Stanley Black & Decker

A tools manufacturer with more than meets the eye

What is Stanley Black & Decker?

According to their latest annual report, Stanley Black & Decker SWK 0.00%↑ is:

The Company is a diversified global provider of hand tools, power tools, outdoor products and related accessories, engineered fastening systems and products, services and equipment for oil & gas and infrastructure applications, and automatic doors, with 2021 consolidated annual revenues of $15.6 billion. Approximately 60% of the Company’s 2021 revenues were generated in the United States, with the remainder largely from Europe (17%), emerging markets (14%) and Canada (5%).

In other words, Stanley Black & Decker is a tool manufacturer.

This is actually a company that I remember from my childhood (at least the Black & Decker half), since my father had and still has, a number of tools with the Black & Decker brand on them.

Stanley Black & Decker is at its core a tools designer and manufacturer, and has been in the business since 1843, a huge length of time, and a clear indicator that there is something about this business that has helped it endure almost 200 years of operations.

So let’s take a look at this business, its strategy and objectives, and see if it might be worthwhile to own it.

Business

Stanley Black & Decker is at its core a brand, and its business model relies on not just providing quality goods and services at affordable prices, but also in maintaining the goodwill that its customers have towards the brand itself.

This has significant benefits in terms of longevity and higher profit margins, but can also impose restrictions on its revenue growth, since almost by definition they are focusing on servicing the high-end market, and setting the low-end market aside.

Additionally the quality of the brand might result in them being slow in implementing new products and features, which gives competitors an opening to get themselves comfortable in a specific niche.

Because of this Stanley Black & Decker is also heavily focusing on acquisitive growth.

By buying up smaller, up and coming brands they can augment their organic growth with new products and brands with a proven market, and can therefore provide those products at lower costs by taking advantage of their scale and cost leadership.

This mixed strategy has provided good results over the past 3 years, with reliable revenue growth and earnings per share and cash flow also growing steadily, even despite a global pandemic with the subsequent economic troubles.

The only black mark here has been in the cash flow statement, where in 2021 a significant investment was made in Inventory in order to meet strong demand.

This is a one off concern though, and is expected to pay dividends going forward… So long as demand remains elevated.

Strategy

This leads us to what the company's strategy will be in the near future, and from that to its 2022 guidance.

Overall 2022 will be characterized by a few different drivers, including the divestiture of their Access Technologies business, and the closure of their Russian branches.

Both of these will result in a significant impact on their expected earnings, though perhaps the most interesting thing is their expectations for high single digit organic growth, and the resumption of their cash flows back to the $1.0 to $1.5 Billion range.

That said, it’s clear that there are significant headwinds, particularly when it comes to inflation, with commodity and transportation costs significantly increasing throughout the year.

Fortunately this is where being a company selling premium products with recognizable brands comes in handy, since it allows the business to raise prices and recover the increased costs.

Make no mistake, inflation is bad for any business, but businesses with strong brands and customer loyalty, as well as a tight grip on its suppliers and the ability to conduct consistent price hikes and control costs are in a more competitive position than those without those advantages.

Reporting Segments

The company has 3 key reporting segments:

Tools & Storage

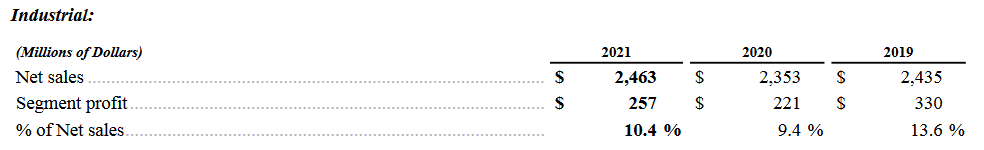

Industrial

Other

Each of these segments is in turn subdivided into other sections, for example the largest segment, with $12.8 Billion in revenues is subdivided into Power Tools & Equipment, Hand Tools, Accessories & Storage, and Outdoor Power Equipment.

Indeed, the company's 10-K is quite open about each segments revenues, and lays them out clearly in their report:

In addition to this, it’s important to take into account the exact end markets for the company's products.

We can see clearly that there is significant exposure to the U.S. Real estate sector, particularly when it comes to the residential sector, with new and existing residential construction and repair accounting for 45% of revenues.

While this is somewhat concerning if we assume a pullback in residential real estate, the fact that 25% of revenues is coming from existing repair and DIY is actually quite encouraging, since it means that the companies products have a long tail, and have a bit of a “recurring revenue” benefit, even if no new construction occurs.

Another interesting thing to note is the actual facilities the company owns:

Geographical Diversification

The bulk of SWK 0.00%↑ business is in the US with around 60% of revenues coming from the US.

The remaining is fairly evenly distribute between Europe, Emerging markets and the rest of the world.

Management

James Loree has been the Chief Executive Officer of the business since August 2016. He has had a number of positions in the company since becoming Chief Financial Officer in 1999, and as such has been in the company for quite a while.

In terms of insider buys and sells, we don’t really see anything too out of the ordinary, other that one director “buying the dip” on the company:

The company seems to have stressed a focus on corporate governance in their Invest Presentation, and presented this slide to showcase some details about its board:

Ordinarily this would be great!

Honesty and straightforwardness when it comes to maintaining corporate governance is a must, and I firmly believe that every company should put significant focus in explaining to its shareholders who, how and why their board takes the actions they take, and how the company as a whole is aligning its interests with the shareholders.

I want to be clear here, there is no problem with their disclosures, and I think many companies would do well to learn from SWK 0.00%↑ here.

The problem here is this:

THIS IS NOT GOOD.

I want to be clear here, there is no legitimate reason for there to be material weaknesses in internal controls over financial reporting. No legitimate reason.

This is a significant issue, and heavily jeopardizes and puts into question every number coming out of the business.

As a general rule any investor should stay away from any business where fraud happens, and while it’s possible that these internal controls issues might not rise to the level of criminal fraud, the same caution applies.

If you cannot trust the numbers, you cannot trust the valuation.

In this particular case it seems the 2 issues were as follows:

The first control deficiency could result in a determination that there are two units of account in which the forward stock purchase contracts, when evaluated separately as freestanding instruments, would be precluded from equity classification. As a result, the asset or liability related to the forward stock purchase contracts would be subject to mark-to-market accounting, which would be significantly influenced by factors outside of the Company’s control, including fluctuations in its share price.

The second control deficiency resulted in material errors in the calculation of diluted earnings per share previously disclosed in the Company’s historical financial statements.

The first issue while concerning, particularly given the unnecessary complexity for something that is effectively a stock purchase contract, is otherwise not too serious as far I'm concerned.

The second issue is serious, and inexcusable.

The company is currently implementing more effective controls to ensure this will not happen again, and I hope they will be successful at it.

Incorrect disclosures harm everyone, particularly investors, and you should demand a significantly high margin of safety as a result of these issues!

Perhaps even higher than 100%, making the company wholly uninvestable!

Risks

Internal Risks

Poor governance practices

Reliant on brand value

Mature business with limited growth opportunities

External Risks

Inflation and supply chain concerns

High business concentration in the US

Requires continuous favorable acquisitions to maintain growth

Fundamental Data

Income Statement

Overall the company has been consistently profitable, though the profit margins look thin at only around 10%.

You can clearly see that this is a hardware company by the high amount of cost of sales expenses! These are gross margins of around 33%, quite low when compared to software companies!

Revenue Growth

Overall revenue has grown at around 5% per year over the past decade or so, partly as a result of organic growth, and partly as a result of acquisitions that the company has conducted during this time period.

This is actually lower than what the company is guiding for 2022, which has its benefits and drawbacks.

On the one hand it might indicate that either 2022 is an outlier, or that the management team is overly optimistic… Or it might be that the company is going to be increasing its revenue growth soon, providing an additional margin of safety to investors.

Margins and Earnings

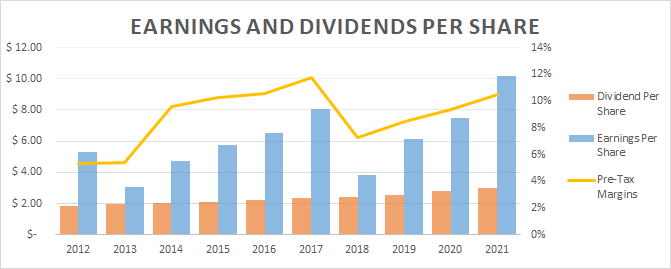

The company's pre-tax margins have been low, though not overwhelmingly so if you compare it to other retail sectors like supermarkets.

Whatever the case, we can clearly see the impact that profit margins have on the company's earnings, with even a slight decrease in margins corresponding to a huge plunge in EPS.

The company has managed to maintain a consistently increasing dividend though, and its earnings have been enough to pay out that dividend throughout the decade.

Balance Sheet

The company talks a bit about their capital allocation strategy in the investor presentation:

It’s clear that they value their credit rating, and that they are currently trying to deleverage their business in order to support their capital returns to shareholders.

Nothing in their strategy here is objectionable to me, though I dislike the use of EBITDA as a metric.

Shareholder Equity

We can see that the company has kept a more or less consistent capital structure, with increases in Liabilities corresponding to similar increases in assets and shareholder equity.

An important thing to note is the high impact that goodwill and other forms of intangible assets have on the balance sheet.

This is an inevitable result of their brand and acquisition focused strategy, but it’s not one that I generally like because it makes it difficult to determine if the book value is accurate or not.

Indeed, if we ignore goodwill and other intangibles, we effectively get a book value of zero.

Debt Schedule

But of course, we also need to have a look at the companies liquidity and ability to make good on its commitments going forward.

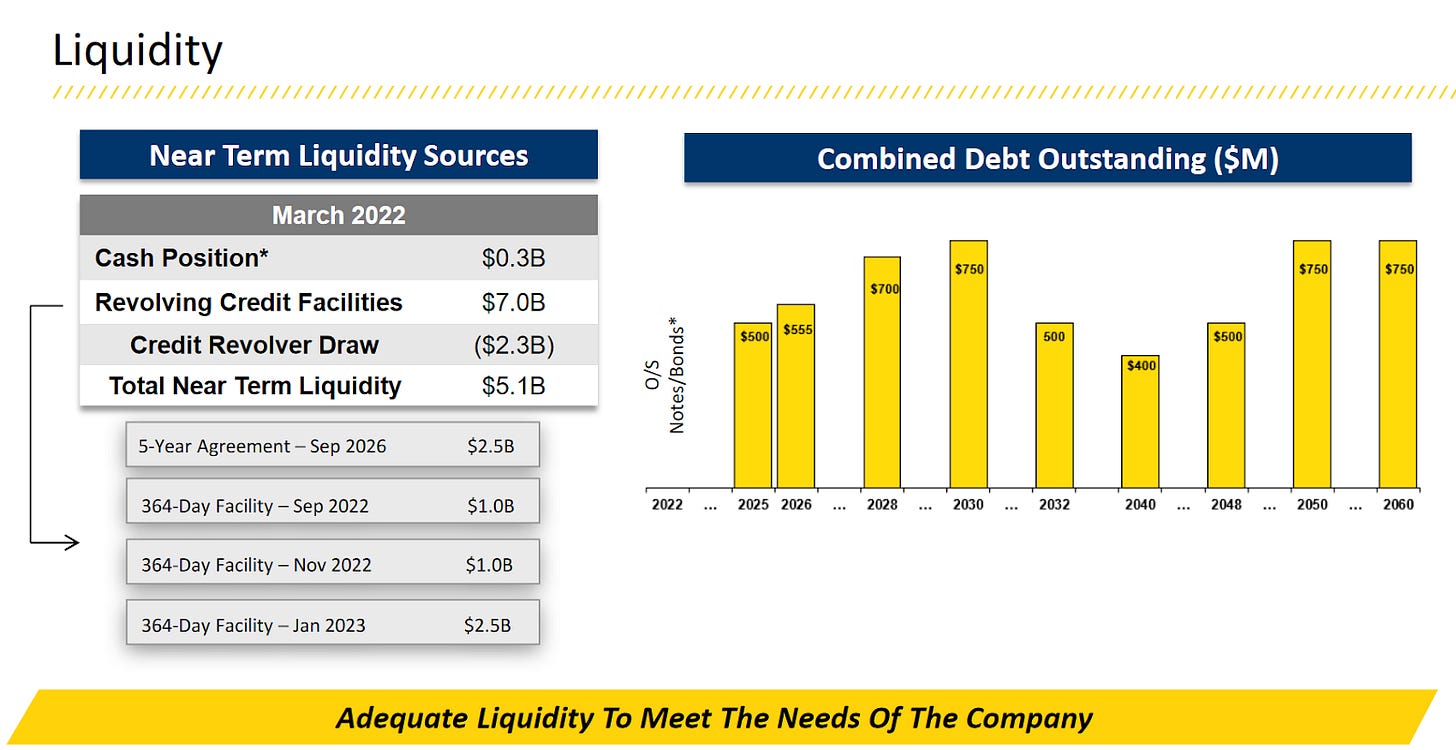

Here again we have a clear answer in their investor day presentation and in their annual report:

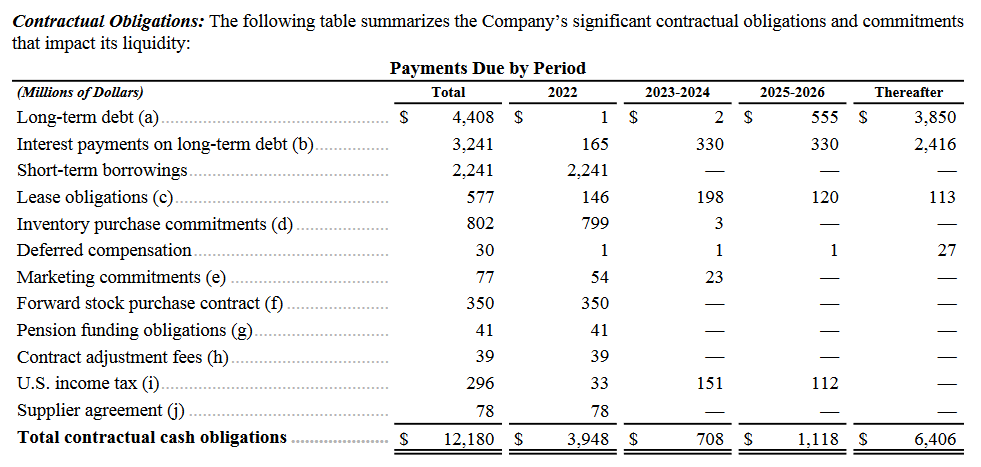

And of course if we want to go a bit deeper, the company provides a very clear and transparent table outlining their contractual obligations over the foreseeable future in their annual report:

While 2022 is looking a bit concerning with the 4 Billion in liabilities coming due, the company has enough revenues coming in, and accounts receivables and inventories that I don’t think they will have a problem making good on its commitments.

That said, they may need to refinance some of their debt, which isn’t good in a rising interest rates environment.

The long term looks good though.

Shareholder Returns

Buybacks

The company doesn’t have a clear buyback strategy, and seems content to buyback just enough to reduce any dilution coming from stock based compensation.

This is just fine with me because…

Dividends

They have a clear strategy to return capital to shareholders via regular and growing dividend payments.

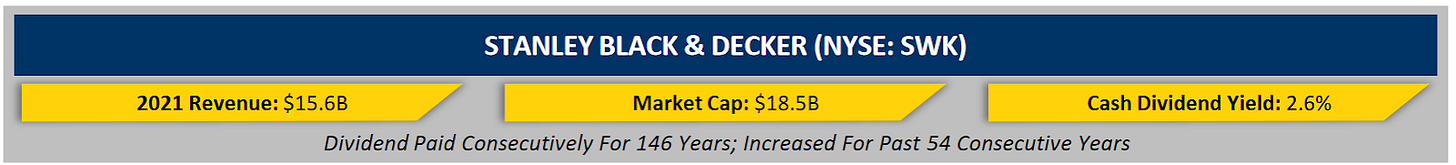

Few companies can boast of over a hundred years of uninterrupted dividend payments, and even fewer can add 54 years of consecutive increases to that record.

While their current yield might not be the most attractive, their consistency certainly makes up for it!

I like companies that return capital to shareholders, and SWK 0.00%↑ has certainly delivered on that end.

Strengths and Weaknesses

Strengths:

A long and continuous record of returning capital to shareholders

Low payout ratio

Low debt cliffs after 2022

Weaknesses:

Low pre-tax margins

Significant cash outflow commitments for 2022

High capital requirements (CAPEX + Acquisitions)

Valuation

None of these ratios look bad, though the discrepancy between the price to operating cash flow and price to earnings might seem concerning at first.

The reason for this discrepancy is due to the increase in inventories in 2021, if you remove that the ratios are essentially the same.

Is that removal reasonable though? I think so, since the company does not have a history of doing this, so I'm inclined to call this a one-off and move on.

If you think it’s a more long term concern, or that the inventories won’t be able to be sold, then you should add a greater margin of safety there.

Key Ratios

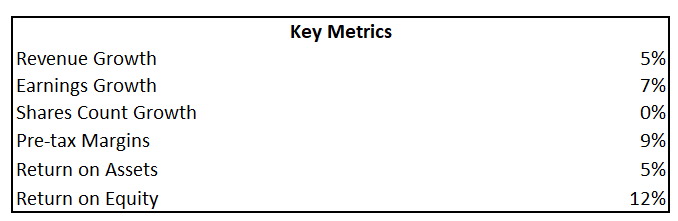

As we can see the revenue growth has been 5%, a bit on the high end for such a mature industry, but nothing to worry about or celebrate.

The earnings growth was 7%, entirely from increased margins, though again, those margins are still quite a bit lower than what i would go for.

Standard Valuations

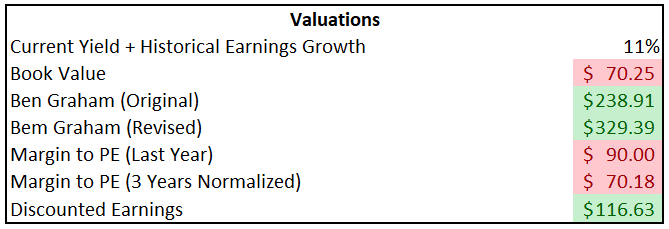

There is a pretty big divergence between Ben Grahams methods, and the other valuation methods I use.

Like always I tend to favor the margin to PE method, and those values are quite a bit lower than Ben Grahams, and even the discounted earnings method.

Also remember that the book value there is actually significantly lower when you account for the goodwill and other intangibles.

Safe Purchase Value

Using our 30% margin of safety, and an average of the previous valuations we get an average long term value of $152 and a safe purchase price of around $106.

The company is currently trading at around $100 so this would indicate that we can expect a good return if we purchase it right now!

But a few things to note:

The poor internal controls

The high discrepancy between Ben Grahams numbers and every other

The low margins and high inventories

Each of these is worth assessing and potentially increasing the required margin of safety when making a decision to purchase.

Realistically the company is probably fairly valued, and investors will do well going forward, but it’s important to keep in mind that there are risks involved.

Investment Thesis

Key Points

The companies underlying business is fundamentally solid even with low margins

The acquisition strategy is a good method for the business to continue generating growth and innovation

The issues with corporate governance are significant and should not be dismissed.

The lack of buybacks is disappointing, but not a significant issue

The consistently growing dividend appears safe, and is currently yielding a suitable amount

Decision

I keep coming back to the corporate governance thing.

As investors we rely on the board and the management team and auditors to act honestly and with our best interests in mind, that reliance means that they can commit fraud against us, and we have little power to prevent them from doing so, or even detecting when they do it.

This issue was caught by the auditors, and I thank them for it, but it puts into question the honesty of the management team.

At the same time, the low margins is something that I also don’t like, though admittedly the company has managed to produce consistent cash flows for decades, and the dividend seems to be well covered.

Currently I’m still in the process of building up my index position, so I won’t be buying the business. But at the same time, it does feel fairly valued, and if i held it in my portfolio right now I wouldn’t be too upset or looking to sell.

Current Status: HOLD

What about you?

What do you think about the business? And its corporate governance concerns?

Let me know in the comments below!