Investor Tools - EDGAR

The all in one stop for researching US equities

From what I can tell, there’s a lot of people who seem to have some difficulty in finding accurate, reliable and up to date fundamental data for the companies that they research, and so I wanted to spend some time to demonstrate some of the tools that I use whenever I analyze a business.

And so, my first port of call is going to be EDGAR.

What is EDGAR?

Well, the easiest way to find out is to go to their about page:

EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, is the primary system for companies and others submitting documents under the Securities Act of 1933, the Securities Exchange Act of 1934, the Trust Indenture Act of 1939, and the Investment Company Act of 1940.

Containing millions of company and individual filings, EDGAR benefits investors, corporations, and the U.S. economy overall by increasing the efficiency, transparency, and fairness of the securities markets. The system processes about 3,000 filings per day, serves up 3,000 terabytes of data to the public annually, and accommodates 40,000 new filers per year on average.

In other words, EDGAR is a database that is owned and operated by the American Securities and Exchange Commission that holds regulatory filings that are required to be filed with the SEC.

These filings include (but are not limited to):

Annual Reports

Quarterly Reports

Current Reports

Insider Trades

Etc…

These filings contain an enormous wealth of information that lets investors, both retail and Institutional, make the correct decisions at the correct time.

The data is generally reliable, and fairly easy to access, and so it truly is a “one-stop-shop” for all sorts of key data necessary to properly value a business.

How do we use it?

Well, the easiest way to demonstrate this is by taking on a specific task, and going step by step.

Let’s say that we would like to know how much cash Aflac AFL 0.00%↑ spent last year (2021) on their office leases.

That’s a fairly specific (and useless) data point on itself, but you can easily replace that with “How much cash was paid in interest by LEG 0.00%↑ last year?", or some other data point you want to find out more about.

The first thing we need to find is where that particular companies filings are located, and the easiest way to do it is by using the “Company Search” functionality, and searching by the companies name:

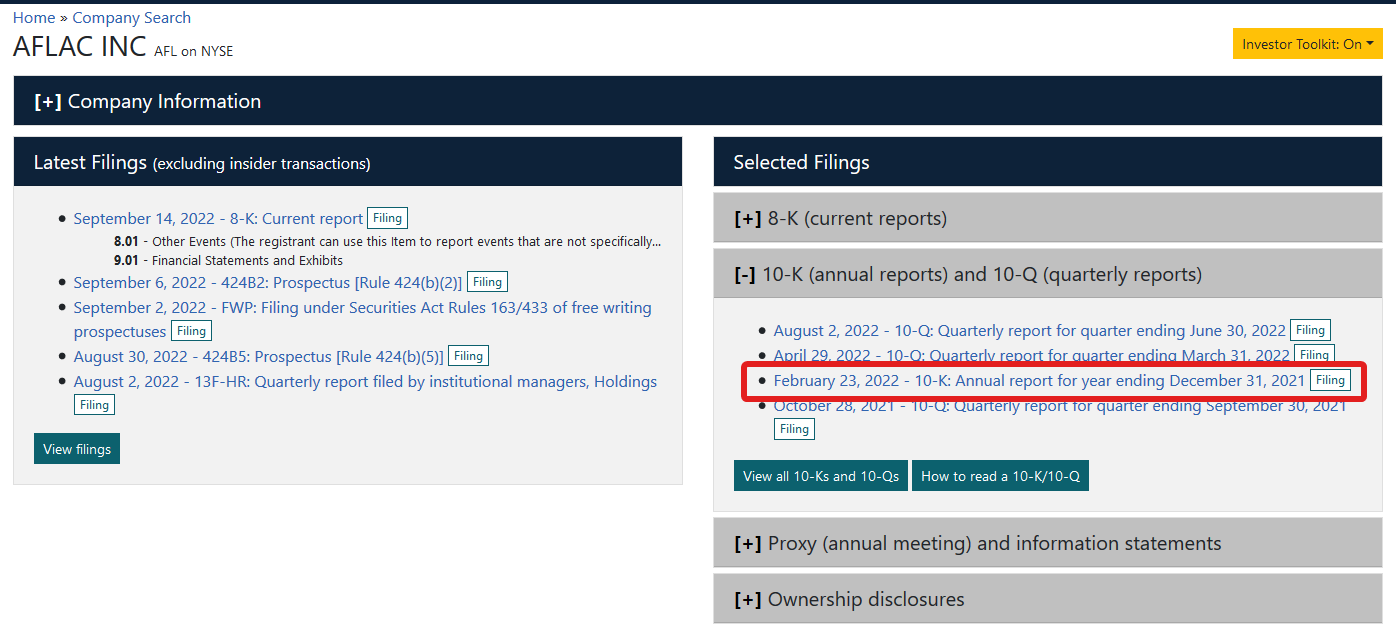

From there, we are brought to the companies webpage, where a number of differente filings are listed, and the company information is detailed.

In this case, we want data from the whole of 2021, so our best bet is to look into the Annual Report (10-K).

We can find last years annual report by simply clicking on the “10-K (annual reports) and 10-Q (quarterly reports) tab on the right:

If we find the specific report we want, we can just click on it and it will open in its own webpage.

If we’re looking for an older report, then the “View all 10-Ks and 10-Qs” button will open up a dropdown at the bottom of the page with a list of all of those reports:

When we find the one we are looking for, we can simply click it, and it will open the report in a separate page:

That report is fully searchable, and you can use the top left search bar to look for specific things.

Searching for “Lease” in there, we eventually find the number:

As you can see, the operating lease costs were included in the insurance expenses for the earnings statement, and for 2021 was around $58 million US dollars.

There’s also a bunch of other different and interesting data points related to leases, including their upcoming lease liabilities and expected expenses… But I’ll let you be the one to look that up as an exercise.

Conclusion

As you can see the EDGAR database is fairly easy to use, it’s accessible from anywhere, by anyone, and provides a lot of in-depth fundamental information that is useful for any investor that wants to learn more about a business.

If you’re doing research on a company, it should really be your first port of call, and you should be sure to read the companies reports before you start going into the investor presentations, and the “daily news” that make up and color the story of the company.

Remember, the actual fundamental data is what matters in the end, and the best way to get that data is by looking at the places where they are legally required to file it.

You don’t want to get caught off guard, when the plans were on display:

So give it a try, and do some bottoms up fundamental research!

Great tip, always go to the official source, too many mistakes for going into any investment service out there. I would really like that in Europe we would have something like EDGAR in the US...