We talk a lot about budgets but we don’t often see any real examples, so today I wanted to go over a real life example by showcasing my spending for August, and seeing what went on.

I’m not going to put exact numbers because frankly they don’t matter. I’m going to split things off into percentages of income, and see where we go from there.

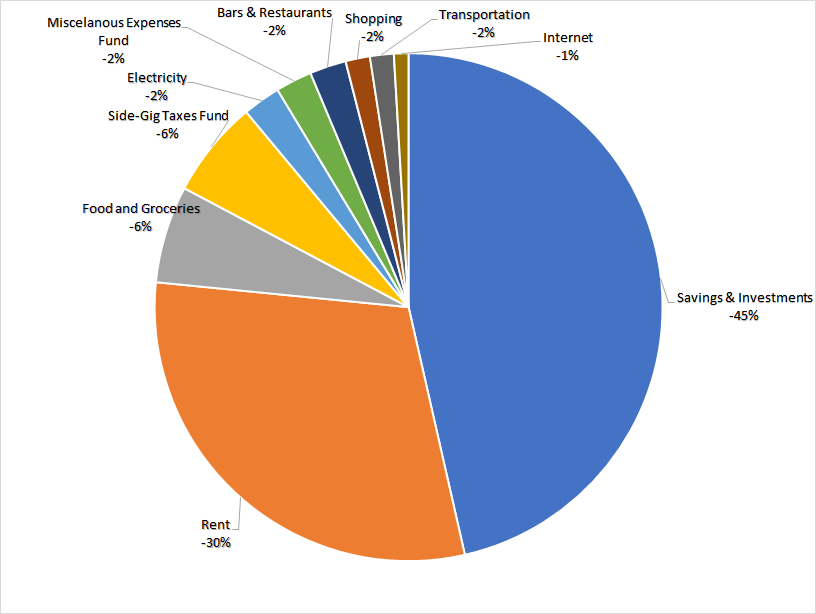

The Expected Budget

The first thing I do is set up my “Expected Budget” for the month that’s coming up, so this Expected Budget was originally created in July.

This expected budget is actually fairly simple, and generally doesn’t change much month to month.

I consider it more or less a perennial budget and I make heavy use of sinking funds, that is, items on my expense list where i set money aside to pay for non-monthly expenses like vacations, medical expenses, etc…

Here it is, a fairly simple budget with Savings & Investments taking the front set followed by rent.

This is a zero based budget (or very close to it), which means every cent that comes in, has a destination to it.

I’m very focused on saving and investing, so I’m making some serious compromises in order to maintain that high savings percentage, but ones that I hope will pay dividends in the future.

The “baseline income” that I use as the basis for this is my regular day job salary, which I receive once per month.

This means that my Side-Gig income isn’t counting towards this, and isn’t used to allocate my budget. In practice over the past year I’ve used that income to pay taxes, so it’s not a big deal.

That said nowadays I have to make tax pre-payments so I’ve recently added that new “Side-Gig Taxes Fund” expense. This is a fund to which I add money every month, and which I will withdraw from in order to make my tax prepayments.

Theoretically this should mean that when I file my taxes I will not have a significant amount of tax to pay.

These prepayments were a pain to do, since effectively I’ve had to “shift forward” a significant expense, but hopefully that won’t be an issue going forward.

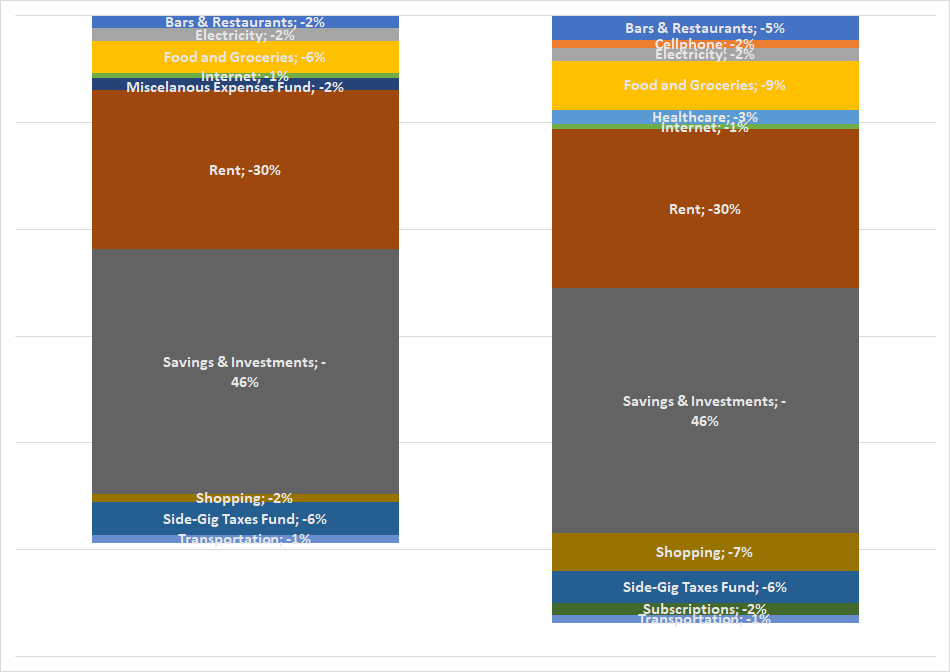

The Actual Budget

Of course, there’s a big difference between the Expected Budget and the Actual Budget:

As you can see, I didn’t really stick to my budget, and not in a good way!

I actually spent more than my regular day job brought in, which is not a good thing at all and is unsustainable! I have to fix this!

So what were the unexpected expenses?

There were a few categories, but they can basically be summed up as follows:

Recurring

Cellphone - I only charge my cellphone every few months and it happened that it landed on this month. This cash came from my miscellaneous sinking fund

Subscriptions - I have an office 365 subscription and it landed on this month. Also comes from a sinking fund

Food and Groceries - I had an extra person in the house for most of the month, so my grocery expense went up even with their contribution. This will be re-evaluated.

Healthcare - I had a couple of health exams done for the first time in a few years. They too came from a sinking fund

Non-Recurring

Bars & Restaurants - I had a few unexpected visitors which resulted in going to restaurants a bit more often than expected

Shopping - I made some purchases for my vacation in September.

All those together seriously blew up my budget, and so some reflection is needed.

Final Thoughts

The first thing to do is to realize that my vacation fund is simply inadequate. Those shopping expenses were significant, and frankly my fund for that has been insuficient. Going forward I will need to increase that fund significantly.

The recurring expenses were ok, but they too revealed that perhaps i’ve been setting too little aside each month for these eventualities.

In general though, while I think I spent a bit too much money than I should have, having reviewed every expense I had shows that I haven’t been wasting too much money on worthless things.

Could I save more? Maybe.

Could I do with spending a bit more, and slightly reducing my savings rate? Maybe.

It’s something to think about.

That said, please keep in mind that I haven’t accounted for the income from the side-gig. If I account for that, I actually did manage a zero-based budget!

Though I like to think of that as a bit of an “extra” rather than something to rely on.

In sum, going forward I will:

Increase the amount I’m setting aside for my sinking funds

Cut down on the shopping and eating out

Consider whether I need to reduce my savings rate to face up the expenses.

What about you? What does your budget look like?

Let me know down below!