Last week we talked about issues at Vonovia, a German real estate company that rents out apartment buildings.

One of the key problems that I saw in the business came from the difficulties in judging the fair value of the assets in question.

For today what I want to do is go through a back of the napkin calculation on a possible real estate investment, to see if I have a decent idea of what it takes to invest and value this business.

The background

In order to make a proper valuation of any real estate investment we need to know what sort of investment it is, what sort of property, and the legal and regulatory environment in which that investment will operate.

Changes in any of these factors will significantly impact the return that investors will get, and we will see later on an example of one such change that might turn an otherwise unprofitable investment into a profitable one.

For the purposes of this “back of the napkin calculation” we’re going to assume the following:

The investment will be in Portugal and under Portuguese law

The management fee for the management company will be zero

The investment will be in a 1 bedroom apartment in the suburbs of Lisbon

We will be using a combination of debt and equity to fund the investment

We will look at the 1st year of cashflows, earnings and balance sheet

If you’re new to the newsletter some of these assumptions might seem off to you, so I’d like to give a bit of context.

I am Portuguese, and as such the regulatory environment that I am most familiar with when it comes to real estate is the Portuguese one.

Additionally my family is heavily involved with real estate, and already rent out and operate some rental units of various types. This unit would be “bundled in” with those in terms of operation and my parents would take on those responsibilities at no cost to me.

This is not a reasonable assumption for most people, but the original “back of the napkin calculation” that this post is based on came about amid a family conversation about me actually investing in real estate in Portugal with these conditions.

As such I thought it best to be as close as to the real situation as I would find myself in, if i were to chose such an investment.

For most people these things would change, and I heavily encourage you to check your regulatory environment and the costs associated with rental management companies when you do your own calculations.

These are real, and significant costs, and you ignore them at your peril and loss.

The Balance Sheet

Here we can see the balance sheet of our little investment property:

As you can see we have a Debt-to-Equity ratio of 1, withy one Euro of debt for every Euro of equity.

You will note that I’m not including the lease agreement in both assets and liabilities, as is required by GAAP.

There’s several reasons for this, including:

GAAP isn’t used in Portugal and IFRS standards don’t record it in the same way

Due to the regulatory environment it is difficult for me to properly value these lease commitments and associated allowances for default

This is intended to be a simplified calculation, and so these things can be ignored for now

Another thing you’ll note is the bank loans conditions.

In order to get an accurate indication of the costs in question I made a simulation with the “Caixa Geral de Depositos” a major Portuguese bank that is partially owned by the state.

You can have a look at the exact simulation details here (in Portuguese).

The key details are as follows:

Loan amount - 75 000€

Interest rate - 4.45%

Total Effective Interest Rate - 5.2%

Total to pay (1st year) - 5 595.86€

Monthly payment - 444.67€

A few things to note, while the “Interest Rate” is supposedly 4.45%, there are some additional requirements and costs that are mandatory for this loan. This includes life insurance, fees, taxes, etc… All of which bring up the effective interest rate to 5.2%.

I chose a fixed interest rate because I don’t want to be exposed to interest rate changes, had I gone with an adjustable interest rate I may have paid less (or more) for the loan.

While the total yearly payment does vary throughout the lenght of the loan (as a result of the fees, taxes, etc…) the difference is not significant and the difference between the “highest year” and the “Lowest year” is less than 75€.

For the purposes of this simulation it is fair to assume that the yearly cost of the loan will be 5 600€, and that is the number I will be using.

The total Interest paid in the first year will be 2 768.68€, so I will round that up to 2 770€ for my calculations.

Remember, this is just a back of the napkin calculation, so these minor roundings shouldn’t really affect it.

And in any case, any investment where the difference between “worth investing” and “not worth investing” is less than 10€ a year, is not an investment you should consider.

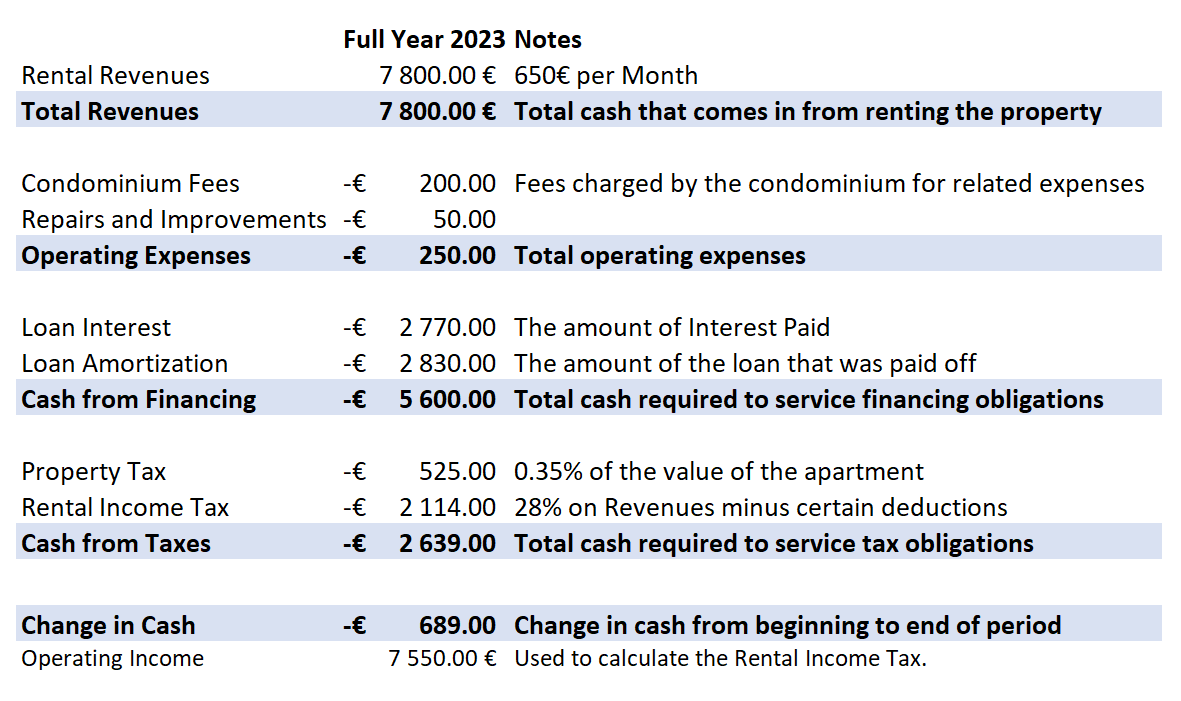

The Cashflow Statement

Now that we have the asset, we can start doing some calculations on the cashflows:

Alright!

So we got a pretty simplified list of revenues and expenses that we will probably have throughout the year, and so we have what I would call a fair and reasonable estimate of how much cash this property will generate us in that period.

There is a few things to note here however:

The 650€ might seem a bit low

We’re assuming a very low level of repairs and improvements

We are not cash-flowing this property

The rental income tax is taking a very hefty chunk of cash

In regards to the 650€ it might seem a bit low, and it’s true! If you check real estate websites for apartments in Lisbon you will be hard pressed to find one for that price!

That said you will also not find a 150 000€ apartment in Lisbon for that price either.

In order to get those prices for apartments you will need to get on the outskirts of the metropolitan area, and there you will find that rental and home prices are more in line with this simulation.

Ultimately I’m not expecting to invest in downtown Lisbon, so these values seem reasonable for the areas and level of investment we are talking about based on what real estate agents have told me.

In terms of repairs and improvements, we just bought a new apartment so I’m assuming that during the first year any repairs or improvements actually undertaken will be minor. These numbers will fluctuate year to year, and we will account for that in the income statement.

In regards to the fact that we are not cash-flowing the property… This is bad.

It’s really very, very bad and frankly to me it stops any possible investment here.

We would be cash-flowing the property if the taxes were lower, but with such high tax rates, low opportunities to reduce that tax burden due to the fact that Portuguese law does not allow deduction of interest and financing expenses, we’re stuck with a gigantic tax bill.

This is compounded by the fact that we are not allowed to deduct depreciation or similar allowances from our taxable income either, raising the tax burden even higher.

I will have a lot to say regarding the Portuguese tax code, and rental regulations in the next few sections, but suffice to say that I am unhappy with it, and it would make rental properties uninvestible to me even if it were otherwise a good idea.

The Income Statement

And here we get to the rub of it.

At the end of the full year 2023 we’ve made a net loss of almost 1000€!

The key expenses here, that weren’t accounted for in the cash flows, are primirly non-cash expenses related to depreciation, risk and long term repairs.

To be more specific we are assuming a few things:

That every couple of years we will have the unit empty, or with a tenant who isn’t paying rent for a month

That some long term expenses will be incurred unrelated to depreciation (perhaps a pipe will burst, or a new roof will need to be put in, etc…)

That the apartment itself will be essentially worthless after 30 years (This is in line with the rental property depreciation schedules listed here)

The the property will appreciate in line with inflation at a long term rate of 2%

Are these assumptions and values associated with them reasonable?

I think so.

Allowance for an empty unit

The first one is probably the easiest to discuss, that is, the allowance for an empty unit, or other lack of revenue.

At the end of the day we will have some period of time in which the unit will be empty, and indeed we don’t want to have the unit always occupied because that means we are effectively leaving money on the table since clearly our rental rates are too low.

In general I would say that a 95% occupancy rate is close to optimal so that’s what I used.

That said there are a few issues here, in particular when it comes to non-paying tenants, in Portugal it is practically impossible to evict someone, even for non-payment.

Indeed, even prior to the covid related eviction bans, which some political parties are now trying to make permanent, the minimum period of time that was legally required to process and evict someone was around 9 months.

In practice the average time to eviction was about a year and a half, throughout which you as a property owner would not be getting paid, and for which you were unlikely to be able to ever see your money.

I really cannot stress this enough, it is practically impossible to evict someone, and a non-paying tenant can essentially make any real estate investment into a loss.

Allowance for repairs and improvements

In regards to the allowance for repairs and improvements, I am using this to account for non-depreciation expenses that will nonetheless be imputed onto ourselves.

To be more specific, this is your run of the mill ruptured water-pipe that causes damage to the unit, or the fire and earthquake insurance you’ll need.

This is effectively stuff that isn’t necessarily depreciated, but is needed to pay for some of the risks inherent to owning a piece of property.

I think 0.5% of the property value per year is a reasonable amount for these sorts of things.

Depreciation

Regarding the Depreciation, we’re using a straight line depreciation of 30 years, which is close to the GAAP depreciation schedule.

I’ve been told that this is too short by real estate people, but personally I don’t think that their argument was convincing.

In the best case scenario you’re looking at a 75 year schedule, which would reduce that cost to 2000€.

I’m saying that 75 years is the best case scenario because modern apartments are built with armored concrete, which has a useful lifespan between 50 to 80 years. Generally speaking I don’t believe a building with its load bearing beams past their viable lifespan has any value beyond salvage value, so thats the longest I’m willing to consider.

Personally I feel like the 30 year depreciation schedule is closer to reality, since the bulk of the value in the property after 30 years will be related to the repairs and improvements that were done during that time, rather than the initial property value.

Remember, roofs don’t last forever, and you will have regular expenses to maintain the building.

Asset Appreciation

Here we have the increase in value that comes with owning the apartment.

First things first, this is not guaranteed income, it may not come at all, and it is fundamentally dependent on macro trends way outside of my control. Fundamentally this is a bet on the good economic performance of the locality where the apartment is located in.

Second, this is not a cash return! You only get to take advantage of this when you sell, and all the while you’re paying the property tax on that increase in value! This is arguably a negative up until the moment you sell!

Finally some of you may consider that an increase in line with inflation is too low, after all “Real Estate only goes up!”.

There’s several problems with that attitude, and quite frankly if that is what you truly believe, you need to take a step back and seriously reconsider your real estate investments.

You are wrong, Real Estate does not always go up.

On a fundamental level the valuation of any investment can only increase if the ability to generate earnings increases, assuming all else remains the same.

So if we assume we’re not purchasing a particularly undervalued property (hint: there’s a real estate bubble in Portugal at the moment), any increase in the valuation of the property will come from being able to charge more rent for it!

So are we able to charge more for it?

Well, maybe.

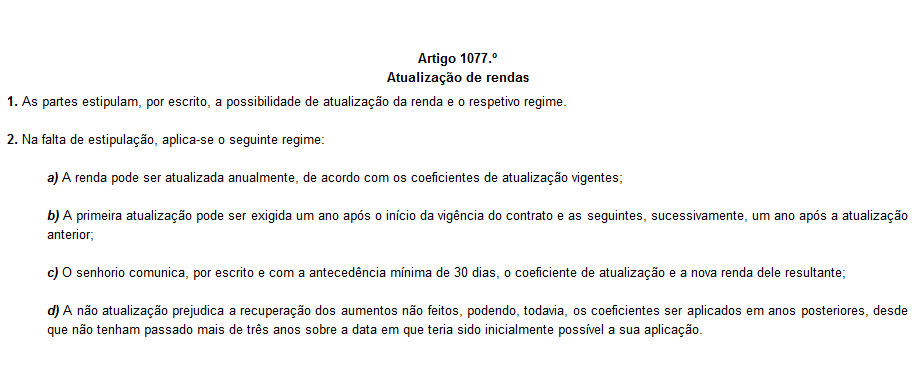

Most rental agreements in Portugal do not specify rental increases in the contract, and since contracts can be automatically renewed it’s often legally difficult to enforce a binding rental cost increase.

In cases where nothing is specified there is a rental increase quotient that is published by the government on a yearly basis, and so landlords may be able to enforce an increase up to that amount.

That value has been around 1% per year for the past 20 or so years.

Since eviction isn’t really an option, nor is pre-defined rental increases, then the most reliable method of increasing rents will be through that quotient as well as renters simply moving on from the apartment and therefore us being able to “reset” the rental price to a value closer to market rate.

And why would someone paying below market rent want to move?

Overall, I’ve given this a 2% rate because of these reasons, and while i do believe that might be a bit cautious, I would heavily discourage you from assuming increases substantially greater than that.

There is a significant political pushback against rising rents, and a not insignificant chance of rental freezes, eviction freezes, etc…

Indeed, even today around half of all rental units in portugal are under rent control, some have been continuously under rent control since as far back as the 1910s!

You do not want this for you investment!

Summary

Rental property in Portugal does not seem to be a reliable and profitable investment, and the regulatory environment makes it exceedingly unattractive.

While it’s certainly possible to make money with real estate, a lot of people vastly under appreciate the non-cash costs particularly those related to depreciation, allowances for empty units, etc…

In essence, a lot of landlords are subsidizing their tenants, even without getting into the issues of rent control and other ways that the state has taken on to offload its social security responsibilities towards landlords.

The back of the napkin math does not add up, and I won’t be investing at these price levels.

What about you? Do you own rental real estate? Is it profitable?