Unilever PLC

An old Consumer Goods company that is ripe for a turnaround

Unilever PLC

What is Unilever?

According to Wikipedia, Unilever is:

Unilever PLC is a British multinational consumer goods company headquartered in London, England. Unilever products include food, condiments, ice cream, wellbeing vitamins, minerals and supplements, tea, coffee, breakfast cereal, cleaning agents, water and air purifiers, pet food, toothpaste, beauty products, and personal care. Unilever is the largest producer of soap in the world.[3] Unilever's products are available in around 190 countries.[4]

In other words, when you go to a supermarket and look at the shelves, chances are you will find some Unilever brands. Some of these will be refreshments, like Lipton Ice Tea, others will be Personal care products like toothpaste or deodorants, such as Rexona.

Unilever develops, manufactures and distributes products used in everyday lives by millions of customers all over the world.

I use their products almost every day, and have been drinking their tea since I was a child, so I am very familiar with their products, and if you take a look at some of the products in your home, chances are you’ll find some Unilever in there as well.

Business

Strategy

As per their latest Annual Report:

They intend to achieve that vision by taking on the following strategic choices and actions:

Ultimately they have an 8 step business model intended to develop, manufacture, market and sell goods to consumers:

Reporting Segments

Unilever has 3 main divisions:

Beauty & Personal Care is the largest division by sales, closely followed by Foods & Refreshments.

In terms of operating margins Beauty & Personal Care again takes the lead maintaining margins around 20%, with the other two divisions holding operating margins between 10% to 15%.

As a whole the Foods & Refreshment division has been shrinking, whereas the Beauty & Personal Care segment has been taking on an increasingly bigger role in the company.

This decrease of the Foods & Refreshment division will likely continue to accelerate in the future, since Unilever's management team is actively seeking to divest itself of its Tea business (the largest in the world!).

Personally I don’t like this approach, while it’s true that the Food & Refreshments segment isn’t as high-margin as the Beauty & Personal Care segment, the fact is they still have unusually high margins for what is otherwise a commodity business.

Their brand power is strong, and so is the quality of their products, so to divest of an otherwise consistently profitable part of the business is troubling to me, especially when it’s not clear that they will have better places to use that capital.

Geographical Diversification

Unilever is a truly global enterprise that operates in over 190 countries in all continents, with emerging markets in Asia, Africa, the Middle east, etc… taking an increasingly large share of the company's revenue.

Overall as Emergent Markets grow and become wealthier their people become more able to consume Unilever products, and so a pivot towards those growing markets is providing a growth path to the company.

Of course this high geographical diversification brings forward some challenges not just in terms of adjusting products for local markets, or the difficulties involved with buying significant portions of the worlds commodity market (Unilever buys 10% of all black tea produced in the world!), but also difficulties and issues involved with Exchange rates and capital controls.

While the company does use some hedging mechanisms, exchange rates are an omnipresent threat and drag on performance.

Management

Alan Jope is the current CEO of Unilever, and he has been in the position since January 2019. Jope joined Unilever in 1985 as a graduate marketing trainee, and has risen from the company since. He was the president of the Beauty & Personal Care division of Unilever.

Unilever management is increasingly focused on a multi-stakeholder approach to governance. This is seen through its focus on Environmental Protection, Consumer Protection and Social Justice.

The stakeholders involved are as follows:

Our People - Dealing with Employees

Consumers - The End-users of the products

Customers - The Retailers and Distributors that sell the products

Suppliers and Business Partners - Who provide Unilever with the raw materials for production

Planet and Society - The environment in which Unilever operates

Shareholders - The Owners of Unilever

This approach may have certain social and PR benefits, but it is not one that I see with good eyes.

A company exists purely for the sake of its owners, not anyone else, and the fact that Mr. Jope and his team don’t see it that way is problematic and indicative of poor quality of management.

It’s worth asking just how responsible is this “multi-stakeholder” approach responsible for the management failures to generate shareholder value over the past decade, and just how much it is responsible for management's current urge to conduct sales of profitable assets, and make failed and overpriced bids on other companies' divisions while calling them “strategic acquisitions”.

Risks

Internal Risks

Brand Preferences, Innovation and maintaining Brand Relevance

Portfolio Management and Strategic Investment Choices

Customer Relationships

Talent Acquisition

Product Quality and Safety

External Risks

Climate Change and regulatory actions relating to it

Supply Chain Disruptions

Economic and Political Instability

Treasury and Taxation

Legal and Regulatory

Fundamental Data

Income Statement

Unilever has been consistently profitable, and its high revenue and margins are in line with some of its competitors like Procter & Gamble, Colgate-Palmolive, etc…

That said, the decrease in turnover and subsequent earnings in the past 3 years is concerning, so let’s see if it’s a more long term issue.

Revenue Growth

As we can see Unilever’s revenue has been more or less flat over the past 10 years with an annual compound growth rate under 1%.

This is the main cause of their lagging earnings growth and subsequent shareholder returns, and it’s worth thinking about what is causing this…

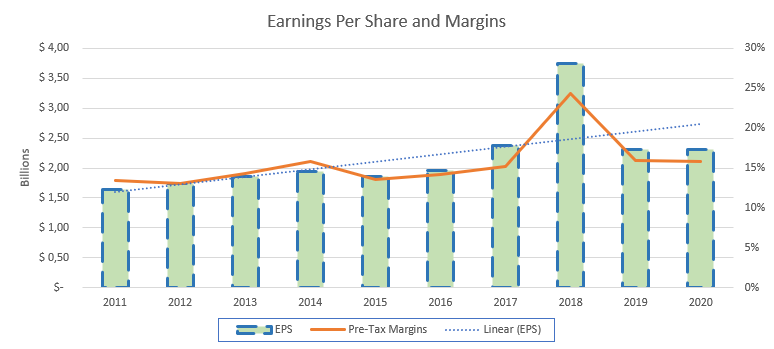

Margins and Earnings

Pre-tax margins have been slightly increasing and are a steady and reasonable 16%.

Earnings per share have remained more or less flat over the past 10 years, with a compound growth rate under 4%, mostly as a result of higher margins and share buybacks.

Balance Sheet

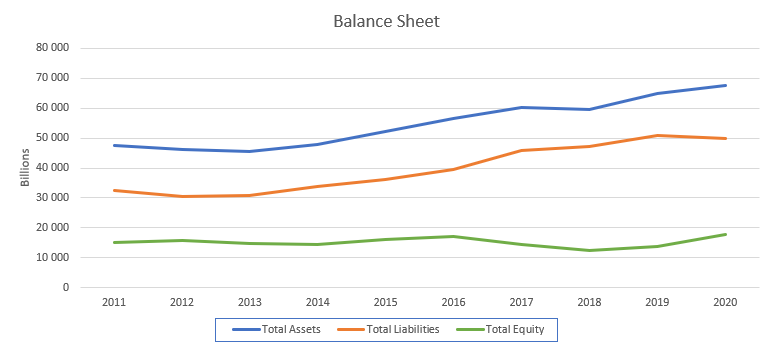

Shareholder Equity

Shareholder equity has remained flat over the past 10 years, and any increases in assets has been the result of increasing liabilities and leveraging.

This is concerning since neither earnings nor revenue have increased at this rate, which in turn makes it harder to justify or sustain the increased leverage.

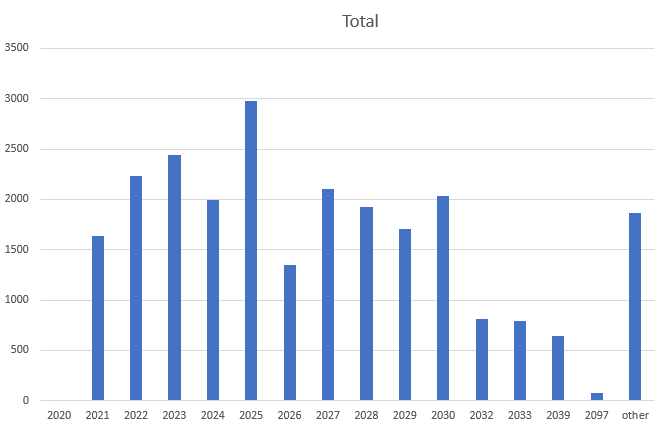

Debt Schedule

Unilever holds roughly 27 Billion Euros worth of financial liabilities, of which 4.5 Billion euros are current liabilities:

In terms of timing to debts, their latest annual report outlines the following:

So there are no major debt cliffs that we can see, though a significant portion of pre-tax income will have to be allocated to pay for the high debt load the company currently has.

It’s interesting to see that they have a 5% bond that expires in 2097, so it seems that at least some bond holders believe the company will be around for a while.

Shareholder Returns

Buybacks

Unilever has conducted share buybacks, but it does not seem to do so in a consistent manner.

The bulk of the buybacks were conducted in the 2016 to 2018 period, and follows it’s refusal of the takeover offer by Kraft foods, and the subsequent divestiture of the Spreads business, and other re-organization and re-focus of the corporate strategy.

I would prefer it if the board established a more consistent buyback policy, but it doesn’t look like that is in the cards at the moment.

Dividends

Unilever is a company with a long history of paying an increasing dividend to its shareholders, and the past 10 years have been no different.

The company has increased their dividend every year for the past 25+ years, and holds paying an increasing dividend as one of their core goals and highlights:

A company having a long history of rewarding shareholders is a great indicator, and the fact that the current management hasn’t entirely abandoned it is indicative that the dividend is well established in the mindset of the company.

Strengths and Weaknesses

Strengths:

Geographically Diversified

High Brand Power

Non-cyclical Consumer Goods

Longstanding history of returning capital to shareholder

Weaknesses

Weak revenue growth

Increasing debt load

Too much focus on stakeholders to the detriment of shareholders

Incompetent management

Valuation

Key Ratios:

Overall none of this is particularly good or particularly bad.

The revenue and earnings growth rate is small and uninspired, and given that it is vastly outpaced by the dividend growth rate, we can see that the increased dividends are getting paid out of an increased payout ratio, which is higher than what I’m comfortable with.

Ultimately Unilever will have to either significantly increase revenue and earnings, or reduce the rate at which it increases dividends. Any other option there is fundamentally unsustainable.

The pre-tax margins are decent and in line with competitors such as Procter & Gamble, though the tax rate is higher than desired, and is being a drag on the company.

The PE ratio and PEG ratio are both quite high for the type of business it is in, and will likely get compressed in the future.

Standard Valuations

Overall these standard valuations indicate that Unilever is currently overvalued, and its true value is significantly lower than its current price.

I would say that given the long history of returning capital to shareholders the Margin to PE method is likely the most accurate estimate of the long term value of a Unilever share.

Safe Purchase Value

Overall the safe purchase value of Unilever is around 24€, which would (assuming the dividend remains as is) result in a dividend yield of around 7%.

This would be an adequate value to provide us with a 30% margin of safety, assuming the underlying qualities of the company remain the same as they have been over the past 10 years.

You may think that 7% is quite a high yield, and that as such the safe purchase value of 24€ is quite low (especially when compared with the current price of 44€), however we are trying to purchase issues that are at least 30% undervalued.

As is, the current price of 44€ is only around 25% over the estimated long term value of the company, so depending on your risk tolerance, you may be happy buying Unilever at current prices.

Additionally you may believe that some or all of the assumptions we have used are wrong, or that the growth rates might meaningfully change in the future in such a way that the value of the company will be affected.

If we assume that some of those things might happen, and modify the inputs accordingly, we do get significantly higher estimated values. For example, increasing a few assumptions by 5% gives the following result:

This assumption however increases the risks involved with purchasing the business.

Investment Thesis

Key Points

The streamlining of the companies operations into its Beauty & Personal Care segment will increase revenue and margin growth

Divesting of its Tea (and other food and beverage) business will reduce costs and the capital will be redeployed in a more productive manner elsewhere

The increased focus in Asia, Africa, and US markets will provide new paths for profitable growth

The Dividend and share buybacks will continue increasing at sustainable rates

The focus on Stakeholders and other ESG will mean that Unilever will be less impacted by any such legislation than its competitors

The company will not continue to increase its debt and leverage profile without corresponding earnings to sustain the increase

Decision

The current price of Unilever is too high to justify investing additional capital in the company.

It’s clear to me that the current management at Unilever is a far cry from some of its predecessors, and the main thing holding back the company..

Their flailing after the Kraft Merger proposal, the lack of revenue growth, the recent failed attempt at purchasing GSK consumer health business, and the politically sensitive policies that they have been promoting at the expense of selling their products shows that this management team is unable, or unwilling, to unlock the massive brand value that the company has.

Until we have a new management I don’t think that paying 22 times earnings for what @DKK quite rightfully calls a “marginal margarine maker which only seems to make shareholders skinny” is a good idea.

That being said, the underlying quality of the business means that it can take a lot of punishment before going down, and given the recent interest from activist investors it may well replace its current management with one that is more shareholder friendly.

I will not be selling my existing shares, nor will I be adding any new ones.

My Current Stance: HOLD

What about you? Are you buying Unilever?

Let me know in the comments below, and don’t forget to subscribe for more equity analysis!