What is Greif?

According to their Annual report,Greif is:

We are a leading global producer of industrial packaging products and services with operations in over 40 countries.

We offer a comprehensive line of rigid industrial packaging products, such as steel, fibre and plastic drums, rigid intermediate bulk containers, closure systems for industrial packaging products, transit protection products, water bottles and remanufactured and reconditioned industrial containers, and services, such as container life cycle management, filling, logistics, warehousing and other packaging services.

We produce and sell containerboard, corrugated sheets, corrugated containers and other corrugated products to customers in North America in industries such as packaging, automotive, food and building products.

We also produce and sell coated recycled paperboard and uncoated recycled paperboard, some of which we use to produce and sell industrial products (tubes and cores, construction products, protective packaging and adhesives).

In addition, we also purchase and sell recycled fiber. We are a leading global producer of flexible intermediate bulk containers and related services. We sell timber to third parties from our timberland in the southeastern United States that we manage to maximize long-term value. In addition, we sell, from time to time, timberland and special use land, which consists of surplus land, higher and better use (“HBU”) land and development land.

That’s a lot of words, but the business is actually fairly straightforward once you think about it.

They make barrels.

There’s a bit more to it than that, they also make tubes, cartons, partitions, etc…

As a whole the company is an industrial packaging business that designs and produces packaging solutions for other businesses. This can be barrels (their traditional business) or stuff like cardboard boxes, tubes, etc…

This is a simple business that anyone can understand, and its long standing history is proof that the business is difficult to disrupt, even while operating in wildly different markets, economic conditions and regulatory environments.

This is the sort of business that you can explain to a child and have them understand what it does, and how it makes money, so it is perfect for investors like me who like the KISS principle.

Remember, when investing, you got to Keep It Simple Stupid!

Of course, not all things are positive for the company!

On a fundamental level they produce a commodity-like product with highly standardized products that have little if anything in the way of differentiation. Any advantage the company may have over its competitors must therefore come from cost controls or efficiencies of scale.

They have managed to do so so far, however there is no guarantee that they will continue to do so indefinitely into the future, and given the simplicity and standardization of the products, its essentially impossible to prevent any new entrants from coming in and competing directly with GEF 0.00%↑ either on a local level, or more importantly on a local level.

Still, a 150 year old history, a simple and boring business, and a willingness to return capital to shareholders is worth a look!

Business

Strategy

Greif has a fairly good investor relations section in their website, and their latest investor day presentation is certainly worth a look at.

As a whole the company right now is focused on diversifying its business away from its traditional steel and container-board business to a more balanced portfolio with their Paper, Packaging & Services (PPS) segment taking on a more prominent role.

As you can see this is actually a process that they have been working on for a few years, and that is well on its way.

As part of this strategy they have made a number of changes to the business, most notably a handful of acquisitions in the PPS segment.

While I don’t generally like moving away from a tried and true formula, there are some advantages in diversifying away from the Global Industrial Packaging (GIP) segment, particularly given its natural cyclicality, and low expected growth rates.

The PPS segment on the other hand is currently seeing some favorable winds blowing in its direction, with the push towards recyclability, sustainability and plastic substitution coming in to provide new and exciting opportunities in the segment.

This allows them to prioritize higher margin products, which in turn results in a more efficient and profitable business.

Alongside this, do you remember when I mentioned that the company was a commodity-like manufacturer that made its money based on efficiencies of scale and cost controls?

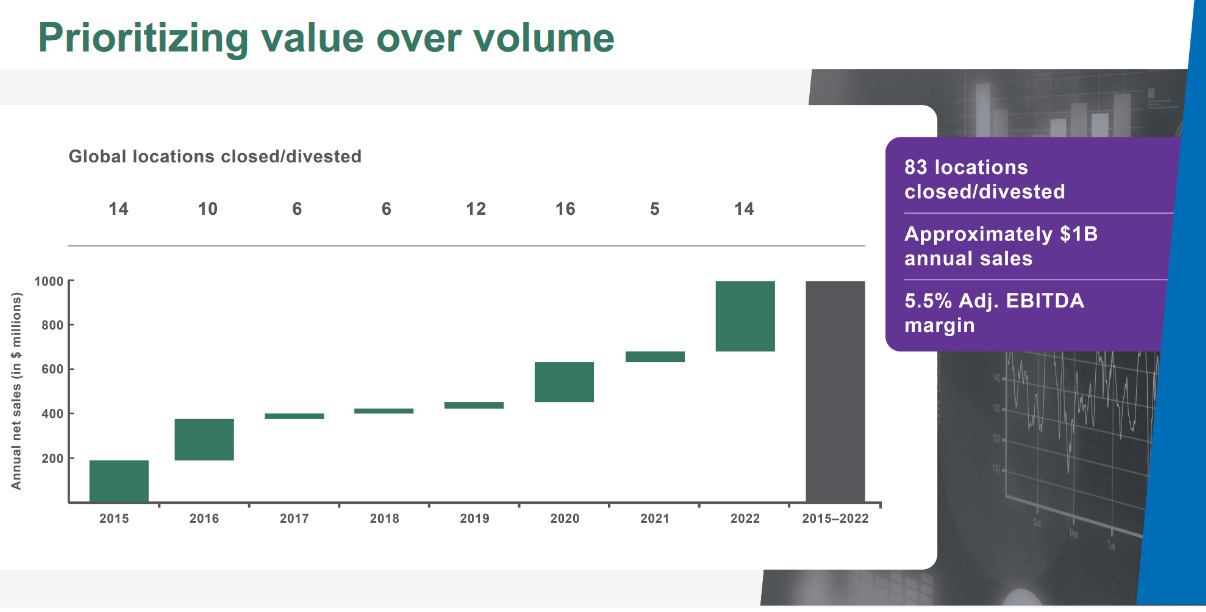

The company's management is clearly on the ball here, and over the past decade or so has been closing low-margin or unprofitable locations in order to more efficiently allocate capital.

It's understandable that most investors would be put off by a company shutting down production plants, reducing its workforce, and being on a path that seems to be on the decline, however I’m not most investors.

I don’t generally mind it if a company has low or no growth, so long as its is trading at a suitable price, and the company's situation and actions are clear and understandable.

To me, Greifs shrinking footprint is well in line with what I would expect from a commodity-like business trying its best to efficiently allocate capital, and so I’m not too troubled by it. Arguably I’d be more troubled if the company kept expanding its fixed costs without a clear and profitable growth in revenues and earnings waiting in the wings!

And so far, that strategy has seemed to work, not just from an increased margin perspective, but also from a revenue perspective.

While going from $3 billion in revenue in 2016 to $5 billion in 2021 might not seem like much in the way of growth, when compared to the tech darlings that are now getting their stock prices crushed, I still think its a perfectly reasonable growth for a mature industry that has been around for a very long time.

And that’s really what's important here, time.

The company is highly focused on the long term prospects of the business, and that involves not taking too many risks, staying in its area of competences, and being careful not to over-expand in a raging bull market.

To me the balanced growth and margin expansion strategy they are going for is a great way to run a company like this, and its focus on value-accretive capital allocation, and cash return to shareholders are encouraging sights for investors like myself.

Reporting Segments

As we mentioned before the company has 2 core segments:

GIP - Global Industrial Packaging

PPS - Paper, Packaging & Services

GIP is the traditional business that built this company, and it is still a significant part of the business and the company's strategy.

With $3 billion in revenues, $400 million in EBITDA, and a global footprint this side of the business is quite interesting, though it’s important to note that it is also highly dependent on the petro-chemical industry with lubricants/ petrochemicals and specialty chemicals comprising most of the business.

That said the company’s wide range of products, deep integration into the worlds supply chains and most importantly the longevity and trust with its client relationships provides a highly enduring competitive advantage over new entrants.

PPS on the other hand is a “young cousin” of the GIP segment with all of the issues that come along with it.

That said, its growth and profit margins in recent years is quite encouraging, and indicative of the quality of the underlying business.

Its new and emerging products provide a healthy and sustainable growth engine to what is arguably quite a boring and mature company.

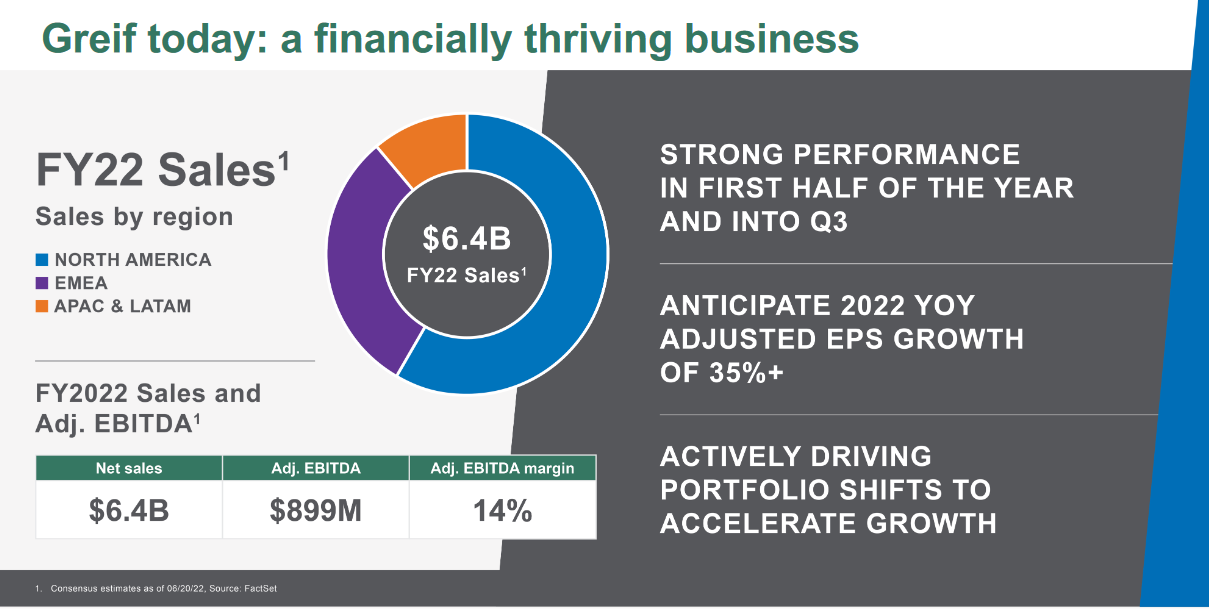

Geographical Diversification

While the company operated worldwide, the bulk of the companies sales come from North America and EMEA, with the rest of the world representing a negligible portion of the business.

In a way this distribution is to be expected, given the high GDP and the considerable petrochemical production occurring in the US and in the Middle East.

For the most part I believe that this revenue distribution is likely to continue going forward, particularly since the growth opportunities for PPS are mostly located in North America and Europe.

Management

Ole Rosgaard is the president and Chief Executive Officer of Greif, having joined the company only in 2015.

During his tenure at the company he has overseen the Rigid Industrial Packaging - North America business unit, and has served as vice president for the GIP segment.

Additionally from 2016 to 2019 he led the transformation of the company’s Sustainability program bringing it into an industry-leading position. Most recently, he was Greif’s COO.

Overall he has seemed to have led the company in a capable manner, and I have no objections to his work so far. That being said, his short tenure at the company, and particularly as COO means there are still a lot of questions unanswered and the only time will tell.

In terms of insider buying/sales we can see that there have been quite a lot of sales on the part of insiders recently, though if you look back to earlier in the year when the company was at a more attractive price we can see plenty of buys alongside the sales.

Generally I don’t see any red flags here, though perhaps the company might be slightly overvalued according to insiders.

Risks

Internal Risks

Limited “fat” to cut

Difficult to find additional economies of scale while shrinking a business

External Risks

Commodity-like business with no differentiation

Highly susceptible to a downturn in the oil markets

Fundamental Data

Income Statement

Revenue Growth

Overall revenue growth isn’t great, but it's also not terrible.

Sitting at a 10-year revenue CAGR of around 3%, this is about what we would expect for a mature business in a cyclical industry that has just gone through a down cycle.

Margins and Earnings

It’s clear to me that the 2021 earnings were a massive outlier, with profit margins being substantially higher than in other years (as were revenues).

I would not expect such a situation to repeat, and so I would expect that margins and earnings per share to return to their pre-2020 levels. The question then becomes whether or not 2018 and 2019 were outliers? I would expect 2018 to be one, given its substantially higher margins, but 2019 might not be.

If we assume a return to a 2019 mean, then we’d expect EPS in the range of $3.5 for 2022 and forward. This would be sufficient to sustain the dividend, but doesn’t leave a lot of room for growth, and indeed the dividend has been flat for years so betting on this company being a dividend growth machine is not a good bet to take.

Furthermore the pre-tax margins are quite a bit lower than what I like to see, owing to the commodity-like business that GEF 0.00%↑ is in.

Overall, this isn’t great.

Balance Sheet

Shareholder Equity

The company has kept its book value fairly stable between $20 and $30 per share over the past decade.

Unfortunately the company doesn’t have all that much cash on hand, and would likely need to raise capital if the companies long term debt comes due soon.

Of course it’s important to note that the bulk of this book value consists of goodwill and other intangibles, so I don’t think that this is a good asset play.

We’re buying this company for its earnings capacity, not its assets.

Debt Schedule

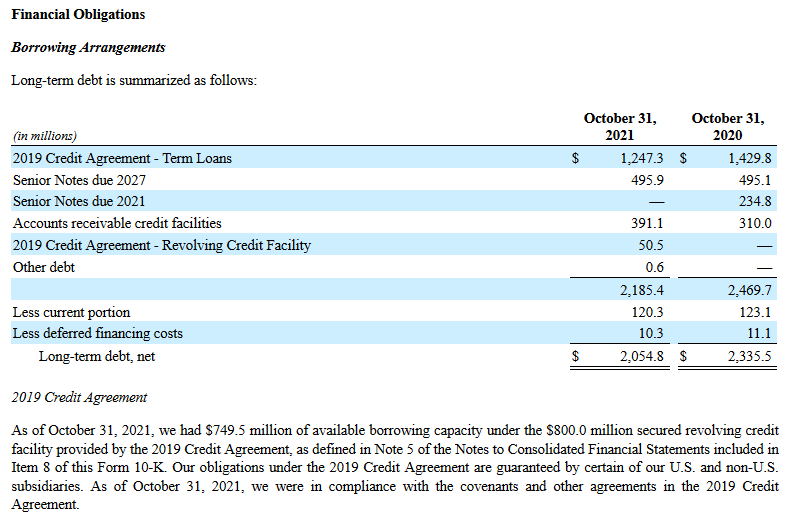

The bulk of the company's long term debt consists of term loans and senior notes that are due in 2027.

I am a bit concerned that the “upcoming recession” might result in the company failing to meet the covenants of the 2019 credit agreement, and so this may be a danger since they don’t have the cash on hand to pay that off, and would likely need to refinance the debt at unfavorable rates.

Shareholder Returns

The company has been paying dividends for decades, and has generally stayed away from share buybacks over the past decade.

That said this might be changing with a new $150 million buyback authorization…

Buybacks

As we can see, the company's outstanding shares have been totally flat over the past decade, though this might change in the near future (not by much though)

Dividends

The dividend paid per share has also been flat at around $2 per share over the past decade (the changes in the chart are due to rounding the cash-flows and outstanding shares in the annual reports).

Strengths and Weaknesses

Strengths:

Demonstrated willingness to return capital to share holders

Somewhat of a comeback over the past 5 years

Clear strategy and growth path

Weaknesses:

Multiple share classes

Low growth

Potential debt trouble

Valuation

Key Ratios

Overall we can see the key issues with the business here in the key ratios.

Low revenue growth, low pre-tax margins, low returns on Assets and returns on equity…

The one good thing is the 14% earnings growth, but not only is that reliant on increasing margins (which I doubt will continue), but also due to a potentially unique year…

I like the company, I really truly do enjoy these sorts of boring companies that have been around for decades, and rewarding shareholders, but the quality of this business simply isn’t that strong…

Standard Valuations

Overall the valuations look bad, and though Ben Grahams method may look high, you should be aware that this is getting heavily impacted by the unusual EPS growth. I would honestly not take too much stock in those particular numbers.

The discounted earnings do look good though!

Safe Purchase Value

Overall this Safe Purchase Price is unreliable in my view, due to the heavy impact that Ben Grahams valuations have had.

Personally I think the real average long term value is much closer to $50-$60, and so a real safe purchase price would be closer to $30.

Investment Thesis

Key Points

$GEF is a simple and understandable business

The quality of the business isn’t great

I don’t like the multiple share classes

The valuations are being heavily impacted by an unusual 2021

The dividend is likely safe, though I wouldn’t expect much in the way of share buybacks

Decision

I’m not buying GEF 0.00%↑

Don’t get me wrong, I like the company, I like the business and I do have a little bit of a soft spot for it.

But ultimately the quality of the business is too low for its current valuation, and even though a 9 PE is usually a fair deal, I'm concerned that that 9 PE is coming off the back of an unusually profitable year and that it’s actually closer to a 18 PE…

For this sort of business i find it difficult to pay these current prices, and so I’m just going to keep it in the back-burner, and wait for a better entry price.

Current Stance: HOLD

What about you?

Do you like GEF 0.00%↑? Do you own it? Let me know in the comments below!