Realty Income

Taking a look at the Monthly Dividend Company

Realty Income

What is Realty Income?

According to its latest 10-K, Realty Income is:

Realty Income, The Monthly Dividend Company®, is an S&P 500 company dedicated to providing stockholders with dependable monthly dividends that increase over time.

The company is structured as a real estate investment trust, or REIT, requiring it to annually distribute at least 90% of its taxable income (excluding net capital gains) in the form of dividends to its stockholders.

The monthly dividends are supported by the cash flow generated from real estate owned under long-term net lease agreements with our commercial clients.

In other words, Realty Income owns standalone commercial properties that it rents to other companies under a Triple Net Lease scheme where the renters are responsible for 3 things:

Property Taxes

Maintenance

Insurance

The company uses the income from these leases to issue regular, monthly dividends to its shareholders.

Business

Strategy

Realty Income’s strategy is focused on unlocking growth, not just in the US market, but especially in the European market where they have been making inroads.

In order to fuel this expansion Realty Income is leveraging their existing size, scale and access to capital to acquire the resources needed.

This way they are able to continue building a diversified high quality real estate portfolio that can consistently return capital to shareholders, with little volatility and a comparatively low amount of leverage for a REIT.

In fact their 10-K clearly and succinctly outlines their investment strategy, and is well worth a read.

Here’s a few of the comments they have about their business strategy:

We believe that owning an actively managed, diversified portfolio of commercial properties under long-term net lease agreements produces consistent and predictable income. A net lease typically requires the client to be responsible for monthly rent and certain property operating expenses including property taxes, insurance, and maintenance.

Diversification is also a key component of our investment philosophy. We believe that diversification of the portfolio by client, industry, geography, and property type leads to more consistent and predictable income for our stockholders by reducing vulnerability that can come with any single concentration.

Suffice to say this diversification and stability shows up on their occupancy levels, and has done so for a long time:

There’s a lot more to talk about there, that the annual report goes further in depth, so do read it.

Reporting Segments

Realty Income may be a large company, but it’s not one where having multiple reporting segments makes much sense.

Indeed for REITs in general it makes a lot more sense to talk about property or even the industry of their clients, and then see from there as to what sort of revenue is coming from where.

Fortunately Realty Income has a very detailed table of the rents collected in their 10-K. It’s quite big, so let’s just have a look at their Investor Presentation instead to see just where the money is coming from:

Realty Income has around 6000 properties in the US, UK and Spain, with more on the way in Europe, so that, in addition to the fact that the types of properties it owns are not overly concentrated in one client or one industry means that the business can get quite stable.

Geographical Diversification

The vast majority of revenue comes from the US, at roughly 94%.

This concentration makes Realty Income naturally exposed to the US economy, and subsequently hurts its diversification prospects. It also hurts their growth prospects since the US Net Lease market is actually quite small compared to the European market.

That being said, it is clear that they understand that this is an issue, and they are putting heavy emphasis, and investments, into correcting it.

If Realty Income manages to continue to significantly expand their presence in Europe, either through greenfield approaches, or through their current Sale-Leaseback approach, this can provide a good growth path for the company.

While ordinarily I would be concerned with a company making investing in Europe a core part of their thesis and strategy, the fact is that this sort of expansion, via Sale-Leaseback agreements, is less fraught with regulatory hurdles and dangers than most other businesses in Europe.

The reason for this is because most of the regulatory hurdles have already been surpassed in the initial construction, and so those hurdles now become methods of regulatory capture for the owner of the property (in this case Realty Income).

Additionally, Realty Income's focus on commercial real estate removes much of the political risk involved with nationalizations and rent freezes that are very common in countries run by people with only a child's understanding of economics.

Management

Realty Income has a nice little blurb on their website where you can go over every major member of the company leadership to learn a bit more about them.

Sumit Roy is the president and Chief Executive Officer of Realty income he has served as Realty Income’s Chief Executive Officer since October 2018 and President since 2015.

He joined the company in 2011, and comes from a computer science and banking background.

To be quite frank the management team at Realty Income is one of the best in the business, and companies such as AT&T and IBM would do well to take some notes.

It’s clear from their strategy, their dividend policy and their shareholder letters that they have their head in the right place, and understand the exact role that a company like Realty Income can perform.

Just read their annual report:

We seek to deliver favorable long-term risk-adjusted returns for our shareholders and, as of year-end, we had delivered a compound average annual total shareholder return since our public listing in 1994 of 15.3%. At Realty Income, the dividend remains our strategic and operational lodestar, and in January of 2020, we were proud to be added to the S&P 500 Dividend Aristocrats® index for having increased the dividend every year for the past 25 consecutive years. As of this writing, we are one of only three REITs and 65 companies in this exclusive index.

This is clearly a management team that is laser focused on returning capital to shareholders, and is doing so successfully.

While I do have my gripes about certain things which we will go over later, it’s clear that within the constraints involved with REIT businesses, Realty Income’s management is high quality.

Risks

Internal Risks

Realty Income is distributing more cash than their Earnings per share

Revenue and income per share has not increased as much as earnings per share

Dilution of existing shareholders interest in the company is almost guaranteed

Expansion into new (and existing) markets may not be as profitable as expected, and may result in diminished EPS due to the dilution of equity to pay for it

External Risks

The obligation of distributing 90% of their earnings as dividends may make them more fragile than they otherwise would be

They have taken a haircut from some of their tenants (Theaters), and any further lock-downs may cause additional losses

A downgrade in their credit ratings would severely affect their ability to expand and refinance their existing debt

A drawn out commercial real estate crash would affect the companies ability to lease/sell their properties

Fundamental Data

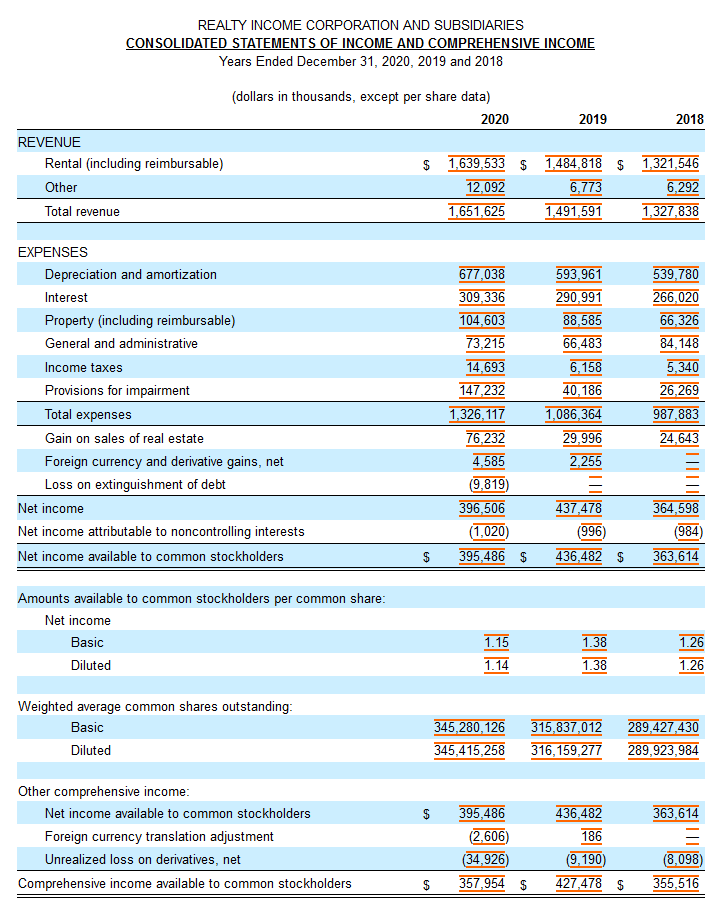

Income Statement

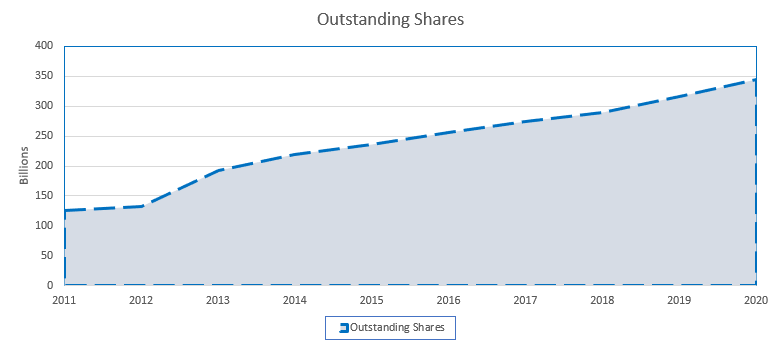

We can see a clear and consistent earnings increase, which looks great but isn’t actually as extreme as it looks like because of the corresponding increase in shares outstanding.

This increase is a result of the unique regulatory position that REITs are in, which results in them having very little capital remaining to reinvest, due to the obligation to pay out most of it as dividends. This means that the only way for them to acquire capital to expand is either through taking on more debt, or issuing additional shares, which dilutes existing shareholders.

In addition to this we can see that most of the expenses are actually non-cash depreciation charges, which allow the company to payout more than its earnings for an extended period of time.

The problem with this sort of thing is that I’m not convinced that such a situation is sustainable in the long term.

Depreciation and amortization are real costs, and ignoring them does no one any good.

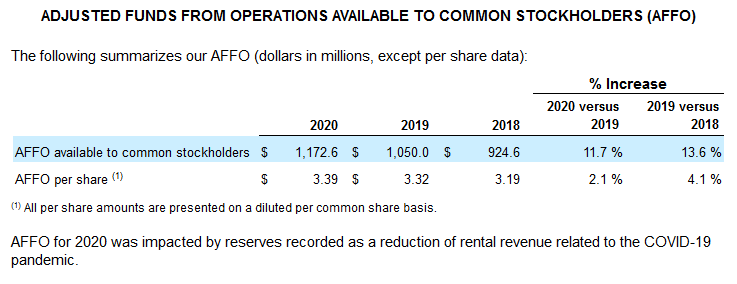

In a way I think the focus on “Cashflow” and “Adjusted Funds From Operations” that many investors have is misguided, and has the hallmarks of the “Growth Ponzi Scheme” that Strong Towns has warned about (though in that case it’s related to urban development in general, rather than a specific real estate company).

I went a bit more in depth about the particularities and difficulties in evaluating REITs in a previous post which you can find here. I suggest you read it to get a better understanding of what’s causing this sort of unusual behavior.

Revenue Growth

Even looking back at the past 10 years we can see that revenue growth has steadily increased at almost a 17% Compound Annual Growth Rate. That’s pretty outstanding, and you will be hard pressed to find companies that have managed to sustain this sort of growth for such an extended period of time.

But again, this sort of growth is being done at the expense of existing shareholders being diluted, and since that will likely not change going forward, we must account for this.

After all, it does us no good to get a pie that’s 20% bigger, if we have to share it with twice as many people!

Margins and Earnings

And here we see the results of this expansion of the shareholder base.

Even though Revenue in general has increased 17% annually, the fact is that earnings per share, that is, the earnings that you the existing shareholder are entitled to only grew by close to 1% annually!

Now, I suspect that the actual earnings per share increase haven’t been quite so dire, and I go into why in this post, but it’s still interesting to see and be aware of the effects that this dilution has on the company, and your little piece of it.

Balance Sheet

Shareholder Equity

We can see clearly here the assets and liabilities consistently increasing in step with the company's expansion and revenue. This is to be expected since as a real estate company their revenues are directly linked to the properties and assets it owns.

The fact that liabilities and equity have consistently increased at roughly the same rate means that investment leverage has remained consistent throughout the investment cycle. This is good because it means that the company hasn’t been leveraging themselves up during this period of low interest rates in order to juice up their per share earnings.

Essentially what this means is that the amount of debt they are willing to take on per new property has remained constant throughout, which is a good thing since it means they have stuck to the same clear strategy, and haven’t been flip flopping as to how their capital allocation should change based on temporary changes in interest rates.

There is clearly a long term view for the business, and management has been sticking to it.

That being said just because equity has been increasing doesn’t mean our share of it has been doing so as well…

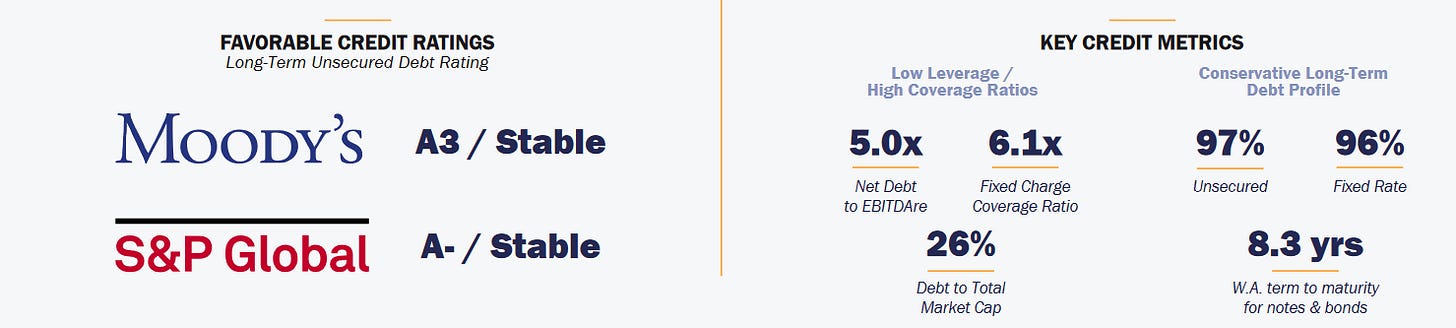

Debt Schedule

Debt and other similar liabilities are a key component of a REITs business strategy, much like in any other real estate investment, so we need to understand not just their debt schedule, but also their cost of debt, the riskiness of it, and whether or not this debt is fixed in terms of interest rates, or if the company is overly exposed to changes in those rates.

Fortunately it is clear that Realty Income has gone to great lengths to ensure their cost of capital is low and that bondholders can trust that the business will pay them back.

This is clearly seen by the fact that the company is one of the few REITs with a A credit rating from several reputable credit agencies:

This lets the company issue debt at a significantly lower cost than its competitors, and that allows better outcomes not just for bondholders, but for us equity investors as well.

Additionally the vast majority of their debt is fixed rate, which helps insulate the company from changes in interest rates, and should provide it a competitive advantage in the near future as rates begin to rise to fight inflation.

And finally the staggered debt maturity not only allows the company to not have to worry too much about any debt cliffs, but also means that its debt repayments are in general paired up with contractually agreed lease payments. In essence, the debt repayments are being done by already agreed upon lease income.

This type of conservative capital allocation is what you want to see in a company, and I have no complaints.

Shareholder Returns

Buybacks

Realty Income does not conduct share buybacks, and instead regularly dilutes its shareholders.

I’ve hit on this point before, but it’s important to stress because the fact that the company dilutes its shareholders is a key component of the companies business strategy, and is one that is actively working against its existing owners.

Now, I understand why they do it, and we’ve talked about why that is earlier, but it’s really important to make investors aware that although this is normal, this is also not a good thing!

I have seen many would-be investors cheer for the issuance of new shares, and while that issuance might be prudent, it is still a bad thing!

I don’t like this, and neither should you!

Dividends

The dividend is an intrinsic part of Realty Income, not merely a legal requirement to hold the REIT status and associated tax benefits.

It’s such a big part of the company culture that they have trademarked the term “The Monthly Dividend Company”.

They pay a dividend monthly, and have increased that dividend for over 26 consecutive years.

Everything you find about the company makes it clear that the dividend is the top priority, and management clearly has their eye on the ball there.

While the dividend growth isn’t large, it’s also not small either, and I am happy to receive these stable and increasing dividends well into the future.

Strengths and Weaknesses

Strengths:

Longstanding history of returning capital to shareholders

Non-Cyclical business model

High quality debt profile

Clear path for further expansion

Quality management

Weaknesses

High amounts of dilution

Mediocre organic non-dilutive growth

Current lack of geographical diversification

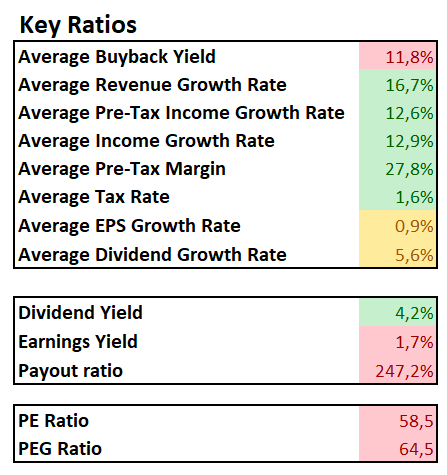

Valuation

Key Ratios

Overall the key ratios all look at least OK, with the exception of the buyback yield, the payout ratio and the EPS growth rate.

Ultimately if we check the difference between the buyback yield and the revenue growth rate, we see that the actual non-diluted growth rate of revenue is about 5%. This is actually in line with the dividend growth rate, and is very close to the rental agreements established rent increases.

Essentially what that means is that our organic revenue growth that we as owners are entitled to is actually closer to 5% than the 16% of total revenue growth or the 1% of EPS growth.

Of course that doesn’t really help us when it comes to PE and PEG ratios, but it does let us understand what exactly is going on behind the scenes and where the cash being paid out is coming from.

Standard Valuations

And here we get to the rub of the issue.

These valuations are primarily focused around earnings, and earnings growth, both of which are things that REITs suffer from due to their unique accounting quirks.

This means that the standard valuations aren’t going to help us much, and aren’t very reliable.

That said, it's clear that the company is being sold at a significant premium over them, which I don’t like very much.

Safe Purchase Value

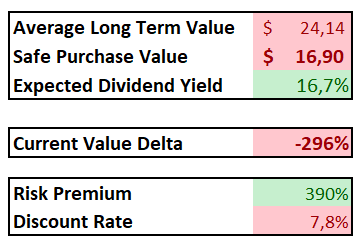

Overall the expected long term value of this company's reported earnings is around $24, which would mean a safe purchase value of around $17 and require an expected dividend yield of around 16.7%.

This is an extremely low price compared to the company's historical norma and the price that it’s currently trading at.

While I'm confident that this is an unreasonably low price, the truth is I can’t think of a better method of valuing the company, and so I must take this at face value.

From a personal subjective view, I get the feeling that the company's real earnings are quite a bit higher than what shows up in the income statement. Indeed if we use the Adjusted Funds from Operations as if they were the companies earnings:

We can see that the “net Income” would almost triple, and if we input that into the valuation model we get this:

Do I think that $69 is a safe purchase value for the company though? Not really.

Like I said, the intricacies of REIT accounting, and the subsequent hidden or invisible income associated with it means that I don’t have a good way to value the company.

From a personal perspective I think the real safe purchase value of the company is somewhere in between, maybe between $40 and $50.

That said, I’d love to hear from you in terms of what you think we should take into account when evaluating a REIT.

Investment Thesis

Key Points

Continued stability in revenue and earnings

Maintain A credit ratings to reduce the cost of capital and provide a competitive advantage

The expansion into Europe will provide an ongoing diversification and growth path

Dividends will continue to be paid and increase at a rate similar to organic rental income growth (above inflation)

High quality management with a clear goal of returning capital to shareholders

Maintain existing debt/equity capital allocation strategy

Decision

The current price of Realty Income is too high to justify investing additional capital in the company.

That said, depending on your view and experience with REIT accounting policies you may well come to a well reasonable value for the company that is higher than the one I reached. Like I mentioned before, this method of valuing companies tends to fail when certain income doesn’t show up on the income statement or balance sheet…

The company is good, their business model is solid and easily understandable, their management is cautious and shareholder focused, and they have clear paths to expand their business and increase revenue and earnings.

Overall this is a high quality business that you can’t really go wrong buying, and so the only concern that I have is due to my inability to accurately value the company and the price I should be willing to pay for it.

That’s why I will not be selling my existing shares, it’s a good business with good management and selling it doesn’t really make sense because of it. If my subjective ballpark estimate of the true value of around $40-$50 is accurate then it isn’t as wildly overvalued as what the valuation model makes it seem.

At the same time, since I can’t accurately value the company, I also can’t make a good decision as to whether I should buy additional shares.

My Current Stance: HOLD

What do you think? Is Realty Income at an attractive price? Do you think they will be able to expand into Europe?

Let me know in the comments below!

Hi Tiago, just reading the above from back in Feb, and with O now dropped to $57.60 per share approx 15%

Do you see further downside for this company ? Was also looking at MAIN who are down Aporox 20+%

Would love to get your views on these 2 REIT’s

Thanks

B