Over the past few decades the holding periods of assets has been decreasing leading me to question what exactly investors have been doing?

It seems that to many people the old motto no longer appeals to them:

Time in the market beats timing the market

Where we are, and where we were

According to Reuters the average holding period has been decreasing to record lows and now stands at less than 6 months!

If we look at it over a longer timeline this change is astounding:

To go from as high as 8 years in the 1960s to less than 6 months today is a gigantic shift, and one that honestly confuses me

Are we not long term investors?

Do we genuinely expect to get any meaningful returns in less than 6 months?

What exactly is going on?

To me, I generally approach any investment with the idea that I will never sell it. Yes, occasionally there are exceptions, but by and large I try to approach it with the view that I am not able to exit my positions at will.

This should theoretically lead me to consider companies that have solid fundamentals and that will be able to provide me with decent long term returns.

But is that actually the case?

Have I actually “beaten” the average holding period?

Let’s take a look!

Please note a few things:

I’m counting all assets I purchased for the long term, which means I’m not counting the options i sell and expect to expire

I’m merging together the same stocks that I purchased in bought IBKR and Degiro. This means that a company like O 0.00%↑ I’m using the degiro opening position date, despite the fact that’s since sold all of those shares as a result of my transfer over to IBKR.

When it comes to funds, some of them track the same index, but since they are different funds I’m tracking them separately.

For example $VUSA and $CSPX both track the S&P500, but one is accumulative and the other distributive. I’m tracking them seperately with CUSA having a holding period of 468 days and CSPX at 937 days.

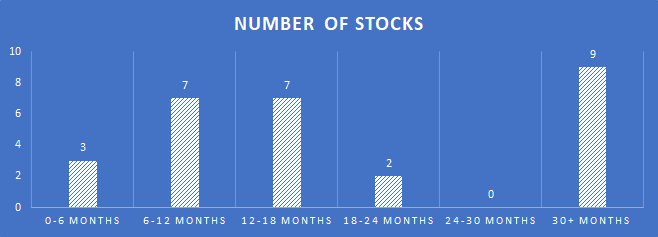

Overall my average holding period is 606 days, with my shortest holding period at 26 days (Yokogawa Bridge Holdings which I’ve just recently purchased), followed by VUTY (a treasury bond ETF) at 128 days. The last entry under 6 months us KHC which stands at 182 days.

The longest held shares are O 0.00%↑ JNJ 0.00%↑ and UL 0.00%↑ all of which have been held for over 1000 days each.

If we consider only the positions that I’ve already closed then my average holding period is quite a bit shorter at only 378 days, with my shortest holdings being $VUTY , KHC 0.00%↑ and PEP 0.00%↑ at 128, 182 and 285 days respectively.

Overall, I’d say i’ve been keeping to the old maxim of “my preferred holding period is forever”.

How about you? Do you keep track of your holding periods?

Let me know below!