Q3 2023 Review

A new play?

Summer is now gone, and I keep on investing.

Let’s see how I’ve performed!

How my portfolio performed

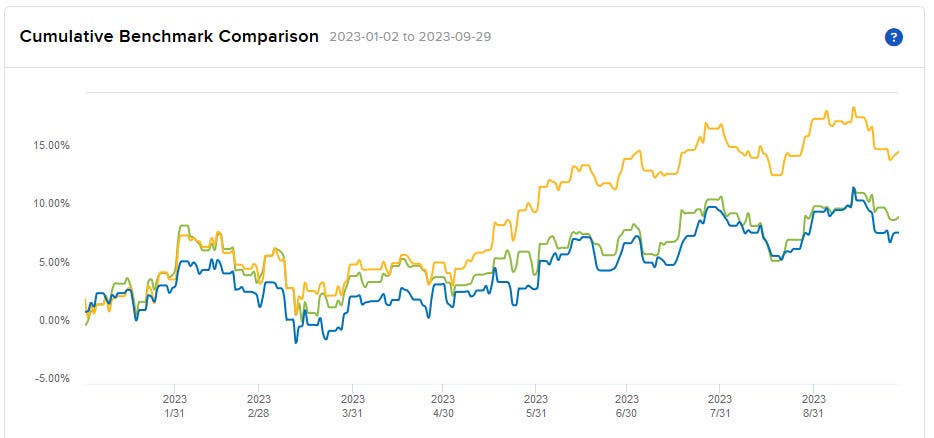

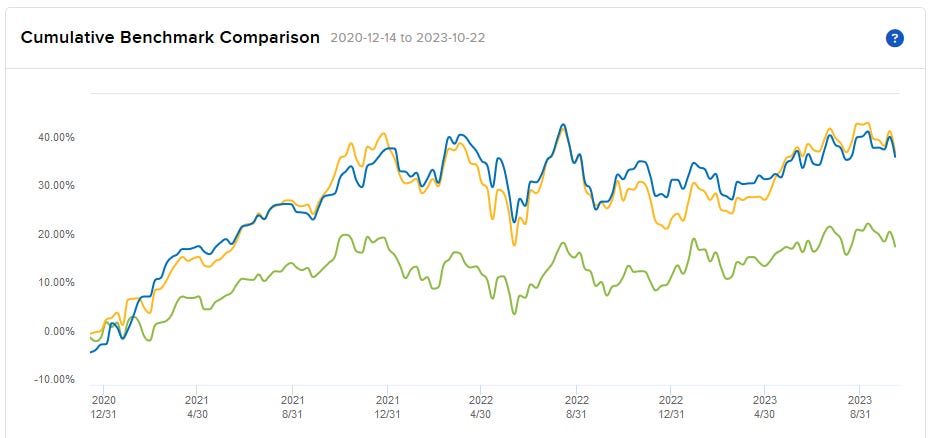

Like always, we will be using Time Weighted Returns since they take out the impact of additional deposits and let us compare on a one to one match with indexes.

The indexes we will be comparing against will be VWRL and SXR8.

VWRL is the distributing version of VWCE (unfortunately Interactive Brokers won’t let me assign VWCE as the index). This distribution makes it slightly under-perform VWCE which makes no distributions.

This is the Vanguard FTSE All-World UCITS ETF, and is a whole world market cap weighted index. This is the European equivalent to VT.

SXR8 is a accumulative S&P500 index. It tracks the S&P500 including any reinvested dividends.

Overall my portfolio has outperformed the S&P500 index and is neck and neck with VWRL. This makes sense given my current portfolio allocation, with the individual issues having little impact in my overall performance.

If we check the year to date performance:

Much like last quarter I am still underperforming the index on a year to date metric, though once again since inception I am still in line with the S&P500:

As usual, I made 3 deposits during the quarter, and the bulk of the cash from those deposits (and the dividends received) went to the following equities:

BUYS:

VWCE

5911.T

SELLS:

No sells.

I put 2 of my deposits into VWCE, with the remaining one going towards 5911.T in order to open a new position in this Japanese Bridge builder. You can read more about why I purchased the company here:

I also purchased 25 shares of WU 0.00%↑ using the dividends I received during the quarter.

I terms of options I sold:

MSFT 230929P00280000

TROW 230929P00100000

WU 230818P00011000

TROW 230825P00099000

All of these expired worthless, as did the options I had outstanding at the start of the quarter.

I continue to hold my worthless Jan. 19th 2024 Intel 50 Call.

In terms of dividends this quarter is in line with the dividends I received in the same quarter 2022, and significantly lower than the previous quarter.

The reason for this is simply due to timing in regards to the day that I actually received the dividends, due to weekends. To be more precise, my WU dividend was paid on Monday, October 2nd, which resulted in a shortfall of around $53.

There was a dividend cut for FL 0.00%↑ during the quarter, so I don’t expect that the company will pay any more dividends for the foreseeable future.

I have not yet decided what to do with FL 0.00%↑ though it’s clear I screwed up and should have sold them at $45 per share. Oh well.

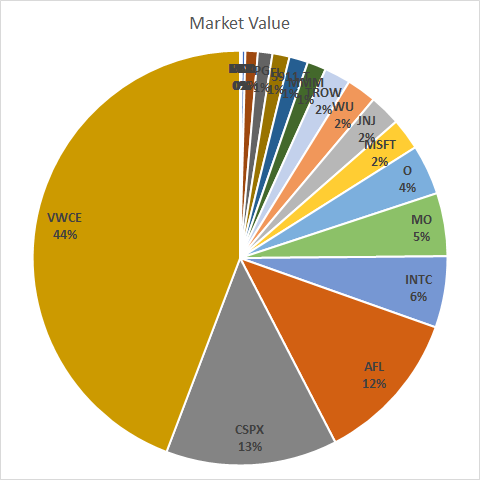

In terms of portfolio distribution, here it is excluding options:

If we’re only interested in seeing the individual issues, here it is:

AFL 0.00%↑ continues to outperform, and I remain a happy owner. They have consistently raised dividends, and I am not concerned with the quality of the business.

The newish positions, 5911.T and WU 0.00%↑ also are visible and WU 0.00%↑ in particular has been performing quite well.

In terms of concerns, I have the following:

FL 0.00%↑ - I don’t like the dividend cut, and I’m unclear what my play here is. I held it for too long compared to my original plan.

O 0.00%↑ - I’m concerned with the companys debt profile.

UL 0.00%↑ - I’ve been wanting to sell it for a while. It’s not clear to me what the company is doing.

Conclusion

I’m satisfied with my portfolios performance, and I look forward to bringing my index position to my desired 60% so I can continue building up my individual issues and increase my dividends.

How about you? How did you deal with the quarter?

Did your dividend payments increase?

Let me know in the comments below!