Problems at Vonovia

A real Estate Company with some questionable accounting

Today we’re going to be doing something a bit different from what we usually do in this blog.

Usually we analyze a company with the idea of understanding a business, and then deciding whether or not it might make sense to invest in it.

Today however we’re going to look at a company, its earnings, balance sheet, and cash-flows not because I am considering investing in it, but because I found a few things that have confused me enough that I’d like a second or third viewpoint to let me know what I am missing, and whether all of these problems and giant red flags are due to my lack of knowledge and understanding of accounting and the real estate business, or if I truly am right and there are a lot of problems with this business, and poor incentives in their accounting practices.

What is Vonovia?

Vonovia is a German real estate company that owns and operates around 635 thousand rental units, primarily apartments.

The company has been around in one form or another for quite a few decades, and went public on the Frankfurt stock exchange in 2010. As the biggest real estate company in Germany, the company has been in the news a lot recently, particularly in regards to its merger to Deutsche Wohnen as well as the 2021 Berlin Referendum which is looking to nationalized both companies properties in Berlin.

While both of those are interesting topics in their own right, they are not the reason I’m making this blog post.

The Problems

There are several problems that I saw when looking over the companies annual report, and I wanted to bring attention to them because I’m either missing something, or there are significant risks and dangers that many Vonovia shareholders seem to be wholly ignorant about.

If any of these problems stem from my misunderstanding of accounting, or of the business, then great! Please let me know in the comments where and how I misunderstood things! I want to understand this better, and if you can help me do that, thank you!

Accounting Standards Concerns

There are a few concerns that I have with the accounting standards that Vonovia is making use of.

While I am not an accounting expert, some of the decisions in regards to property classification make little sense to me, and seem conveniently designed to either prop-up reported profits, or that are otherwise questionable.

Classifying Assets as Investment Properties

Vonovia classifies the vast majority of its real estate assets as “Investment Properties”, rather than the “Property, Plant and equipment” that is the standard under US GAAP.

This has significant impacts on their income reporting, and even if not necessarily fraudulent, and is definitely in line with the IFRS standard, it does leave room for the company to manipulate the numbers to investors' detriment.

Asset revaluation

To be more specific, I’m speaking of the use of the “Revaluation model” that IFRS permits companies to use when it comes to investment properties.

Under IFRS, entities are allowed to apply the revaluation model, which allows the entity to measure property, plant and equipment at fair value. If they chose to do so, then the model must be applied to entire classes of assets, which for Vonovia essentially means their entire rental property portfolio.

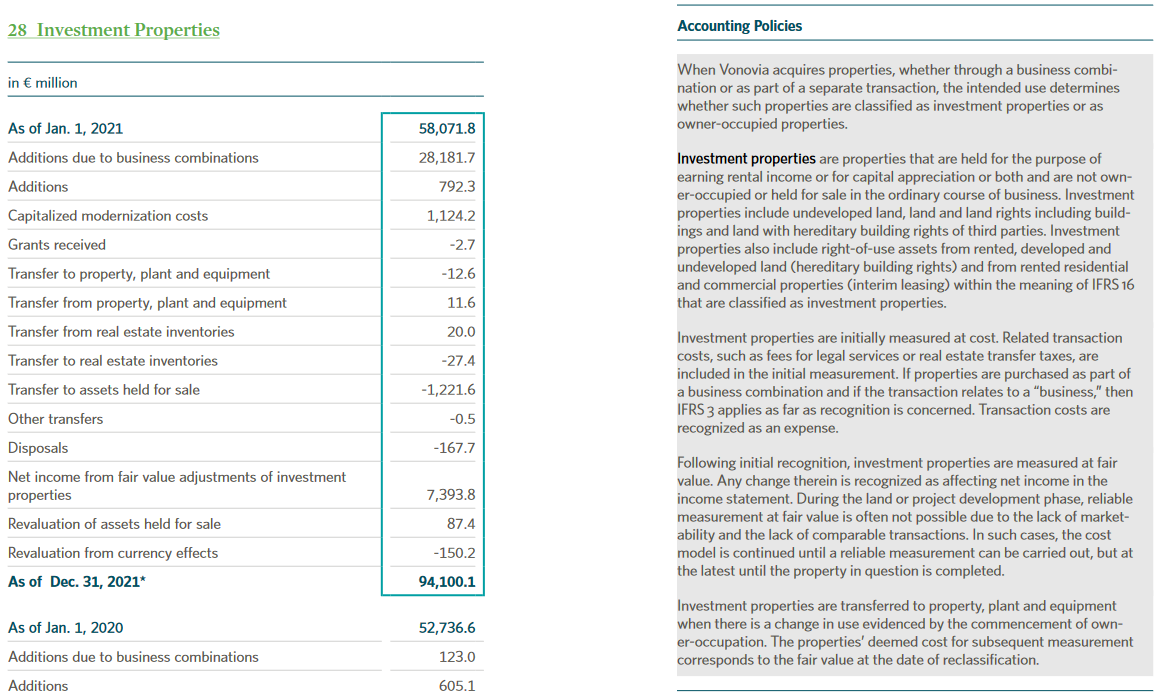

This means that every year Vonovia revalues their real estate portfolio, and accounts for the change in value as “income”, even if the property has not changed at all, and no cash has changed hands.

And Vonovia has been doing this extensively, which has greatly propped up their income statement and earnings per share.

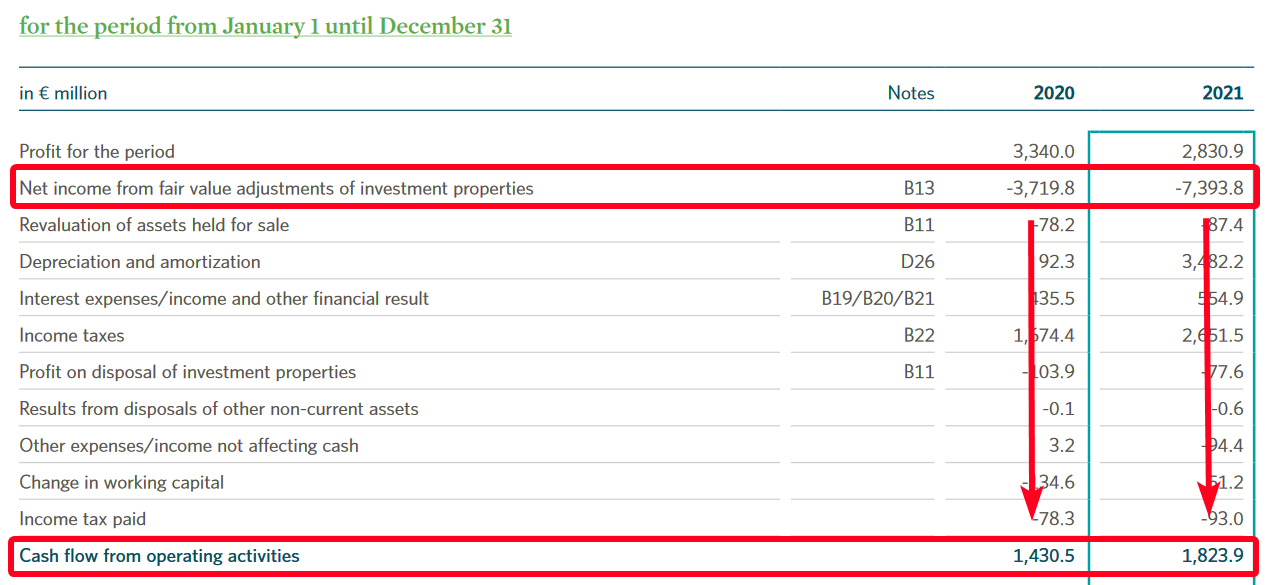

For example, just last year they added 7.4 Billion euros to their net income just in adjustments to the fair value of investment properties! That’s 4 times the actual cash that their operating activities provided them!

And this isn’t just a one off either! The same thing happened in 2020, where they booked another 3.7 Billion euros, 3 times their operational cash flow for the period!

As you can imagine this makes their numbers look great in a period of lowering interest rates, like we’ve seen over the past decade, but will provide an equally large drag in a period of rising interest rates.

This is something that they themselves mention briefly in the notes:

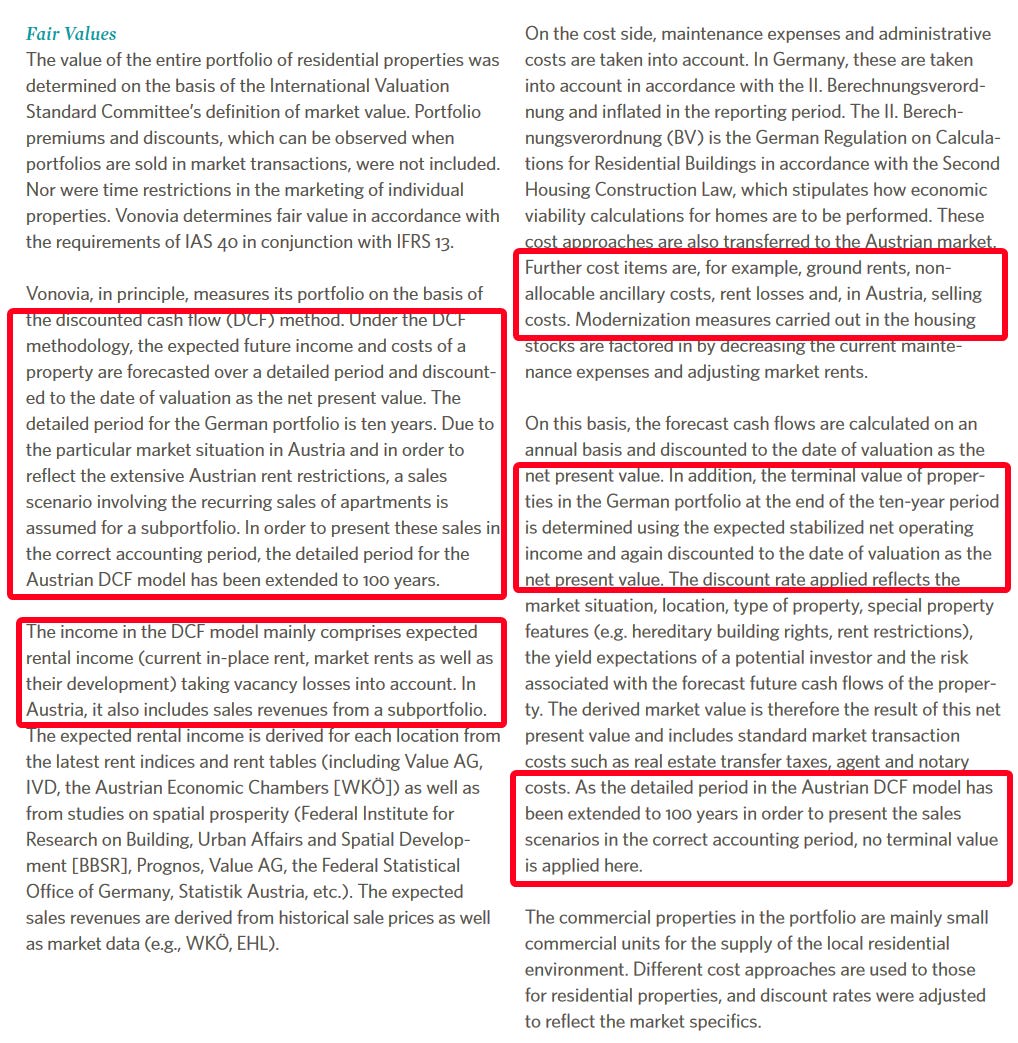

Additionally, the model used to make these revaluations have a lot of issues in themselves, including huge amounts of assumptions in their discount rates, etc…

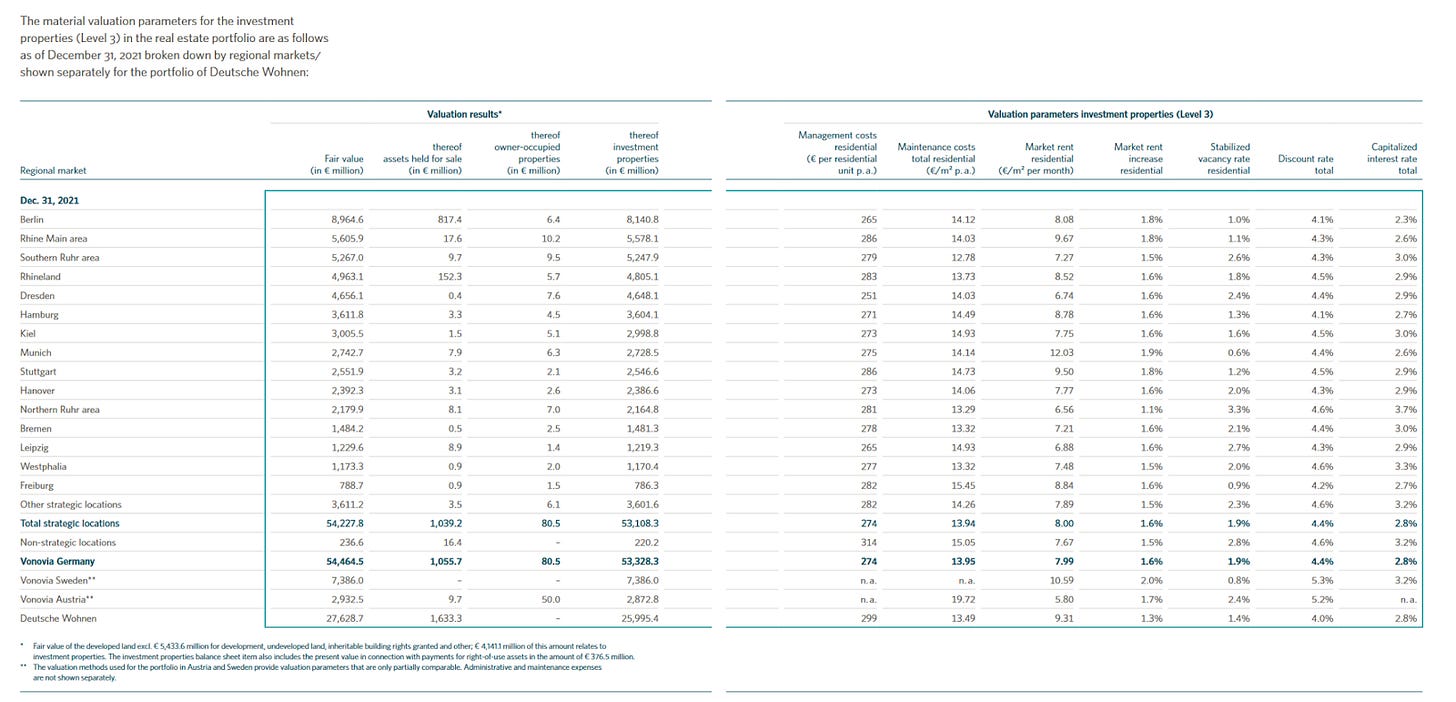

They explain all of these in page 192 of their annual report, and provide a handy table for the parameters they used to value each regional market:

I’ll leave you to decide whether these values seem reasonable or not, but to me, they look overly optimistic.

Differing Standards on a Country by Country basis

Another important thing to note is the fact that Vonovia accounts for things differently based on the country the asset is located in.

This is concerning because it means that there is no standardization in the numbers throughout the business, and investors can’t rely on any of the numbers providing the same, consistent information that you’d expect.

This is particularly the case when it comes to the austrian properties, where they have a number of special differences:

I don’t like any of this, there’s far too many places where things are unnecessarily inconsistent, which provides cover for potential mis-behavior on the part of the company.

To be clear, I have no evidence of any misbehavior on the part of Vonovia or its management team.

As far as I am aware, the company is following the correct accounting principles, and I have seen nothing that would indicate that they are doing so in an incorrect or illegal manner.

All the same however, it is clear to me that the accounting principles and standards they are using leave far too much leeway for malfeasance than I am comfortable with, and might hide significant dangers within the company.

Depreciation and Amortization

This brings me up to another issue with the accounting standards used, that is, the lack of Depreciation and Amortization charges.

If we have a look at their property, plant and equipment we can see that the depreciation and amortization charges are tiny:

This is in large part the result of the classification of the rental units as “Investment Properties” that are subject to revaluation instead of being depreciated over its lifespan:

This is something that I really dislike, because it hides the true cost of depreciation of the rental units behind a nebulous “fair market value” which as we’ve already discussed has a lot of confounding variables

Goodwill Impairments

There’s really no way around this, the company recorded a massive 3.4 Billion euro goodwill impairment:

This was essentially a complete write-off of certain portions of their business:

This is a huge amount of shareholder wealth destroyed, and it’s being treated like an afterthought!

I’ve read this section of the report 5 times already, and I still can’t make heads or tails as to the underlying cause of this impairment!

The lack of proper information and transparency here is quite frankly outrageous, and investors deserve better!

Business Quality Concerns

Debt Schedule

Debt Maturity

First things first, the debt maturity profile that the company is showing in their website does not match up with what they reported in their latest annual report:

What we see in their latest annual report

What we see in their latest annual report.

While some of the differences in the 2022 numbers can be explained by the possibility that the website accounts for debt repayments since the beginning of the year, some of the later debt schedules also have significant differences.

Regardless of the odd differences between the maturity profiles that were made public by the company, one thing is common throughout, and that is the relative short term profile of their debt.

In total they have about 46 Billion euros worth of long term debt (which they report as “Non-derivative financial liabilities”) on their balance sheet, that’s about 40% of their total assets and 1.27 times their shareholders equity.

Vonovia is a real estate company, and so the bulk of this debt is being used to finance long term capital assets like real estate. The question then is, why are they funding a long term, illiquid asset like real estate with comparatively short term debt?

This wouldn’t be a problem if they were paying off the debt as it comes due, but they don’t make enough cash to do that…

Refinancing

In other words, since they don’t make enough cash to pay off their debt as it comes due, then they need to either finance or dispose of their assets in order to make good on their commitments.

This leaves them vulnerable to interest rate changes, and forces them to refinance their debt regularly, and at a potentially bad time. Even disposals of property, when possible become inconvenient, since interest rate changes often have significant impacts on the valuation of real estate.

So has that been happening? Has Vonovia been issuing debt to repay their outstanding debt commitments?

Yes!

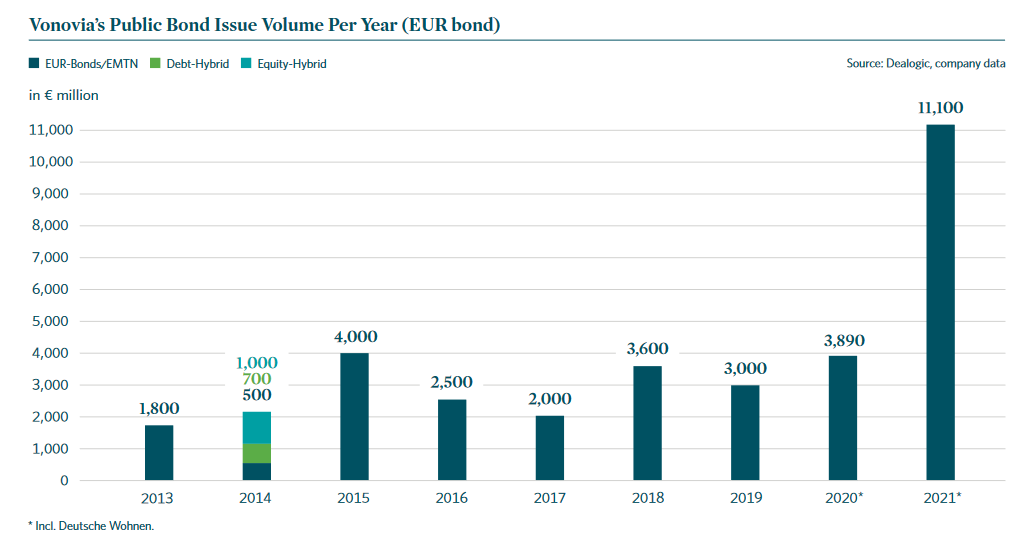

Vonovia has regularly been issuing new bonds, in amounts well in excess of their cash flows! This has been happening over the last decade of low interest rates!

In other words the company has spent the past decade leveraging themselves up to the hilt, on properties that they cannot and are not cash-flowing enough to make good on their amortization schedule!

This has worked so far because interest rates have been decreasing, property prices have been going up, and so they have always had an easy time refinancing on attractive terms, and disposing of properties in a profitable manner.

What happens when that is no longer the case?

Interest Rates

The company seems to see no issue with taking on debt, and is wholly unconcerned with the effect that rising interest rates will have on their business.

Indeed, they seem to expect that rising interest rates will not affect their business at all, according to their opening statements:

In my view this is quite frankly stupid.

Interest rates have a significant impact on the real estate market, particularly when it comes to valuation, which is one of the inputs the company uses to determine fair value!

Are they really trying to tell me that a component of their earnings which accounts for 4 times their operational cash flow, and which is almost entirely dependent on interest rates for its values is “not directly correlated”?

And “Long maturity”? Does this management team consider 80% of their debts coming due and needing refinancing in the next 10 years as a “long time period”? Really?

The interest rates on their debt has an average interest rate of 1.14%, this is about 1.5 percentage points above the average euribor rate, and results in a total interest payment (with no amortization) of around 550 million euros.

If we take this away from their operational cash flows, that means that the company is outputting 2.378 billion euros in cash flow.

The 555 million in interest payments, at a 1.14% interest rate give about 48 Billion in debt, which is fairly close to the 46 billion long term debt we discussed in the debt schedule above (the difference I’m assuming is other minor debt, rounding errors, and already paid off debts).

This means that we can simulate what an increase of interest rates will do to their operating cash flows fairly easily, so let's do that!

Let’s assume Euribor will progressively rise up to 5% over the next 5 years, from their current 0%. This is a fairly reasonable value given the increased inflation, and Euribors historical rates (it was at this value prior to 2008!).

Additionally, I’m going to assume the company's 1.5% premium over euribor will maintain itself during that time.

So if their operating income doesn’t grow, and their interest rates rise without them being able to pay off their debt…

By 2030 about 70% of their operating cash-flow will be used to pay off their debts, and they will not have enough cash to make good on their dividend, and deal with other commitments and issues.

If interest rates remain persistently elevated, a dividend cut is required.

This is a significant drag on their business.

They currently have about 520 million in dividend expense, and that is not covered without increased income if all of their debt would be refinanced at these reasonable interest rates.

A 4x increase in their interest charges would hamstring the company, prevent it from investing in growth, prevent it from paying out shareholders, and would meaningfully affect the businesses cash flow, not to mention the negative impacts on the asset valuations!

And they seem to be aware of this issue, at least according to their half year report:

They can see that depressed valuations of their equity, combined with rising interest rates, and lack of cash flowing properties, means that:

Repayment requires refinancing at higher rates

Repayment requires asset disposals

This is a significant problem!

In Summary

I don’t think Vonovia is doing anything illegal.

But it’s clear that they are making some questionable accounting choices that make the company and its management team look good, while hiding risks and costs from shareholders.

I think the company's management team is overly optimistic in both the likelihood and strength of interest rate hikes, and is delusional regarding the impact that such changes can have on their business.

Even a back of the napkin calculation shows significant impacts on the company's cash flows and asset valuations from even minor interest rate changes.

I urge investors to dig deeper into Vonovia before putting any money in it.

I would also like to ask you, the reader, to let me know if I’ve misunderstood something, or if my numbers are wrong, or if I missed something. Like I’ve mentioned before, I’m not an accounting or REIT expert, and so it’s perfectly possible my views here are mistaken.

For now though, this entire company stinks to me, and I don’t want to touch it with a 10ft. Pole.

What about you?

Thank you for your analysis, I was looking at the Vonovia in the past couple of days and my main problem with it was as you said asset revaluation.

Not a REIT expert but I do know that your first argument perhaps has a impact at earnings per share which is not a valid metric for a REIT (AFFO is better to look at)