Western Union Earnings - 2023 Q3

Returning capital to shareholders, now and forever.

It’s been some time since I last had a look at some of the earnings that companies I own have reported, and so you can imagine that I was surprised when just a few days after I bought some more WU 0.00%↑:

I get surprised at the stock price dropping almost 15%:

What happened?

The Earnings

The company’s revenues were up 1% compared to 2022, which is quite unexpected. Indeed the year to date revenues, which I originally expect would be down 10% in 2023, are only down 2%!

The company’s year to date EPS are down 22% compared to 2022, however it’s already at $1.33 per share, when I actually expected the full years earnings to be $1.44 per share!

As long as the business can generate 11 cents per share over the next quarter, then my prediction will happen… Though I fully expect them to generate anywhere between $0.40 and $0.55 per share!

So why the drop? Has there been any worsened guidance?

No, they actually revised their guidance upward!

Some dividend cut?

Not really, the company has has returned slightly less cash this year than they did last year, but there has been no dividend cut, and the difference in Buybacks is more than made up by the increased value generated by those buybacks given the substantially lower share price.

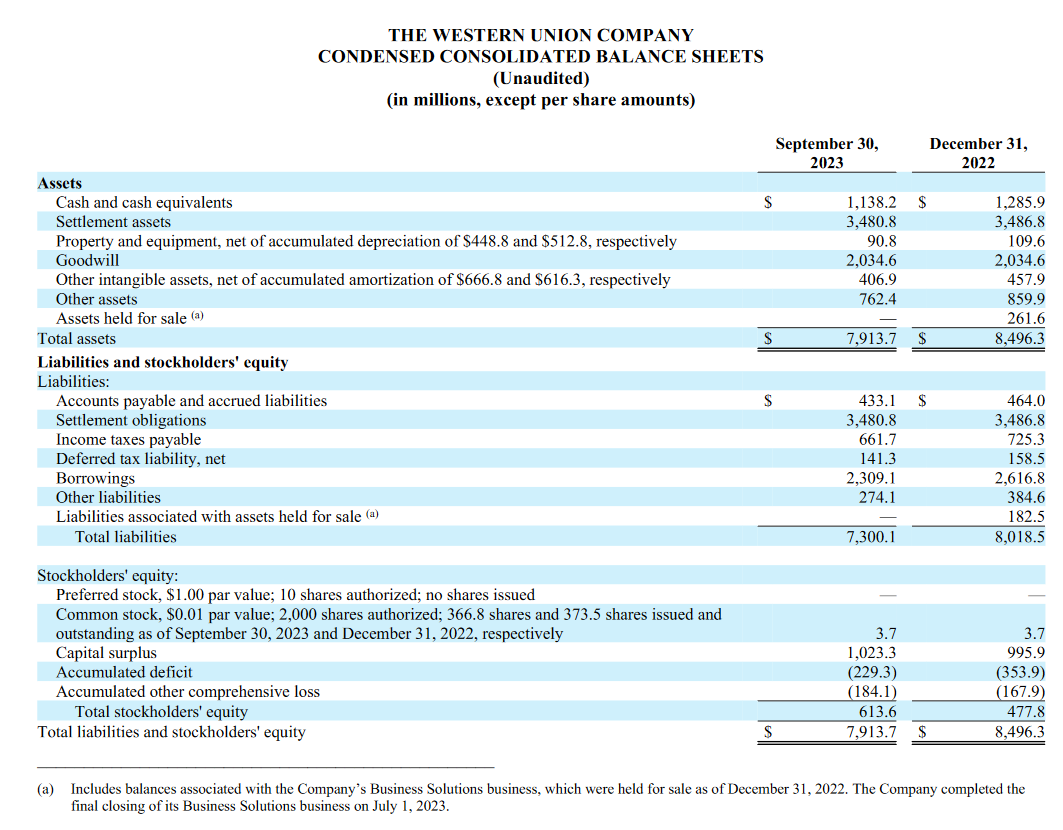

Has their balance sheet meaningfully deteriorated over the past year?

Not really.

Their asset base has decreased, but so have their liabilities, and even more than their assets!

Over all their shareholders equity is substantially higher than it was last year! Not that it matters much, since WU 0.00%↑ isn’t an asset play.

Frankly I don’t know why the stock dropped, and I don’t care.

The company is profitable, returning profits to shareholders, and cheap. That’s all that really matters to me.

Do you have any idea? Let me know down below.

Market seems to have low confidence in WU’s new “Evolve 2025” plan (Oct press release). Not sure why, however it may be a fear that WU is moving it’s focus away from its core business function of money transfer, at a time when MT competitors are focusing ever more on it.