What is Investors Title?

According to their annual report, Investors Title is:

The Company’s primary business activity, and its only reportable operating segment, is the issuance of residential and commercial title insurance through ITIC and NITIC.

Additionally, the Company provides (i) tax-deferred real property exchange services through its subsidiaries, Investors Title Exchange Corporation (“ITEC”) and Investors Title Accommodation Corporation (“ITAC”);

(ii) investment management and trust services to individuals, trusts and other entities through its subsidiary Investors Trust Company (“Investors Trust”);

and (iii) management services to title insurance agencies through its subsidiary, Investors Title Management Services (“ITMS”).

In other words, ITIC 0.00%↑ is an insurance company in the real estate business. They insure titles against any possible issues that might arise, they provide services related to 1031 exchanges, and they provide investment management and trust services.

If you’re familiar with the real estate market, this probably makes sense to you, but for those of you who have no idea what this means, let’s see if we can get some additional detail from the report:

Title insurance protects against losses resulting from title defects affecting real property. Upon a real estate closing, the seller of real property executes a deed to the new owner, and typically, the property is encumbered with a new mortgage. When real property is conveyed from one party to another, occasionally there is an undisclosed or undiscovered defect in the title or a mistake or omission in a prior deed or mortgage that may give a third party a legal claim against such property or result in the invalidity or unenforceability of the insured mortgage. If a claim is made against the title to real property, title insurance provides indemnification against covered defects.

So you buy title insurance so that when you buy a property, and some guy comes around saying that the property is actually his, you can go to your insurer and have them deal with the issue (by either going to court, buying them out, or some other way).

What about 1031 exchanges?

In 1988, the Company established ITEC to provide services in connection with tax-deferred exchanges of like-kind property pursuant to § 1031 of the Internal Revenue Code of 1986, as amended. ITEC acts as a qualified intermediary in tax-deferred exchanges of real property held for productive use in a trade or business or for investment, and its income is derived from fees for handling exchange transactions and interest earned on client deposits held by the Company. In its role as qualified intermediary, ITEC coordinates the exchange aspects of the real estate transaction, and its duties include drafting standard exchange documents, holding the exchange funds between the time the old property is sold and the new property is purchased, and accepting the formal identification of the replacement property within the required identification period. ITAC provides services as an exchange accommodation titleholder for accomplishing “parking transactions” as set forth in the safe harbor contained in Internal Revenue Procedure 2000-37.

Investors Trust provides investment management and trust services to individuals, companies, banks and trusts.

In other words, a 1031 exchange is a tax-advantaged real estate transaction. ITIC 0.00%↑ works as a middleman here, ensuring the transaction qualifies for the tax-advantages and charging a fee for it.

Overall it’s a fairly straightforward process, and as long as the lawyers working for the company don’t screw up too badly it’s a fairly low-risk business.

Business

Strategy

The company's strategy is simple, and can be summarized in the following 2 points:

Maintain financial Strength by keeping a strong balance sheet with no debt and highly tangible assets

Cultivate long-term mutually beneficial relationships with business partners

These work together to provide a stable reliable business with growing revenues and a dedicated workforce and client base whose interests align with the company.

That’s a bit too high level though, isn’t it? How do they actually make money?

The main segment in terms of revenue for the company is the premiums they collect for their insurance activities.

These premiums are collected whenever a new client is on-boarded, which happens whenever a house is sold, or a new mortgage is issued. In general the higher the real estate activity, then the higher the revenues.

That said, there are substantial costs to this, for one there is the obvious costs regarding claims on the insurance made. Additionally, the bulk of insurance revenues comes from agents who generally work on commission.

Indeed in terms of revenues around 52% of those revenues go straight out the door as commissions to the agents who produced those premiums, leaving 48% to pay out claims, deal with operating expenses, and eventually turn a profit.

This indicates to me that the insurance agents have a significant amount of power in the relationship, indeed if you compare it with a company like AFL 0.00%↑ you can see a stark difference since AFL 0.00%↑ commissions to agents are only about 7% of premium revenues.

This isn’t a good thing, but it also does provide insurance agents a strong incentive to provide ITIC 0.00%↑ business, so silver linings?

The second largest expense is personnel expenses, with around 20% of all revenues going towards that..

Indeed, something worth noting is that the smallest line item in the expenses category for the company is… Provision for claims, with a grand total of 2% of premium revenue going towards it.

Doesn’t that look oddly low?

If we look at AFL 0.00%↑ again we see that 60% of premium revenue is spent on paying out claims, but looking at some other title company competitors we see that such spending is under 10% across the board (though admittedly ITIC 0.00%↑ does still seem to have lower than normal claims even when comparing to its immediate competitors)

Indeed the closest competitors I’ve been able to find, FNF 0.00%↑ and FAF 0.00%↑ both seem to have very low “expense ratios”.

On the one hand this is great! We’re selling risk protection worth 2 cents for 1 dollar! What’s not to like?

On the other hand it also begs the question… Why is title insurance such a better business than other types of insurance? Is it a regulatory barrier? Perhaps they are taking on too much risk?

What exactly is going on here?

I contacted investor relations in order to find out more about their historical financial data, but unfortunately they informed me that they weren’t able to provide me with annual reports from before the year 2000.

It’s too bad because I would have liked to have a more holistic view of the company's history, but oh well I’ll have to make due with what I have.

And what I have are 20 years of claims and premiums data…

Orange - Commission Ratio

Blue - Claims ratio

You might notice the graph ends in 2006.

Unfortunately prior to that it seems that the company didn’t really report their net premiums? At least not in a standardized way on their income statement, so I thought it best not to add that data.

You can see that the early years have quite substantial claims ratios, though that soon settles at a comparatively low level.

I wish I had more data, but from the data I do have it seems to me that title insurance just seems to be a high margin product. Looking at the competitors gives similar results too, so it appears to be an industry wide trend.

Reporting Segments

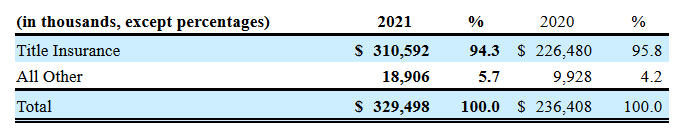

The company has only 2 reporting segments::

Title Insurance

Exchange Services, Investment Management and Trust Services, and Management Services

Title insurance is by far the largest of their segments, and the oldest.

Indeed when we break down their revenue by segments:

We see that title insurance comprises well over 90% of their revenues.

In terms of premiums revenue we can see a 75/25 split in terms of home and Branch and agency premiums written:

Home and Branch are “in-house” sales for which no commissions are paid. These are primarily based around North Carolina.

Agency premiums occur when a policy is written through a title agency, in this case the premium is shared between the agency and the underwriter, with the agent retaining a majority of the premium.

Geographical Diversification

The company traditionally operates in North Carolina, but more recently they have begun expanding in Texas, Georgia and South Carolina:

Management

J. Allen Fine founded Investors Title in 1972 and has been chairman of the board since its incorporation. Mr. Fine served as president of Investors Title Insurance Company until February 1997, when he was named chief executive officer. Mr. Fine is the father of James A. Fine, Jr., chief financial officer and executive vice president of the company, and W. Morris Fine, president and chief operating officer of the company. A Certified Public Accountant, Mr. Fine earned a bachelor's degree in Accounting and a Master of Business Administration degree from the University of North Carolina at Chapel Hill and began his career teaching accounting at the UNC-CH School of Business.

I have no problem with Mr. Fine, by all accounts he has done a good job, and the company has been growing steadily over the past decade.

That being said, it’s important to note that ITIC 0.00%↑ is a bit of a “family company” with all three board members being either Mr. Fine, or his sons:

This is, in more ways than one, a Fine company.

This can be good, or bad, depending on where you stand. Generally speaking family owned businesses like this have too much of a mix between business and family, and so I try to stay away. But at the same time they can provide a somewhat reliable and conservative investment opportunity at the right price.

Succession is also an important matter, given Mr. Fines advanced age, and so having experienced successors in place can also provide a decent security… Though of course more than one company has gone bust due to familial in-fighting after the death of a parent…

In terms of insider trades, it’s clear that the family isn’t dumping their shares onto the market (or buying any more!) at the expense of the common stockholders.

The only transaction I have found in the past few years was this single sale in 2019 by James Fine Jr., for 150 thousand dollars. Perhaps he bought a house then? Either way I’m not too concerned here.

Risks

Internal Risks

Highly dependent on their sales team

Potential conflicts of interest in the management team

External Risks

Dependent on the Real Estate market

Small player in the industry can be squeezed out

Fundamental Data

Income Statement

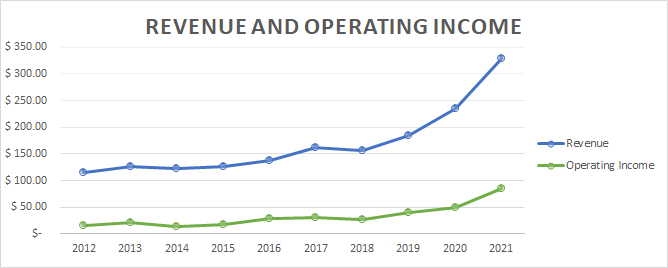

The company's revenues have seen a big bump up in 2021 and 2020 as a result of the booming real estate market then, as well as expansion into other non-traditional states.

The company is heavily impacted by the real estate market, so now that interest rates are the highest they’ve been in years this will have an impact going forward, and it’s likely that new premiums revenue will decrease in the next few years.

That said, the high profit margins, including the incredibly low provisions for claims are quite attractive…

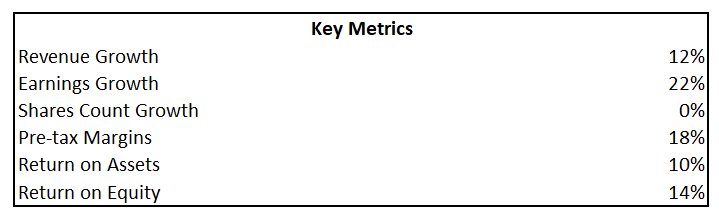

Revenue Growth

Over the past decade the company has increased revenue at a fantastic 12% CAGR, this is a fantastic growth rate, though it is in part due to its small revenue basis…

That said, revenue growth of any kind, particularly such large growth, is great.

Margins and Earnings

And with the increased revenue, the economies of scale (and lowered claims) the company's earnings have been increasing tremendously.

With a 22% earnings growth, and pre-tax margins at 18%, this is clearly a high quality business with a lot of room to grow!

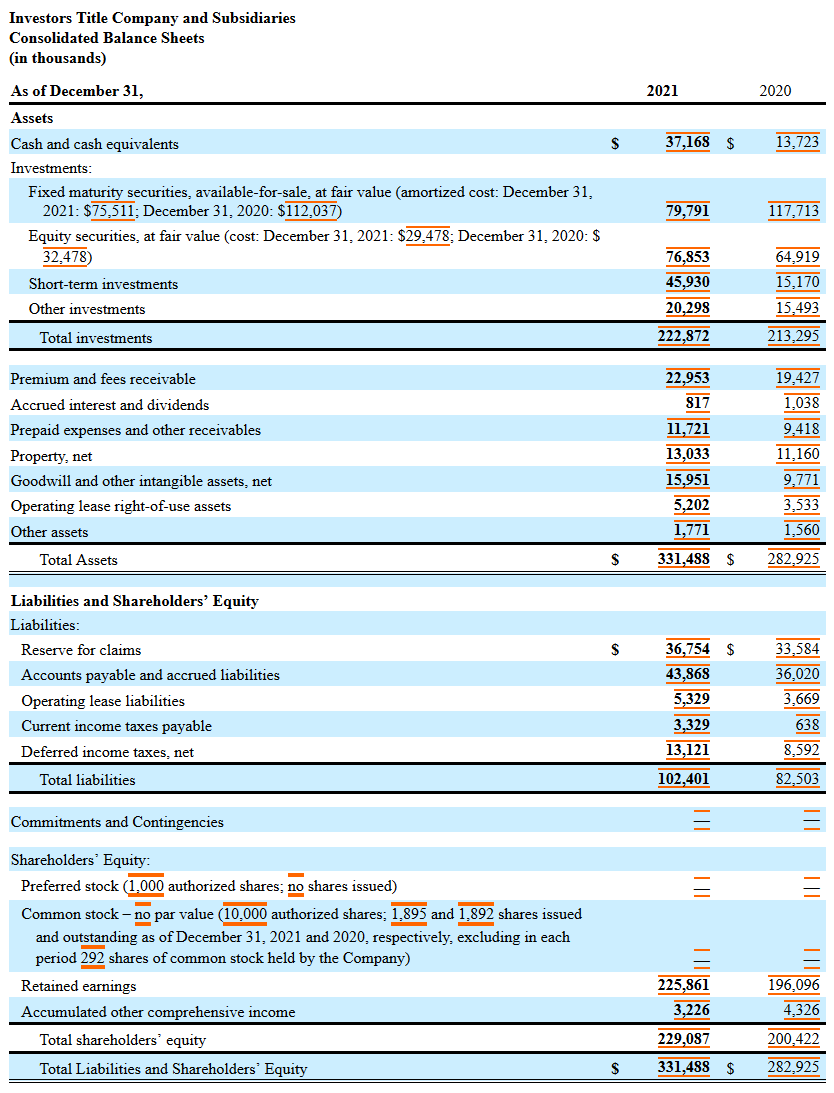

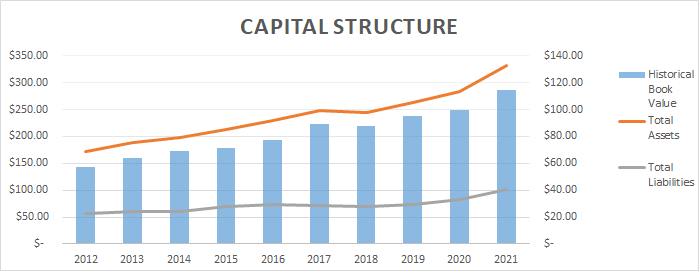

Balance Sheet

I like this balance sheet!

The bulk of the liabilities are either reserves for claims or accounts payable, which are inherent to the business, whereas most of the the assets are highly liquid investments.

I had a look at the investments themselves and they mostly are comprised of public debt, and other high quality debt instruments.

Shareholder Equity

Overall the companies liabilities have been increasing at a lower rate than its assets, which I quite like, and the fact that the liabilities are primarily those inherent to the business, rather than debt is also quite good.

Debt Schedule

The company has no debt.

This is a great thing, particularly since it’s a small company with comparatively low easy access to the debt markets.

Remember the old maxim:

It’s very hard to go bankrupt when you have no debt.

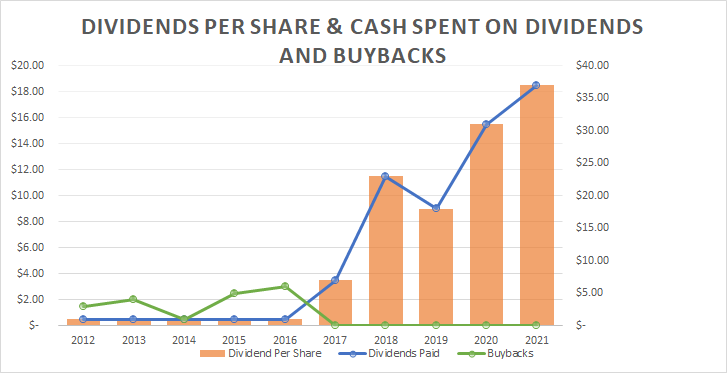

Shareholder Returns

Buybacks

The company doesn’t generally conduct any meaningful buybacks.

This is honestly fine with me, buybacks are just a method of returning capital to shareholders, and it's important to be tactical in how they are used.

Dividends

Here we see the main “juice” in terms of shareholder returns!

The company pays a quarterly dividend of $0.46 per share, for a total dividend of $1.84, they last increased this dividend in 2021, and although they haven’t cut their regular dividend yet, their increases are not really consistent, with them sometimes skipping a year.

So what’s with the huge spikes beginning in 2017?

Those are special dividends!

ITIC 0.00%↑ regularly issues special dividends to its shareholders, and indeed we can see that in the past 5 years they have issued a total of $54 per share in special dividends!

When you add up special dividends and regular dividends the company has returned nearly 75% of its operating cash flow to shareholders over the past 5 years!

Strengths and Weaknesses

Strengths:

Demonstrated willingness to return capital to shareholders

Lots of room to grow

Weaknesses:

Small company

Are those provisions for claims really enough?

Valuation

Key Ratios

I like these ratios!

The company has grown revenue at 12% annually over the past decade, and earnings have grown even further with consistent margin expansion.

The 18% pre-tax margin is inline with a high quality company like AFL 0.00%↑ which I heavily invested in, and the return on assets is quite high for the type of business it’s on.

While it’s a bit disappointed that it hasn’t bought back shares, the consistently growing dividend (and the very, very juicy special dividends) more than make up for it.

Standard Valuations

Of course the fantastic ratios and historical performance result in equally fantastic valuations.

Like always I tend to favor the margin to PE method, though the discounted earnings method gives similar results.

Insurance companies generally sell at a multiple of book value, and in this case we would be buying at too high of a price… But then again the company has paid out significant amounts of cash to shareholders so it's natural that the book value is depressed…

Safe Purchase Value

And so we see that the “Safe Purchase Price” is very high.

Personally I think it’s a bit too high, and its certainly getting bumped up by the Graham valuations.

Still, even if we cut in half the discounted earnings value, we get a value far above the current price of the company, and when we add a margin of safety it’s clear the company is cheap.

Investment Thesis

Key Points

This is a small cap company with all the issues and illiquidity that come with it

Most of the returns will come from special dividends

Revenue (and earnings) will likely substantially drop over the next 2-3 years

The high margins in terms of claims vs premiums might hide some poor actuarial practices (or not)

There are significant conflicts of interest in the board and management team

No debt!

Decision

It’s difficult.

I really dislike “family companies” because there is often a lack of professionalism, shareholder incentive alignment and baggage that come with them.

That said, the revenue growth on this company is out of this world, and the fact that they have done this while increasing margins, is fantastic.

The fact that it's an illiquid small cap company can be problematic, but it's also where many of the great value plays can be found.

Additionally, I’m still trying to bump up the index ratio in my portfolio…

I can’t buy it right now, so I won’t.

Current stance: HOLD

What about you? What do you think of ITIC 0.00%↑ ?

Let me know in the comments below!