Key Data

Ticker Symbol: NC 0.00%↑

Price: $36.5

Market Cap: $273 Million

Forward Dividend: $0.83

Dividend Yield: 2.2%

Payout Ratio: 24%

Areas of operation: US

Sector: Energy - Thermal Coal

Business

NACCO Industries is a mining company with a particular focus on thermal coal operating in the US.

NACCO Industries® brings natural resources to life by delivering aggregates, minerals, reliable fuels and environmental solutions through its robust portfolio of NACCO Natural Resources businesses

NACCO industries is a small cap in the much maligned coal mining industry so it’s natural that some investors would be put off by investing in such a business.

Fortunately I have no such hangups, and will happily own businesses that are undervalued because others stay away from them.

The company operates in 3 main segments:

Coal Mining Segment

NAMining Segment

Minerals Management Segment

Each of these distinct groups has different, but interrelated focuses.

The Coal Mining Segment operates as “The North American Coal Corporation” and operates surface coal mines under long-term contracts with power generation companies in a service-based business model. This coal is mined and used in North Dakota, Texas and Mississippi, with each mine being fully integrated with its customer’s operations and being the exclusive supplier of coal to its customers facilities.

The segment's revenues are about $95 million with a gross profit of around $5 million. This does not include earnings of unconsolidated subsidiaries, which add an additional $52 million to its operating profit.

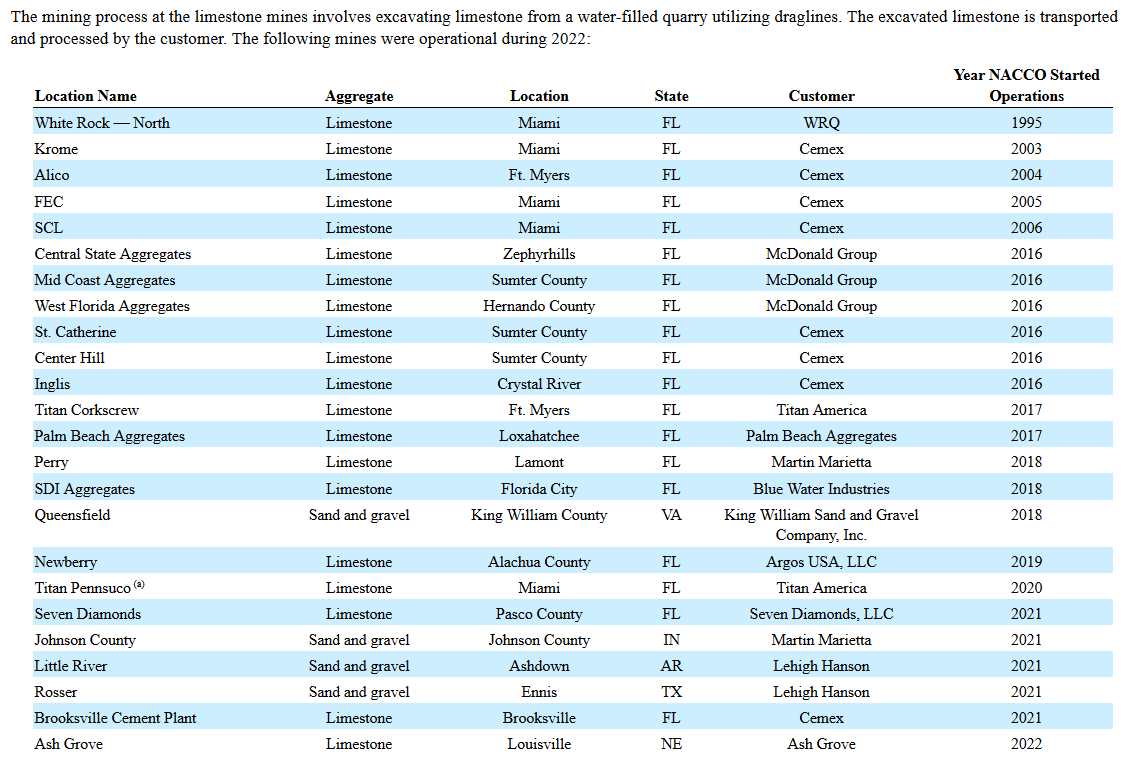

The NAMining Segment provides value-added contract mining and other services of producers of industrial minerals. This segment is the company’s platform for growth and diversification of its mining activities outside of the thermal coal industry. It provides contract mining services for independently owned mines and quarries, allowing its clients to focus on their areas of expertise, such as materials handling and processing, sales and distribution. Historically this segment operated at limestone quarries in Florida, but has been expanding outside in recent years. The company operates mines in Florida, Texas, Arkansas, Indiana, Virginia and Nebraska, with an upcoming lithium contract in Nevada.

The segment's revenues are about $85 million with a gross profit of around $5 million. A significant part of the segment's revenues come from reimbursable costs that we will get into later. When we exclude those costs, the segment's revenues is around $32 million.

The Minerals Management Segment derives its income by leasing its royalty and mineral interests to third-party exploration and production companies, and other mining companies, granting them the rights to explore, develop, mine, produce, market and sell gas, oil and coal in exchange for royalty payments based on the sales of those minerals.

The segment's revenues are about $60 million with a gross profit of around $56 million.

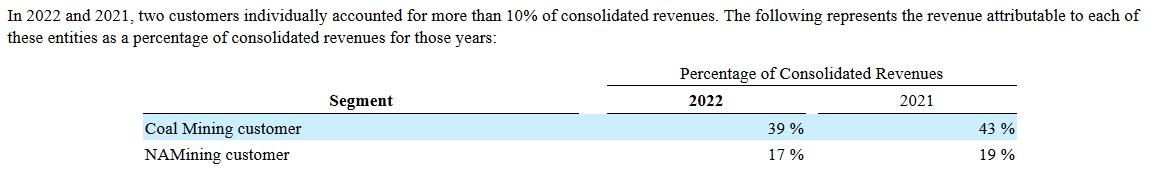

As a small cap company it’s important to be aware that a significant portion of revenues are often exposed to only a small amount of clients, and particularly given the tight integration between those clients and the mines the company operates, any issues with those clients may significantly impact the companies revenues and earnings.

This means that 2 clients account for roughly 60% of the company's revenue, making the company highly dependent on these business agreements.

Given the small size of the company it’s possible, and recommended, to clearly understand the entirety of the business, so I’d like to discuss a bit of the companies revenue streams, and the issues they are facing.

Coal Mining Segment:

The company operates 5 separate coal mines in 3 states, with each mine being the exclusive supplier to its respective customers' facilities.

These mines are:

The Coteau Properties Company

Coyote Cross Mining Company

Falkirk Mining Company

The Sabine Mining Company

Mississippi Lignite Mining Company (MLMC)

With the exception of the MLMC each of these mines are run by unconsolidated subsidiaries of NACCO, under Cost-plus contracts in which the company is reimbursed for the majority of expenses, including any post-mining remediation efforts that might be required. In general profitability in these mines results from collecting a management and operation fee for the mining services provided.

The corporate structure here is unusual, since the primary beneficiaries of each of these mines are the single customer they serve.

This means that those mines are classified as Variable Interest Entities (VIE) which under GAAP means their revenues are not consolidated into NACCO revenues, and instead they are treated separately.

The mines are the only significant suppliers for the clients they serve, and conversely the clients are the only possible clients for those mines. This means that the health and contracts with these clients are entirely dependent on the operation of the power plants they service… which is concerning given the de-carbonization trends and regulations intended to prevent the expansion or continuing existence of coal power plants.

So for how long will those power plants function?

The Coteau Properties Company - 2031 no apparent risks

Coyote Cross Mining Company - 2040 - At risk due to poor economics

Falkirk Mining Company - ??? At risk due to potential denial from EPA due to change of ownership

The Sabine Mining Company - 2023 About to shutdown

Mississippi Lignite Mining Company (MLMC) - ??? at risk with the latest operator defaulting in late 2022

In short, with the exception of the Coteau mine, all of the company's coal mining operations are at risk of being shut down in the near future.

While it’s possible that some of these mines may remain open, I wouldn’t really count on the coal mining segment to provide any meaningful revenue and earnings to the business going forward.

The one silver lining here is this sentence from the annual report:

Under any scenario, Coteau, Coyote Creek and Falkirk will be cash flow positive as a result of the terms of the mining agreements.

Which is good, but for how long can we expect those cash flows to come in?

The NAMining Segment is more encouraging, and provides an interesting growth engine for the company

They operate 32 drag-lines in 25 mines, the bulk of which are owned by the customers, with NACCO merely operating the mining and excavating activities. An additional mine is expected to open in Nevada in the near future.

These mines are generally uncontroversial from a carbon emissions perspective, and it’s unlikely that ecological concerns will play significant parts in their operations.

The fact that most of these mines had NACCO begin operations in the past 10 years is also quite encouraging.

Nonetheless the profit margins here are slim to none, and it’s difficult for me to determine if it’s even worth considering this segment into the valuation.

Finally we have the bulk of earnings coming from the company’s mineral activities in the Minerals Management Segment, where I believe the bulk of the company's operational value is being (and will continue to be) generated.

The bulk of the value here comes from their ownership of mineral rights to substantial amounts of Oil, natural Gas, Residue Gas, etc..

I’m not a commodities guy, and it’s difficult for me to accurately determine the value of these mineral rights, so I won’t try and simply assume they are going to continue providing similar earnings as they have so far.

Additionally it’s important to note that these mineral rights expire as they are used (you can’t exactly drill for the same barrel of oil twice!), so if the company wants to continue in operation they must be able to continually acquire new mineral rights, which requires substantial capital.

From my perspective the operating business, except for the minerals segment, is a wash. I wouldn’t expect this to be an earnings play.

Management

J.C. Butler has been President and CEO of the operating companies since July 2015 and its public parent company since October 2017. He began his career with the company in 1995 and has served in a range of financial, business development and administrative roles. Prior to 1995, J.C. was an investment banker in New York City specializing in mergers and acquisitions with McFarland Dewey & Co. and Drexel Burnham Lambert.

The company has been reasonably profitable under him, but it’s not clear to me how much that is due to good decisions, and how much is just normal business.

There isn’t much activity in terms of insider sales for the business:

In the past some insiders bought a lot of stock in the company at discounted prices to the market value.

This stems from the dual share structure, where the family of the founders through a series of trusts, and family relations controls roughly 80% of the total voting power, through their ownership of 99% of class B shares.

I don’t like these types of setups, and I tend to stay away from multiple share classes, since they mis-align incentives.

Key Risks and Opportunities

Risks:

Dying industry with heavy political scrutiny

Ongoing fights with the EPA

Not a lot of value in most of the business.

Opportunities:

Lots of cash on hand

Potential value play in the minerals segment

Fairly consistent profitability even in the imperiled segment (until it goes to zero)

Financial Data:

Shareholder Returns:

Dividends

The company pays a $0.83 dividend.

The company has increased its dividend yearly for 9 years.

The company has increased its dividend over the past 5 years at a 10% CAGR.

Share Buybacks

The company doesn’t conduct regular share buybacks

The company has authorized a stock repurchase program for class A shares

It’s not clear if any significant buybacks will occur

Income Statement:

Revenue Growth Rate

Long Term - (13.3)%

3 Year - 88% (Covid)

Revenues are reasonably solid and stable, while growing at a mild rate since restructuring a few years ago.

Pre-Tax Profit Margins

Long Term - 21%

Highly dependent on segment

Return on Assets

Last Year - 13%

Deceptive due to large amount of cash

EPS Growth Rate

Long Term - (3)%

3 Year - 429%

Cyclicality

Non-Cyclical

Cash Flow Statement:

Operational Cash Flow Growth Rate

Long Term - (8)%

3 Year - (3450)%

Not cash flowing easily

Investing Cash Flows Growth Rate

Significant capex, particularly in the acquisition of mineral rights and Property plant and Equipment

Financing Cash Flows Growth Rate

They have been paying down debt over the past few years

Balance Sheet:

Assets:

A substantial amount of assets are highly liquid current assets

Each mine has somewhat substantial property assets

There is only a very small amount of non-tangible assets

Liabilities:

Mostly current liabilities

Current assets can payoff all liabilities and have cash leftover

Debt:

No substantial long term debt

No Debt Cliffs

Valuation:

Key Metrics:

Bullish

Discounted Earnings - $95

Discounted Cash Flow - $63

Margin to PE - $448

Market Multiple - $211

Cash Multiple - $114

NCAV - $61

Bearish

Discounted Earnings - $21

Discounted Cash Flow - $14

Margin to PE - $21

Market Multiple - $7

Cash Multiple - $0

NCAV - $6

Average

Discounted Earnings - $50

Discounted Cash Flow - $33

Margin to PE - $164

Market Multiple - $97

Cash Multiple - $24

NCAV - $17

Expected Value:

I wouldn’t buy this company for its currently operating business.

The risks are simply too high, and the political pressures too strong to make that a viable long-term strategy.

That said, if we were to look at this as an asset play, I could see myself owning this business.

If we were to buy it at the Net Current Asset Value we would get about $17 in cash, while still having a substantial margin of safety coming from the large amount of property and equipment and other long term assets the company owns.

The question then becomes, how likely are we to realize this value?

The company is controlled by a single family, and so it’s not really possible for an outside activist shareholder to come in, fire the board, and tear apart the company for every shred of value it owns.

Any idea of disassembling this business would require the consent of the family with controlling power over the business, which is a difficult undertaking.

Maybe something around $12 per share might be interesting?

That would provide an almost 7% dividend, alongside the asset play, which might be a sufficient margin of safety to “bet it all” on the company being stripped for parts (or cash)..

Investment Thesis

This is an asset play through and through

There is limited if any value in the company continuing operations

It’s questionable that the asset value of the business can be realized due to

The family owned style of business. I hate this.

The dividend is nice, but may be in danger given the challenges in the companies coal mining segment

Much of the business is composed of “pass throughs” for which the company collects a fee and interest

Decision

Current Stance: HOLD

I don’t currently own NC 0.00%↑ , and I'm not sure if I will own it at these prices.

While I have no problem with investing in dying industries, the price needs to be attractive and there must be some path for me to realize value. Both of those things are not clear to me here.

I think if someone can convince the family to dispose of the business, or just buy it off of them, then disassembling for parts is a valid method of realizing the value.

The minerals management segment can be a viable business in its own right, while the NAMining and Coal mining segments should likely be kept on life support until they slowing get shut down.

Do you have a different view on the company? Are you buying, selling or holding?

Let me know down below!