Microsoft Corporation - Part 3

The story of this Software Company

In the past couple of weeks we have been discussing Microsoft, an American Software company with a large and diverse business that is growing at an amazing pace.

Today on the final part of our deep dive into Microsoft we are going to be digging into the story of this company, where its been and where it will likely go in the future.

Management

We’ve talked about Microsofts’ management before, and I explained that I was very positive on Microsofts’ previous CEO Steve Ballmer.

Today however I want to bring up the current CEO Satya Nadella, and what he has brought to the company.

It’s not unfair to say that just like Bill Gates and Steve Ballmer, Satya Nadella has left his mark on the company, and not just in terms of share price.

Since becoming CEO in 2014 Mr. Nadella has led the company in a number of initiatives that strayed away from Microsofts’ traditional cash cows (Windows and Office). These initiatives which included an embracement of Linux and open source (and subsequent acquisitions of companies like Github), a move towards the cloud with its Azure cloud offerings, and even diversification into gaming and social networking with the acquisition of companies like Mojang and LinkedIn.

Although in some cases these initiatives competed with Microsofts traditional business, the risks and costs of such a competition were more than made up by the higher margins and future-proofing.

This willingness to abandon and self-compete against highly profitable offerings was a key component in Microsofts out-performance over the past decade, and an important factor in Microsofts current status in markets like Cloud Services where had that shift not happened Microsoft would likely simply not have a competitive offering against companies like Amazon or Google.

In other words, thanks to Mr. Nadellas’ courage in embracing new business models at the expense of older more profitable ones, Microsoft has successfully managed to avoid becoming another Kodak.

Dividends and Share Buybacks

And of course, he managed to do this while creating massive amounts of shareholder value via dividends and share buybacks.

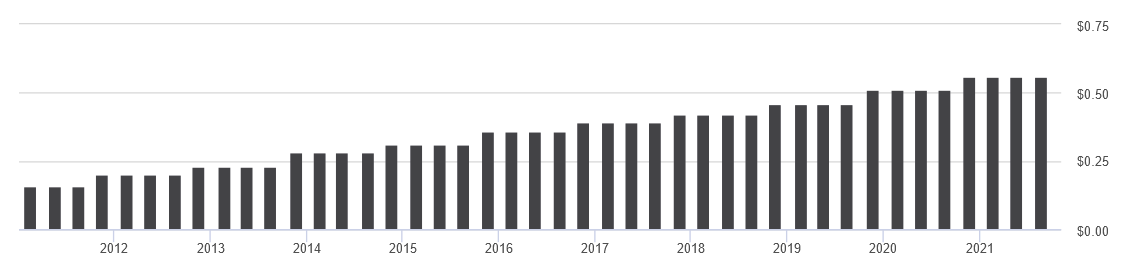

How massive? See for yourself:

The amount of cash returned directly to shareholders has been increasing yearly at a 13.35% CAGR, well above the market average.

Indeed, like we discussed in part 1 over the past 3 years alone Microsoft has returned 84 Billion dollars in cash straight to shareholders.

These are mindbogglingly high numbers that show the commitment of the company to not just create value, but to distribute it to its owners.

So now the question is… Is that sustainable? Or to be more precise, is that growth in shareholder return sustainable?

Well, that’s entirely going to depend on Microsofts’ ability to continue growing its earnings. For now thanks to its pivots, and the growing markets it is competing in the answer to that is looking like yes, but of course that may change…

Regulation and other risks

…Because regulation is on the way.

It’s no secret that Big Tech is under threat over the past year or so.

The anti-monopoly crackdown may have begun under President Donald trump, but there is no indication that it will stop or slow down now that Joe Biden is President, especially since he has surrounded himself with outspoken advocates of anti-trust enforcement.

This crackdown isn’t just limited to the US either, with China beginning a large scale crackdown on its own tech sector which may have secondary effects.

On the bright side Microsoft is probably the best positioned “Big Tech” company to deal with these crackdowns.

For one its 90s involvement in anti-trust has meaningfully changed the company, and they have since been very careful to avoid controversial actions that might imply they are making use of their Windows monopoly to expand into other areas.

The focused nature of their social network also protects them in the area where the most visible crackdowns are happening. LinkedIn is a massive business, but not a sexy one, it exists in a specific niche and an uncontroversial one at that, which means its more or less insulated from the popular social media crackdowns.

Facebook and Twitter affect elections, which means politicians are inclined to pay attention to them. But the job board you put your CV in and get interview requests? Nobody is complaining about that too hard.

Future Business

Finally let’s talk about where Microsoft is going, and whether it has a chance to get there.

The next few steps are clear, and essentially boil down to expanding on their cloud strategy and growing their existing businesses in that way.

Indeed, it’s a fairly simple and understandable strategy that was outlined succinctly in their last annual report:

The Ambitions That Drive Us

To achieve our vision, our research and development efforts focus on three interconnected ambitions:

Reinvent productivity and business processes.

Build the intelligent cloud and intelligent edge platform.

Create more personal computing.

All of these are simple to understand goals that leverage their expertise and which have been in place for some time.

But of course, goals are very nice and well, but what are they doing to achieve them?

We are investing significant resources in:

Transforming the workplace to deliver new modern, modular business applications to improve how people communicate, collaborate, learn, work, play, and interact with one another.

Building and running cloud-based services in ways that unleash new experiences and opportunities for businesses and individuals.

Applying AI to drive insights and act on our customer’s behalf by understanding and interpreting their needs using natural methods of communication.

Using Windows to fuel our cloud business and Microsoft 365 strategy, and to develop new categories of devices – both our own and third-party – on the intelligent edge.

Inventing new gaming experiences that bring people together around their shared love for games on any devices and pushing the boundaries of innovation with console and PC gaming by creating the next wave of entertainment.

Given their track record so far there is no reason to think that they won’t be able to accomplish them as they have so far.

Summary

So should you Buy? Should you Sell?

On my end I am a happy Microsoft shareholder, however while I am fully confidant in the high quality of the business, I have to admit that the current price is higher than I feel comfortable investing in.

I need a margin of safety in order to invest in a company, and unfortunately Microsoft right now is valued at a level that is too high.

While I have no plans to sell my shares anytime soon, I will not purchase more unless the price comes down significantly, or the fundamentals of the company meaningfully change for the better (without a corresponding price increase).

What about you? Are you a Microsoft shareholder? Do you like the company and their products?

Let me know what you think!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

And of course, don’t forget to subscribe!