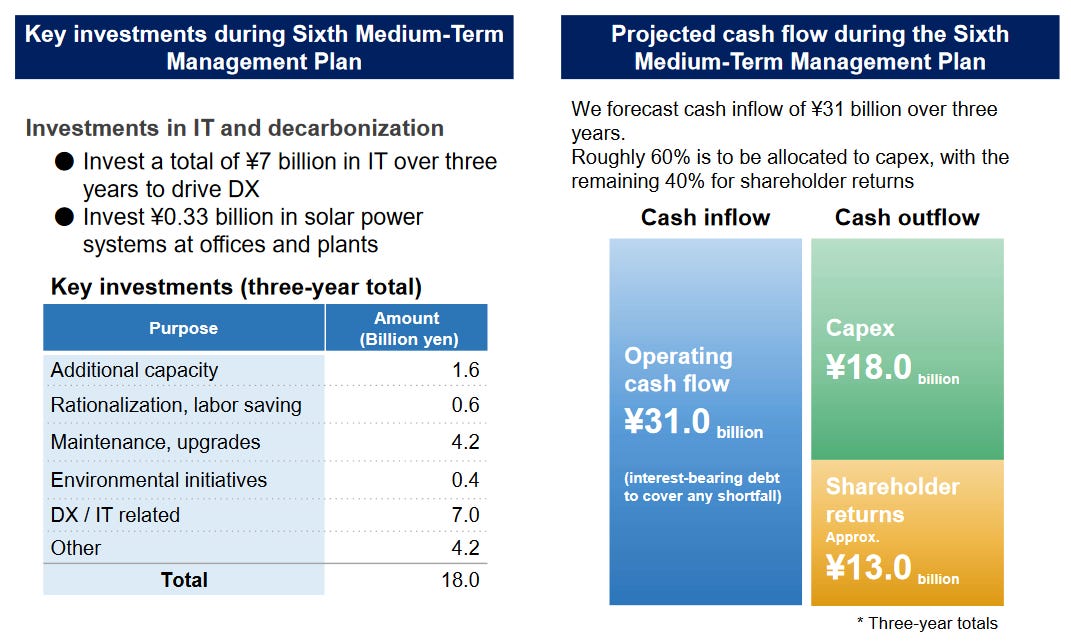

This growth will require substantial investment, particularly when it comes to their IT infrastructure:

This will be primarily focused on their sales IT infrastructure and will hopefully drive higher sales and subsequent profits in the coming years.

Of course reinvestment is very good, but as investors we should always demand that capital be returned.

Fortunately the company has a fairly simple capital policy of returning around 30% of earnings back to shareholders as dividends, with some buybacks as conditions permit.

This is a perfectly reasonable policy to me, and given the current price of the company I believe any buybacks would be accretive to the business.

Management

Kazuhiko Takata is the President of Yokogawa Bridge Holdings, and he has been with the company since 1985, having worked in the legacy Bridge segment for decades.

He became President of the company in June 2020 off the backdrop of the COVID-19 pandemic, and had a rough time because of its impacts. The company during his guidance failed to reach the sales targets outlined in the 5th medium-term management plan (though they reached the profit target!).

That said he seems to be a slightly more shareholder friendly executive, having raised the company’s target payout ratio from an anemic 15% to a healthy 30%.

Unfortunately I don’t have an easy way to check for insider trading activity in Japanese companies (if you know how, please tell me!), but he does own over 21 thousand shares in the company, the most of all the directors.

I’ll give him some time to settle into his position before making a judgment on the quality of his management.

Key Risks and Opportunities

Risks:

Decrease in Demand for new bridges

Stagnant core bridge business

Substantial non-tangible CAPEX in coming years

Opportunities:

Long term consistent revenue over decades

Increased demand for maintenance and upgrade contracts

Engineered structures provides a suitable growth engine

Financial Data:

Shareholder Returns:

Dividends

The company pays a ¥85.00 dividend.

The company has a clear capital policy

The dividends are paid twice per year and a decade long history of increasing dividends

Share Buybacks

The company occasionally conducts share buybacks

Income Statement:

Revenue Growth Rate

Long Term - 4.4%

3 Year - 0%

Revenues are reasonably solid and stable.

Pre-Tax Profit Margins

Long Term - 9%

Lower than I would like, though COGS is high so theoretically lower revenues should reduce those expenses.

Return on Assets

Last Year - 7%

Good! Lower than my estimated cost of capital!

EPS Growth Rate

Long Term - 22%

3 Year - 21%

This isn’t sustainable I think

Cyclicality

Cyclical

I has some non-cyclical characteristics with the maintenance business

Cash Flow Statement:

Operational Cash Flow Growth Rate

Long Term - 28%

3 Year - 86%

Significant increases in Accounts receivable have distorted the cashflow numbers.

Investing Cash Flows Growth Rate

Major Capex expected in the near future!

Financing Cash Flows Growth Rate

No real impacts here except for dividends being paid and small amounts of short term loans being revolved

Cash spend may decrease since they are running out of debt to pay off

Balance Sheet:

Assets:

The majority of assets are cash and equivalent current assets with high liquidity

NCAV is about 40% of market cap

Liabilities:

The main liabilities are the notes payable for ongoing projects

Significant retirement benefits liabilities

Debt:

No substantial long term debt

No Debt Cliffs

[Share]

Valuation:

Key Metrics:

Bullish

Discounted Earnings - ¥5673

Discounted Cash Flow - ¥5673

Margin to PE - ¥4430

Market Multiple - ¥5135

Cash Multiple - ¥5760

NCAV - ¥2462

Bearish

Discounted Earnings - ¥2327

Discounted Cash Flow - ¥2327

Margin to PE - ¥2017

Market Multiple - ¥2072

Cash Multiple - ¥0

NCAV - ¥328

Average

Discounted Earnings - ¥3778

Discounted Cash Flow - ¥3778

Margin to PE - ¥2682

Market Multiple - ¥3576

Cash Multiple - ¥2086

NCAV - ¥1057

Expected Value:

I’ve done all sorts of valuation models on the company, using different discount rates, different assumptions, and different exit multiples, etc…

Ultimately I think that the current price that the company is trading at is a fair value for what is a quality company with little bankruptcy risk and a clear growth path ahead of it.

I don’t think there's a significant downside with the business, and the multiples that they are trading at are favorable.

I’d estimate that the fair value for this business is above ¥3000 per share, and likely quite a bit higher.

If the engineered structures grows as the management team expects, then the true value will likely be over ¥4000.

Investment Thesis

I like the business, it’s simple, understandable and profitable

The company has little to no debt

The company has solid reliable revenues coming in for years to come

The company has a clear path to growth in the engineered structures business

The Bridge business will likely grow a bit and then stagnate

There is little downside, and the company is trading at an acceptable multiple

Decision

Current Stance: BUY

Once my paycheck for the month comes in I’ll be purchasing some shares in the business.

This will be my first direct investment in companies outside of the US (even Unilever $UL I purchased the ADR), and the dividends received will be in Yen, so I will now have a more direct exposure to the Japanese market than I do to even European markets.

Ultimately I think this is a good company at a fair price, and I look forward to continuing to explore the Japanese stock market for some more hidden gems.

Do you have a different view on the company? Are you buying, selling or holding?

Let me know down below!