McDonalds - Part 1

A burger company with more than meets the eye

McDonalds is one of the most recognizable companies in the world, and one of the companies in my portfolio.

Today we’re going to be going over what the company is, how it makes money, and whether or not it’s a good company to own.

What is McDonalds?

As per their latest 10-K report, McDonalds is:

The Company franchises and operates McDonald’s restaurants, which serve a locally-relevant menu of quality food and beverages in 119 countries. Of the 39,198 restaurants at year-end 2020, 36,521 were franchised, which is 93% of McDonald's restaurants.

McDonald’s franchised restaurants are owned and operated under one of the following structures - conventional franchise, developmental license or affiliate.

The Company is primarily a franchisor and believes franchising is paramount to delivering great-tasting food, locally relevant customer experiences and driving profitability. Franchising enables an individual to be their own employer and maintain control over all employment related matters, marketing and pricing decisions, while also benefiting from the strength of McDonald’s global brand, operating system and financial resources.

What exactly does this mean? How do they get revenue coming in?

The Company’s revenues consist of sales by Company-operated restaurants and fees from restaurants operated by franchisees. Fees vary by type of site, amount of Company investment, if any, and local business conditions.

These fees, along with occupancy and operating rights, are stipulated in franchise/license agreements that generally have 20-year terms.

The Company’s Other revenues are comprised of technology fees paid by franchisees, revenues from brand licensing arrangements, and third party revenues for the Dynamic Yield business.

If this all seems very confusing to you, don’t worry, it’s really not.

Essentially McDonalds is a fast-food chain that makes its money from either directly operating its restaurants, or through franchise revenues.

The franchise revenues themselves come from either franchising fees they charge, or by providing goods and services to their franchisees, including the real estate that the franchisees operate out of.

This combination of franchising alongside corporate restaurants allows McDonalds the flexibility to expand in a way that is inline with the target markets tastes, while keeping the overall know-how within the company.

How the Company is Organized

Since January 2019 McDonalds has operated under an organizational structure with the following global business segments:

U.S. - the Company’s largest market. The segment is 95% franchised as of December 31, 2020.

International Operated Markets - comprised of markets, or countries in which the Company operates and franchises restaurants, including Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain and the U.K. The segment is 84% franchised as of December 31, 2020.

International Developmental Licensed Markets & Corporate - comprised primarily of developmental licensee and affiliate markets in the McDonald’s system. Corporate activities are also reported in this segment. The segment is 98% franchised as of December 31, 2020

Overall the distribution in revenue between these segments have remained fairly steady, with the U.S segment growing slightly in 2020:

As a general rule their U.S. and International Developmental Licensed Markets & Corporate segments have higher operating margins, which is to be expected since the US is a wealthier and more mature market than most of the other countries in which McDonalds operates in.

Overall, the wide geographical diversification of McDonalds, and the stability of the revenues that comes with it, as well as the specific franchising model under which they operate, which effectively makes them the landlord of many of their franchisees, means that they have a steady business.

This “landlord” position is no small market, and indeed from their 10-K:

As of December 31, 2020 and December 31, 2019, the Company owned approximately 55% of the land and 80% of the buildings for restaurants in its consolidated markets

This severely increases the predictability of their revenues, and turns what would otherwise be a pure restaurant business (with the corresponding shortfalls) into a what is partly a Real-Estate business, which stabilizes and improves their restaurant business.

Effectively they have fairly stable revenues coming in under normal circumstances, and this stability has allowed them to do a number of things, including consistently raising their dividend.

The Dividend

McDonalds is a dividend aristocrat with 45 consecutive years of dividend increases.

In fact, McDonalds has increased their dividend every year since they first paid one!

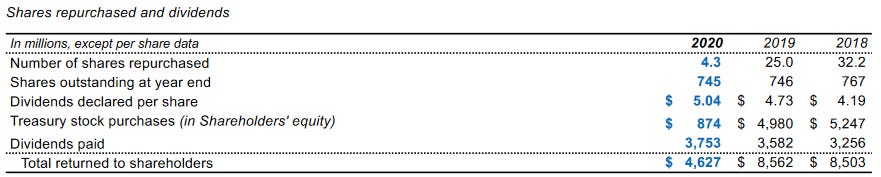

Of course dividends aren’t the only way companies return capital to their shareholders, and McDonalds also conducts share buybacks:

Those share buybacks were even higher than their dividend payments in 2018 and 2019.

The 2020 Buybacks were severely curtailed as a result of the Covid19 Pandemic, but the dividend remained steady.

Ultimately I’m unconcerned with the cutting of the buybacks, since I see Share Buybacks as a good way to have a “buffer” of un-allocated earnings that the company can re-allocate when it faces trouble in their business, or needs to invest in something.

Income Statement and Balance Sheet

Let’s take a look at their Income Statement and their Balance Sheet:

Overall the income statement is looking very good, with strong margins all around.

The one thing to note though, is a high interest costs, which are taking on 16% of Operating Income to pay off.

This is indicative of a highly leveraged operation with a lot of debt, which is generally a very bad thing.

Other than that though their Income statement is surprisingly good for what is normally thought of as a “restaurant” business.

However, if we have a look at their balance sheet we begin to uncover the truth…

McDonalds has almost no inventory, and a lot of cash and equivalents available to them.

Most of their non-current assets are primarily real estate, either through directly owned buildings, or through leases and other rights of use. There’s a little bit of goodwill (around 2.7 billion), but the bulk of their assets are quite tangible, which is good!

When we look at their liabilities though, it looks at a total disaster, with them having more liabilities than assets! In some countries this is called “technical bankruptcy”!

Ordinarily this would be a terrible thing, and I won’t lie, it’s definitely a negative to consider if you’re thinking of investing in McDonalds for the assets.

This is not an asset play!

That being said, it’s not as bad as it looks.

First of all you need to consider the fact that real-estate is being carried on the balance sheet at cost. This means that any increase in valuation of these assets has not been reflected on the balance sheet.

For a company like McDonalds, with most of its restaurants in highly desirable and growing areas, there is a significant chance that these real estate assets are wildly undervalued in the balance sheet compared to their true market value.

In addition, when you consider that the vast majority of the long term debt has been used to purchase these assets, and that 95% of this debt is fixed rate and at a weighted-average annual interest rate of 3.2%, this high leverage is actually looking quite decent.

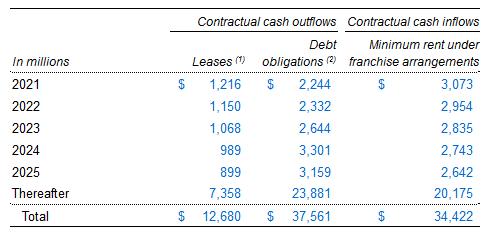

This fixed rate means it’s fairly easy to see if there are any “coupon cliffs” to be aware of, that is, we should see when the debt obligations come due, to see if there will be a sudden outflow of cash that needs to be refinanced at a potentially dangerous time.

Overall the answer seems to be no. There doesn’t seem to be any coupon cliffs we need to worry about in the short term, and the debt obligations seem to be more or less covered by contracted inflows of rent from franchisees.

Effectively the franchisees are paying off McDonalds mortgages!

And if any such liquidity issues come about, given the desirability of the real estate, it’s likely that McDonalds would be able to sell it, and pay off the corresponding debt, without much of an issue.

To me, this clearly looks like McDonalds has been taking advantage of a low cost of capital, and a steady and reliable business to return capital to shareholders.

In a lot of ways, McDonalds is acting more like a REIT, than a restaurant company, and just like a REIT, it makes heavy use of debt to purchase long term appreciating assets such as real estate.

Strengths and Weaknesses

Every company has strengths, and weaknesses, and it’s important to be aware of them before we consider investing in it:

Strengths:

High Margins in a traditionally low margin business

Stable and consistent cash-flow

Demonstrated ability and will to return capital to shareholders

Geographically diversified revenue streams

Weaknesses:

High amounts of debt

Regulatory concerns due to unhealthy products

Low margin self-operated restaurants are key to maintaining effective franchising model

Affected by Covid19

Summary

Honestly I like McDonalds, not just as a client, but as an investor.

While the fact that it has a negative book value is an issue, i’m not nearly as concerned with that as I would be if the majority of the assets on their balance sheet were intangible.

In essence, I believe McDonalds real estate assets are contabilisticaly under-valued, and that their true book value, when you include the market price of their real estate is actually positive.

How positive it is, I have no real idea, and would need significantly more information than I have available to accurately evaluate.

Additionally, I believe the McDonalds brand is strong, and it is that brand that has enabled it to maintain such high margins, through cost control (leveraging the economies of scale and power over franchisees), and through pricing power.

Again, I have no real way to accurately judge how valuable this durable competitive advantage is, however I think it is clear through its effects on the income statement and the balance sheet that such an advantage does exist.

And that’s really the rub of it, isn’t it?

How valuable is this advantage? How valuable are the real estate assets being carried at cost?

We won’t find the true answer next week, but we will be doing a valuation of McDonalds to figure out what price we should be willing to pay for this company.

What about you? Do you own McDonalds? Eat in it regularly?

Let me know in the comments below!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!