Microsoft is another one of my holdings, and probably the priciest of the companies that I bought, standing today at a whopping 36 trailing PE ratio.

Let’s talk about that.

What is Microsoft?

From their latest annual report:

Microsoft is a technology company whose mission is to empower every person and every organization on the planet to achieve more.

Founded in 1975, we develop and support software, services, devices, and solutions that deliver new value for customers and help people and businesses realize their full potential.

We offer an array of services, including cloud-based solutions that provide customers with software, services, platforms, and content, and we provide solution support and consulting services. We also deliver relevant online advertising to a global audience.

Our products include operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; and video games. We also design, manufacture, and sell devices, including PCs, tablets, gaming and entertainment consoles, other intelligent devices, and related accessories.

In short, Microsoft is a diversified software company with products in almost every section of both business as well as personal software. If you’ve used a personal computer, a smartphone, or really any form of technology in the past 30 years, you’ve probably used one or more Microsoft products.

Microsoft is almost omnipresent in anything related to computers, and the Operating System they develop, the back bone of personal computing, has an effective and tight monopoly on that market.

Their cash cow though is without a doubt their business facing offerings, which are also highly diversified. Most businesses use some Microsoft products to conduct their day to day operations, indeed two of the companies that I’ve personally worked for could be considered “Microsoft-shops”, that is, companies that make almost exclusive use of Microsoft offerings to handle everything, from the Operating Systems they use, to their productivity suite.

In more recent times, their cloud offerings have been taking the front stage, which can be seen by their rapid growth in that area:

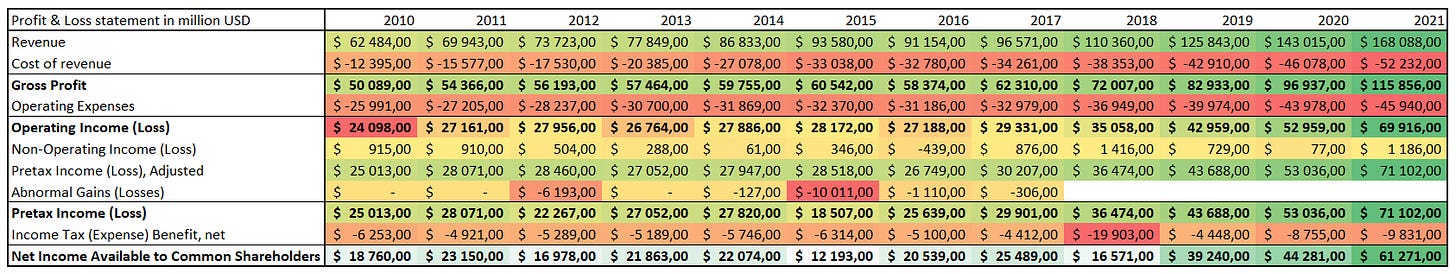

In general, Microsoft revenue and earnings growth is incredible, especially for what is a mature dividend paying company.

These are growth numbers that you expect to see from a small rapidly growing startup, not from a Multi-Trillion Dollar Business.

And yet, Microsoft has managed to grow at well over 10% annually for the past decade, and indeed its growth is only accelerating.

And in chart form:

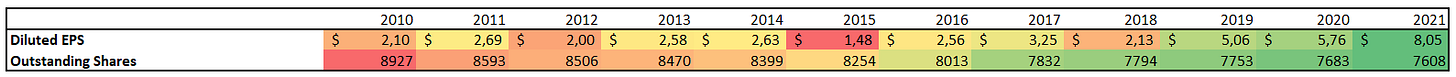

And of course they have used those increased earnings to return capital to shareholders, either through increasing dividends or by buying back shares.

Indeed, in spite of increasing dividends every year for the past 17 years, they still have a small payout ratio and spend more money on share buybacks than they do in dividends. In fact from their last Annual Report:

That’s a whopping $45 Billion dollars of capital returned straight to shareholders via buybacks!

For comparison, Aflac a company that I am very bullish about has a market capitalization that is less than the cash that Microsoft returned to shareholders in buybacks alone.

If we put them all together…

That’s 84 Billion dollars in shareholder wealth created and distributed over a 3 year period.

And of course, the buybacks and earnings growth show up on the per share metrics:

And on the stock performance:

Strengths and Weaknesses

In a company with such a good growth record, future prospects , and such demonstrated willingness to return that success to shareholders, what sorts of weaknesses can we find?

Well, despite its diversification Microsoft isn’t hegemonic in every area, and indeed in many of its business lines it plays second fiddle to other companies.

Strengths:

Monopoly in certain business sectors

High profit margins in a highly scalable businesses

Mature Business-to-Business Ecosystem

Highly diversified business in a high growth industry

Huge cash-flows and clear growth paths

Demonstrated willingness to return capital to shareholders

Weaknesses:

Difficulty in penetrating certain markets such as Hardware

Already has a lot of growth priced into the stock

Competing with competent market leaders in the current growth driving markets.

Reliant on quality management to sustain the current strategy

That last point is something that I want to stress, “Quality Management”.

Throughout its history Microsoft has had some of the best high level management in the industry.

I understand that this is a controversial opinion to hold, Microsofts’ previous CEO Steve Ballmer is disliked by many in the investing community who blame him for the decade-long share price stagnation.

Personally I’m a contrarian when it comes to Mr. Ballmer, unlike many investors I think that his tenure at Microsoft was not just a net positive, but one of the best tenures for a CEO in any company ever.

It was instrumental in leaving behind Bill Gates’ legacy, which while fantastic was wholly dependent on a single person who was moving on to other things, it reinvigorated the company setting the stage for its current business lines, and above all it set the standard for rewarding shareholders by instituting for the first time a regular and increasing dividend.

Yes, there were pitfalls and failures, Bing and the windows phone being the most famous ones, but I cannot overstate the effort and drive that it took Mr. Ballmer to take Microsoft from a profitable growth company into a mature business focused on providing value to its clients and shareholders.

Satya Nadella is a fantastic CEO who I would not replace. He came at the right time, and took the actions needed to modernize Microsoft and turn it into the earnings monster it is today, but even he is building on Ballmers legacy.

Balance Sheet

Finally, let’s have a quick look at their balance sheet:

Overall this is a very solid balance sheet with over 130 billion dollars of cash and cash equivalents.

While $50 Billion in long term debt might seem like a gigantic amount, the fact is almost all of its liabilities can be covered using only Microsofts’ current assets, and indeed with less than 4 years worth of earnings Microsoft could pay off all of its liabilities.

Both its earnings power and solid balance sheet that mean Microsoft has AAA ratings on its bonds, something that not even the US government has.

In other words, the ratings agencies think that it’s less likely for Microsoft to default on its obligations than a government who can print any amount of money it wants.

This allows them ready and cheap access to credit that will help them survive any setback, and take advantage of any opportunities that the 130 Billion cash in the bank isn’t enough to pay for.

This company is in almost no danger of going under, unless there is significant fraud going on beneath the hood.

But of course, a solid business and good prospects are only one part of the factors that need to be taken into account when investing.

For the other parts, you’ll have to wait for Part 2 (and 3!) of this deep dive into the bowels of Microsoft.

In the meantime, if you’re in the mood for more content, check out the European Investor Network. It’s a project that I am involved with alongside a few other content creators that I think you might enjoy.

Let me know what you think!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

And of course, don’t forget to subscribe!