Miroku Jyoho Service Co.

A Japanese Accounting software firm at a reasonable price

Key Data

Ticker Symbol: $9928.T

Price: ¥1634

Market Cap: ¥48 Billion

Forward Dividend: ¥45

Dividend Yield: 2.8%

Payout Ratio: 34%

Areas of operation: Japan

Sector: Software - Application

Business

Miroku Jyoho Service is a Japanese software development company focusing on providing systems and solutions to tax accounting, CPA firms, and their client companies and small and mid-sized companies in Japan.

Since its establishment in 1977, the company has grown together with its customers by developing and providing ERP products with a focus on financial accounting and tax affairs and by supporting the management innovation and improvement of accounting firms, mid-sized companies and smaller enterprises.

The company maintains this focus on the small and medium sized enterprise market segment and has grown steadily over the past decade as they have smoothly navigated the digitization of the Japanese economy.

This digitization is in no danger of stalling out in the near future, particularly as many existing Japanese SMEs are still using antiquated paper-based systems.

The Japanese government too see this antiquated system as an issue, and has established a number of incentives to encourage small companies to modernize their accounting systems.

The management team has clearly identified this trend, and means to continue taking advantage of it as seen in their medium term plan:

I want to be clear here, Miroku Jyoho Service is a growth company.

They are not the sexiest company. They don’t have particularly interesting technology. They aren’t a hyped up startup.

What they are is a company with a clear niche, in a growing industry, with a track record of successfully growing, and a clear vision for the future.

And they’ve been growing.

So what is their growth exactly? What are the key features of their current business, and what will come next?

The company has 3 core methods for both increasing revenues, and making those revenues more stable and long term:

Offer Subscription-based Services

Improve software interoperability

Provide consulting services and improve cross-selling

This is a long term project, and one that has already begun a few years ago, and has by all accounts been a success so far with revenues increasing 13% in 2022 and 7.4% in 2021, with margins being 14% and 19% respectively.

This trend, particularly when it comes to the increased margins stemming from the subscription business is likely to continue, and particularly in the next few years I would expect margins to enlarge:

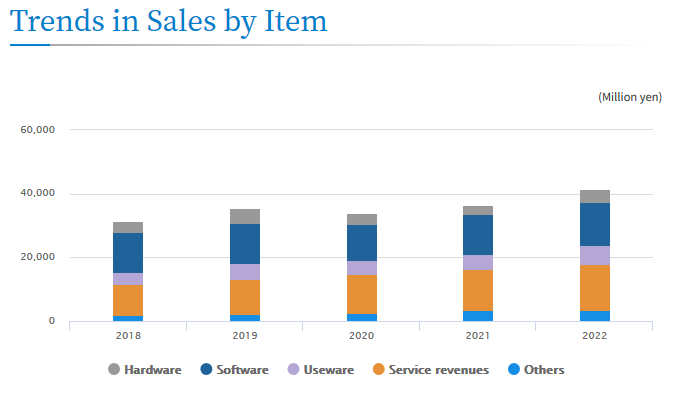

We can see this trend towards SAAS continuing, and it has been the primary driver of revenue growth over the past few years:

Indeed, when we look at revenue growth in terms of client base, we can see that their platform has been taken up primarily by small and medium enterprises, providing MJS with a direct link to the client, rather than an indirect link via a tax accountant:

Additionally we can see that this growth is likely to continue, when we consider the current and historical backlog trends:

And naturally these positive business trends are accompanied by a management team that focuses on high margins, high returns on equity, and a relatively stable dividend payout.

Management

Hiroki Koreeda is the president of MJS and he has been in the company since 1991, and became its CEO in 2015. I’m not Japanese, and I can’t read Japanese, so It is difficult for me to find more information about him beyond his message to shareholders, and his performance so far.

That said, it’s worth finding out a bit more about the shareholder structure of the business:

The largest shareholder of the company is NK Holdings Co., Ltd at 34% of outstanding shares, followed by the bank of Japan at 8%.

Nobuhiko Koreeda, the founder and chairman of the business owns about 3.5% of the company, with investment funds, banks, employees and other individual investors making out the rest of it.

The company has a tendency of not retiring treasury stock once they buy it back, which is troubling to me, since it implies they may re-issue it again. About 14% of shares that could be outstanding are currently in that limbo, which I don’t like and meaningfully affects my valuation of the company for the negative.

Key Risks and Opportunities

Risks:

Japan has a very traditional business culture, and it may be that all of the “easy gains” of digitization have already been captured, making growth difficult

Information in English is difficult to come by which makes research and keeping up with the business difficult

It’s a small business compared to what I usually invest in, with a single key shareholder

Opportunities:

Asset light

Extremely sticky subscription business model

Stringent regulation is a key moat

Good growth opportunities

Financial Data:

Shareholder Returns:

Dividends

The company pays a ¥45.00 dividend.

The company has increased it dividend on a regular basis since 2010

The company pays 1 dividend per year

Share Buybacks

The company conducts regular share buybacks

The company does not retire shares that have been bought back, causing a wide discrepancy between diluted and basic EPS

Income Statement:

Revenue Growth Rate

Long Term - 7.9%

3 Year - 22%

Revenues are reasonably solid and stable, while growing at impressive rates.

Pre-Tax Profit Margins

Long Term - 14%

Nothing out of this world, but likely to increase in the mid term

Return on Assets

Last Year - 8%

EPS Growth Rate

Long Term - 14%

3 Year - 42%

Cyclicality

Non-Cyclical

Cash Flow Statement:

Operational Cash Flow Growth Rate

Long Term - 37%

3 Year - 80%

2020 was a significant low-point due to covid.

Investing Cash Flows Growth Rate

Regular expenditures of intangible fixed assets, about 3 billion Yen

I’d consider that analogous to Capex for this type of business, and it should be subtracted from the 7 billion operating cash-flow to get 5 Billion in free cash-flow

Financing Cash Flows Growth Rate

Plenty of cash available for dividends and buybacks

Balance Sheet:

Assets:

The majority of assets are cash and equivalent current assets with high liquidity

Liabilities:

Mostly current liabilities, including about 11 Billion Yen worth of Convertible bonds

Debt:

No substantial long term debt

No Debt Cliffs

Valuation:

Key Metrics:

Bullish

Discounted Earnings - ¥7083

Discounted Cash Flow - ¥2361

Margin to PE - ¥3651

Market Multiple - ¥2637

Cash Multiple - ¥2222

NCAV - ¥711

Bearish

Discounted Earnings - ¥1039

Discounted Cash Flow - ¥346

Margin to PE - ¥969

Market Multiple - ¥767

Cash Multiple - ¥300

NCAV - ¥0

Average

Discounted Earnings - ¥2513

Discounted Cash Flow - ¥837

Margin to PE - ¥1591

Market Multiple - ¥1587

Cash Multiple - ¥875

NCAV - ¥183

Expected Value:

The valuation that’s closest to reality is probably the Average Discounted Earnings valuation, since we’re buying this company for the earnings it generates, and there are no meaningful barriers to its continued growth, and the company appears to have a solid built-in moat to its business model.

That said, when we aggregate all Average valuations into a single average value we expect a fair value of ¥1265 which is below its current trading price.

Assuming a 30% margin of safety, I would expect that the company would be a somewhat secure investment at ¥885 per share.

This would provide a 5% dividend yield.

Investment Thesis

The company provides software and services that are highly sticky and key to their clients businesses

The profit margins are average but likely to climb soon

Regulatory requirements, and the deep integration between MJS and the clients business provide decent moat

The ability to continue growing will determine whether MJS will be a good investment. If they continue to grow as is, they will do well. If they slow down, some capital loss is to be expected.

The company is likely fairly valued at this time

Decision

Current Stance: HOLD

I don’t currently own MJS, but if I did I would be a happy owner. Ultimately the company is in no danger of bankruptcy, is growing rapidly and it has demonstrated a commitment to returning capital to shareholders.

While there may be better options out there, the growth in the business, alongside the deep moat means that selling out of the company wouldn’t be a good idea.

Is it possible that the company will continue growing? Certainly, the Japanese market is quite large, and the company only owns about 25% of the market share so there is certainly places to grow, even with competition.

But will that growth be high enough over a long enough period to justify the current valuation? I have my doubts.

5% is quite a high growth rate in a low growth economy/market/sector/country, and I find it difficult to accept anything less without capital loss.

Additionally I still need to account for the portfolio balancing issues which I’m still going through.

I wouldn’t sell, but I’m not rushing to buy either.

Do you have a different view on the company? Are you buying, selling or holding?

Let me know down below!

If you’d like to find out more about how I first found the company, check out my previous blog post where I use Stockopedia to narrow down my search and define my screening criteria.

If you’d like to try Stockopedia yourself, just use my partner link to get access to a free trial.