Texas Instruments

More than just a calculator company

What is Texas Instruments?

According to their annual report, Texas Instruments is:

We design and make semiconductors that we sell to electronics designers and manufacturers all over the world. Our operations began in 1930, and we are incorporated in Delaware. With headquarters in Dallas, Texas, we have design, manufacturing or sales operations in more than 30 countries. Our two reportable segments are Analog and Embedded Processing, and we report the results of our remaining business activities in Other. In 2021, we generated $18.34 billion of revenue.

Texas Instruments is a company that needs no introduction to anyone who has taken high school math classes any time in the past 30 years, after all, the calculator you used in those classes was most likely the TI-86 Graphing Calculator, designed and manufactured by Texas Instruments.

The company makes microchips, integrated circuits, and other types of electronic semiconductors.

This is a company that has been around forever, and has played an essential role in bringing the semiconductor industry to where it is now.

In many ways, Texas Instruments was the precursor for companies like Intel, AMD and TSMC, and many key employees and even founders of these companies worked at Texas Instruments.

Indeed, Texas Instruments was the first “real” successful mass market semiconductor company, and it’s the forefather of many of the technologies and microchips used today.

Business

Strategy

The entire Texas Instruments strategy is in many ways the complete opposite of Intels strategy.

Unlike Intel or AMD, where the focus is on making huge capital expenditures in R&D and cutting edge production facilities, Texas Instruments focuses primarily on efficiency.

The entire business model of Texas instruments relies on providing affordable, diverse and long-lived semi-conductors that will be relevant for decades before needing to be replaced by more advanced chips.

This longevity of chips is key, because it means that Texas Instruments doesn’t have to spend nearly as much in R&D and in new production facilities. Unlike Intel where the chip that was released 2 years ago is already outdated, Texas Instruments produces evergreen chips, suitable for a wide range of uses.

You won’t find Texas Instruments chips in the list of “latest and greatest CPUs”, but you don’t need to. That car with small CPU that deals with engine sensors doesn’t need to be 2% faster than last years model, the same applies to any number of thousands of chips that we rely on for our modern lives.

Texas Instruments produces chips that are good enough for the purpose, at affordable prices, and that’s just fine!

This is a mature company, and they know it.

This strategy of long-lived generic chips results in a wide market, opportunities for cost control in R&D and production, as well as greater opportunities to establish long-lived customer relations and subsequent value per customer.

In short, Texas instruments is trying to maximize their return on capital in order to be able to return that income to shareholders.

This is a good thing, and I’m fairly happy with this type of strategy for a mature company in what might otherwise seem a highly competitive industry.

Reporting Segments

Texas Instruments has 3 primary reporting segments:

Analog

Embedded Processing

Other

The analog segment is the largest segment corresponding to around 77% of the companies revenue in 2022. These correspond to sensors, amplifier, regulators, controllers, converters, etc...

When you think of a “dumb” chip that does one small task that interacts with “the physical world” and nothing else, those are generally analog sensors/chips.

The Embedded Processing comes in at about 17% of revenue and is what you would normally consider “the brain” of electronic equipment. These often have custom made software, and can vary a lot from very simple, low-cost microcontrollers, to more specialized and complex devices that deal with controlling servos and motors.

We should also take a look at the markets that the products that Texas Instruments sells service:

As you can see, it’s a fairly well diversified business, and almost every part of modern life is using some product from Texas Instruments.

This market diversification means that the traditional boom and bust cycles that have historically characterized the semiconductor industry are ameliorated (though never eliminated!) for companies like Texas Instruments.

Geographical Diversification

Texas Instruments has over 100 thousand customers all over the world. Additionally Texas Instruments also has some manufacturing facilities in North America, Asia, Japan and Europe.

They primarily sell their products through direct sales channels, including their website and broad sales and applications team. They also make use, to a lesser extent of direct sales, of distributors.

Over the past few years they have made efforts to build closer direct customer relationships. In 2021 about two thirds of their revenue was direct.

Online sales were big beneficiaries of the pandemic, and it’s becoming a bigger and bigger portion of overall sales.

This is both good and bad, on the one hand it reduces costs, and allows Texas Instruments to begin selling to under-served markets, but at the same time as customers get used to online semiconductor sourcing, it also means Texas Instruments will be competing with more entrants from all over the world.

Looking at their manufacturing facilities, we can see they are fairly well diversified with plants all over the world:

I don’t think geographic risk will be a major problem here. Its worldwide distribution means that a single earthquake or other disaster will not prevent the company from doing business entirely.

Management

Richard K. Templeton is the chairman, president and chief executive officer of Texas Instruments.

Mr. Templeton has been CEO of Texas Instruments since 2004, and his performance speaks for itself. Revenue, earnings and dividends have steadily increased, and it’s clear from both his past performance, and his stated intentions in the near future that returning capital to shareholders is a priority for him and his team.

I have no complaints about his past performance or his future strategy, and I commend him and his team for being able to transform Texas Instruments into a fantastic instrument for wealth creation.

The one complaint I have is that for the past few years both he and his team have been regularly selling off their stake in the company, usually as a result of a combined Options Exercise + Sale procedure that results from equity based compensation.

There are many reasons to sell a company, so I don’t necessarily think that there is anything wrong with the business, but at the same time, it’s clear that the insider transactions don’t inspire confidence.

Risks

Internal Risks

Capital expenses may not be as efficient as past investments

Significant capital expenses will be required in the near future

Management seems to be selling their shares while the company is buying them back

External Risks

The strategy can be disrupted by foreign competition due to comparatively low barriers to entry

The current oligopolistic market will likely not remain so in the future

Highly cyclical industry and we seem to be at the top of a cycle

Fundamental Data

Income Statement

The company has been consistently profitable over the past few years, with steady margins and consistent R&D and SG&A expenditures.

That said 2021’s revenues were significantly higher than 2020, and something that I don’t think will repeat itself.

I’m not sure if 2022 will have additional revenue growth, or if it will actually decrease in revenue, and I don’t think there is any way to tell at this point if the reopening-related demand has all been fulfilled. If it has, it’s very possible that we will see revenues decrease to levels closer to 2020.

Another thing to note is the low impact that interest and debt expenses have on income, this is something that I like since it means they either have low amounts of debt (great!) or they have very low interest rates (which can be good and bad).

Revenue Growth

When we look at their revenue growth over a longer period of time, we can see that 2021 has in fact been a massive outlier.

Indeed if we look at the 20 year revenue growth rate we can see that their revenue has been growing at around 4% yearly over the past 10 years.

This is pretty in line with a mature and established industry, and a far cry from the 26+% revenue growth rate in 2021!

If I had to guess I would say that this growth will revert to the mean, and likely result in 16.5 billion dollars in revenue in 2022.

Still, I’d love to be proven wrong about that!

Margins and Earnings

With lack luster revenue growth we have to figure out where the 20% Earnings Per Share growth rate over the past 10 years came from, and here we can see that it’s mostly coming from increases in pre-tax margins.

The question then becomes, “Can they continue to increase these margins?”

It’s clear that no margin increase is sustainable indefinitely, after all your profit margins can’t ever be more than 100%.

So, is 50% margins low enough that the company still has room to grow?

Personally I don’t think so.

This is close to a commodity product, and while there is currently a bit of an oligopoly situation with significant shortages of chips all over the world, I think that enough investment is being made in semiconductors that the situation that enabled such high margins will not remain 10 years from now.

I’m not sure what the “right” margins will be, but I would not be surprised if it was pressured down to 30% or 20%, or maybe even lower!

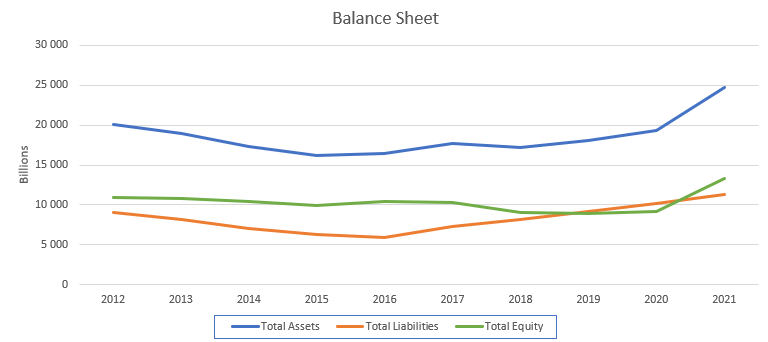

Balance Sheet

Shareholder Equity

I’m quite happy with the capital structure due to the fact that it’s got a decent amount of shareholder equity in it, and there have been no significant changes to its structure over time.

I’m usually quite concerned if a company will suddenly start taking on massive amounts of debt and replacing its equity with debt, but it’s clear that Texas Instruments has more or less maintained the same amount of equity in the business.

That said if we look at the balance sheet…

We can see that about a third of the company's shareholder equity is composed of goodwill.

Goodwill is a difficult topic, but it’s generally not a good thing to have on the balance sheet since it’s difficult to determine it’s true value, and can very easily indicate that the company has overpaid for some acquisition.

Another thing to note is the amount of current assets, which is high enough that it could pay off all of the companies liabilities. Indeed they have enough cash in hand to pay off over half of their long term debt!

Debt Schedule

The vast majority of the companies outstanding debt is composed of fixed-rate notes with the following repayment schedule:

As you can see there are no significant debt cliffs anytime soon, and indeed the only debt cliff that i can see here is due in 2048, and is quite small compared to the companies net income, cashflows and even cash on hand.

With most of these borrowings under 3% interest it’s clear that the company has taken advantage of the low cost of capital to get some working capital. I don’t particularly like this strategy, but it’s clear that the management team isn’t being overly aggressive about it, and so i’ll let it slide.

That said, I’d really prefer if they were to use the cash they have on hand right now to pay off those 2039 and 2048 notes. That interest rate is too high for my liking, and they certainly have the cash to do it.

Shareholder Returns

It’s clear from the company's investor presentation and annual report that they are very focused on giving investors the best “bang for their buck” they can, and if we look at the amount of cash they have been returning the shareholders over the past decade we can see that they have certainly been successful at it.

Buybacks

The company has been buying back shares at a steady rate, and over the past 10 years they have bought back around 2% of their outstanding shares each year.

That said, I think it’s been a mistake to do so.

The company has been trading at over a 20 PE for much of the past 10 years, and so share buybacks weren’t providing investors as much as they could have. Personally I would have preferred if they had simply paid a bunch of special dividends instead.

Dividends

Texas Instruments is not yet a Dividend Aristocrat, though all signs indicate that they are pursuing such a status, and given that they have been growing their dividend for 17 years, they will likely enter that club sometime in the next 10 years.

They currently issue a $1.15 quarterly dividend for an annualized dividend of $4.60.

This dividend has grown fast over the past 10 years,and at a CAGR of 23% it’s faster even than their EPS growth rate.

Their payout ratio isn’t too high though, and stands at a reasonable 55%.

Strengths and Weaknesses

Strengths:

Focused managements team with a clear strategy

Ongoing commitment to return capital to shareholders

Insignificant debt profile

Weaknesses

Unsustainable earnings growth will likely stall in the near future

Mature industry with low growth

Some capital has been misallocated into overpriced share buybacks

Valuation

Key Ratios

Have we ever seen a company in this blog with such good key ratios? I don’t think so.

The one dark mark in these ratios is the average revenue growth rate which is still a perfectly acceptable growth rate for a mature industry.

Other than that, only the valuation related ratios are a bit disappointing, with dividend yield and PE ratios being above the general markets long term average. In a way this is to be expected given the otherwise stellar ratios.

Standard Valuations

The low book value is again the outlier, indicating that purchasing this company will be done for its earnings power, not for its assets.

The remaining valuation methods indicate a fair value between $300 and $570, but personally I don’t think that will be accurate.

More realistically with the expected lower forward returns for the headwinds we discussed above, I’d expect these numbers to get cut down a bit, perhaps by as much as 20%!

I’m feeling tempted of bumping up my margin of safety, or my assumptions to reflect the issues that these unsustainable methods of increasing returns (ie: margin increases and share buybacks) cause.

But again, these are the numbers we have and so we must use them as they are if we want to be consistent across multiple companies.

Safe Purchase Value

And here we see the results.

With an average Long term value of $320 compared to the current price of $166 at the time of writing, we can see that even with a margin of safety of 30% we still have quite a significant value delta!

While I do think it might be worthwhile to increase that margin of safety, it’s still clear that we are looking at a company that is undervalued, and which has good prospects of future returns.

Investment Thesis

Key Points

Stable business in a growing industry with some competitive advantages

Efficient capital allocation and high returns on assets

Sustainable amounts of debt, and low cost of capital

The dividends and share buybacks will continue to drive shareholder returns

Some head winds will come in the next decade, including:

Higher levels of competition

Margin pressure and shrinkage

Reduced revenues

Capable and focused management team.

Decision

It’s clear that Texas Instruments is a quality company with quality management and a clear path forward.

While there are some incoming headwinds for returns going forward, it’s still a good company that will likely continue to make money well into the future.

So the question primarily is… “Is it worth buying?”.

Given the clear undervaluation of the business I would generally say that a cautious investor would likely do well in purchasing the business.

My Stance: BUY

That said, I will not be buying Texas Instruments at this time.

That sounds a bit strange, doesn’t it? It’s a Buy stance, but I'm not buying?

Well there are two main reasons I'm not buying, the first is that I already have significant amounts of capital invested into the semi conductor industry in Intel, and I don’t want to overly concentrate my portfolio in that industry.

The second is that I’m still in the process of increasing my allocation to VWCE, and as such I simply don’t have the capital structure that would allow me to invest in more individual issues.

This is a good business, and one that I would like to own, but until I have finished the changes to my portfolio allocations I simply don’t have the cash to invest in it.

That said, if I happen to get a tax return i might make a small purchase.

What about you?

Do you own Texas Instruments? Do you think I’m wrong about the headwinds?

Let me know in the comments below!

A very high quality article my friend!!! 👏👏

One thing we disagree on is the valuation, but that’s because of the difference in methodology. I use DCF and I get to a fair value of 166 dollars per share ;-)

I enjoyed the read, keep them coming!

eDGI

Hi Tiago and European DGI - I find both blogs very valuable but since I am new to dividend investing and still learning how to evaluate companies I am quite confused how come that FV difference between both of you is so large it is 166 vs 320. How to interpret this?