As per the SEC Insider Trading is:

Illegal insider trading refers generally to buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security.

Insider trading violations may also include "tipping" such information, securities trading by the person "tipped," and securities trading by those who misappropriate such information.

In other words, if you have a fiduciary duty to someone, and you breach that duty by making use of material non-public information to either buy or sell a security, you are guilty of illegal insider trading, and may be prosecuted for it.

Of course, even if you have a fiduciary duty, that is, even if you are an insider, that doesn’t mean you’re not allowed to trade.

Indeed, the primary difference between insiders and non-insiders is not in their ability to trade, but in the reporting requirements related to trades they have already done.

Form 4 is a United States SEC filing that relates to insider trading.

Every director, officer and owner of more than 10% of a class of equity securities registered under Section 12 of the Securities Exchange Act of 1934 must file with the United States Securities and Exchange Commission a statement of ownership regarding such security.

The initial filing is on Form 3 and changes are reported on Form 4.

The annual statement of beneficial ownership of securities is on Form 5.

The forms contain information on the reporting person's relationship to the company and on purchases and sales of such equity securities.

A Form 4 must be filed before the end of the second business day following a change in ownership of securities or derivative securities (including the exercise or grant of stock options) for individuals subject to Section 16 of the Securities Exchange Act of 1934.

What does this mean?

Ultimately this means that if you’re interested in a company you can very quickly and easily go through the Form 4 that have been filed for that company on EDGAR.

This lets you see if any insiders have recently bought or sold shares in the company.

After all, insider trading rules don’t actually prevent buying and selling on insider information, they simply punish them if they get caught.

Since insiders may have Insider Information available to them, even if they don’t consciously misuse that information, or if the level of evidence for that misuse is insufficient to convict, it may be that their buys and sells might transmit useful signals for prospective investors.

So whenever I am thinking of investing in a company, I like to go through the filings to see if insiders are buying or selling.

The easiest way to do this is by using a free application, such as the Open Insider Website.

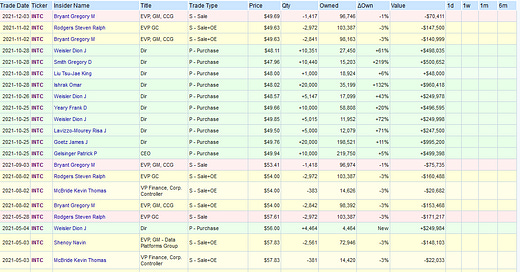

For example, let’s say I want to check out if Intel Insiders have been buying or selling stock.

All I have to do is go to open Insider, and search for Intel, this shows me that over the past 6 months quite a lot of insiders have purchased Intel Shares, while only a few sold.

Now, there may be many reasons to sell shares, Insiders might want to purchase a home, or perhaps they have come accross an unexpected expense.

But there is only one reason they might buy a stock, it’s if they think that the stock is going up!

The insider has only one reason to buy: to make money.

And:

Insider buying is a positive sign, especially when several individuals are buying at once.

And he is right!

If we look back at insiders, we can see that they tend to outperform the market, even with the restrictions that the SEC imposes on them!

Summary

Don’t buy and sell companies based on insider trading.

That being said, when you value a company, and think it’s good value, having a look at insider buys can be a good indicator that you’re not missing anything serious about your investment thesis.

If you see a lot of insider sells on a company that you feel is good value, then perhaps it might be worth taking a second look at the company to double check that you haven’t missed anything.

What about you? Do you use insider trading as an indicator to the health of the company?

Let me know in the comments below!

See you next time!