Intel Corporation - Part 1

Why Intel is a clear value play for the discerning investor

Last week I sold my AT&T stock, and took the earnings of that sale into opening a new position in my portfolio by buying 54 shares of the Intel Corporation.

Let’s talk about that.

What is Intel?

As per their 10-K report, Intel is:

“Intel put the Silicon in Silicon Valley, and today our technology remains at the core of the most exciting, life-chaning innovations on the planet.

We are an industry leader, creating world-changing technology that enables global progress and enriches lives. We stand at the brink of several technology inflections - AI, 5G network transformation, and the rise of the intelligent edge - that together will shape the future of technology. Silicon and software drive these inflections, and Intel is at the heart of it all with data emerging as a transformational force in this era where an explosion of devices permeates all our interactions. That data must be moved, stored, and processed faster and more securely than ever before. We are unleashing the potential of data to unlock value for people, business and society on a global scale.

With a clear, shared purpose, we are inspired to create, innovate, and push the boundaries of technology.”

That’s a lot of fluff, that doesn’t really tells us much, so let’s summarize it:

Intel is an American technology company that designs and manufactures semiconductors, microprocessors and other computing hardware.

What are semiconductors though? What’s a microprocessor?

Well, you’re reading this blog on a computer, that computer is made out of motherboards, CPUs, GPUs and other hardware. Chances are that the computer you’re reading it on has as some of its key parts Intel manufactured components, like an Intel CPU.

With this in mind it now becomes easy to understand Intels business, they make money by developing and manufacturing electronic components, which they then proceed to sell to laptop manufacturers, data centers and consumers.

The products they make may be complicated, but the business model isn’t, and that’s a good thing for retail investors since it means we know exactly where our earnings are coming.

Strengths and Weaknesses

Intel has been beaten down, but it’s important to understand that it is still a major player in the semiconductor market, and has some unique strengths and weaknesses.

Strengths:

Consistently high profit margins

Growing addressable market

Solid financial standing

Consistently high cash-flows

Historical ability and willingness to return cash to shareholders

Weaknesses:

Recent under performance in R&D

Business requires very high capital expenditures to remain competitive

Vulnerable to supply chain constraints

Competitive industry

Heavy state involvement in the industry

Their strengths are looking good and solid, with a particular note on their consistently high profit margins and willingness to return cash to shareholders.

That being said there are a few things to note on their weaknesses that will need to be addressed.

First and foremost is their recent under performance in Research and Development.

We will go more in depth there when we talk about the companies story, however it is important to note that when it comes to semiconductors, companies live and die by the quality of their R&D, the fact that they have been lagging behind in the past couple of years is a big danger to watch out for.

Additionally the high capital expenditures involved in this business, and the highly competitive industry are also big red flags that will need to be addressed. In an industry where new factory costs are in the tens of billions, it’s important to keep our finger on the pulse.

Finally we will have to discuss the heavy state involvement in the industry. From its very beginnings, to the current day at every point there has been state involvement, either in Intel or its competitors, and this involvement will continue and likely intensify going forward.

For shareholders this can be an opportunity, regulatory capture and government contracts can be very profitable after all, but it can also be a major danger and risk.

I don’t think it’s a stretch to say that to shareholders one of the 2 worst words to hear coming out of a ministers mouth are “National Interest”, because you can be sure that bodes ill to your investment.

Income Statement

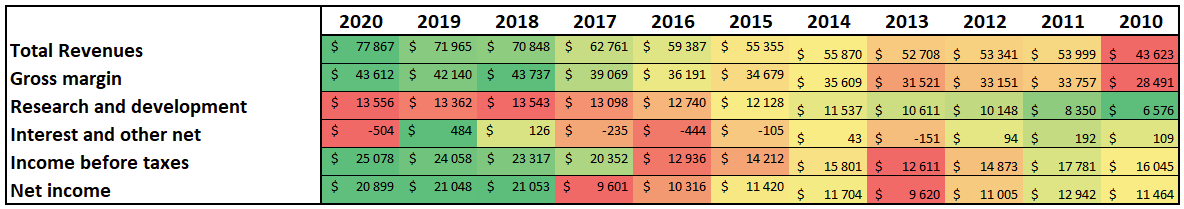

Let’s have a look at some of the key numbers over the past 10 years:

There’s lots of numbers here, but I’ve color-coded the interesting bits.

Generally though we can see steadily increasing earnings and revenue, which is great. Of particular note here is the increased earnings in the past 3 years, it seems that Intel R&D issues haven’t bitten it in the behind just yet.

This growth is great, and a big change compared to the previous companies we had a look at. Aflac, which has seen flat revenues and 3M with its lackluster growth, this contrasts with Intel, which has almost doubled in earnings and revenue in the past 10 years.

Another thing we can see is that their margins have also been consistently above 20% over this decade. Intel has been the leading semiconductor manufacturer during this time, and their margins show their competitive advantage.

Let’s have a look at the per share earnings:

Seems pretty consistent compared to their earnings, though it does seem to have been growing slightly faster than their overall numbers… Could they have been buying back shares?

Yes they have!

They have bought back about 25% of the shares they had outstanding in 2010, with the subsequent increase in Earnings Per Share.

In fact if we have a look at their latest 10-K we can see that last year alone they re-purchased around 14 billion dollars worth of common stock. Over the past 3 years alone 38.5 billion dollars worth of cash has been returned to shareholders this way!

Not to mention that they have been paying an increasing dividend all along, which thanks to buyback has not been placing an undue burden on the company, which now sits at a very comfortable 30% payout ratio.

Let’s put this growth into a simple table:

Overall it’s looking pretty good with an above average 9.41% EPS CAGR.

Balance Sheet

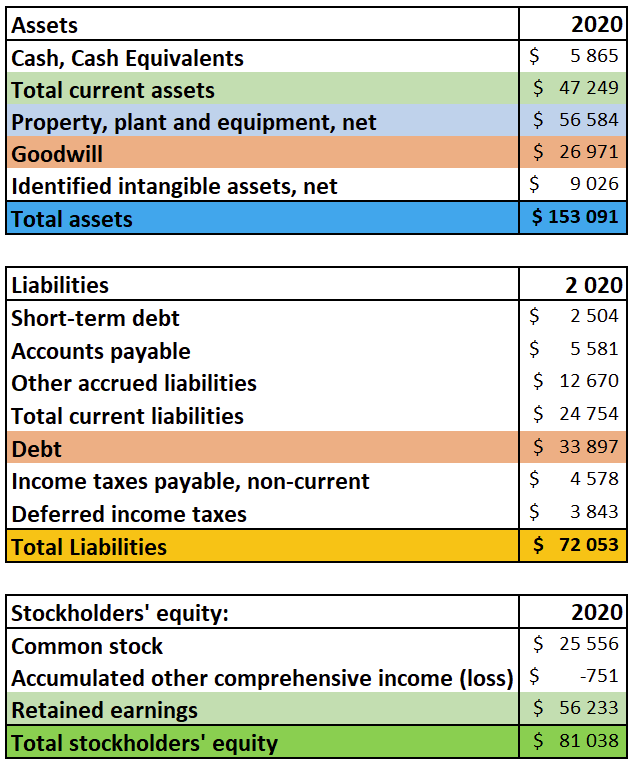

Here’s the Balance Sheet at year end 2020:

Overall the balance sheet is looking healthy, but I’d like to point out a few things to note:

Property Plant and Equipment

Intel factories are a clear competitive advantage they have, and a cornerstone of their business. Its what allows them to compete with both AMD and TSMC, and its notable to see that it corresponds to a significant part of their assets.

Debt

Intel has almost 33 billion in long term debt, this might seem like a lot, but its actually only about 1.5 years worth of earnings. In fact the companies current assets are well able to handle its current liabilities as well as a significant portion of its debt.

Retained Earnings

The retained earnings are also encouraging to see. It means that the company is actually sustainable and can be profitable over long periods of time without shareholder capital injections.

Overall this balance sheet tells me that Intel is not a highly leveraged enterprise, which is a good sign for its ability to survive downturns. This means that it has time to fix whatever product issues they may currently have, and are therefore not on a timer before they blow up, like many tech companies are.

It also tells me that despite issues they have been having, management has managed to keep focused on shareholder returns.

In Summary

At first glance Intel appears to be a company in a growing industry which has historically had a dominant position.

Over the past 10 years it has used that dominant position to increase its earnings, and return that capital to its shareholders in dividends and share buybacks.

While the company is in a very competitive industry, which major competitors on all of its areas of business, it has so far managed to withstand them, and be consistently profitable.

The major issue is related to its recent R&D failures, which will drive the success of the company going forward. We will talk more about that later.

So far though, I’m positive about the company, and it is now time to start working on coming up with a value for the company itself. Let’s discuss that next week!

Let me know what you think!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

And of course, don’t forget to subscribe!