PepsiCo - Part 2

Let's value this tasty company

Last week we talked about PepsiCo, a snacks and drinks company that owns brands such as Lays, Doritos and Pepsi.

Today we’re going to conduct some valuations, and see what metrics we find most important when it comes to valuing this consumer staples company.

The Valuation

We begin with our standard valuations based on the last 10 years of data. We’ve talked about how these values are calculated in previous discussions, and I’ve provided you with a template for your own use in a previous post.

For PepsiCo in particular, you can find the file I’m using here. Just download it and open it in excel (or google sheets if you’re OK with losing the conditional formatting).

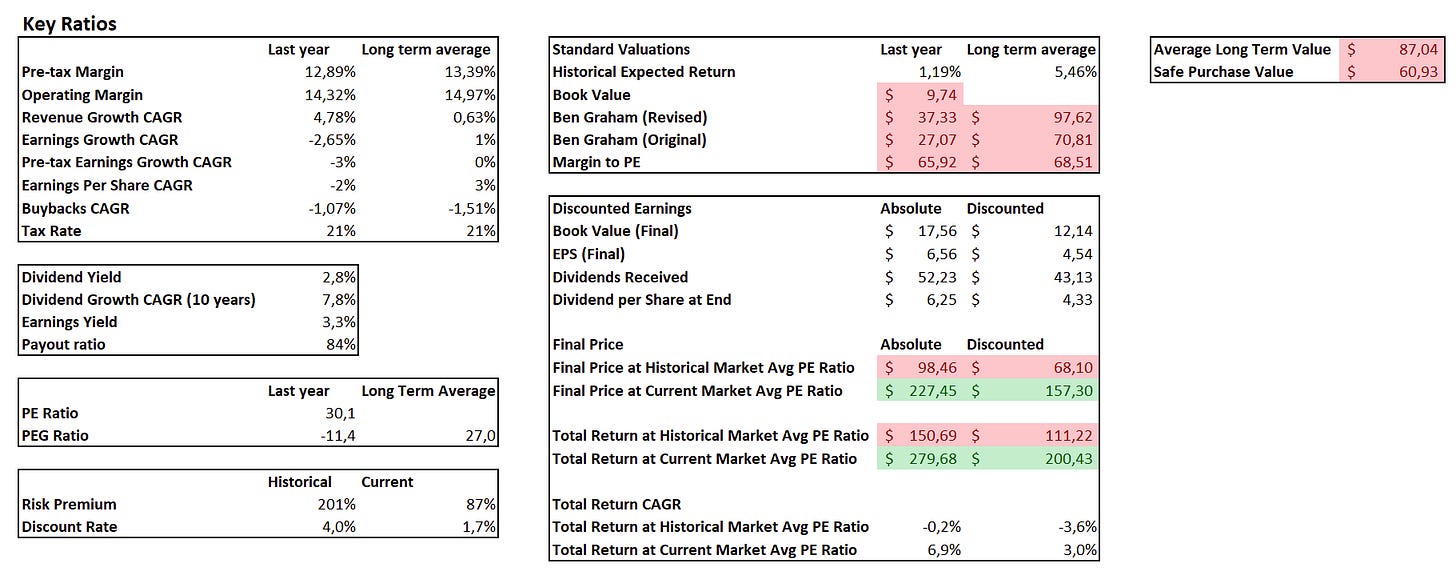

Let’s take a look:

There’s a lot to unpack there, and quite a lot of red!

I won’t lie, this isn’t good, and very much not what I want to see.

At the current price level it is clear that PepsiCo simply does not have enough value to justify its current price.

Now, I did buy it at the more attractive price of around $132 per share, so I didn’t make as much of a mistake as if I had bought it now! Always look on the bright side!

That said, let’s take a look at a few things…

Key Ratios

The pre-tax margins are OK, but not great. Usually I try to aim for margins above 20%, since that tends to indicate that the company has a durable competitive advantage.

13% pre-tax margins aren’t bad, and it’s clear that PepsiCo has some advantage in the business, since usually this sector has margins below 10%, but it’s only a very slight one.

This is actually quite surprising to me, since personally I tend to consider their products to be expensive and “premium” compared to my usual “white-label” tastes.

The lack of revenue and earnings growth is concerning though. Companies live and die by their earnings, and stock prices have essentially a 1-to-1 correlation with earnings over the long term.

Whatever growth we see in the earnings per share is coming from the 0.63% earnings growth combined with the 1.51% buybacks they are doing.

It’s good that they are returning cash to shareholders via buybacks as well as dividends, and its true that in a mature market like Consumer Staples growth prospects are not readily available, but the lack of growth does make itself seen in the valuations.

Yields, Ratios and Premiums

We got a dividend yield of 2.8% which is above the market average, but a perfectly reasonable yield for a dividend focused company in a mature industry.

What isn’t reasonable is the 7.8% dividend growth CAGR.

While dividend growth is a wonderful thing, that dividend must come from earnings and when earnings per share are growing at 3% per year, and the dividend is growing at 7.8% that is unsustainable.

You can see that unsustainability in the very high payout ratio of around 84%, which is levels you would expect to see in a REIT. This is not even mentioning the share buybacks which too come from earnings…

Overall unless the company starts growing significantly more than it has over the past 10 years, I would say they will have to meaningfully slow down their dividend growth and share buybacks in order to maintain the stability of their business.

The PE ratio too is quite high at around 30, around twice the market average.

This makes PepsiCo have a risk premium of around 200%, which combined with the expected inflation rate of 2% gives me a discount rate of 4% to use in my Discounted Earnings Model.

The Standard Valuations

This is all Red.

The “Historical Expected Return” is a combination of dividend yield and the earnings growth, assuming that we purchase PepsiCo at current prices and that the earnings will grow in line with the past 10 years.

In this case we can expect a yearly total return on our investment of 5.46%, which is quite low, especially since it doesn’t account for inflation.

For reference the “before inflation” average return of the market is around 10%, so we’re expecting about half that return if we invest in PepsiCo…

Of course that’s assuming that there is no PE compression, which seems unlikely if earnings continue to have sub-par growth…

In terms of the book value too there isn’t much to buy there, only around $10 worth of equity, most of which will be tied up in goodwill and other non-tangible assets.

The brands PepsiCo owns are good, but it’s always tricky to sell them if need be.

The Ben Graham methods are a bit more encouraging, but even still both methods give us a value of about half of the current stock price.

The pre-tax margins too are simply OK, which doesn’t lead to a particularly high value.

The Discounted Earnings Model

There’s a lot of information here, and plenty of numbers, but there’s no need to be confused.

This table simply has the value of the company roughly 10 years from now.

On the left side, the “Absolute” column tells you the value that should show up on the Income Statement and the Balance Sheet in 10 years.

On the right side, you have those same numbers discounted to their present value by the discount rate (which we talked about previously).

Generally speaking you want to use the “Discounted” values when doing your valuations, because you’re interested in the present value of the future return.

In this case, if you were to buy 1 share of PepsiCo today at current prices, 10 years from now you would have receive $52 worth of dividends which are worth only $43 today.

You would also expect to have what is only $4.54 worth of earnings today, and if we assume that the PE ratio will return to the market average over these 10 years, the share price would be equivalent to $68.10.

In other words, the present value of a share of PepsiCo 10 years from now is $68.10, and if we add the present value of the dividends you would receive over that time period ($43.13), you would end up with a total return of $111.22.

This means that if you were to buy at today’s prices, and hold for 10 years, your total return CAGR would be -3.6%.

Yes, that is negative 3.6%, you are expected to lose money.

Of course, most of that loss is the result of multiple compression, that is, of the PE going from twice the market average, to the historical market average.

If we assume that the multiple won’t compress, that is, that PepsiCo will continue to trade at its current multiple, then your total return is looking a lot sunnier at around 3% CAGR.

Is that lack of a return to the mean reasonable to expect? Generally I would say no, but that’s better left for part 3.

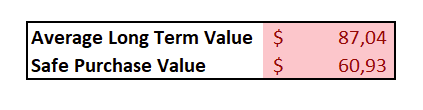

The Safe Purchase Value

The Average Long Term value is the expected present value of a share of Pepsico, and is calculated using the average of the multiple valuation methods.

To this value with take out our desired Margin of Safety, which I default to 30%, and that gives us our “Safe Purchase Value”, this is the value under which you can reasonably expect to make a profit from owning the company.

For PepsiCo the price that an investor should be willing to invest in PepsiCo should be $60.93, well below the current price of around $154.

Summary

So what went wrong? Why did I buy PepsiCo at $132? Should I sell? Should I keep buying more despite it appearing to be wildly overvalued? Should I just hold?

Well, first things first, PepsiCo is not a bad company and they do not have a bad business.

They have a simple and stable business and have been using it to return capital to shareholders.

While it is true that their growth over the past 10 years has been disappointing, it may well be a temporary setback in an otherwise old and reliable company.

Despite their high payout ratio, I don’t believe the dividend is in jeopardy right now, and I expect that it will continue to be raised annually in such a way that allows the company to retain their Dividend King status.

I suspect that part of the reason for its current overvaluation may have to do with this status, that is, with investors being willing to pay a premium for a stable and consistently growing dividend.

If so, this buying pressure may well reduce the PE compression that I am accounting for in my calculations of total return, thereby increasing returns.

As for whether I should sell or not, I think I will make that decision in part 3, once I have taken a better look at their story, and their future prospects.

Let me know what you think I should do!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!