PVH Corp.

Tommy Hilfiger and Calvin Klein might be onto something

What is PVH Corp.?

According to their latest 10-K, PVH 0.00%↑ is:

We are one of the largest global apparel companies in the world.

We manage a portfolio of iconic brands, including TOMMY HILFIGER, Calvin Klein, Warner’s, Olga and True&Co., which are owned, Van Heusen, IZOD, ARROW and Geoffrey Beene, which we owned through the second quarter of 2021 and now license back for certain product categories, and other licensed brands.

We design and market branded sportswear (casual apparel), jeanswear, performance apparel, intimate apparel, underwear, swimwear, dress shirts, neckwear, handbags, accessories, footwear and other related products. Our brands are positioned to sell globally at various price points and in multiple channels of distribution.

In other words this is a fashion company with well known brands like Tommy Hilfiger and Calvin Klein in its portfolio.

They design, make, market and ultimately sell clothes.

If you’ve been to a shopping center, a high street, or really any major retail location in the world anytime in the past 10 years, you’ve probably seen some of their products for sale.

I know that I’ve regularly seen Calvin Klein and Tommy Hilfiger advertisements, and products on sale whenever I go out to a place with a lot of apparel retail locations.

These are well known brands, with a clear audience and market, that being said the fashion industry is difficult and highly competitive, and its competitors like Inditex, Shein, etc… can very easily knock the business down a peg.

Business

Strategy

Fortunately PVH 0.00%↑ does seem to be aware of the issues, and they have recently presented their MultiYear Strategic Plan to Drive Brand Digital and DTC-led Growth.

So what does this strategy consist of exactly?

Well according to their release, their plan relies on five key drivers:

Win with product

Win with consumer engagement

Win in the digitally-led marketplace

Develop a demand and data-driven operating model

Drive efficiencies and invest in growth

Personally I think their press release had a lot of fluff and took far too many words to say what they are actually going to do. Frankly a lot of it is bullshit, and I wouldn’t trust it as far as i could throw it, but it’s still important to understand the underlying concepts and goals involved here.

At its core the PVH 0.00%↑ strategy is:

Focus on their core brands (Tommy Hilfiger & Calvin Klein)

Focus on digital platforms, particularly in direct marketing

Focus on cost controls and efficiencies

And honestly, when you take out all of the fluff and all of the buzzwords, this isn’t a bad strategy!

2020 in particular was quite frankly a disaster for PVH 0.00%↑ , the lock-downs and other COVID restrictions wreaked havoc on the business, and it’s since become clear that the companies digital offerings were simply not up to scratch, particularly when compared to digital-only competitors.

Changing this status quo will make or break this business.

There’s no doubt that physical retail is on its way out, and apparel related retail in particular has had several companies with digital-first or digital-only strategies with very successful revenue and earnings growth for a number of years.

If we have a look at the companies revenues by distribution channels, it’s clear that coming into 2020 their digital channels were an afterthought.

This needs to change, and fortunately it has begun changing with digital revenues in 2021 being almost twice those of 2019.

While I do believe there will always be a place for some physical retail locations, I would expect that that will increasingly become a minority of the apparel business, and most likely concentrated on luxury branded apparel.

The company's Tommy Hilfiger and Calvin Klein brands do have a chance to carve out a market niche in those sectors, but the rest of its brands do not and so should focus exclusively on its digital platforms.

So, the best option here is in my opinion to spin-off/sell-off the brands that do not lend themselves to digital-only distribution channels, and build up a digital distribution network for what remains.

Tommy Hilfiger and Calvin Klein too should not dismiss or ignore the digital distribution channels, and they should lead the charge for the companies digital transformation.

The business may have started this late, but I don’t think it’s too late, and as long as this PVH+ strategy is successful, I can see the business enduring for years to come.

Reporting Segments

PVH 0.00%↑ has 6 separate reporting segments:

Tommy Hilfiger North America

Tommy Hilfiger International

Calvin Klein North America

Calvin Klein International

Heritage Brands Wholesale

Heritage Brand Retail

In terms of revenue we have the following split:

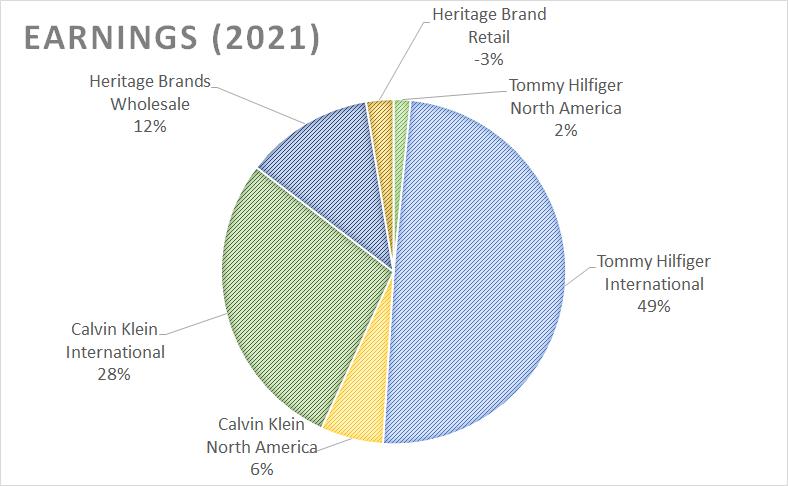

As you can see the international Tommy Hilfiger and Calvin Klein segments comprise the bulk of the revenue, and when we expand our view to the earnings, they become even more prominent.

I was honestly quite surprised with this, since usually speaking the North American segments tend to be the most profitable ones, due to the higher than average disposable income that that region has.

Geographical Diversification

Over half of the company's revenue comes from their international segments, so the business is fairly well diversified geographically speaking.

The fact that the bulk of the revenue and profits are coming from international markets is surprising, but not necessarily a bad thing. I’m already heavily exposed to the US markets, so having a company that is more international focused is arguably a good thing.

Management

Stefan Larsson is the CEO of PVH Corp. having joined the company in 2019, and being elevated to CEO in 2021.

So far we don’t have a lot of indications of his performance, but it’s still early days.

That said, there are a few red flags, Trish Donnelly joined the company at around the same time, but she will now be leaving PVH to pursue other opportunities.

It’s fair to say that the business is currently undergoing a major shake up in the management team, and it’s not yet clear exactly what the outcome of this will be.

The company did poorly in 2020, but it’s not clear if Stefans direction will be able to right this ship.

Additionally I am a bit concerned that they are only now beginning to look for a new executive, this indicates to me that the departure was not well planned out, especially given that Trish came in with Steffan, so theoretically they should have been working together and aligned on the new PVH+ plan…

In terms of insider transactions, i can’t see anything meaningful here:

A few sales, a few purchases, but overall nothing particularly unusual.

Risks

Internal Risks

Instability in the Management Team

Difficulty in driving the digital transformation

Difficult industry to work in

External Risks

Supply chain issues

Further lock-downs may result in significant losses

Geopolitical issues may complicate the international business

Fundamental Data

Income Statement

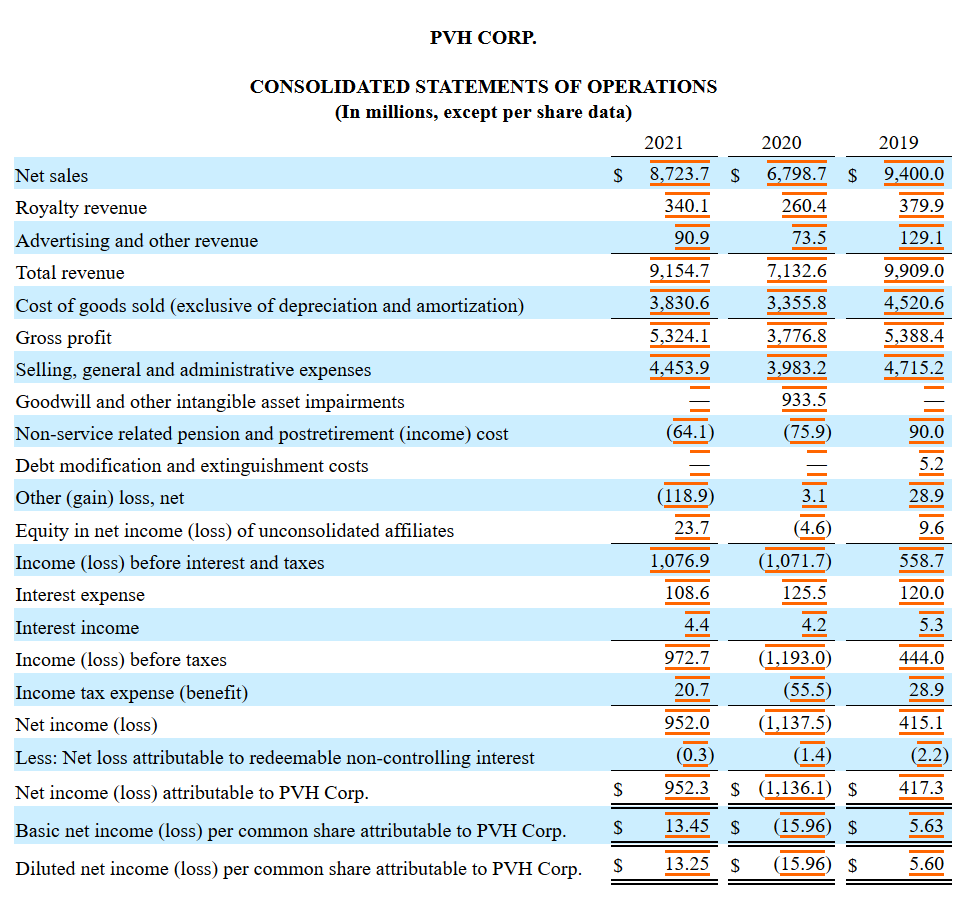

We can clearly see the major impact that 2020 had on the business, with earnings turning to a significant net loss, and sales dropping almost 30% over 2019.

2021 had a recovery in terms of earnings, but the revenues were still under the 2019 levels so it’s clear that the business has not yet recovered.

The increased earnings in 2021 are encouraging, but it’s not clear to me if those will remain of if they are just an outlier. I’m inclined to think it was an outlier and earnings will return down to the $400-$500 million range.

The companies pre-tax margins aren’t really great either, if anything this is an example of a bad company to own in the long term, with thin margins.

Revenue Growth

Overall in the past 10 years the company's revenues have grown only at a 5% CAGR, this isn’t really good.

While the pandemic did have some impact on revenue, the fact is that even prior to it the company was struggling to grow revenue, and unless this PVH+ strategy is successful this lack of growth will likely continue.

I’m not against investing in companies that do not grow in revenue a lot, $AFL is my largest individual holding and they too haven’t grown revenues for 10 years!

But it’s important that I can gain some returns, in some way, so can I get a return with PVH 0.00%↑ ?

Margins and Earnings

In terms of profit margins the company hasn’t really done all that well, with no real improvement in margins over the past decade, and with the margins themselves being significantly low and in the level of what I would normally classify as a highly competitive industry.

PVH 0.00%↑ does have some well known brands, but it’s clear that the business hasn’t been able to convert that notoriety into actual profits.

Additionally the lack of growth in revenues shows itself here again, with the earnings per share being more or less flat.

2020 was a disaster, but at the same time prior to that the company was somewhat consistently profitable, though not extremely so.

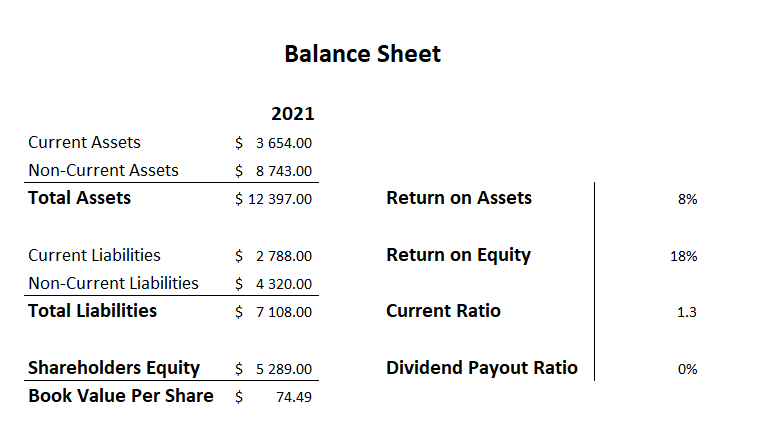

In terms of returns it’s clear that the dividend is for the most part not a factor here, the yield is tiny and the payout ratio is equally low. It’s basically zero if we’re being realistic here.

We will not get a return from dividends with this company.

Balance Sheet

The company's balance sheet is fine, and indeed the business is selling at levels below book value.

That said, most of that book value is goodwill and other intangibles, so it’s doubtful that in a bankruptcy situation the business would be worth much.

Is bankruptcy a likely scenario though?

Personally I don’t think so, the company has enough cash on hand to make good on its commitments, and though the margins aren’t great, I do believe that they will be able to generate enough cash flow to continue to make good on those commitments.

Shareholder Equity

We can see that the companies book value has increased over the past decade, as a result of reinvesting its earnings. Additionally there hasn’t been any big changes in its capital structure which I quite like.

Overall I’m satisfied with the balance sheet.

Debt Schedule

The company doesn’t have a lot of debt, and the majority of its short term commitments are inventory purchase commitments and leases, both of which are key to the business and that I don’t see as bad things.

The long-term debt portion does have a large debt cliff in the 2023-2024 period, but the company has enough cash in the balance sheet right now to pay it off, so I would not be too concerned with this cliff. The debt thereafter is small enough that it’s not worth worrying about.

Shareholder Returns

Buybacks

And here we see where all of those earnings are going!

The company has regularly returned almost all of its free cash flows to its shareholders through share buybacks, not dividends!

That said, the big capital raise in 2013 means that we are only now back to the number of shares that we had in 2013!

That’s a lot of money spent just to be back where we started!

Dividends

And here we see the big change!

The company's dividend has been flat for about a decade, with it being severely cut in 2020 as a result of covid.

The buybacks have already made a comeback, but the dividends not so much.

I don’t like this.

Personally I prefer that dividends are a bigger part of the way that the company will return capital to shareholders, and so a company that prioritizes buybacks over dividends isn’t one that I appreciate.

I prefer a healthy mix of the two, with the dividend providing the bulk of returns.

That said, capital returned is capital returned, so I won’t be as bothered by this as if the company had never returned capital at all.

Strengths and Weaknesses

Strengths:

Willingness to return capital to shareholders

Little likelihood of bankruptcy in the near term

Decent returns on assets

Weaknesses

Low Revenue growth

Low Margins

Low Dividend and a Dividend cut

Valuation

This is what I like about a business!

That fantastically low price to earnings, price to book and price to operating cash flow is music to my ears!

I really like these companies that are selling really, really cheaply!

In a way PVH 0.00%↑ reminds me of my play with FL 0.00%↑ which has been quite successful so far!

It’s clear what the play here is, the company looks wildly undervalued and so this would be a classic value play where I would be looking to purchase stock and hope that the market will recognize the undervaluation in the next couple of years and re-rate it at a higher multiple.

Key Ratios

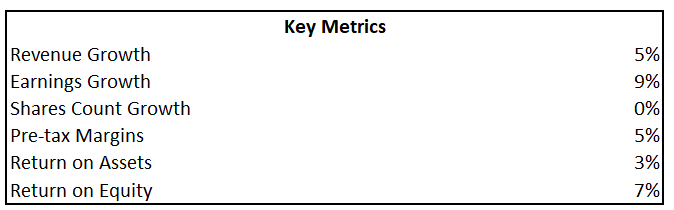

Once again, the revenue growth isn’t great, but at the same time it’s not terrible. The earnings growth is actually quite good, but again it’s going to depend a lot on whether those are durable earnings, and whether the new strategy will work out or not.

The margins are really the low point here, and 5% just tells me that I really don’t want to own this business for too long.

Standard Valuations

Looking at the standard valuations we get quite a wide range! From $500 all the way to $5!

The 3 years normalized margin to PE isn’t really a valid valuation of the business since it includes the only year where the company made a loss, which naturally severely impacts its profit margins.

Personally I think the book value is the most accurate value here, though again, it’s difficult to make a judgment given the wide range of values we’re getting.

Another thing to note is that the discounted earnings value we get is also getting heavily impacted by that loss in 2020.

In fact, if we turn that loss into a break-even where earnings were $0, we get these results:

That $131 actually looks like a reasonable value to me!

It’s actually probably fairly close to the businesses actual intrinsic value!

Safe Purchase Value

If we get an average of the standard valuations though we get an average long term value of $173, with a safe purchase price of $121.

This means that we should be willing to purchase the business at a 9 PE, and so the company is severely undervalued!

From a valuation perspective the company does feel cheap, but again it’s going to depend a lot on whether their digital transformation will succeed and whether their 2021 earnings will be durable and here to stay for years to come.

That said, even if earnings dip back down to 2019 level, I think we would still be within the margin of safety, and so long as the business continues to return capital we can make a return.

Investment Thesis

Key Points

This is a profitable business that had 1 outlier year that severely damaged it

It operates in a highly competitive environment

It is willing to return capital to shareholders

It had one outlier year with high profits that may be messing with its ratios

It appears to be severely undervalued, and even a return to the mean would result in a fair value

Decision

I don’t know.

This company is everything I dislike, low profit margins, low growth, in an industry I don't really appreciate, but it’s just so cheap!

The value investor in me tells me to BUY BUY BUY, and to be perfectly honest that hasn’t really led me astray yet! Or has it? Intel had a similar undervaluation, and I’m deep in the red there so far!

Still, the closest analogue to this company is my investment in FL 0.00%↑ which has been quite good so far. I don’t like the ultra-low dividend from PVH 0.00%↑ though, that’s really a negative and makes me question the longevity of the companies earnings.

For now I’m not going to jump in, I still need to balance out my portfolio with more indexes, but afterwards perhaps.

I would not sell it if i owned it now.

Current stance: HOLD

What about you? What do you think of PVH 0.00%↑? Let me know in the comments below!

Thank you for an excellent write up on a stock that's been on my watchlist for a while. The compelling case is the valuation. It is CHEAP. My problem is that valuation is the only reason why I would buy it. CK and Tommy are good (but not great) brands operating in the cut throat mid-price range of fashion. Then we have the looming (current?) recession.

I'm a LT investor and there's not enough going for PVH to convince me.