PepsiCo - Part 1

Let's take a sip of this cola company

One of the positions in my portfolio is PepsiCo, and so today we will be going through this company, what it does, its profitability and check to see if it’s a good investment, or if we are better off allocating our money elsewhere.

What is PepsiCo?

As per their latest annual report, PepsiCo is:

We were incorporated in Delaware in 1919 and reincorporated in North Carolina in 1986. We are a leading global food and beverage company with a complementary portfolio of brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. Through our operations, authorized bottlers, contract manufacturers and other third parties, we make, market, distribute and sell a wide variety of convenient beverages, foods and snacks, serving customers and consumers in more than 200 countries and territories.

Out of all the companies we’ve talked about so far, I think that PepsiCo has the simplest to understand business model.

They simply make food and drinks that everyday people consume.

This really isn’t hard to understand for most people, and indeed I would say that the vast majority of investors has purchased some good that was produced by PepsiCo.

I know that I eat some of their snack products on a regular basis, and I have done so since i was a child.

Pepsi, Lays, Doritos and other brands owned by PepsiCo all make products that I personally enjoy, and which are sold all over the world.

Their products are, for the most part, good quality, desirable and have a good (or premium) brand image.

How is the company organized

PepsiCo is organized into seven reportable segments (also referred to as divisions), as follows:

Frito-Lay North America (FLNA), which includes branded food and snack businesses in the United States and Canada;

Quaker Foods North America (QFNA), which includes cereal, rice, pasta and other branded food businesses in the United States and Canada;

PepsiCo Beverages North America (PBNA), which includes beverage businesses in the United States and Canada;

Latin America (LatAm), which includes all beverage, food and snack businesses in Latin America;

Europe, which includes all beverage, food and snack businesses in Europe;

Africa, Middle East and South Asia (AMESA), which includes all beverage, food and snack businesses in Africa, the Middle East and South Asia; and

Asia Pacific, Australia and New Zealand and China Region (APAC), which includes all beverage, food and snack businesses in Asia Pacific, Australia and New Zealand, and China region.

The multiple divisions when it comes to their North American operations are very necessary, since that’s where most of their revenue and operating profit is actually coming from:

Out of all of their divisions, their snacks business with Frito-Lay is the real driver of their operating profit.

Such a high concentration of profit in a single business and market might seem problematic, and truthfully it is a concern.

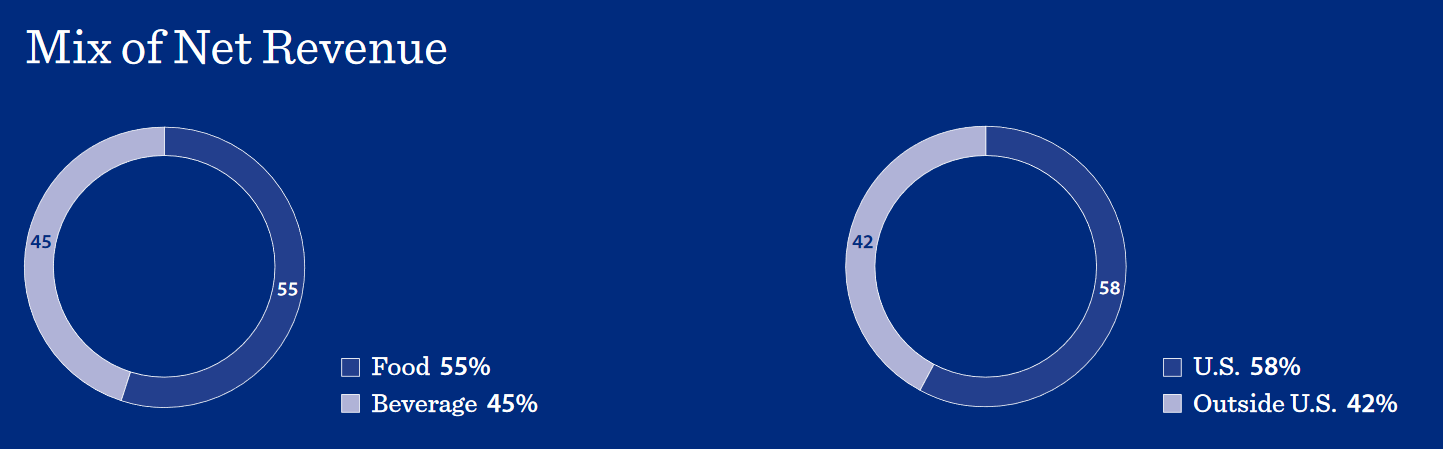

That said, PepsiCo still has an overall fairly even distribution between their Food business and Beverages, as well as between US and Non-US markets in terms of Net Revenues:

Of course this mix and match of Beverage and Food businesses is simplistic and doesn’t accurately outline PepsiCos business strategy and future steps.

Ultimately consumer staples is a competitive industry, but also one where branding has a significant impact. It’s important for PepsiCo to continue innovating in their product offerings, as well as the methods through which they reach clients, lest their brand become “old and dated”.

So far, they have been doing that successfully with many new products, both local products intended for the cultural sensitivities of a specific market, as well as other less localized options that create new markets entirely.

In addition to this, PepsiCo is embracing direct-to-consumer via the internet, with investments in PantryShop.com and Snacks.com, and so on. Eventually they will be able to leverage these investments into higher margins, if all goes well.

The Dividend

PepsiCo is a Dividend Aristocrat with a whopping 49 consecutive dividend increases.

This is an amazing track record, and it shows very clearly that management is clearly prioritizing Shareholder value as one of their goals.

In addition to paying these dividends they also conduct regular share buybacks, which too return capital to shareholders.

In total, over the last year they have returned $7.5 Billion in cash to shareholders, delivering an 11.7% increase in total shareholder return.

While their payout ratio right now is quite high at 70%, it’s still lower than some of their competitors like Coca-Cola.

Income Statement and Balance Sheet

Let’s take a look at their income statement and their Balance Sheet:

The high amount of Indefinite-Lived Intangible Assets (which includes goodwill) is concerning.

The Current assets and current liabilities are more or less even, so we don’t have to worry about them going bust any time soon.

The pre-tax margins are quite low, at around 12.5%. I usually try to aim for above 20%, but that’s something that we will need to see in greater detail when we are valuing the company.

Overall though, nothing really jumps out as particularly concerning, which is great.

Strengths and Weaknesses

Every company has strengths, and weaknesses, and it’s important to be aware of them before we consider investing in it:

Strengths:

Surprisingly high Growth rates in a mature industry

Stable and simple business model

Commitment to shareholder value

Clear path and strategy

Weaknesses:

High Payout Ratio

Mature industry makes it hard to “grow the pie”

Average Pre-Tax Margins indicate Brand is not sufficient to enable a clear competitive advantage

Highly Competitive industry with comparatively low barriers to entry

Summary:

Overall PepsiCo is the type of company that I like to own.

I like their products, I understand their business model, and they clearly are providing value to their customer while returning cash to their shareholders.

I own PepsiCo, and I enjoy going to the store and seeing their products on the shelf. Whenever I have a gathering I buy some of their products so my friends and I can have something to snack on while playing games, or chatting.

Every time I receive a dividend from them, I think of the Pepsi that I drank recently, or the Doritos I just purchased.

But of course, when it comes to investing we should do so with our head, not our stomach.

And to do that, we need to know what price we should be willing to pay for this Dividend Aristocrat, so we will be doing just that next week.

Do you like Pepsi? Or are you a Coca-Cola fan?

Let me know in the comments below!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!