Q3 2022 Review

Let's check out the 3rd quarters performance

It’s been quite volatile recently, hasn’t it?

My portfolio certainly seems to think so, with it recently reaching all time highs and subsequently crashing down into the red!

Let’s talk about my Q3, and see what happened!

How my portfolio performed

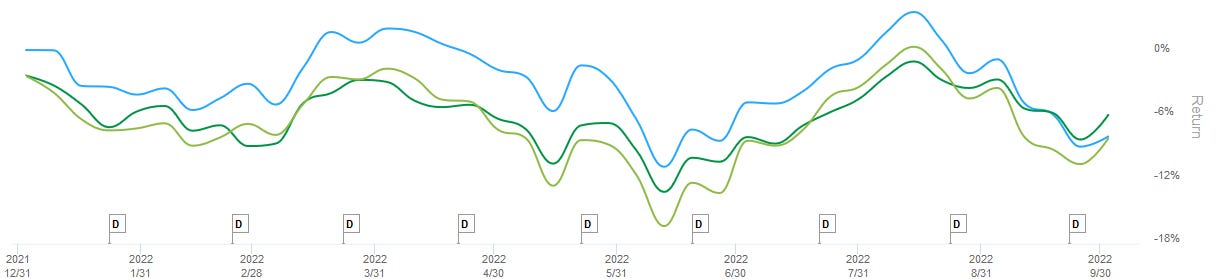

Like always, we will be using Time Weighted Returns since they take out the impact of additional deposits and let us compare on a one to one match with indexes.

The indexes we will be comparing against will be VWRL and SXR8.

VWRL is the distributing version of VWCE (unfortunately Interactive Brokers won’t let me assign VWCE as the index). This distribution makes it slightly under-perform VWCE which makes no distributions.

This is the Vanguard FTSE All-World UCITS ETF, and is a whole world market cap weighted index. This is the European equivalent to VT.

SXR8 is a accumulative S&P500 index. It tracks the S&P500 including any reinvested dividends.

Overall my portfolio performed slightly worse than the market, particularly in the last month, ending up just slightly below both the VWRL and the SXR8 index.

A quarter is a 3 month period, and so I made 3 deposits into my investment account, on my usual investment schedule.

Like always consistency is key, and so my deposits generally go in at the end of the month, when I receive my paycheck.

Remember, the easiest way to save is to not have the cash in your bank account ready to be spent!

I made a few purchases during the quarter, and sold some options:

BUYS:

VWCE

SELLS:

None

I sold puts on the following equities with the following expiry dates:

AFL 0.00%↑ (26 Aug)

MO 0.00%↑ (26 Aug, 30 Sep)

MSFT 0.00%↑ (26 Aug, 30 Sep)

AAPL 0.00%↑ (23 Sep)

MMM 0.00%↑ (30 Sep)

TROW 0.00%↑ (21 Oct)

And had puts expire or being bought back on the following equities:

MO 0.00%↑ (22 Jul, 26Aug)

AFL 0.00%↑ (26 Aug)

MSFT 0.00%↑ (26 Aug)

AAPL 0.00%↑ (19 Sep)

The puts expiring on the 30th of September ( MO 0.00%↑ , MSFT 0.00%↑ , MMM 0.00%↑ ) all expired worthless, but since they were only settled on the 3rd of October they are not included here.

The AAPL 0.00%↑ put i bought back on the 19th was a mistake, and I went over the details of that in this post.

About 75% of the cash spent purchasing equities this quarter was spent purchasing VWCE, with the remaining 25% going to TROW 0.00%↑ for the purposes of opening a new position.

I wrote up an article about TROW 0.00%↑ here that explains my views on the company, my valuation and why I chose to open the position. I reccomend you take a look if you haven't yet.

In terms of dividends I grew them almost 200% year over year!

That’s an amazing increase, and not one that I think I will repeat any time soon (if ever!).

In terms of comparison to Q2, my dividend payment increased by $26.67, partly as a result of dividend increases, and partly as a result of the purchases made in Q2.

The biggest payers in order were:

Altria - MO 0.00%↑

Aflac - AFL 0.00%↑

Realty Income - O 0.00%↑

Intel - INTC 0.00%↑

Overall I’m very happy with my current dividend payout, and every-time I get a new dividend coming into my account I can’t help but smile.

The Year to Date

On a year to date basis my portfolio has been just about even with my prefered index, the FTSE All-World index.

I also thought that you’d like to take a look at the recent trajectory of my dividends, and their distribution by company:

Please keep in mind that this does not include the dividends received from Degiro, hence why the dividends prior to Q1 2021 are not represented (and even the Q1 2021 are not complete).

The reason for this is because I moved brokers, and so the data set I used to generate this graph does not have that data.

In terms of my original goal of $1500 in dividends for 2022, I am well on track!

Given the turbulent market though I don’t think I will make the first goal of increasing my Assets Under Management to at least twice my Gross Annual Wage.

Part of this is due to increased wages, and part of it is due to the poor market performance in terms of price appreciation.

That said, the low prices should help get better deals, so I’m not too concerned.

Conclusion

Overall the quarter went well, and according to plan. The multiple compressions that the market went through provided some interesting deals which I took advantage of, particularly in TROW 0.00%↑.

How about you? How did you deal with the quarter?

Did your dividend payments increase?

Let me know in the comments below!

Hi Tiago, nice to see you keep your objectivs and they are doing fine. I have a question in respect to put options, could you elaborate more about them, do you seel puts in IBRK? how do you do it, could you some day make some print screens of the movements you make?

Thank you in advance and good luck for your investments

Nice one! those graphs are custom made or you use any platform? if so, which one?

thanks