McDonalds - Part 2

Let's value this Big Mac

Last week we had a look at McDonalds, a well known fast food company that has raised their dividend every year since they began paying one.

Today, we’re going to value this company, see how some of its key ratios, and come up with an estimate on what its intrinsic value is.

The Valuation

We begin with our standard valuations based on the last 10 years of data. We’ve talked about how these values are calculated in previous discussions, and I’ve provided you with a template for your own use in a previous post.

For McDonalds in particular, you can find the file I’m using here. Just download it and open it in excel (or google sheets if you’re OK with losing the conditional formatting).

Let’s take a look:

Well that’s not good.

It’s looking even worse than Pepsico!

At the current price it is clear that McDonalds is wildly overvalued, and trading at about twice its intrinsic value, and almost 3 times what I would consider a “Safe Purchase Value”.

While I did buy at a more attractive price, around $210, and the company has become more pricey since, it’s clear that I did not properly value this company when I made the decision to buy it.

While’s it is possible that my valuation is wrong, and that there are some qualitative reasons as to why

Let’s take a look at a few key details.

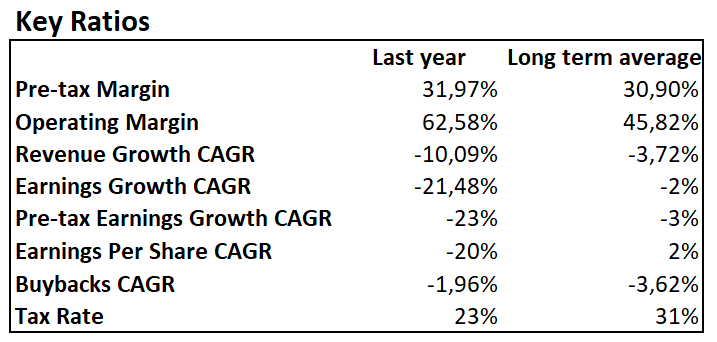

Key Ratios

Those margins are very, very nice.

Usually I try to aim for margins above 20%, since that tends to indicate that the company has a durable competitive advantage, and McDonalds blows that out of the water!

These are margins you’d see in a company like Microsoft, and yet we’re looking at them in a boring old fast food company.

That being said, these high margins are primarily the result of the unique franchising/real estate business that McDonalds is in. If you have a look at the more detailed breakdown of the revenues, you can see that their self-run restaurants have significantly lower margins.

Of the rest, nothing really stands out in a positive manner.

While I will give them some leeway in terms of growth, since restaurants have been heavily affected by the Covid lockdowns in 2020, the fact is that even prior to 2020 their revenue and earnings growth was mostly flat.

While they have managed to return a ton of capital to shareholders, either through dividends or buybacks, the earnings capacity of the company hasn’t really improved in a significant manner over these past 10 years.

Ultimately these ratios are a mixed bag, I really like those margins, but everything else is not good.

Yields, Ratios and Premiums

We got a dividend yield of 2.1% and a dividend growth of around 7.4%, this isn’t bad, but at the same time it’s really not that great.

The dividend growth has been much greater than the earnings growth, so this growth is coming at a cost of a higher payout ratio. They are already paying out 82% of earnings, so it’s concerning as to whether they will be able to safely grow their dividend in the future.

I would expect their dividend growth to slow down to under their earnings growth, in order to give the company greater leeway into how to allocate capital.

While the 80% payout ratio doesn’t worry me too much, given the stability and diversification of the business, I still see the growth of the dividend as being constrained by the underlying earnings growth.

In terms of the PE ratio, and the associated risk premium, it’s clear that numberwise it’s quite risky to purchase McDonalds now, though part of that is due to the overall elevated PE ratio of the S&P500…

The Standard Valuations

This doesn’t look good.

We knew going in that the Book value was going to be negative, and that’s not too concerning, because like I mentioned in part 1, I suspect that the real estate is worth significantly more than what it is being carried at on the balance sheet.

The Ben Graham methods indicate a value of around $90 per share. This value is being heavily affected by the low earnings growth as a result of the 2020 Covid effects.

The margin to PE method gives a much higher number, accounting for McDonalds high profit margins.

I generally find this to be the most reliable number, and my original purchase price in 2020 was below this value. That said, my most recent purchases after the portfolio reshuffling were around $210, so clearly I didn’t pay enough attention here!

The Discounted Earnings Model

The discounted earnings model is a simplified model that is intended to provide me with an estimate of the present value of the companies cashflows 10 years from now.

This table simply has the value of the company roughly 10 years from now.

On the left side, the “Absolute” column tells you the value that should show up on the Income Statement and the Balance Sheet in 10 years.

On the right side, you have those same numbers discounted to their present value by the discount rate (which we talked about previously).

Generally speaking you want to use the “Discounted” values when doing your valuations, because you’re interested in the present value of the future return.

In this case, if you were to buy 1 share of McDonalds today at current prices, 10 years from now you would have receive $67.56 worth of dividends which are worth only $52.21 today.

You would also expect to have what is only $4.17 worth of earnings today, and if we assume that the PE ratio will return to the market average over these 10 years, the share price would be equivalent to $62.53.

In other words, the present value of a share of McDonalds 10 years from now is $62.53, and if we add the present value of the dividends you would receive over that time period ($52.21), you would end up with a total return of $114.74.

This means that if you were to buy at today’s prices, and hold for 10 years, your total return CAGR would be -8.3%.

Yes, that’s negative 8.3%, you are expected to lose money.

Now, I don’t necessarily agree that the situation is as dire as its implied by the numbers, since McDonalds has been restructuring for a couple of years to become more profitable, and the Covid pandemic severely impacted its earnings (and consequently it’s growth).

I think Mcdonalds is suffering a bit of the issues that cyclical companies often suffer, which is that our inputs are not accurately reflecting the actual underlying economics of the business due to external and temporary factors.

That being said, I don’t believe this difference is significant enough to overcome the significant overvaluation of the company.

The Safe Purchase Value

The Average Long Term value is the expected present value of a share of Pepsico, and is calculated using the average of the multiple valuation methods.

To this value with take out our desired Margin of Safety, which I default to 30%, and that gives us our “Safe Purchase Value”, this is the value under which you can reasonably expect to make a profit from owning the company.

For PepsiCo the price that an investor should be willing to invest in McDonalds should be $87.15, well below the current price of around $250.

Summary

Overall this is another failure, much like the one with Pepsico.

I purchased at too high of a premium, and while I have not yet lost money, there are always consequences to buying over-priced companies.

I am currently seriously considering whether or not to sell McDonalds as a result, but let’s wait for next week, where we will take a look at the story of McDonalds.

Perhaps if there is a particularly convincing growth driver, I may change my mind, and take a risk on a company whose Margins are great, but whose growth has been lagging its stock price and dividend growth.

Let me know what you think I should do!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!