We need to talk about Realty Income

Why I'm concerned

Realty Income is one of my longest held companies and I’ve been a happy shareholder so far, receiving the monthly dividends that the company has been paying for decades.

What’s the problem?

The company, is a Real Estate Investment Trust dealing primarily in the Triple Net Lease commercial real estate market.

By all accounts the underlying operations of the company are fine, but the problem I see is this:

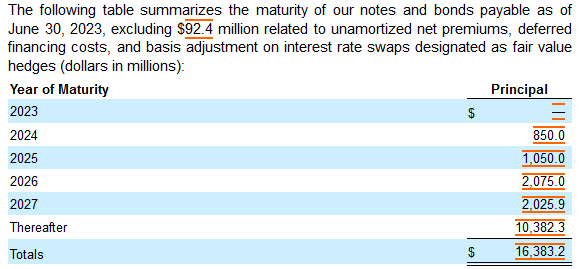

The company has significant portions of their capital stack maturing over the next 5 years… But do they have the cashflow to pay for it?

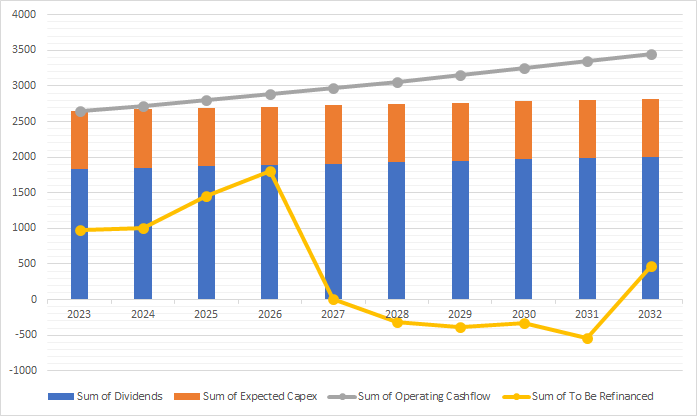

If we assume a “steady state” of the business, where there is no accretive dillution to the shareholders (ie: they issue no more share because the current valuation is not attractive), then we can see that over the next 5 years they will need to issue around $5 to $6 Billion in debt to refinance their current outstanding loans.

Their interest rates on that much debt will be going up from 4.5% to what I would expect to be around 7%, which will have major impacts in the cashflow they will have available to distribute to shareholders.

That’s an additional expense that must be made up by either reducing dividends… Or issuing additional shares at what are currently 6% yields.

Neither of those things are attractive to shareholders…

Thanks for sharing your concern! Another one that bothers me is that some of their top tenants are currently struggling too (Walgreens, Dollar General and CVS for example make up +/- 10% of Realty Income annual rent). All 3 feel like "too big to fail", but their situation keep worsening.

What about lease contracts maturing in the same timeline?