Johnson & Johnson

A dividend king that's making the world a better place

What is Johnson & Johnson?

According to Wikipedia, Johnson & Johnson is:

Johnson & Johnson (J&J) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods.

In other words, Johnson & Johnson does 3 main things:

Develops new drugs and medicines

Develops medical devices

Produces consumer facing medical and personal care products

If you live in a first world country, chances are you’ve seen or used some Johnson & Johnson products in your life.

If I look at my medicine cabinet i can see several Johnson & Johnson products in there, and I’m not the only one given their worldwide sales figures.

That said, the company is currently in the process of spinning off its consumer division to focus on its higher margin pharmaceutical business.

This is actually a significant issue when it comes to valuing this business because the business model of Pharmaceuticals and Consumer products is quite different, and this spin-off will meaningfully change it’s business model in a way that something like the Realty Income / Orion Office spin office didn’t.

Pharmaceuticals are very much a feast or famine type of business, and the stable low-growth consumer products business serves as a counterbalance for when the “feast” gives way to the “famine”.

Without that counterbalance the risks involved in the company, and its potential returns meaningfully change, and I suspect that Johnson & Johnson will in a few years look a lot more like Abbvie, than it will look like the Johnson & Johnson today.

Or at least that’s the idea…

Business

Strategy

Innovation is at the core of Johnson & Johnson’s business strategy, and has been since its founding over a hundred years ago.

From producing new drugs, new consumer facing products and new medical devices, innovation is the primary thing keeping the company competitive over the long term, and that means massive capital expenditures and time investments to keep that business model going.

That’s actually part of the reason why I think the company is now spinning off their consumer health business.

Consumer health products simply don’t have a lot of innovation in them, and so business there is driven more by brand power, product quality, and pricing, than by creating new and more effective products.

At the end of the day, all of the low hanging fruit in Johnson & Johnson Baby oil innovation has already been picked, and given the legal issues in the past few years have tarnished the brand image, it might be better to spin that off into its own company with its own (new) brand.

And those branding issues are a problem, not just because the medical field is one where providing quality products is a life or death issue, but because Johnson & Johnson has for decades made consumer safety a core part of their business ethos.

It’s not a coincidence that Johnson & Johnson is, to this day, used as the case study for crisis management as a result of their handling of the Chicago Tylenol Murders.

Their most recent handling of the Talcum Powder cancer suits however has not been as much of a success, and by spinning off the division responsible for this, the company can distance themselves from what is quickly becoming a Public Relations nightmare.

Reporting Segments

Johnson & Johnson is split into 3 reporting segments:

Consumer Health

Pharmaceutical

Medical Devices

Each of the segments is fairly self-explanatory, the Consumer Health segment focuses on personal healthcare products, such as wound care products, over the counter medicines, baby care, etc…

On the other hand both the Pharmaceutical and Medical Devices segments focus on other areas that aren’t as visible to the general market, but which still revolve around medicine, these include specialty medicines (Pharmaceutical) and orthopedics devices (Medical Devices) among others.

Despite the higher visibility of Consumer Health products to the average person, the fact is that Consumer health is the smallest segment of the company, and the majority of its revenue comes instead from the Pharmaceutical segment.

Since the spin-off is coming soon, it’s good to know what exactly will be the new companies business, so let’s take a quick look at the Consumer Health segments franchise sales numbers, to see if it’s suitable to carry on as an independent company:

This is actually quite surprising to me!

Yes, the overall consumer segment area as a whole does seem to be a low growth business where the market is for the most part already saturated, and where Johnson & Johnson holds a preeminent position, however if we dig through the franchise sales we can see significant changes in sales numbers on a year over year basis.

Now, this may be an artifact of the unusual year that was 2020, so let’s take a look at the 2018-2019 period as well:

Even here we see significant changes in terms of individual franchise sales.

What this tells me is that the Consumer Health segment isn’t quite as consolidated and saturated as the overall numbers might make it seem.

Perhaps when this segment is its own company it will be able to take advantage of this to more accurately target the growing franchise sales? I’m not sure, but these numbers do look like there is something there to take advantage of…

What about the Pharmaceutical segment?

Pharmaceutical segment sales in 2020 were $45.6 billion, an increase of 8.0% from 2019, which included operational growth of 8.2% and a negative currency impact of 0.2%. U.S. sales were $25.7 billion, an increase of 7.8%. International sales were $19.8 billion, an increase of 8.3%, which included 8.8% operational growth and a negative currency impact of 0.5%. In 2020, acquisitions and divestitures had a net negative impact of 0.2% on the operational sales growth of the worldwide Pharmaceutical segment.

So the company is growing in that segment, and doing so in an organic manner rather than through acquisitions.

Let’s take a look at what their pipeline for the next few years:

Now, I’m not a doctor so I can’t tell you just how good these new drugs will be at solving the issues they mean to solve.

That being said, a pharmaceutical company lives and dies by the quality of its Research & Development, and so it’s encouraging to see that Johnson & Johnson have plenty of new products on the way over the next few years.

While I wouldn’t expect all of these to be commercial successes, or even approved by regulators, it’s still a good sign to have them.

If they had only one or two new medicines on the way, that would be concerning…

Finally, let’s take a look at their Medical Devices segment:

This is awful.

2020 saw a major decrease in sales for this segment, mostly as a result of patients postponing surgeries and other necessary medical procedures.

At the time I’m writing this I still don’t have the 2021 numbers, so perhaps the situation has already reversed, however even when we look at the 2018-2019 numbers the situation is not encouraging:

Though in that case the cause of the sales decrease was the divestiture of the Diabetes Care business.

Overall the Medical Devices segment is a solid “Meh”.

Finally, let’s just take a look at each of the segments profits, and their corresponding margins:

Wow, the Consumer Health segment made a loss!

That’s actually quite surprising to me, since I thought the business was significantly more stable than it apparently is.

The remaining segments are about what I expected, with high margins throughout. The very high Pharmaceutical margins are an encouraging sign going forward.

If we take a look at the 2018-2019 period we see a similar situation:

The positive earnings in the Consumer Healthcare segment for that period tells me that 2020 was likely a one-off rather than an indication of a chronic problem with that segment's business. This is encouraging because it means that Consumer Healthcare is likely a viable company in its own rights, and would probably fit my investment style (if a bit on the low side on margins).

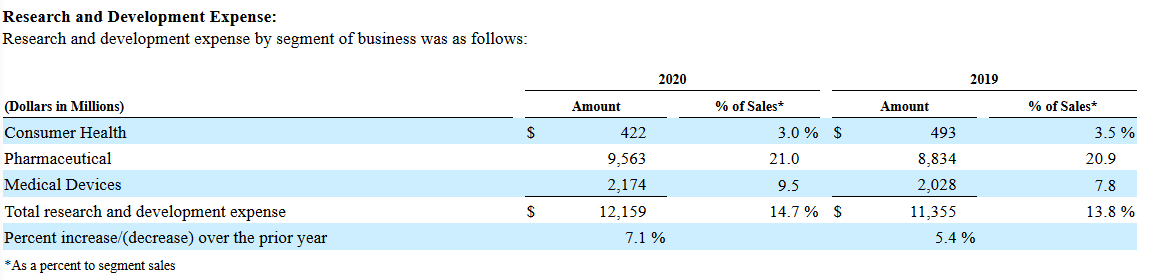

Finally, let’s have a look at the segment R&D expenditures:

Once again here Consumer Health is the odd man out, spending significantly less than the other segments. This lends credence to my theory that “all the low hanging fruit in baby oil technology has been picked”.

Let’s expand our timelines for a bit, and take a look at the segment revenues over the past 20 years:

We can see that most of the growth the company has had over the past 10 years comes from the pharmaceutical segment, with the consumer segment being stagnant throughout.

We’ve spent a lot of time on these numbers because for a spin-off of this magnitude it’s very important to be aware of what exactly is getting spun-off, and what the effects that spin off will have on both the remaining Johnson & Johnson, and the new company.

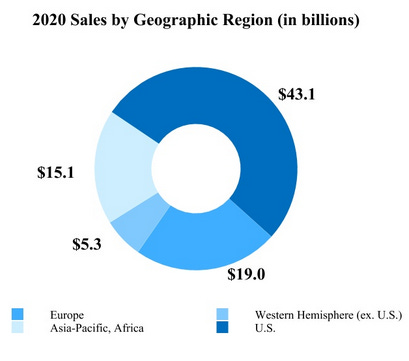

Geographical Diversification

As is often the case with companies in the healthcare sector the bulk of sales comes from the United States as a result of its unique regulatory structure which imposes significant barriers to entry alongside economic pricing deregulation.

That being said, it’s clear that Johnson & Johnson is a global company and as per their 10-K they operate worldwide:

And indeed we see a far more balanced distribution of employees:

Management

Johnson & Johnson has recently undergone a change in CEO, with Joaquin Duato taking up the role effective January 3rd.

Mr. Duato seems to be optimistic of the spin-off, and I suspect that he has been one of the driving forces pushing for it.

Mr. Duato commented, “This planned transaction would create two businesses that are each financially strong and leaders in their respective industries. We believe that the new Johnson & Johnson and the New Consumer Health Company would each be able to more effectively allocate resources to deliver for patients and consumers, drive growth and unlock significant value. Importantly, the new Johnson & Johnson and the New Consumer Health Company would remain mission driven companies with exceptional brands, commitments to innovation, and remarkable talent. Each company would carry on the Johnson & Johnson legacy of putting the needs and well-being of the people we serve first.”

Prior to becoming CEO he was heavily involved with the Pharmaceutical side of the business as the Vice Chairman of the Executive committee.

He was responsible for driving the transformation of the company's pharmaceutical business, and was the overseer of the company's response to the Covid-19 virus, which led to the creation of the Johnson & Johnson vaccine.

Overall it’s clear that he is a capable person to lead the new pharmaceutical focused Johnson & Johnson, so I’m not concerned here.

The management team for the spin-off company has not yet been announced.

Risks

Internal Risks

Research & Development may stall

The spin-off will reduce diversification

The spin-off may have unforeseen costs

External Risks

Medicines in Pipeline may not receive regulatory approval

Supply Chain disruptions

Anti-Pharmaceutical regulation in the US may jeopardize profits

The current legal issues may not be resolved favorably

Fundamental Data

Income Statement

Overall the company has been consistently profitable with decent margins. We’ve seen before that the pharmaceutical segment has been growing significantly, so the main cause of the decreased earnings is the other segments, particularly the Consumer Health segment which is getting spun-out.

Overall this is about what I would expect from a huge company that is a market leader, there just isn’t much growth to be had.

Something to note:

Johnson & Johnson has released their 2021 full year earnings in their press release for the 4th quarter, but has not yet released their annual report.

I have chosen to include those earnings in this chart and the remainder of my valuation calculations, because those are the latest numbers available to me.

Unfortunately Johnson & Johnson has not yet released the full annual report, including the balance sheet. As a result I’m using the balance sheet numbers from their latest quarterly filing instead, which relate to October 3rd 2021. I do not expect these numbers to be meaningfully different, but I nonetheless encourage you to review the annual data once it is released.

That said, let’s take a look at the last decade:

Revenue Growth

Overall Revenue has grown at a lackluster 3.8%. This is disappointing, but in line with what we would expect from a mature company in a mature and highly regulated business.

Margins and Earnings

Earnings per Share growth has been a fairly solid 8.1%, this is the result of the 3% revenue growth as well as some buyback and increased margins thanks to the growth of the more profitable Pharmaceutical segment.

I’m fairly content with this, since its above average in a mature business like Johnson & Johnson’s.

Balance Sheet

Shareholder Equity

Like many other companies in the past decade, shareholder equity has remained more or less flat over the past 10 years, and the increases in assets have been the result of increased leverage.

You can clearly see the jump in 2017 when a more favorable tax regime came into being.

This is not really sustainable in the long term, and it’s worth looking into what their commitments are.

Debt Schedule

Johnson & Johnson holds roughly 32 billion dollars worth of long term debt, 5 Billion of which was accrued in 2020. From what I can tell all of this debt is fixed rate, so for the short term the company should have no issues if interest rates increase.

In addition to this the company has access to an additional 14 billion dollars worth of liquidity through revolving credit facilities, which should forestall any short term liquidity issues.

Johnson & Johnson is one of very few companies with a Aaa credit rating from Moody’s, which means Moody’s believes the company has a lower likelihood of defaulting than the US Government.

While the spin-off is being seen negatively by the ratings agencies, the company will retain its Triple-A rating.

I am not concerned with the ability of the company to generate the cashflow to make due on its commitments.

Shareholder Returns

Buybacks

Johnson & Johnson has conducted buybacks regularly whenever prudent, and will likely continue to conduct them.

That being said, they are not being very aggressive with their buybacks, are buying back less than 1% of outstanding shares on a yearly basis.

Dividends

Johnson & Johnson is a Dividend King with over 59 years of consecutive dividend growth.

They pay out on a quarterly basis and their current annualized yield is $4.24.

It’s clear that the dividend is a core component of the company, and I don’t expect that they will pause said growth in the foreseeable future since they can clearly sustain it.

The company has already announced that after the spin-off both companies will pay a dividend in line with their existing amount, so we do not expect any cut in total income from the spin-off.

Take note AT&T.

Strengths and Weaknesses

Strengths:

Diversified business in the healthcare sector

Catalyst on the horizon (spin-off)

Non-Cyclical high demand products

Longstanding history of returning capital to shareholders

Weaknesses

The spin-off may not provide the expected benefits

Incoming regulation may reduce profitability

Ongoing legal issues

The spin-off may result in less diversified and more fragile companies

Valuation

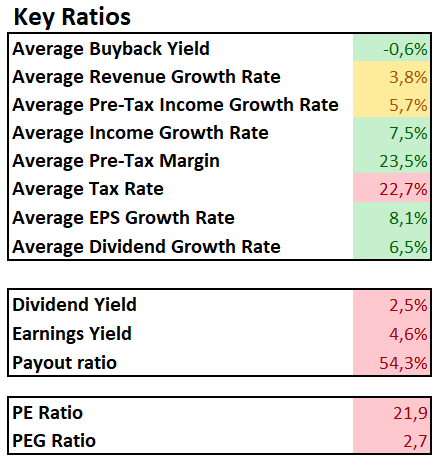

Key Ratios

Overall all of these ratios are good.

Even the revenue growth rate which is at 3.8% is fairly decent considering it’s a massive company in a very difficult and saturated market.

The fact that the dividend growth rate is lower than the EPS growth rate is encouraging because it means the company has been decreasing its payout ratio over time. That ratio is now around 55% which is fairly sustainable for this type of business.

The only thing really worth noting on the negative side are the ratios regarding price, namely Dividend Yield, Earnings Yield, PE and PEG ratios. It’s clear the market is valuing the company richly, which can make it less attractive, even in spite of otherwise stellar fundamentals.

Standard Valuations

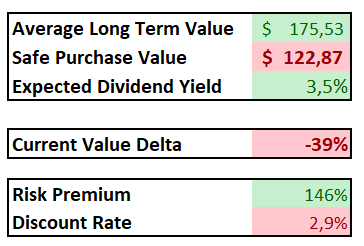

That being said, other than the Book Value and the Historical Expected Return, the Standard Valuations are all fairly positive.

The company is not an asset play, so I don’t put much stock into the book value. We’re buying this company primarily for the earnings power.

As always I tend to favor the Margin to PE method, though perhaps that is a bit conservative in this case?

Safe Purchase Value

As always I favor a 30% margin of safety, so if we assume an Average Long Term Value of $175 (it’s getting dragged down a lot by the low book value!), then our safe purchase price is around $122.

Given the fact that we’re purchasing this for the earnings power, I wouldn’t be uncomfortable assuming a slightly higher Average Long Term Value, perhaps in the mid to high $180s. That would lead to a Safe Purchase value of around $130.

That’s pretty much in line with my original purchase of shares ($126 during march 2020!).

Right now the company is fairly valued in my view.

Investment Thesis

Key Points

The Spin-off will help unlock value in both key areas of the new companies (Consumer Health and Pharmaceuticals)

The companies business is fundamentally stable and sound

The R&D Pipeline is strong and will continue providing new and innovative products in the coming years

The dividend and share buybacks will continue to increase at acceptable rates

The Pharmaceutical side of the business will continue to be the growth driver

The Consumer Health side of the business is a mild “turn-around” story that can focus on cost control and branding power to reinvent itself.

The judicial issues will be resolved without a significant drag on financial performance.

Decision

It’s clear that management knows what they are doing and they have a plan to improve performance by splitting the lagging segments of the business and giving them the freedom to make the changes necessary to improve performance.

I think it’s likely that both companies will be viable post-spin-off and I’m not concerned with being a shareholder with either of them, despite the consumer health one having some profitability issues in 2020.

The business in general is high quality, and I have no issues owning it, but of course the price at which I own it is a key issue.

Johnson & Johnson is not wildly overvalued, nor is it particularly undervalued.

I can’t in good conscience give a “Buy” rating because I’m not buying it right now since it’s not quite cheap enough for me to bite (and I have some portfolio allocation changes I’d like to do throughout the year which leave little free capital for Johnson & Johnson).

That said, it’s a high quality company, and the price isn’t too high, so I don’t think I’d be taking major risks if I were to buy more…

My Current Stance: HOLD

What about you? What do you think of Johnson & Johnson?

Do you think the spin-off will go well, or do you have concerns?

Let me know in the comments below!