Union Pacific Corporation

What is Union Pacific?

According to their latest 10-K, Union Pacific is:

Union Pacific Railroad Company is the principal operating company of Union Pacific Corporation. One of America's most recognized companies, Union Pacific Railroad Company connects 23 states in the western two-thirds of the country by rail, providing a critical link in the global supply chain. The Railroad’s diversified business mix includes Bulk, Industrial, and Premium. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems, and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its roughly 10,000 customers by delivering products in a safe, reliable, fuel-efficient, and environmentally responsible manner.

In other words Union Pacific is a company that owns and operates railroads, both on the infrastructure side, as well as by operating specific routes.

This is actually one of the oldest and most well established business models for public corporations, and Union Pacific has been around since 1862.

This is, on a fundamental level, a stable business with clear pros and cons, which provides an important service to the communities and clients it serves.

This is an archetypal “boring business” that’s providing value but doesn’t really have anything interesting or new going on, and hasn’t had that for a very long time.

The business model of railroads in general hasn’t really changed since the initial “jump-start” over 150 years ago, despite the ebbs and flows of the stock markets along that time.

The entire business model revolves around making enormous capital expenditures to build up a network, and then “sit back” and enjoy the profits that come in from operating that network.

Those profits can come in through direct leasing of certain routes to other companies which mean to operate trains through them, through operating the lines directly, or from other associated revenues related to the railroad operations.

Of course it sounds simple, but it’s a lot harder in practice, and so the original hopes and dreams that led to the massive capital investments often fell flat to the reality that it is operating a stable and boring commodity business like rail transportation.

If you’re interested in learning more about the history of railway, and the initial stock market bubbles that they were involved in.

I heavily recommend taking a look through “Collective Hallucinations and Inefficient Markets: The British Railway Mania of the 1840s”.

It’s a really nice book that details the early history of railroads in the UK, and the stock bubbles and manias that came alongside them.

Business

Strategy

Union Pacific's strategy has 4 key components:

Serve

Focused on improving operational excellence on existing business by making it more efficient through the use of technology to reduce bottlenecks and improve throughput

Grow

Focused on acquiring new business by providing new and innovative solutions in existing lines, and by expanding the geographic reach of their railroads

Win

Channel the increased financial performance from efficiency improvements and growth into shareholder returns, via Dividends, Share Buybacks and greater Enterprise Value

Together

Engage with the four stakeholder groups, communities, Customers, Employees and Shareholders to keep up to date with each of their needs

Of course these components don’t really tell us a lot about the company's actual business is doing, to do that we need to understand what the actual business model is, and then we can see if they are actually being successful at that.

Union Pacific is fundamentally a freight business, and so we need to understand exactly what they’re carrying.

Fortunately Union Pacific is quite open about their business, and have specific pages on their website showing live details about their business!

They literally publish weekly reports on things like Freight Car Velocity, train velocity, operating cars inventory, revenues, etc…

This is transparency on a level that is very rarely seen in companies, and as a retail investor researching the business I find this very interesting and a massive green flag!

Public companies should be transparent, they work for you!

Another thing that investors should be aware of is that Union Pacific is a crucial link in the US (and global) supply chain.

This has its benefits, in terms of stability of ongoing business, but also has its negatives in terms of regulatory environment.

I won’t go into the history of railway regulatory environment, but suffice to say that Union Pacific's operations are heavily constrained by labor relationships, and the specific railway-labor laws that regulate them.

Additionally the company is also heavily subjected to sovereign risk.

Railways is a massively important piece of infrastructure in case of war, and even in the ordinary course of work, and as such specific laws are crafted targeting it which often reduces efficiency and has negative impacts on investors.

There has been more than one case of railway nationalization in the world, and the US and Union Pacific are not immune to such risks, particularly when it comes to foreign investors!

I’m just a small retail investor from a country with generally good relations with the US, hence such risk is reduced, but it is not eliminated!

Reporting Segments

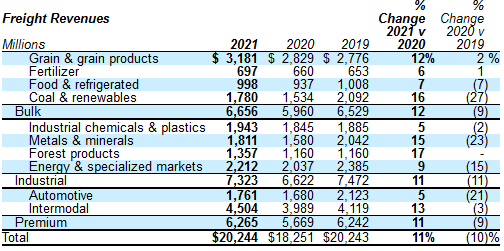

Most of Union Pacific's revenues come from freight, with other revenues being essentially a drop in a bucket.

Union Pacific doesn’t have specific reporting segments, but they do split their revenues (and carloads) into 3 key areas:

Bulk

Industrial

Premium

Each of these lines of business commands roughly the same amount of revenue:

But of course not all business is equal, and some goods require more carloads to generate the same amount of value:

And this shows in the average revenue per car:

Geographical Diversification

A railroad's geographical diversification is intrinsically connected with the network they run, and in those cases the best way of getting a clear overview is simply by looking at their network map.

Fortunately Union Pacific makes that public in their reports and marketing material!

As we can see, the company is based primarily in the western US, though it does do some business into and out of the US at specific interchanges at the border.

You won’t see the geographic diversification that you often see with huge US corporations due to the real estate focused nature of their operations.

Management

Lance M. Fritz is the Union Pacific chairman, president and chief executive officer. He previously served as president and chief operating officer of Union Pacific Railroad.

Mr. Fritz began his career in 2000 as vice president and general manager in the company's marketing and sales department.

I have no strong feelings about Mr. Fritz and his team, by all accounts they’ve done a fine job growing and operating the business in what is a constrictive regulatory environment.

It’s clear from his shareholder letters that he is committed to growing the company and providing returns for shareholders, and that’s shown in the growing dividend and share buybacks as well.

That said, the manner in which he’s been doing this does raise some questions…

While there are been a few black marks on his career, including a few safety incidents and train robberies, these are generally minor things, and often not something that he is responsible for, or able to fix himself.

Overall, Mr. Fritz and his team are an OK management team that, while uninspired, is well suited for operating a boring and mature business like a railroad.

Risks

Internal Risks

The Precision Scheduled Railroading implementation may fail to provide the desired outcomes

Strikes and other issues with labor might endanger operations

Claims and lawsuits regarding pollution, health issues, etc… may cause unexpected costs

External Risks

Sovereign risk might reduce the performance of the company

Sovereign risk might impact my specific investments in the company

Disruptions in commodity markets may impact demand for transportation

Fundamental Data

Income Statement

Overall the company has been consistently profitable, and able to make good on its dividend commitments.

Its pre-tax margins are looking very good at a whopping 38%!

These are margins on the same level as a company like Microsoft, which is quite extraordinary for such a boring, and mature industry as railways!

Ordinarily if a company has such high margins, over a long period of time, they have a durable competitive advantage, however shipping is a commodity, isn’t it?

Well, not quite.

Union Pacific and BNSF Railways hold an effective duopoly over railway shipping in the western united states, this lack of competition means that both BNSF and Union Pacific can more or less set whatever prices they like over railway dependent transportation.

That said, non-railway dependent transportation, that is, goods that can be transported via trucks, do have other alternatives. However, trucking is significantly more expensive to transport than via railways, even with railway shipping high prices, this allows the railways to adjust their pricing to ensure they optimize their profits.

Revenue Growth

Revenue is… Flat.

Indeed, over the past 10 years revenue has grown at a disappointing 0.5%!

This is not good, but at the same time it is to be expected in some ways. This is a mature industry, and for something like a railway revenue can only be grown in one of three ways:

Increasing Prices

Optimize operations

Expanding the network

The problem here is that increasing prices naturally drives clients onto competitors, or simply causes them to reduce their usage.

Given the long experience of the company, it’s doubtful that their pricing models are not efficient, so I’d expect that they are already maximizing their pricing as much as possible, and any further increases would simply not result in higher profits.

Optimizing operations is another option, and indeed, this is in line with their goals, and what they’ve been doing. Indeed if you look at their investor day info graphic, you can see this happening.

And this shows in their pre-tax margins.

Finally we have “expanding the network”...

The problem here is that this requires gigantic capital investments, alongside political will and support to expropriate the necessary land.

Additionally all of the easy-pickings are all already gone, so it’s difficult to justify additional investment into new routes.

Overall, it’s simply more effective right now to run the company as a cash cow, and not reinvest that money into new routes.

This doesn’t mean capital investments aren’t made (indeed we can see they spend between 2 and 3 billion annually on them!) but it does mean that the age of new and gigantic railroad routes is more or less done for now.

Margins and Earnings

And so with flat revenues, we have to ask ourselves… Are earnings growing?

And the answer there is a simple “yes”.

Earnings seem to be growing off the back of 2 things:

Higher margins

Reduced share count

Both of these are good things, but at the same time there is a limit as to how high these margins can get before we see diminishing returns.

At the end of the day, the company will need to bump up their revenue in order to sustain their earnings growth, or increase their already substantial buybacks to make up for their inability to improve margins.

Either of these things are difficult to do, and so I’d say that over the next 10 years or so the company will have to come up with a solution for this.

Balance Sheet

It’s clear that the company is making heavy use of debt in its capital structure, but has that always been the case?

Shareholder Equity

We can see that this really began in 2017, so what likely happened was that the tax cuts, and favorable environment for debt financing has led the company to rework its capital structure to favor debt, rather than equity.

I have to say that I generally don’t like this.

Debt is a drag on performance, and what the company is doing is juicing up its short term returns at the expense of the long term outcomes and health of the company.

I’ve said this before, but I’ll say it again:

It’s really hard for a company to go bankrupt if it has no debt.

By making a choice to reduce its shareholder equity, Union Pacific is making the company more fragile and giving openings through which it can go bankrupt.

I would prefer it if they paid down their debt, and returned to a less debt focused capital structure.

Debt Schedule

There’s good and there’s bad.

The good thing is that there doesn’t seem to be any debt cliffs anytime soon, and that the companies normal operating income is more than enough to make good on its commitments.

The bad thing is that there’s a lot of debt, and some of it is floating rate.

Not only that, but they’ve been issuing additional debt, instead of paying it down!

Out of everything in this company this sort of thing is really what I dislike…

They are taking on debt to replace their equity capital structure with debt based capital.

This is not a good thing, and definitely a red flag.

Shareholder Returns

Buybacks

And here we see the results of this debt juicing, a steadily decreasing share count at a rate of around 4.1% per year.

Don’t get me wrong, I like share buybacks!

It’s a great tool to have in an industry with lackluster growth, or when the company is divesting of certain parts of its business.

But when a company is taking on debt to buyback its shares at high prices, then there’s a big problem.

And UNP has been buying back stock at high valuations!

Source: iO Charts

This is not a good thing, like I said before, “if you're a tech company trading at a 36 PE you should be paying dividends, not making buybacks”

Overall, I don’t like this, and it’s a symptom of poor management decisions.

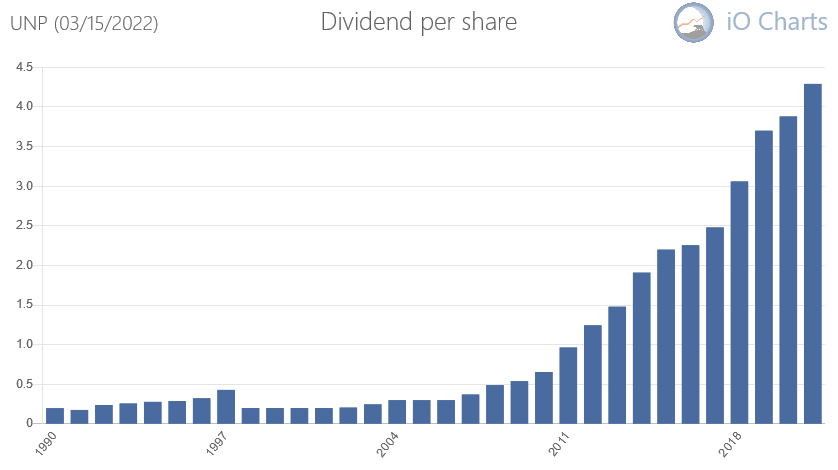

Dividends

Source: iO Charts

The dividend growth rate too has been high, at a 10 year average annual growth rate of 16%.

This is very high, which is nice, but is it sustainable? Well their Earnings Per Share growth has only been growing at 10% annually over the past 10 years, so clearly this isn’t sustainable over the long term.

That said, their Payout Ratio is below 50%, which is low enough that the dividend isn’t in danger right now.

Overall, the dividend is OK, even if its growth will have to slow down in the future.

Strengths and Weaknesses

Strengths:

Stable mature business

Little competition

Longstanding history of returning capital to shareholders

Unlikely to fail due to geopolitical considerations

Weaknesses

Low growth

Changing capital structure is fragilizing the company

Highly Regulated

Little operational efficiencies left to improve

Valuation

Key Ratios

Most of the non-valuation related ratios look good, the only real black mark on the companies record is the lack of top line revenue growth, with the subsequent lackluster income growth.

Most of the returns are coming from increasing margins, and share buybacks, both of which are good, but we’ve already talked about how both of those are unsustainable in the long run.

Ultimately I think we will have to have EPS growth rate decline over time.

Still, for now it’s fine, and I’m not too concerned.

Standard Valuations

Here we see the results of leveraging the company up!

The book value is tiny compared to the the valuations we get from earnings, and the reason for that is simply because the company has been replacing its equity capital with increasing amounts of debt.

If we end up buying this, it will be purely for the earnings power the company has, which is quite significant!

Safe Purchase Value

As of right now the company is trading at $264 which is just in line with the average long term value that our model predicts.

This means that if we add in our 30% margin of safety we should be willing to purchase the company at around $186 per share.

This would give us a dividend yield of 2.5%, and a PE of 18.

That’s still honestly a bit pricey for me, since I'm concerned about over-leveraging… But it’s probably a reasonable price for anyone else.

Investment Thesis

Key Points

Business will remain stable and growing in line with US GDP

The Company will continue paying dividends and conducting share buybacks

The Precision Scheduled Railroading Initiative will successfully improve operations and allow a path to growth

In the short term, the supply chain constraints will provide a boost to earnings

Decision

I considered this heavily, and despite the fact that I fundamentally like the business model, the increased leverage path that management has chosen to take the company through over the last 5 years rubs me the wrong way.

I don’t like companies taking on debt to conduct share buybacks, I generally feel that is a poor decision that makes the company weaker in the long run.

That being said, it’s not like Union Pacific is “too far gone” or anything of the sort.

They have a stable business with great margins and limited competition.

This is something that I would legitimately love to own… At a good price.

So that’s the issue here, the price isn’t bad, but it’s also not really good. I don’t want to buy companies at their fair value, I want to buy them when they’re undervalued!

I do not currently own any share of Union Pacific, and currently I don’t feel the margin of safety is there to buy it. That said, I also don’t think it’s overvalued.

My Current Stance: HOLD

What about you? Do you own any railways?

Let me know in the comments below!

I got a little confused:

- You wrote: "As of right now the company is trading at $264 which is just in line with the average long term value that our model predicts."

- But it's quote this Friday was $193.10.

I am new at these things, but the trading quote is very far the value you wrote.

Please help me understand it.