Q2 2022 Review

Let's check out the 2nd quarters performance

The market has been turbulent these past 6 months, hasn’t it?

What started off as a correction has since turned into not just a bear market, but one of the worst bear markets ever recorded.

The war in Ukraine, Inflation woes and subsequent rate hikes have caused investments to lose value at consistent rates, and it’s likely the worst is yet to come.

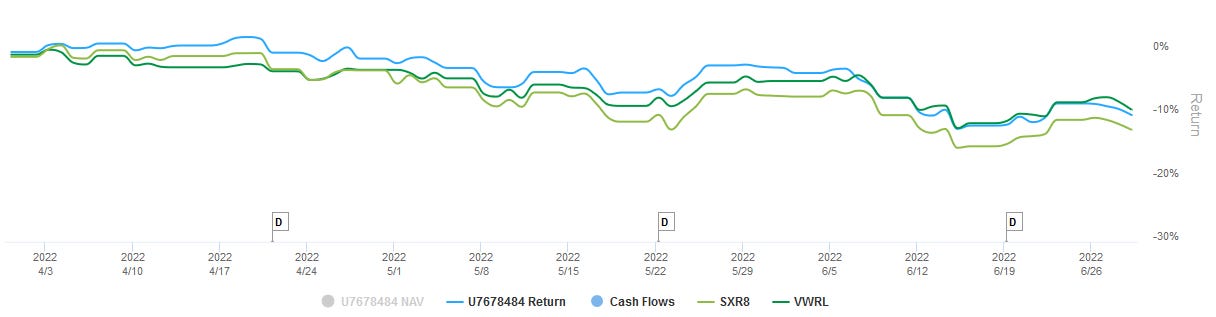

How my portfolio performed

Like last time, we will be using Time Weighted Returns since they take out the impact of additional deposits and let us compare on a one to one match with indexes.

The indexes we will be comparing against will be VWRL and SXR8.

VWRL is the distributing version of VWCE (unfortunately Interactive Brokers won’t let me assign VWCE as the index). This distribution makes it slightly under-perform VWCE which makes no distributions.

This is the Vanguard FTSE All-World UCITS ETF, and is a whole world market cap weighted index. This is the European equivalent to VT.

SXR8 is a accumulative S&P500 index. It tracks the S&P500 including any reinvested dividends.

Overall my portfolio performed in line with the market over the quarter, ending period just slightly below the VWRL index.

A quarter is a 3 month period, and so I made 3 deposits into my investment account, on my usual investment schedule.

Like everything in life, consistency is key in achieving good results, and so I highly encourage everyone to make a monthly budget, like I do, and regularly save and invest some of your income every month.

It’s really not that difficult, and as long as you get a habit going, you won’t even notice an effect on your lifestyle, since the money won’t be sitting in your checking account just waiting to be spent.

I made quite a few purchases during the quarter, and even sold some options. If you are following me on twitter you already know what they are, but if not, here is a list of what I bought or sold during the period:

BUYS:

VWCE

AFL

INTC

I did not make any sales of any equity I’m long on.

The bulk of my purchases were into VWCE, though I did buy 50 shares of Intel and 22 shares of Aflac, just so I could get some round numbers in my portfolio.

I did sell some put options to collect the premium, most of which has already expired worthless.

I sold puts on the following equities:

AFL

FL

INTC

MO

MSFT

Like always I sold puts with strike prices well below their underlying’s price at the time, and at prices that I would be happy to own the shares at.

I will continue to sell similar options throughout the year.

The total amount of revenue from selling these puts was $276 dollars, well below the 1st quarter.

I’m in the process of deleveraging my portfolio, so I wanted to make sure I did not have to dip too deep into margin if the puts were triggered, hence why the options income is so much lower than the previous quarter.

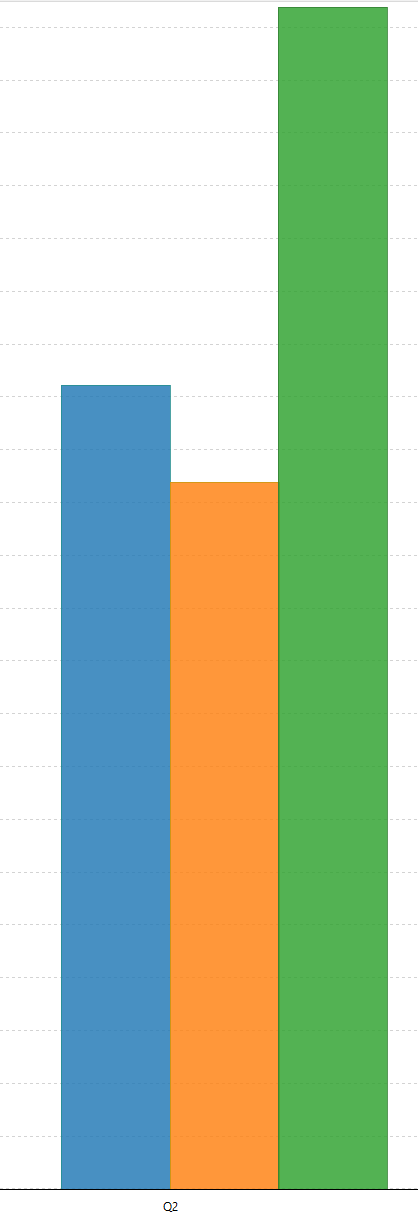

In terms of dividends the Year over Year growth of my dividend income was 67%!

And indeed Q2 had around $20 more in dividend income than Q1, mostly as a result of increases in the dividend payouts from the companies!

Overall I’m very happy with my current dividend payout, and everytime I get a new dividend coming into my account I can’t help but smile.

Once again, my highest dividend payer for the quarter was Altria, with Realty Income, Aflac and Intel following.

I would expect Aflac to surpass realty income next quarter as a result of the purchase (which happened after AFLACs ex-dividend date passed). Intel may alsobecome neck and neck with Realty Income on a dividend per-quarter basis.

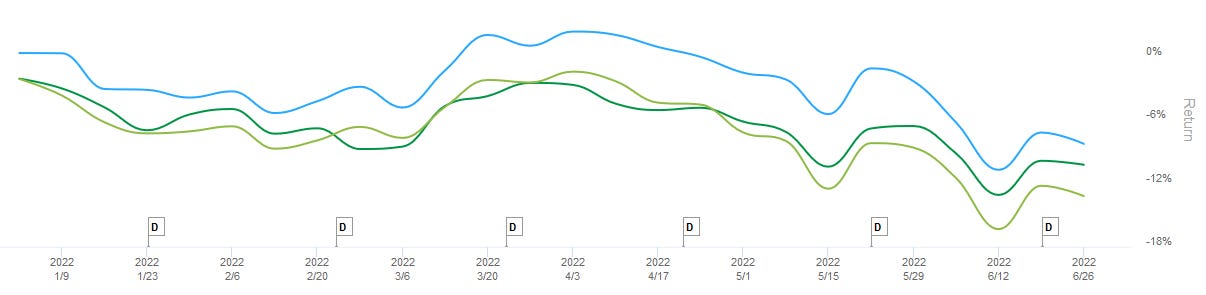

The Year to Date

But of course it’s not just important to look at the quarter, but also to look at the year to date numbers.

Here, as a result of the large out-performance in the 1st quarter we can see that my portfolio is not yet in correction territory, though it certainly went there a couple of weeks ago.

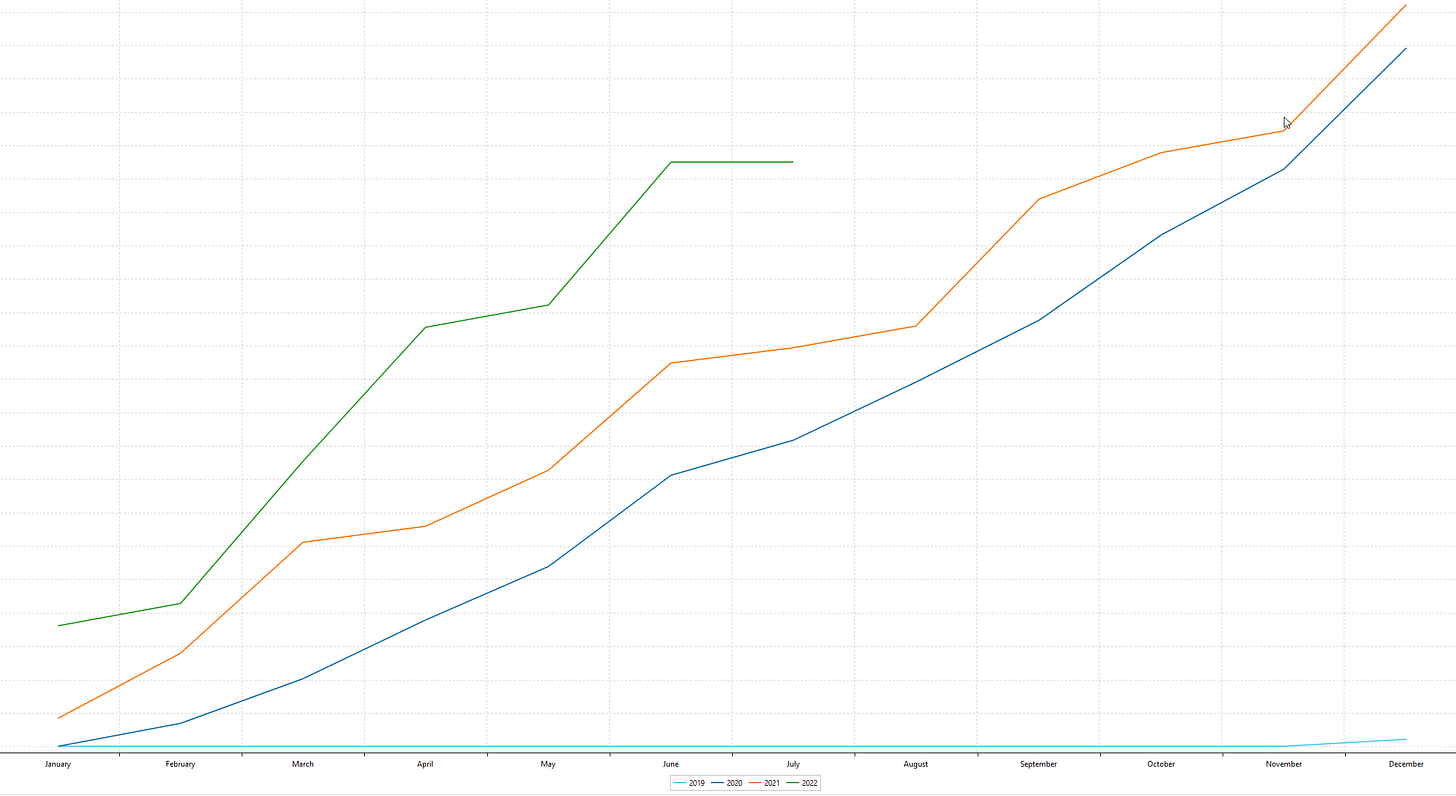

In terms of total dividends received up until now, compared to the same period in the past few years, we have this chart:

As you can see, this year my portfolio pulled ahead early, and is increasingly pulling ahead in terms of dividends received.

Taking into account my expected forward dividend income, I would say that my original goal of $1500 in dividends in 2022 is perfectly viable, and well on track.

Conclusion

Overall the quarter went well, and according to plan. The multiple compressions that the market went through provided some interesting entry prices which I took advantage of.

How about you? How did you deal with the quarter?

Did your dividend payments increase?

Let me know in the comments below!

Thank you for your overview. On which broker you buy the VWCE? All of my (european) brokers do not have this one...