How 401Ks work

A small mistake with big consequences

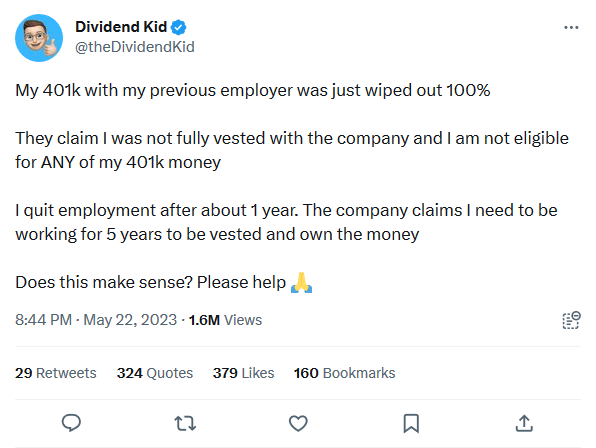

A couple of weeks ago theDividendKid caused a bit of a stir on Twitter when he tweeted this:

Now this was clearly a bit of a blunder on Dividend Kids part, since it was clear that he just misunderstood certain things about his compensation package, and how 401Ks work.

That said it does illustrate a very real problem which I’m guilty of myself!

That problem is:

Most people have little understanding of how their retirement accounts work

So I thought I would give a bit of a crash course about how 401ks work, what vesting is, and some of the other details around the topic.

What is a 401k?

A 401(k) plan is a tax-advantaged retirement savings account established by employers in the United States. It is named after the section of the Internal Revenue Code that governs it.

This retirement savings vehicle allows eligible employees to set aside a portion of their salary before taxes are deducted, enabling them to potentially grow their retirement savings more effectively.

It's important to note that there are contribution limits imposed by the Internal Revenue Service (IRS) on how much you can contribute to your 401(k) plan each year.

These limits are designed to ensure that the tax benefits of 401(k) plans are targeted toward retirement savings rather than other forms of income reduction.

What is an Employer contribution?

Because 401ks are part of your compensation, and are managed by your employer, the employer may choose to provide you with additional contributions into your 401k account as a form of increasing your compensation while minimizing the tax impact.

Employer contributions can take different forms, and companies have the flexibility to design their contribution plans based on their financial resources and desired employee benefits.

These contributions may be subject to restrictions or conditions.

What is an employer match?

An employer match is when an employer will “match” you for however much money you put into the 401k.

In other words, it’s essentially the employer saying “If you put in $1, I’ll match you and put in $1 as well”.

Employers may establish a matching formula, such as matching a certain percentage or dollar amount of the employee's contributions up to a specific limit.

For example, a common matching formula is a 50% match on employee contributions up to 6% of their salary. This means that if an employee contributes 6% of their salary, the employer will match that with an additional 3% contribution.

What is Vesting?

Vesting is a way for employers to encourage you to remain with the company for longer.

In the case of 401k vesting generally means that the employer will contribute/match your contribution to your 401k, but you only get that contribution free and clear once the conditions of the vesting occur.

If they don’t occur, the contribution is returned to the employer.

Usually the conditions are something like “You must remain a part of the company for X years”, and so once the X years from the contribution pass, the money is yours (assuming you didn’t quit!).

This is what happened to the Dividend Kid, he simply didn’t stay at the company long enough for his employers contributions to vest.

It's important to note that employee contributions, which are funds contributed directly from the employee's salary, are always 100% vested. Only the employer's contributions or matches are subject to vesting requirements.