T. Rowe Price

This financial company is looking highly undervalued

What is T. Rowe Price?

According to their latest 10-K, T. Rowe Price is:

T. Rowe Price Group, Inc. is a financial services holding company that provides global investment management services through its subsidiaries to investors worldwide.

We provide an array of U.S. mutual funds, subadvised funds, separately managed accounts, collective investment trusts, and other T. Rowe Price products.

The other T. Rowe Price products include: open-ended investment products offered to investors outside the U.S. and products offered through variable annuity life insurance plans in the U.S.

We also provide certain investment advisory clients with related administrative services, including distribution, mutual fund transfer agent, accounting, and shareholder services; participant recordkeeping and transfer agent services for defined contribution retirement plans; brokerage; trust services; and non-discretionary advisory services through model delivery.

We are focused on delivering global investment management excellence to help clients around the world achieve their long-term investment goals.

In short, T. Rowe Price, ticker symbol $TROW, is an asset manager that works with its clients to invest their funds and help safeguard their retirement.

Personally I don’t use their investment advisory services since as a general rule I like to manage those things myself, but I can certainly see many people in my life who would benefit from such services.

Though like we discussed earlier, they should really make sure the incentive structures are aligned!

That said, I do make use of some products that companies like T. Rowe Price provide, namely “pre-packaged investment products”.

What do I mean by that?

Well, while I am comfortable with managing my individual investments myself, I’ve talked before about the benefits of diversification, and in particular of making use of low-cost index funds to fulfill that need in your portfolios.

T. Rowe Price provides products that allow investors to have specific exposures to certain investments, and there is substantial value in that.

Business

Strategy

The easiest way to find out a company's strategy is by simply going to their investor relations website, and looking for their most recent “Investor Day”.

T. Rowe Price is no different, and the company has a very nice investor day presentation that you can find here.

What I see here is good!

It’s clear that the company's management is focused on providing high quality investment services to their clients, and aligning their own interests with both the clients and the owners of the business.

I like management teams that focus on this.

I like the fact that they are clearly concerned with having debt on their balance sheet and therefore run the company in such a way that it has no long term debt.

I like the substantial employee ownership, and the long tenure of their management team.

The only thing I could really say that isn’t that great here is the fact that it operated in only 17 countries, but given the otherwise global reach of their business, I don’t think that's in any way concerning.

And here we see a more mixed picture.

I want to be clear here.

I do not like ESG.

It’s a combination of bad practices, cargo culting and simply ineffective initiatives that serve primarily to enrich ESG salesmen and ESG compliance auditors.

Professor Damodaran went into greater details in this brilliant piece, and I genuinely recommend that everyone who believes that ESG is a good thing to take a step back and really read that article.

That said, if the clients want ESG, and they are willing to pay for it, there is nothing wrong with giving people what they want.

I may not believe that there’s gold in that river, but I'm perfectly happy to sell those who do shovels and pans.

As long as T. Rowe Price sticks to the selling shovels part, rather than the drinking the Kool Aid part, I'm happy to own them.

So, how exactly does TROW 0.00%↑ make money?

Well, for the most part they charge fees on the assets they manage, and these fees are generally a percentage of the assets under management.

In a lot of ways this is great, since it does align the interests of the company with those of its clients, though it can certainly by very expensive for the clients!

We can see here that TROW 0.00%↑ has regularly increased their assets under management, which has subsequently resulted in higher revenues and obviously higher net income for the shareholders.

Part of the increase comes from organic growth, that is, the company has taken advantage of the longest bull market in history, and the assets they have managed have become more and more valuable!

Another part is that the company has managed to attract new customers that come in with new assets to be managed.

Right now the company is managing around 1.552 Trillion US Dollars worth of assets! That’s an incredibly large amount, and they are charging their clients a fee of only 0.5% to do it!

That’s honestly a good deal for the clients! Most funds that compete with the market segment as TROW 0.00%↑ tend to charge higher fees, and so 0.5% is quite a low amount.

I’ve seen plenty of funds in Portugal where fees are 2%! On returns close to inflation!

This client friendly fee structure has allowed them to increase revenues by 9.6% per year over the past 5 years, and given the way that the industry operates, this gives them advantages of scale that resulted in their expenses not growing as quickly!

This is key in creating shareholder value, because it means that the company has enough cash and enough earnings to not need debt or additional capital injections, and additionally to return that cash to shareholders.

Which they do:

The company is a dividend aristocrat, and it shows in their commitment to continue increasing dividends.

They have also been buying back shares, and remaining debt free!

There is also a recent annual meeting presentation here.

Reporting Segments

The company doesn’t really have any specific reporting segments, but they do have different products they sell, and different methods of selling those products.

To be more specific they deal with 4 key product lines:

Equity

Fixed Income

Multi-Asset

Alternatives

Additionally in each of these product lines they provide a number of different options to both US and international markets.

For example when it comes to equities, they provide different types of products focused on specific themes, such as:

Growth

Core

Value

Concentrated

Quantitative

Sustainable

And within those categories of products they provide different types, like All-Cap, Large-Cap, Mid-Cap, Small-Cap, Sectors, etc…

Overall their product line is well diversified, and most people in the market for the services that TROW 0.00%↑ provides will likely be able to find something that will serve their needs.

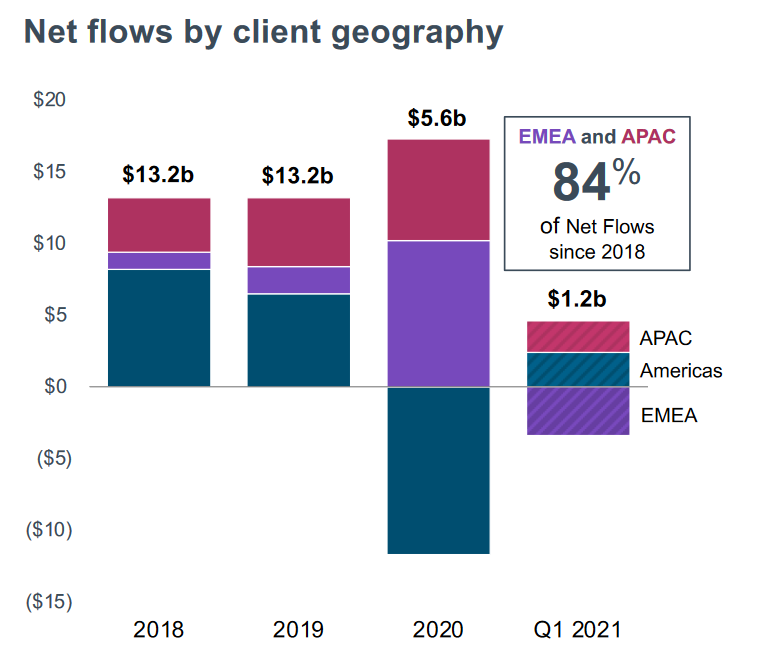

Geographical Diversification

TROW 0.00%↑ has offices in 16 countries around the world, though the bulk of revenues still come from their US business.

In general they consider 3 broad geographical units:

Americas

Europe, Middle East and Africa

Asia Pacific

In total they serve clients in 50 countries around the world, though US based clients comprise roughly 90% of Assets under management.

Though with the growth of net flows from clients in international markets, that figure is likely to change significantly in the coming years.

Management

Robert W. Sharps is the CEO and president of the T. Rowe Price Group, having joined the company in 1997 as an analyst specializing in financial services stocks, including banks, asset managers and securities brokers.

I’m sure that experience is useful in running such a company!

Mr. Sharps has been CEO since January 2022, so he has clearly had a bit of a rough start given the bear market we’ve since found ourselves in.

Overall he hasn’t been in charge for long enough for me to form a strong opinion about his performance.

That said, another thing I’d like to see is any insider transactions that the management team might have been making.

After all, around 9% of the company's outstanding shares are owned by management, according to their 10-K, so I’d like to know if they are buying or selling!

Overall they don’t seem to regularly buy any TROW 0.00%↑ shares, but I'm not too concerned about that. There may be only one reason to buy, but there’s plenty of reasons to sell after all.

This isn’t good, but it isn’t bad either, it’s just meh.

Risks

Internal Risks

Highly regulated industry

Highly Cyclical

External Risks

Revenues are highly exposed to Assets Under Management

Highly competitive industry

Fundamental Data

Income Statement

Overall the company's revenues have seen a large jump in recent years given the retail investor boom during 2020, alongside a roaring bull market.

Now that the market is settling down, and we are looking at a bear market for 2022, we see that their assets under management are decreasing, and as such so is their revenues.

That said, their pre-tax profit margins are huge, and I’m not at all concerned with them going bust any time soon!

I think consistent profits are key, and the recurring nature of their revenue, is a big advantage, as is their lost cost structure.

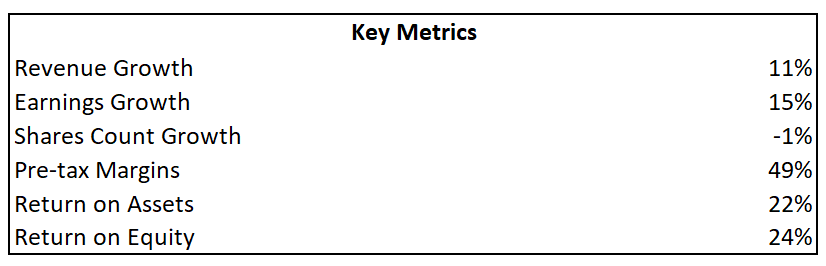

Revenue Growth

Over the past decade the company has steadily grown their assets under management, and their revenues with it.

Overall they market an 11% revenue growth over the past 10 years, which is quite impressive for such a boring business!

Margins and Earnings

And the increased revenue has led to increased economies of scale, so the business has increased earnings by 15% per year! All the while buying back 1% of their shares annually, and paying a dividend!

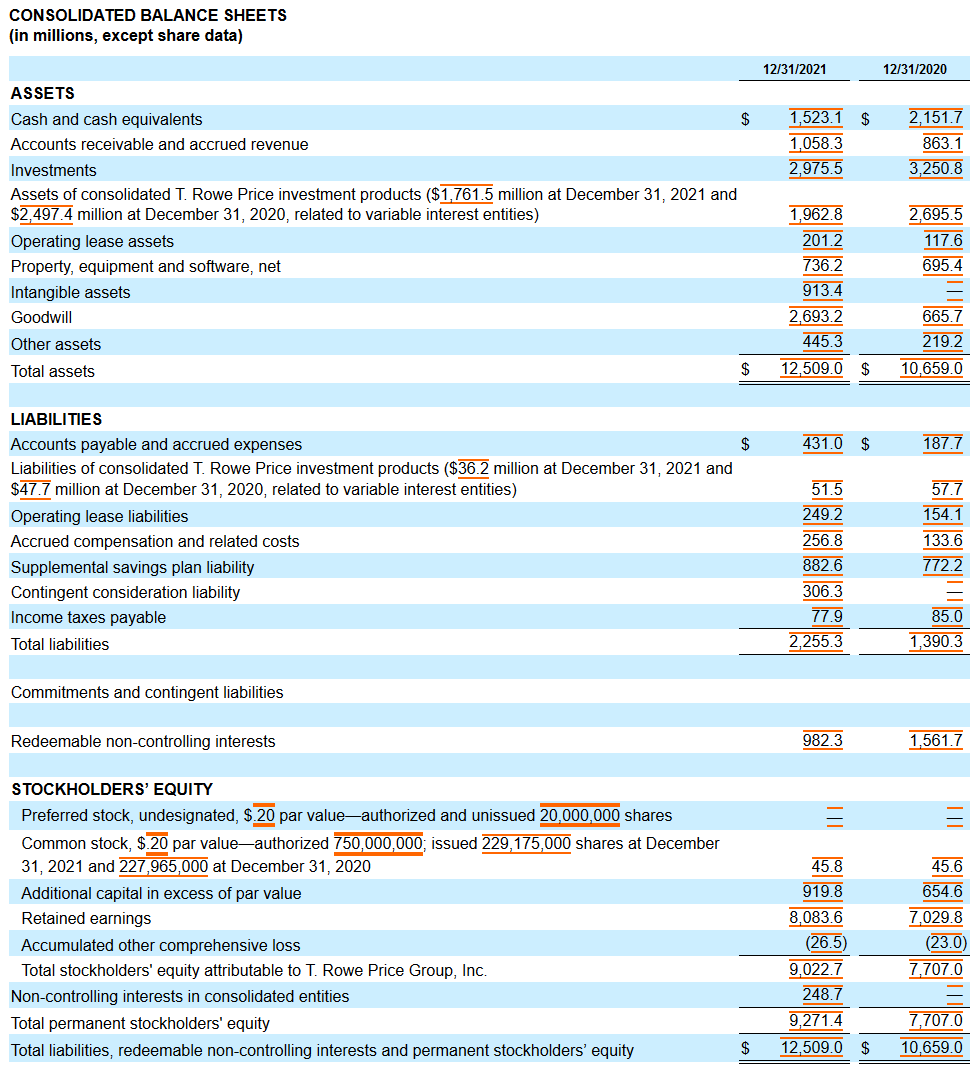

Balance Sheet

Overall this is a stellar balance sheet, and even though there is $2.6 billion in goodwill, that’s just fine with me.

An interesting thing to note is that they are a really asset light company, and have massive returns on assets and returns on equity!

22% returns on assets is simply amazing, and worth praising!

Shareholder Equity

The company has kept a steady capital structure, prioritizing equity over debt.

Indeed the bulk of its liabilities are what I would call “operational liabilities”, that’s accounts payable, taxes payable, operating leases, etc… Essentially these are short term “debts” that are intrinsically necessary to run any business.

On a fundamental level they are not using someone else's money to grow.

Debt Schedule

The company has no debt.

I want to repeat that because it’s worth mentioning.

The company has no debt.

This is amazing and a massive green flag as far as I am concerned!

It’s not that I am anti-debt, or believe that companies should never raise debt, but it’s undeniable that a company without debt is in a much better and financially secure position than a company with debt.

I really, really like this.

It’s very hard to go bankrupt when you have no debt.

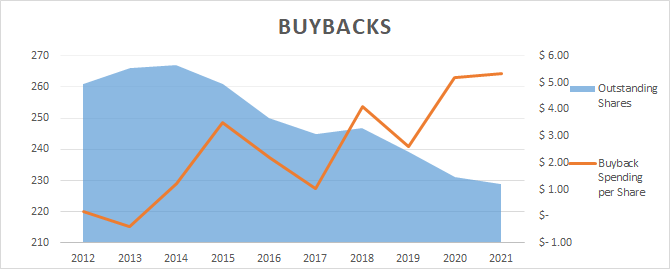

Shareholder Returns

It’s clear that the company is highly focused on returning capital to shareholders, via both dividends and share buybacks.

Over the past decade they’ve returned over $14 billion to shareholders through a combination of dividends, special dividends and share buybacks.

Buybacks

And here we see the impact of those $6.8 billion in share buybacks, which is…

Not that great.

On an annualized basis that’s only about 1% per year, which isn’t that much when we compare to the buybacks we’re getting from something like AFL 0.00%↑ .

Still, it’s a fine return, and I'm not unhappy about it.

Dividends

The company is a dividend aristocrat with 35 years of dividend growth history, and a 5 year dividend growth rate of 32% when you include the special dividends.

They pay a quarterly dividend of $1.2 and from time to time they pay larger special dividends, like the $3 special dividend they paid last year.

I like their dividend policy, and with a dividend payout ratio under 50%, they have plenty of room to grow.

Strengths and Weaknesses

Strengths:

The company has no debt

Demonstrated willingness to return capital to shareholders

Clear business model

Weaknesses

Likely to see revenues and earnings decrease in this bear market

Buyback spending may go down

Highly reputation dependent

Valuation

Key Ratios

Overall every single one of these ratios are fantastic, and any company would be happy to have them!

I have no objections here, though it’s important to be aware that their business is currently on a slight downturn due to the ongoing bear market.

Standard Valuations

And of course, the fantastic ratios and historical performance result in equally fantastic valuations.

Like always I tend to favor the margin to PE method, though in this case the discounted earnings method might be more appropriate.

Regardless, all values (except the book value) are substantially above where the business is currently trading at.

Safe Purchase Value

And here we see our safe purchase price, a whopping $324 per share! About 3 times the current price!

It’s clear the business is currently undervalued, though perhaps that undervaluation is a direct result of the ongoing bear market.

That situation after all gives it a one-two punch where the companies shares get depressed due to following the general market, and the companies revenues will get depressed as well for the exact same reason.

Investment Thesis

Key Points

The company's revenues and earnings will decrease in the next few years

The dividend is safe and will likely continue to grow

The share buybacks will contract as revenues contract

The company is asset light

The company is highly profitable with great margins

The company has no debt

The company is unlikely to go out of business

Decision

There’s not doubt in my mind that this is a high quality company with a solid business model that has a bright future ahead of it.

It also appears to be fairly inexpensive at the moment.

The only thing that’s leaving me reticent right now, is once again my drive to bring my index fund allocation to a higher proportion of my portfolio.

I’ve sold a put on the company, and if it triggers I’ll be happy to purchase those 100 shares.

I also won’t rule out an impulse buy of a handful of shares just to initiate a position, though until my portfolio allocations are done I cannot open a full position or really begin buying.

I bought a small amount of shares at $106 per share just prior to this post going live. It’s not a full position, but the price was attractive and I wanted to have a small position in the company from now on. I won’t rule out reinforcing the position if the price keeps dropping.

Current stance: HOLD BUY

What about you? Are you a TROW 0.00%↑ shareholder? Do you like the lack of debt in the business?

Let me know in the comments below!

hi, thanks for the article. Company is on my radar for some time now, but one of the biggest fears I have here is active vs passive management. This year passively managed index funds have overtaken actively managed funds’ ownership of the US stock market for the first time. There was a nice Financial Times article about it (cant find it now, sorry), generally actively managed funds are crushed by passive managed index funds. Money goes to cheaper alternatives, where 0.5 % fees are considered huge and avoided. The trend is clear. What in 10 years? Won't all the passive investing, technology, AI, cheaper brokers mean further deterioration of fees and AUM? And AUM and fees from management is THE life of this business. Don't we see an equivalent of fax-machine business of late 90s, where everyone was happy to have fax-machine in the office, and 10-15 years later it became obsolete? Not sure, really. ALl great, stellar balance sheet, margines etc, but this trend...