Japan Lifeline

A medical devices company at a fair valuation

Key Data

Name: Japan Lifeline

Ticker Symbol: 7575.T

Price: ¥1124

Market Cap: ¥85 Billion

Forward Dividend: ¥42

Dividend Yield: 3.7%

Areas of Operation: Japan

Sector: Healthcare - Medical Devices

Business

Japan Lifeline is a Japanese Medical devices company primarily dealing with cardiac devices.

The company primarily operates in Japan, with over 99% of its revenues coming from the sales, manufacture and distribution of medical devices.

An interesting characteristic of this type of business model is the both the relatively short expiration data of the products being sold, as well as the prevalence of a "consignment" business model.

What this means is as follows:

The majority of products sold by Japan Lifeline come with built in expiration dates, this is due to the inherent need for sterilization of medical products and devices, and the difficulty in maintaining that sterilization to acceptable levels over long periods of time.

In general the products sold by Japan Lifeline have a 2 year lifespan.

This has serious impacts on the rate of depreciation that comes built-in to the Cost Of Goods Sold, and indeed when we check the income statement and cashflow statement we see that about 2/3rds of the depreciation comes built into the COGS, likely as a result of these devices "expiring" while waiting to be sold.

While this wouldn't be much of an issue if the products were sold soon after being produced, the fact is that these types of products are more commonly handled on a consignment basis. That is, Japan Lifeline "deposits" the products in the hospitals and medical centers where they will be used, and sales are recognized once they are used.

This is partly due to the intrinsically urgent nature of the products being sold, after all, patients can't exactly wait 2 weeks for the new heart valve they need to be manufactured and delivered to the hospital they were brought to.

The company's products are primarily essential medical devices, and their use is not optional on the part of the patients.

The majority of the revenue itself is generated by products with substantial market shares in the japanese market, and the company does possess some unique competitive advantages.

For example, in regards to their BeeAT product, which is one of their key products, they have an effective moat since the procedures for which it is used is a non-standard method international, but prevalent in Japan.

This means there is little demand for catheters with cardioversion functions outside of Japan, making international medical devices giants unlikely to want to invest in the R&D required to come up with their own versions, since they would only be able to sell it to the Japanese market.

In a way, the japanese market can only support one such product, and since no other markets are available, the first company to develop it (Japan Lifeline) gets an effective and highly profitable monopoly.

At the same time however this does limit the overseas sales strategy, since many of the devices developed in house are not able to be sold outside of japan.

This is not great for "explosive growth" coming in from overseas, since over half of sales is coming from in-house products which are not able to be sold outside of japan, but at the same time provides an effective moat, bordering on a monopoly in certain key products.

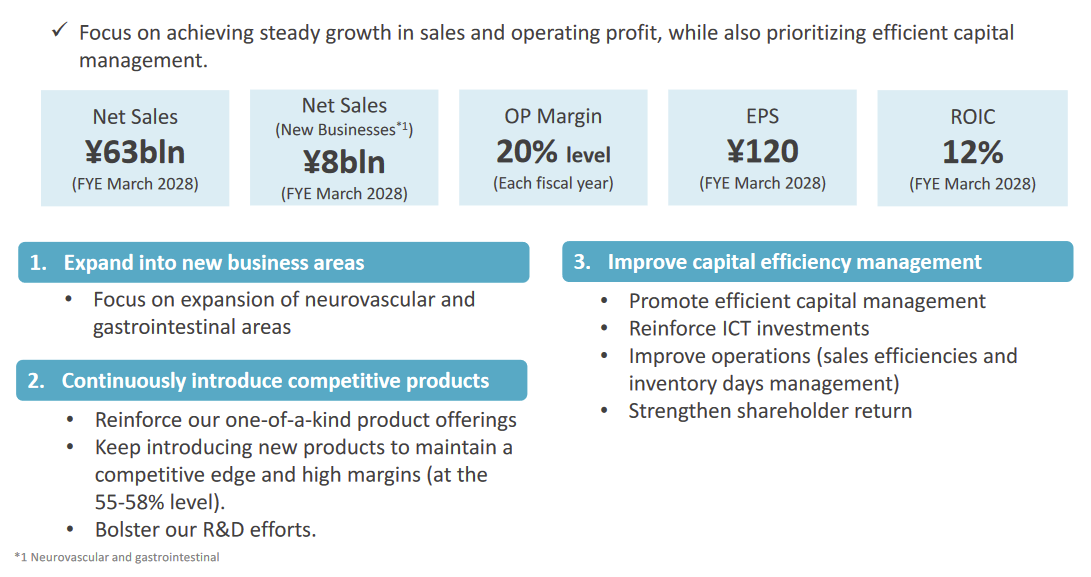

So what is their plan to grow the business?

In essence they are intending to expand into new areas and types of medical devices which they can use to augment their existing offerings.

In particular they want to increase the sales of their neurovascular and gastrointestinal segments, both of which are currently quite small.

In terms of sales on a per segment basis, here is what they expect between 2023 and 2028:

Neuro-vascular - ¥230 Million -> ¥4500 Million

Gastro-Intestinal - ¥650 Million -> ¥3500 Million

This is frankly huge growth, but there's a serious possibility that they can do it, since several of the products they mean to sell have recently been approved for sale by regulatory agencies.

Though of course, there are always risks, particularly when we are banking on growth!

Finally I would like to take a look at the company's shareholder returns, that is, the cash that they are directly or indirectly returning to shareholders, and what their policy is about this.

Fortunately the company has a very simple policy:

For reference the company's current market cap is ¥88 Billion, so they are planning to return almost 30% of their market cap within the next 5 years.

Of course this isn't guaranteed, the company has been very clear that these returns will only happen if they are able to generate cash over this period as they expect:

If we cannot deliver cash generation, we cannot return it to shareholders.

I think that the priority should be on capital investment and research, and if there are surplus funds, they are to be returned to shareholders. So, if we cannot generate enough cash, we can't just borrow money to return to shareholders as we said.

This is perfectly alright with me.

I like the fact that they are conservative with their leverage, and that they are unwilling to juice up returns by taking on additional debt just to return that cash to shareholders.

Which brings me to another topic, Japanese shareholder returns.

The fact is, Japanese companies (and other Asian companies, notably Korean banks) have historically suffered from poor corporate governance which resulted in management teams, and controlling shareholders keeping enormous amounts of cash in the business and refusing to issue any dividends, or other forms of capital returns.

This is a serious problem because for minority shareholders like me, those returns of capital are completely out of my control.

Fortunately the Japanese authorities have recognized this as the problem that it is, and particularly in the past few years have initiated a number of policies to enable some better incentives to be put in place.

I'm not going to go into detail on these policies, but Teddy Okuyama on his substack made a fantastic substack post where he discussed this.

I heavily recommend that you read it, and check out his twitter.

Financials

Income Statement

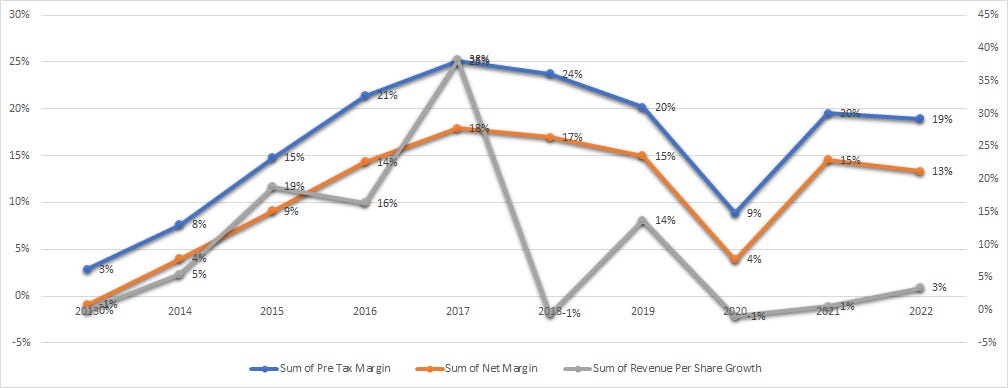

Over the past decade the company has grown substantially, particularly during the years between 2014 and 2019, when the company doubled its revenues. The most recent years have been different, with revenues being stagnant, and even decreasing as a result of a lackluster 2019, and the subsequent impacts of the COVID19 pandemic.

These impacts severely affected the company's plans, and resulted in the scrapping of their medium term plan.

Nonetheless there are a few things to note here, the company has generally maintained acceptable Margins, and while growth can be quite volatile, the underlying business itself is fairly reliable, with strong pre-tax margins and substantial stickiness.

I like high margins, and the fact that the company has managed to essentially double its revenues and increase its margins by developing, marketing and selling its in-house products indicates that they have come a long way from a low margin distributor.

Overall I'm satisfied with their business.

Balance Sheet

Over the past decade the company has taken advantage of the earnings they retained to expand the company without resorting to leverage.

While the company has had a positive Net Current Asset value per share throughout, that value has only increased over time while liabilities have remained more or less the same.

This is good, a company that can growth revenues at such rates, while simultaneously not increasing liabilities is a good business in my view.

Additionally the assets are all fairly liquid, with most assets being current assets, with a fairly even three-way split between Cash, Inventories and Receivables.

No company ever went bankrupt from having too much liquidity and not enough debt.

Cashflow Statement

Ultimately what we expect to see based on the progress of the company has happened:

We see significant expenditures of cash during the 2017, 2018 period that resulted in improved efficiencies which means operating cashflow in 2020 onwards has effectively doubled over 2016.

In essence we spent around 300 yen per share to purchase around 70 yen per share of free cashflow, that about a 23% return on cash.

Of course there are other expenses that don't show up on the cashflow statement, depreciation for one, so in reality I'd expect the actual returns were lower, but still within the companies expected Return On Invested Capital ratios.

Valuation

I've done a number of valuations in the past, and while I'm reasonably happy with all of them, for Japan Lifeline I decided to more or less scrap all of my previous standardized methods and simply build a Discounted Cashflow model from the ground up.

Estimated Fair Value

I'll cut to the chase, I've estimated the fair value of Japan Lifeline shares at ¥1124 per share, broken down in the following way:

Dividends: ¥211

Share Price: ¥913

Total Return: ¥1124

In order to model this, I assumed that I would purchase the shares today, and would sell them at the end of the year in 2028.

I would sell them at an average of the following multiples:

PE Ratio - 8

Free Cashflow - 12

Price to Book - 1.6

I used a 9% discount rate, and my default case assumes the company's mid term plan will go as expected.

I held the capital returns as follows:

Dividend is the greater of the previous years dividend, 40% payout ratio or 5% of shareholders equity

Buybacks are 35% of free cashflow after dividends have been paid.

Ultimately I expect dividend per share to be raised up to ¥60 by 2028, and EPS to be around ¥135 per share (slightly higher than management).

If i check against a perpetuity at 9%, I see that it gives me around the same value.

Stance: HOLD

Great analysis and very interesting business👍 I've included the link to your in-depth analysis in RhinoInsight's latest Friday Roundup.

https://open.substack.com/pub/rhinoinsight/p/the-friday-roundup-256?r=2587ts&utm_campaign=post&utm_medium=web