Q2 2023 Review

Step by step the portfolio grows

Summer is here, and so are my dividends, which means it’s time to take a look at my portfolio, and see how it has performed!

How my portfolio performed

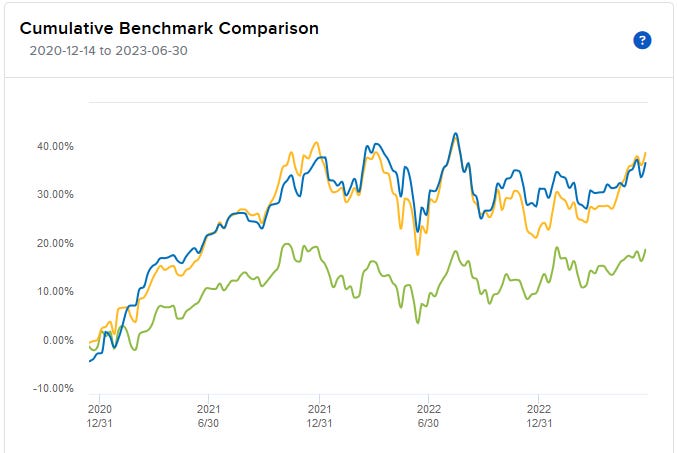

Like always, we will be using Time Weighted Returns since they take out the impact of additional deposits and let us compare on a one to one match with indexes.

The indexes we will be comparing against will be VWRL and SXR8.

VWRL is the distributing version of VWCE (unfortunately Interactive Brokers won’t let me assign VWCE as the index). This distribution makes it slightly under-perform VWCE which makes no distributions.

This is the Vanguard FTSE All-World UCITS ETF, and is a whole world market cap weighted index. This is the European equivalent to VT.

SXR8 is a accumulative S&P500 index. It tracks the S&P500 including any reinvested dividends.

Overall I’m happy with the performance, with the portfolio slightly outperforming VWRL.

Given that around 45% of my portfolio is literally tracking the same index as VWRL, and that an additional 14% is tracking SXR8 it’s normal that my performance would be between the two.

It’s clear that my individual issues are not having a meaningful underperformance relative to the benchmarks, which is good.

Still, 3 months is quite a small period, so lets look at the year to date, and since inception:

As usual, I made 3 deposits during the quarter, and the bulk of the cash from those deposits (and the dividends received) went to the following equities:

BUYS:

SELLS:

No sells.

All of my deposits went towards building up my VWCE position, with the 3 shares of MMM 0.00%↑ and 3 shares of TROW 0.00%↑ being purchased entirely using the dividends I received during the quarter (as well as the premium from selling put options).

I usually write a tweet detailing when I bought shares:

Finally in terms of options I’ve collected $266 in premium from selling TROW 0.00%↑, MO 0.00%↑, MMM 0.00%↑ and PG 0.00%↑ puts.

None of these options were called, and so I simply collected premiums for selling them.

There was a small period of time where I was worried that 1 TROW 0.00%↑ put might get called, since it expired only very sllightly out of the money.

I currently have 2 put options outstanding:

MO 0.00%↑ 42.5 Put expiring July 21

TROW 0.00%↑ 90 Put expiring July 21

I don’t expect either of them to be triggered, and I will continue to sell some puts in the new quarter.

I continue to hold my worthless Jan. 19th 2024 Intel 50 Call.

In terms of dividends, this quarter I received an all time high amount of dividends, and about a 17% increase compared to the amount I received in the same period in 2022.

In terms of dividends we see another all time high during the quarter with $522.77 in dividends received.

This is only a slight increase quarter over quarter as a result of that 66% dividend cut from INTC 0.00%↑ which was one of my highest yielders.

The bulk of that cut was made up by opening a new position in WU 0.00%↑ last quarter, and the remaining was covered by a combination of dividend increases and adding to TROW 0.00%↑ and MMM 0.00%↑.

So long as there are no dividend cuts I should be able to make my $2000 dividend goal for the year.

In terms of portfolio distribution, here it is excluding options:

If we’re only interested in seeing the individual issues, here it is:

I’m a bit overweight on AFL 0.00%↑ as a result of its good performance, and my INTC 0.00%↑ position has done me no favors so far.

I will continue to build up my TROW 0.00%↑ position, and I mean to keep my MMM 0.00%↑ position as is for the foreseeable future since i now have an even number of shares.

As always I continue to try and find wazs to sell out of my UL 0.00%↑ and FL 0.00%↑ positions, but I haven’t found good price points (I was very close to pulling the trigger on FL 0.00%↑ but it crashed shortly after).

For now receiving the dividends is ok with me.

I’m also considering building up my WU 0.00%↑ position some more, and perhaps opening a new position in CE 0.00%↑ like I discussed here:

Conclusion

I’m satisfied with my portfolios performance, and I look forward to bringing my index position to my desired 60% so I can continue building up my individual issues and increase my dividends.

How about you? How did you deal with the quarter?

Did your dividend payments increase?

Let me know in the comments below!