I mentioned in my 2021 annual report that I made some return from selling options, but I didn’t go in depth as to what exactly I do to get that return, and what costs (and risks) I’m taking on.

So today let’s discuss options, what they are, how they work and how I use them to juice up my returns.

What are options?

As per Investopedia options are:

The term option refers to a financial instrument that is based on the value of underlying securities such as stocks.

An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it.

Each contract will have a specific expiration date by which the holder must exercise their option.

The stated price on an option is known as the strike price. Options are typically bought and sold through online or retail brokers.

That sounds pretty complicated and confusing, doesn’t it? That’s why options are generally considered to not be suitable for most investors.

That said options really aren’t as complicated as they are said to be, and we can actually simplify that explanation to something that most people would easily be able to understand.

Here’s my simple explanation:

An option is simply a promise to buy or sell something to someone at a certain date and with a set price.

That doesn’t sound too complicated right?

In fact, I’m willing to bet that you’ve already “bought” or “sold” an option sometime in your life!

Let’s see a common example:

Let’s say that you go with a friend to a cafe to have a cup of coffee every saturday morning.

This week you get there, have your coffee, but you realize that you forgot your wallet at home, and can’t afford the cup of coffee you just had.

So you tell your friend, “Hey, I forgot my wallet, do you mind paying my coffee for me, and next weekend I’ll pay yours?”

Your friend says yes and pays your coffee for you, and when next weekend comes around you’ll pay his.

If you did this before, congratulations, you have sold an option!

To be more specific, you have sold a Call Option on a cup of coffee, with a strike price of Zero and expiring next weekend, in turn, your friend has bought that option.

The Risks

If you think through that example, I’m sure you can easily understand the high level of risk involved with what you did there.

The key risk here is:

What if the price of coffee rises next weekend?

That’s the issue, and potential speculative value, of options!

Depending on the specific option, and whether you bought or sold it, you are exposing yourself to certain risks depending on the price of the underlying (in this case, coffee).

You might not have realized it, since it’s quite a common thing to do, but this example of promising your friend that you’ll buy him a cup of coffee next week is actually the single most dangerous thing you can do with options, because your maximum loss is infinite!

Because you’re now responsible for buying someone a cup of coffee, if that cup of coffee’s price goes up to 1 million dollars, you are now on the hook to pay out that 1 million dollars!

Now, your friend is probably not going to be suing you for a cup of coffee, but then again the chance that a cup of coffee is going up to 1 million dollars is also quite low.

Not everyone has that same relationship with you, and when it comes to investments it’s important to be honest and be reliable in terms of fullfilling ones commitments.

This means that you are obligated, not just morally but also legally to fullfill that commitment, and honor that option you bought/sold.

So it’s important to get a clear idea of what sort of options have what sort of risks you’re taking on when using options.

So let’s outline what sort of options there are, and what risks are involved in each of them.

From the point of view of the buyer, there are 2 main types of options:

Call Option - The Right to Buy something at a certain price on a certain date

Put Option - The Right to Sell something at a certain price on a certain date

These “rights” are instead “obligations” for the seller, so if you’re selling options these look like this:

Call Option - The Obligation to Sell something at a certain price on a certain date

Put Option - The Obligation to Buy something at a certain price on a certain date

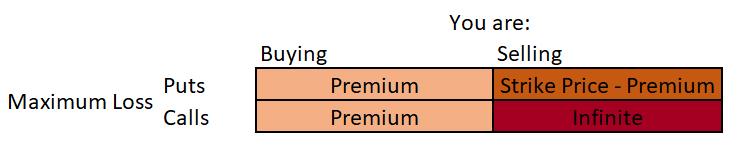

This asymetry between rights and obligations means that there is also an asymetry in the risk the buyer and seller of both types of options take on.

If you buy an option, the maximum loss you can take on is the cost of buying that option.

If you sell an option, your maximum loss depends on what you sold.

Sellers of a Call option have an unlimited maximum loss.

Sellers of a Put option have as the maximum loss the strike price minus the cost of the option.

This means that selling a call option is something very dangerous, and not something that the vast majority of investors should do.

On the other hand selling put options is actually not riskier than that of buying the underlying.

Selling a put option is no different from keeping an open limit buy order.

What I do

If you really think about it, selling put options isn’t really an issue for value investors.

A value investor analyzes a company, comes up with a valuation for the company, and is willing to buy the company for a price below that valuation (plus a margin of safety).

So selling a put with a strike price below the price at which you’re willing to buy introduces no further risk than you would be by buying the shares at that price now.

So what I do, is I sell Puts on companies that I would like to own, at prices I would be happy to own them at.

For example, I currently have sold the following put options:

2x Aflac May 20th 2022 $42.5 Put

2x Intel April 14th 2022 $40 Put

1x Apple March 18th 2022 $130 Put

1x Microsoft April 14th 2022 $210 Put

1x Intel March 18th 2022 $37.5 Put

1x Facebook March 18th 2022 $175 Put

Each of these are companies that I would be happy owning at these prices, and although I would have to use margin if these were all to be triggered, I think that the risks and costs of doing so are worthwhile.

An interesting thing to note is that since selling Put options has a defined risk, we can actually see what my max loss is. We simply need to multiply the number of puts I sold by the strike price (and by 100 since each contract corresponds to 100 shares).

With this we can see that my maximum loss is $71K. That’s quite a lot of money, and would almost certainly require me to dig into my savings to reduce my margin exposure.

That being said, I don’t think any of these companies will go bankrupt anytime soon, and I don’t even believe that they are going to go down in price such that these puts will be triggered (no matter how much I want to buy Aflac at $42.5).

In essence I view selling puts as getting paid to wait to buy a company.

Maybe I will have the chance to buy it, but if not, at least I will have been compensated for the wait.

What about you?

Do you buy or sell options?

Let me know in the comments below!