Last week we had a quick look at Procter & Gamble, a consumer goods company with a whopping 65 consecutive years of dividend increases.

Today we’re going to conduct some valuations, and see what metrics we find most important when it comes to valuing this company.

The Valuation

We begin with our standard valuations based on the last 10 years of data. We’ve talked about how these values are calculated in previous discussions, and I’ve provided you with a template for your own use in a previous post.

For Procter & Gamble in particular you can find the file I’m using here. Just download it and open it in excel (or google sheets if you’re OK with losing the conditional formatting).

Let’s take a look:

Just like with our experience with Pepsico there is a lot of red…

It’s not as overvalued of a company as PepsiCo is, but it’s still not ideal.

Would I buy more? Or sell?

Well, first, let’s take a look at a few things…

Key Ratios

The Pre—Tax profit margins are just fine. Usually I try to aim for margins above 20%, and Procter & Gamble is right on the edge, with some years above that, and some years below.

This means that there is a significant chance that this company holds some sort of durable competitive advantage, and I suspect their branding and economies of scale play a significant role there.

Their revenue growth is somewhat concerning.

Ultimately earnings come from revenue, and if revenue isn’t growing, there is an inherent limit to earnings growth.

From this it seems that although the companies earnings have been growing at a steady pace, that growth is derived primarily from margin growth combined with share buybacks

And that growth is just ok… 5% growth is nothing to scoff at and only slightly short of the 6% long term market average. For a 100+ year old company in a stable and mature market, that’s pretty good, but it’s still trailing the market.

The Buybacks too are good to see and add to the dividends they pay for our “Owners Yield”.

Yields, Ratios and Premiums

We have a dividend yield of 2.4% which is above the market average, but a fine yield for a mature and established company with a dividend focus.

The Dividend Growth CAGR too is 4.6%, which is in line with earnings growth.

This is pretty good, since it means that the company has been keeping a steady payout ratio, and isn’t eating into their working capital in order to fuel dividend increases.

This shows in the payout ratio which is 63%, something that is just fine for a large well established dividend company. I don’t expect any dividend cuts, or change in dividend policy anytime soon.

That said, the PE ratio is quite high, which is a problem for such a mature company.

This means that there is a significant risk premium (176%) we are paying for this company, which will negatively affect the discount rate we will use.

A 3.5% discount rate on a mature company is pretty high, but such is life.

The Standard Valuations

The “Historical Expected Return” is a combination of dividend yield and the earnings growth, assuming that we purchase Procter & Gamble at current prices and that the earnings will grow in line with the past 10 years.

In this case we can expect a yearly total return on our investment of 7.27%, which is low, especially since it doesn’t account for inflation.

For reference the “before inflation” average return of the market is around 10%.

Of course that’s assuming that there is no PE compression, which seems unlikely if mean-reversion takes place, which i find likely…

In terms of the book value too there isn’t much to buy there, only around $18 worth of equity, most of which will be tied up in goodwill and other non-tangible assets.

The Procter & Gamble brands are very good, and a key to the companies success, but it’s always tricky to sell intangibles.

The Ben Graham methods are a bit more encouraging, though I’m not entirely out of the woods, particularly given the large divergence between the current price and the Margin to PE Method.

The Discounted Earnings Model

There’s a lot of information here, and plenty of numbers, but there’s no need to be confused.

This table simply has the value of the company roughly 10 years from now.

On the left side, the “Absolute” column tells you the value that should show up on the Income Statement and the Balance Sheet in 10 years.

On the right side, you have those same numbers discounted to their present value by the discount rate (which we talked about previously).

Generally speaking you want to use the “Discounted” values when doing your valuations, because you’re interested in the present value of the future return.

In this case, if you were to buy 1 share of Procter & Gamble today at current prices, 10 years from now you would have received $47 worth of dividends which are worth $39 today.

You would also expect the Earnings Per Share to be the equivalent of $5.79 today, and if we assume that the PE ratio will return to the market average over these next 10 years, the share price would be equivalent to $86.

In other words, the present value of a share of Procter & Gamble 10 years from now is $86, and if we add the present value of the dividends you would receive over that time period ($39), you would end up with a total return of 126$.

That’s very close to the price that we paid for our current shares ($125), but that’s not that great.

This means that if you were to buy at today’s prices, and hold for 10 years, your total return CAGR would be -1.5%.

Yes, that is negative 1.5%, you are expected to lose money.

Of course, most of that loss is the result of multiple compression, that is, of the PE going from the high 20s, to the historical market average.

If we assume the multiple will not compress we will get a much more attractive CAGR of 5.7%.

Is this likely to happen? We will see that in part 3.

The Safe Purchase Value

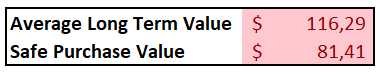

The Average Long Term value is the expected present value of a share of Procter & Gamble, and is calculated using the average of the multiple valuation methods.

To this value with take out our desired Margin of Safety, which I default to 30%, and that gives us our “Safe Purchase Value”, this is the value under which you can reasonably expect to make a profit from owning the company.

For Procter & Gamble the price that an investor should be willing to invest in Procter & Gamble should be $81.41, well below the current price of around $141.

Summary

I purchased Procter & Gamble at around $125 per share, which isn’t that far from what I find the Average Long Term Value to be.

At the current price of $141 per share, I would say PG is overvalued, but not vastly so, after all, it’s only about 20% above what I estimate its true value to be.

I tend to keep a 30% margin of safety, and that works both ways.

I don’t want to sell a company once its at its true value, I want to sell it when it is wildly overvalued from its fundamentals.

I don’t see that as the case with PG.

While there is no sufficient margin of safety for me to reinvest into the company, there is also not enough for me to sell out of the company, so I’m inclined to do neither, and simply hold my existing position as is, collecting dividends as they come.

If you think differently let me know what you think I should do!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!