The York Water Company

What is the York Water Company?

According to their 10-K, the York water Company is:

The York Water Company (the “Company”) is the oldest investor-owned water utility in the United States and is duly organized under the laws of the Commonwealth of Pennsylvania. The Company has operated continuously since 1816.

The primary business of the Company is to impound, purify to meet or exceed safe drinking water standards and distribute water. The Company also owns and operates three wastewater collection systems and five wastewater collection and treatment systems. The Company operates within its franchised water and wastewater territory, which covers portions of 51 municipalities within three counties in south-central Pennsylvania.

The Company is regulated by the Pennsylvania Public Utility Commission, or PPUC, for both water and wastewater in the areas of billing, payment procedures, dispute processing, terminations, service territory, debt and equity financing and rate setting. The Company must obtain PPUC approval before changing any practices associated with the aforementioned areas.

In simple terms, The York Water Company is a utility company that provides clean drinking water to households and businesses, as well as wastewater collection and treatment.

If you own a house in the areas of Pennsylvania that they serve, they are probably supplying that house with water, and dealing with the sewage it produces! It’s a simple, stable business that’s been around for a very long time, and has fairly consistent demand for a product that is unlikely to change significantly over time.

That’s a pretty old company, isn’t it?

This water company was founded in 1816, just one year after the Battle of Waterloo finally dealt with Napoleon. This is one of the oldest companies in America, and even the world, and they have been regularly paying dividends to their shareholders since 1816!

In fact, during this 200-plus year time-span, the company has paid a dividend to its shareholders every single year!

This is an astonishing record, and a clear indication not just of the quality of the business, but of the qualities and benefits that investing in regulated utilities can provide to investors over long periods of time!

Business

Strategy

York Waters business is fairly simple and consists of 3 key sections:

Water Acquisition

Water Distribution

Wastewater Treatment

The bulk of the company's water supply is obtained from both the South Branch and East Branch of Codorus creek, which together have an average daily flow of 73 million gallons, and a combined watershed area of approximately 117 square miles. The company owns 2 reservoirs, Lake Williams and Lake Redman, which together hold up over 2 billion gallons of water.

In addition to these reservoirs, the company also owns and operates a number of pipelines and wells that allow it to supplement their reservoirs in case of a shortfall there.

Due to the inherent logistical challenges involved with transporting large amounts of water over hundreds or thousands of miles, the company's business is naturally susceptible to adverse weather conditions, particularly when it comes to droughts. In order to avoid situations where large fixed costs during a period of drought reduce the company's revenues below sustainable levels, the company institutes minimum service charges intended to make up for such fixed costs.

Because the company owns the reservoirs, and the bulk of the infrastructure is long lived and requires little in the way of inventory acquisition, the company does not require large amounts of working capital.

Because the company has a direct-to-consumer business model they are not dependent on any single customer for a material portion of its business.

Due to the fact that York Water Company is a regulated utility, and the limited growth prospects inherent to a local utility business, increases in revenues are generally dependent on the ability to obtain rate increases from the PPUC in a timely manner and in sufficient amounts.

The company regularly updates its investors on such rate increases in their reports, as in their latest 10-K:

Effective January 1, 2022, the Company's tariff included a distribution system improvement charge on revenues of 3.19%.

The Company expects to file a rate increase request in 2022.

This regulation however also heavily limits any competition the company may have, which for an essential service like water supply, provides the company with substantial stability and political and regulatory protection of the business. The company is well aware of this, as per their 10-K:

As a regulated utility, the Company operates within an exclusive franchised territory that is substantially free from direct competition with other public utilities, municipalities, and other entities. Although the Company has been granted an exclusive franchise for each of its existing community water and wastewater systems, the ability of the Company to expand or acquire new service territories may be affected by currently unknown competitors obtaining franchises to surrounding systems by application or acquisition. These competitors may include other investor-owned utilities, nearby municipally-owned utilities and sometimes competition from strategic or financial purchasers seeking to enter or expand in the water and wastewater industry. The addition of new service territory and the acquisition of other utilities are generally subject to review and approval by the PPUC.

Additionally the federal Safe Drinking Water Act, the Clean Water Act and related state laws also regulate how the company can operate, and subsequently limit competition.

These regulations can impose substantial costs on the company, for example, York Water Company is currently undergoing a number of initiatives, including one to replace existing lead piping with other more modern materials that have less health impacts.

These initiatives are clearly a response to the tragedy that happened in Flint, Michigan, which resulted in thousands of people, including children, being exposed to unsafe levels of lead, as a result of a combination of lead piping, and changes in the water being supplied.

Reporting Segments

Due to the simplicity of the business, and high focus on a single business in a single are, the company has no distinct reporting segments.

Geographical Diversification

The company operates exclusively within its franchised territory located in three counties within south-central Pennsylvania, and as such its is subject to regulation by the Pennsylvania Public Utility Commission.

This can be problematic, since a single natural disaster like an earthquake could cause a major impact on the company!

Management

Joseph “JT” Hand is the company's President and Chief Executive Officer. Prior to his appointment as President and CEO on March 1st 2020, he served as the company's Chief Operating Officer, directing the majority of the company’s operations, including engineering, physical plant, and executing all elements of the Company’s growth and quality strategies.

He is also a Director of the National Association of Water Companies and chair of the Pennsylvania chapter of NAWC.

During his tenure as COO revenues have steadily increased and net profit margins have increased.

I don’t have anything bad to say about his tenure at York Water, by all accounts the business is as steady as it’s ever been, and he and his team have carried on the tradition of returning capital to shareholders in a perfectly respectable manner.

Additionally, I’m quite happy to see that he and his team regularly purchase company stock:

These may be small purchases, but it’s encouraging to see a management team that is committed to continuously Dollar-Cost-Average into the business which they are running on a day to day basis.

Indeed, over the past 2 years, I can see hundreds of buys, and only a single sell order!

Clearly the management team thinks the company has a bright future ahead, and is enjoying the regular dividends!

Risks

Internal Risks

Difficult to grow the client base

Highly concentrated in a single geographic area

Infrastructure concerns (lead pipes, reservoir failures, etc…)

External Risks

Political interference

High levels of regulation

Natural Disasters

Fundamental Data

Income Statement

Overall this is a small business with a turnover of around $55 million in 2021, and a net profit of $17 million.

Don’t let the small revenue and profits deter you from investing in the company though, the company has high profit margins as a result of the monopoly they have been granted.

Overall this is the sort of income statement we would expect from a small local business which has some sort of enduring competitive advantage.

Revenue Growth

Revenue has steadily grown over the past decade, at a rate of around 3.3% per year. The lack of any significant spikes in revenues shows clearly that York Water Company is a mature utility with the bulk of its revenues coming from its existing clients having their water rates hiked with regulator approval.

Had York Water been aggressively expanding, we would have seen significant revenue increases, since the acquisition of even a single franchise area would meaningfully increase the number of clients being serviced, and subsequently the revenues of the business.

As is however, it's clear that this is simply a steady business that just keeps chugging along.

Margins and Earnings

Just look at those margins!

At 30% margins this company is showing that they can go to bat with companies like Apple and Microsoft!

I usually say that consistently high margins are the main indicator of the quality of a business, and it’s clear that York Water is no exception here. While such high margins can be concerning in such a politically fraught environment, it’s clear that at least so far, regulation has primarily served as a way for York water to acquire and maintain a highly profitable, stable business, with growing earnings.

With an EPS growth rate of 7.3%, this is a surprisingly profitable and growing business!

Balance Sheet

Shareholder Equity

The company has maintained a relatively consistent balance sheet over time, and it’s clear that they haven’t been making changes to their capital structure in order to make the numbers look good to shareholders.

While I would prefer it if they put more focus on equity, for a stable and mature business like York Water, using debt to finance high capital expenditures may be an adequate move to make.

Still, We have to see whether the company can afford those levels of debt…

Debt Schedule

Overall this looks OK.

There are no meaningful debt cliffs over the next 5 years, and with the exception of the 2050 notes, all other repayments can be comfortably paid for with the companies cash from operations and earnings.

Given the long life span of the companies assets:

It’s clear that the company is merely using these loans to finance what are arguably very long term capital expenditures.

That said, the spread between the return on assets and the cost of capital that the business has is quite low, which means they are right on the edge of whether it makes sense to fund these capex with debt versus equity.

It might be worthwhile for the company to deleverage.

Still, I am not concerned with the ability of the company to generate the cash-flow to make due on its commitments.

Shareholder Returns

Buybacks

The company does not conduct any meaningful amount of share buybacks.

Honestly, this is the right move to make.

The company has to use its capital in an efficient manner, and that includes when and how it returns said capital to shareholders. If we have a look at the PE ratio for the past decade:

We can see it has been trading above a 15 PE for this entire time.

I’ve talked about this before:

If you're a tech company trading at a 36 PE you should be paying dividends, not making buybacks. If you're an Insurer trading at a 7 PE, then doing some buybacks alongside your regular growing dividend might be appropriate.

York Water is not an insurer, but it’s the next best thing, and it’s been trading at a 30 PE ratio. This is not the time to do buybacks, it’s the time to issue dividends!

Dividends

And here we get to the reason for this post, York Water dividend history.

With over 200 years of continuous and consistent dividend payments, York Water is one of the oldest companies in the US, and has returned substantial amounts of capital to its shareholders throughout its lifetime.

It’s simply amazing to see how such a small and simple company can help people to create generational wealth.

While the dividend growth is not amazing, averaging at around 4.3% annually over the past 10 years, the payout is sustainable.

Strengths and Weaknesses

Strengths:

Demonstrated willingness and commitment to return capital to shareholders

Stable business without meaningful headwinds

No significant debt cliffs

Weaknesses

Low growth prospects

Low dividend yield

High amounts of debt and low returns on that debt

Valuation

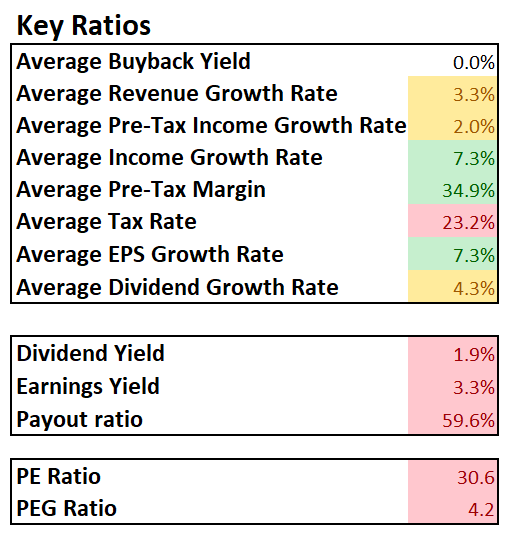

Key Ratios

Honestly, setting aside the valuation related metrics, and the buyback yield, all of this looks OK!

Some of the metrics are extremely good, like the 35% pre-tax margin, or the 7.3% Earnings per share growth rate, while others are less impressive, but nonetheless positive.

The fact that the dividend growth rate is lower than the EPS growth rate is encouraging because it means the company has been decreasing its payout ratio over time. That ratio is now around 60% which, given the stability of the business, is fairly sustainable.

That PE ratio, dividend yield and earnings yield though… This company is expensive, and from a sniff test it’s not looking good.

While it’s clear that 200 years of continuous dividends must command a premium, if that premium is too high then it might not be worth it to invest in the company.

Standard Valuations

And here we see the issues with that premium.

While two of the valuation methods give higher values than the current price, the high difference between the discounted earnings method, and the margin to PE method implies that we might be overpaying for the high pre-tax margins.

While such margins are certainly a positive, the fact that they are being acquired in an uncompetitive environment means they don’t quite pack the punch that organic margins would. And from the lack of growth, it’s clear that we would be overpaying if we were to purchase the company right now.

Safe Purchase Value

If we average out the valuation methods, and add in a 30% margin of safety, then we get a safe purchase value of $21.10 per share.

This is about half the price that the company is currently trading at, and we would expect a 3.7% dividend yield at that point.

Personally I feel like that would be a fair price for the business, and as such the current $40 price tag is far too high for my tastes.

Investment Thesis

Key Points

The company is stable and unlikely to go bust anytime soon

The management team is confident in the business, and has been buying shares

The regulatory environment in which the company operates in is favorable

This is a simple business where not a lot can go wrong or be mismanaged

The business is small and highly concentrated

Debt is not an issue at the moment

The company will continue to pay dividends.

Decision

It’s clear that this is a high quality business with a clear history of shareholder wealth creation, and a management team whose incentives are aligned with the shareholders.

While some investors may not like the size of the business ($55 in revenue is quite small for the businesses I usually review) I don’t particularly mind investing in smaller businesses if the price and quality is right.

York Water does have the quality, but it does not have the price!

This business is trading at a premium, likely as a result of its dividend history, and the stability of the business, but this premium is far too high for my tastes!

You can buy the best business in the world, but if you pay too much for it you will lose money.

I don’t want to pay this much for the premium, particularly given the high geographic concentration of the business, and as such I will not be buying. Indeed, if I owned the business I would likely sell my position due to its overvaluation, like I did with Pepsico and McDonalds last year.

My Current Stance: SELL

What about you? Are you a York Water shareholder?

How do you feel about their 200 year dividend history?

Let me know in the comments below!