Foot Locker

A value play through and through

Foot Locker

What is Foot Locker?

According to their annual report, Foot Locker is:

Foot Locker, Inc., incorporated under the laws of the State of New York in 1989, is a leading global retailer. Foot Locker, Inc. leads the celebration of sneaker and youth culture around the globe through a portfolio of brands including Foot Locker, Lady Foot Locker, Kids Foot Locker, Champs Sports, Eastbay, Footaction, and Sidestep.

As of January 30, 2021, we operated 2,998 primarily mall-based stores, as well as stores in high-traffic urban retail areas and high streets, in 27 countries across the United States, Canada, Europe, Australia, New Zealand, and Asia. Our purpose is to inspire and empower youth culture around the world, by fueling a shared passion for self-expression and creating unrivaled experiences at the heart of the global sneaker community.

In other words, Foot locker is a retailer that operates stores that sell sneakers and other sneaker related apparel.

This is not a complicated business, there aren’t a lot of bells and whistles, you don’t need to wonder about the government declaring the industry something of national interest and nationalizing it.

It’s a bunch of sneaker stores. They sell sneakers. That’s it.

This is the sort of business I generally like precisely because of its simplicity. You don’t have to have in depth knowledge of arcane subjects to understand what they’re doing, and whether they are doing it well.

You don’t need to have a masters in bio-genetics in order to figure out if their pharmaceutical pipeline is viable. You don’t need to worry about the possibility of them having miscalculated their risk, causing them to have collected too small insurance premiums for the massive liabilities they’ve taken on.

This is a sneaker store, it sells sneakers.

There’s thousands of their stores all over the world, if you want to understand their business model, just go to a store, look around, buy a sneaker and you will have seen first hand how they make money.

Business

Strategy

The physical sneaker store is the core of the business proposition for Foot Locker, regardless of the ongoing digital transformation and omnichannel approach that the company is conducting.

Customer experience, flexibility and branding power as a one-stop-shop for sneaker and other sportswear is the value proposition that Foot Locker is offering its clients.

In order to maintain said value proposition the company conducts a number of investments and faces operational challenges. This involves advertising, remodeling of stores to maintain a high quality experience, and seamless integration of direct to consumer and in-store purchases.

It’s clear that customer experience is a driving force behind the companies results, and is what will make of break the companies business in this increasingly online world.

For a customer who wants to buy shoes, Foot Locker essentially provides the ability to try out the sneakers before purchasing, as well as a way to find new sneaker brands and other apparel.

As long as Foot Locker remains the place to do that, by providing an attractive experience, and by having the mind share related to it, then they will have a small competitive advantage.

Of course in order to be able to provide such experiences, Foot Locker will need modern, high quality stores in many different locations, so that it’s more attractive to customers for them to get out of the house and go to a store, than to simply order it directly from the manufacturer.

The management team knows this, and have been focusing their investments in improving the quality of the customer experience by renovating stores, establishing hyper-local strategies and digitizing the company, as well as improving the R&D investment:

Reporting Segments

Foot Locker has 3 reporting segments:

North America

Europe, Middle East, and Africa (EMEA)

Asia Pacific

Each segment includes the results of the stores and direct-to-consumer sales in their respective markets.

Unfortunately Foot Locker does not seem to release absolute numbers for each of these segments, which makes it difficult to judge not just how much each segment is contributing for the companies sales and earnings, but also shows a concerning lack of transparency towards the companies numbers.

That’s the reason why instead of these 3 reporting segments, I prefer to consider the sales channel, since for those we do have some data (though still not enough!)

There are 2 main sales channels for the company:

Stores

Direct-To-Customers

Stores are simple to understand, it’s the typical Foot Locker store in malls. Direct-to-Customers is the aggregation of the company's digital offerings.

As a whole, the in-store sales have a dominant position in the companies revenues, and even in 2020 when in-store sales were forced to stop, and Direct-To-Customers sales exploded, the in-store sales still represented around 75% of the companies sales.

Geographical Diversification

We may not have a clear picture of the sales of each segment, but fortunately the company does release a list of stores, including to which segment they belong to:

With the exception of Sidestep (based in Europe), Foot Locker Europe, Foot Locker Pacific, and Foot Locker Asia, the vast majority of Foot Locker stores and retail square footage are based in North America.

Assuming that sales and earnings are inline with square footage that means the vast majority of sales and earnings (around 80%) are coming from the North American segment, most of which in the US.

This is a high amount of concentration, and given the cultural impact of sneaker culture is most felt in the US, it’s clear that an investment in Foot Locker is an investment in the US, and it’s people's disposable incomes.

Management

The CEO of of Foot Locker is Richard Johnson, and has served as CEO since 2014 and Chairman of the board since 2016.

Mr. Johnson joined Foot Locker in 1993 and has grown alongside the company, playing an integral role in developing and executing the company’s strategic plans and growing its direct-to-consumer business.

I honestly don’t have much to say about his tenure as CEO, he’s taken an OK business and kept it running as well as anyone would have.

I do like some of his policies, particularly the fact that he hasn’t taken the 2017 Tax reforms as an excuse to leverage the company up and take on a lot of debt.

Indeed the company has essentially no debt, which is encouraging to see.

His decision to cut the dividend in 2020 was regrettable, but understandable given the uncertainty of the situation. The fact that he has since restored the dividend bodes well for both the future of the company and the success of its shareholders.

Risks

Internal Risks

Low profit margins mean the business does not have a meaningful moat

Lack of transparency in segment reporting

Highly concentrated in the US

External Risks

Long term trends are moving away from physical retailers

Heavily exposed to a single supplier (NIKE)

Heavily exposed to landlords

Fundamental Data

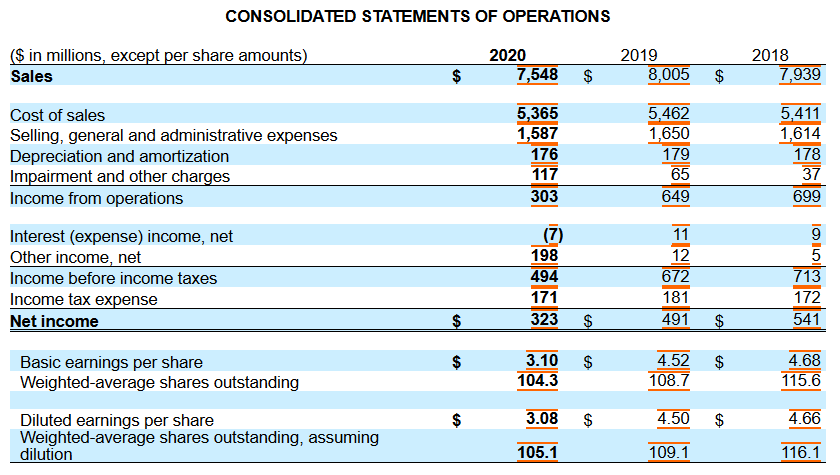

Income Statement

Overall the company has been profitable throughout, even in the disaster that was 2020, where almost all of the companies stores were shut down for months at a time, Foot Locker has been able to maintain sufficient profitability to fulfill its commitments (and in hindsight maintain its dividend).

That said, over the past few years business does appear to not be growing… Or does it?

Those are the 2021 numbers, and we can see quite a lot of growth! Almost 1.5 Billion in extra sales, with a corresponding jump in net income!

I honestly don’t expect this to carry on, and indeed neither does the company. They have set guidance at quite a significant revenue decrease for 2022, which I find reasonable.

A quick note, the 2021 annual report isn’t out yet, but the numbers have been released in their latest quarterly call. I will be using those numbers for my valuations and standard ratios, etc… But I encourage you to confirm them for yourself once the report is out.

Revenue Growth

Revenue has steadily grown over the past 10 years, with the exception of 2020 which was an outlier year in most respects.

That said, revenue growth hasn’t been particularly high, merely around 4.2%, and that’s including the standout 2021 year, which had quite a lot of pent up demand from 2020.

4.2% isn’t bad, but it’s also been quite a long bull market, where income and leisure spending has grown tremendously. It’s clear however that physical retail like Foot Locker has not benefited from the expansion of internet retail in the same way as some of its competitors.

Could that change?

Perhaps, after all they’ve certainly been investing in their online business, and it has grown tremendously in 2020, and likely 2021. Maybe that will provide the catalyst they need to jump-start their sales growth.

Margins and Earnings

The past 5 years have been difficult, 2017 wasn’t great for earnings, and both revenue and earnings have remained more or less flat ever since.

2021 is a major outlier, but not one that I think is indicative of a major systemic change to the company's business, so it will likely return to the mean soon enough.

That said, the Direct-to-Consumer business did grow tremendously in 2020, and its integration with the existing physical retail can provide a catalyst to increase revenue and subsequent earnings.

Realistically I would expect earnings over the next 5 years to be similar to the levels we saw in 2018 and 2019, of around $4 per share.

Their pre-tax margins too are a bit disappointing, though that is par for the course when it comes to retailers.

This is part of the reason I generally dislike and don’t invest in retailers. Ultimately a company's profit margin has a 1-to-1 relationship with the quality of the business, and the higher the better.

Foot Lockers average pre-tax margin is around 10% which is indicative that the company has no meaningful moat, though it also isn’t in a terribly competitive industry like supermarkets with their 2-3% margins are.

Overall the company's earnings ability is OK. It’s not bad, it’s not good, it’s just OK.

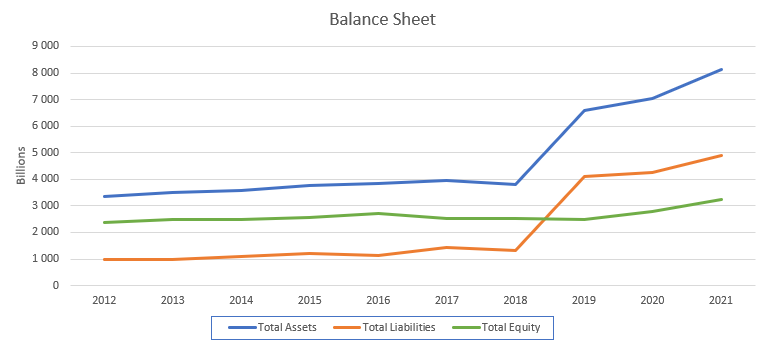

Balance Sheet

Shareholder Equity

Overall the company has kept shareholder equity relatively stable, which given that they have been consistently profitable over the past 10 years means that they have been passing on most if not all of their earnings to its shareholders.

This is actually quite good, and exactly what I’d want to see from a legacy business that is getting “eaten up” by technology.

Yes, the company could have spent millions of dollars jump-starting its direct to consumer internet business, however the fact is that sort of thing has major risks, costs, and would almost certainly not have been successful.

Deciding to wait and see if and how such a business would be successful by sticking to the sidelines and then buying up one of the businesses that did make such investment, was, in my view, a wise decision, and one that put billions of dollars in Foot Lockers owners pockets.

The company has been run as a cash cow, which is exactly what I want from it.

Debt Schedule

Foot Locker has essentially no debt. They could pay all of their debt today with the cash they have in the bank, and would still have more than enough cash to run their operations.

Now I don’t know if you know this, but when a company has no debt, it’s really hard for it to go out of business. It takes a really special management team to succeed at bankrupting a company that has no debt.

This is a major positive indicator for me that the management team knows what they are doing, and that the company has a fortress-like balance sheet.

This is great!

That being said, you may have noticed a major increase of liabilities in 2019 and are wondering what that’s about.

That’s the result of a change in GAAP accounting standards, which meant that lease commitments, which were previously seen as an operating expense, were now accounted for as an asset and liability in the balance sheet.

This is a good change, but has made companies like Foot Locker have significantly higher liabilities than they used to have (though those liabilities have always existed, and are now simply shown in the balance sheet).

You can learn more about this change, and the benefits of it from this video from Professor Damodaran.

That said, these lease commitments are liabilities, and so we should have a look at when and how much these will cost, and for how long.

The average term of the leases has been decreasing, and the amount of stores that are outside of (dying) malls is increasing.

This is actually quite good for the company because short lease terms means they can more easily cut under-performing stores without having to pay penalties for disposing of the lease early. This added flexibility is great for a “dying” business.

That said, how much will they have to pay?

As you can see, lease payments are around 700 million, and decreasing in the coming years as some leases expire.

Realistically this value should remain more or less constant over the foreseeable future, and will naturally impose a drag on earnings. That said, it’s a necessary expense to do business, and there’s no real way around it, unless Foot Locker wants to get into the commercial real estate business (which it should definitely not do!).

Overall, nothing too concerning.

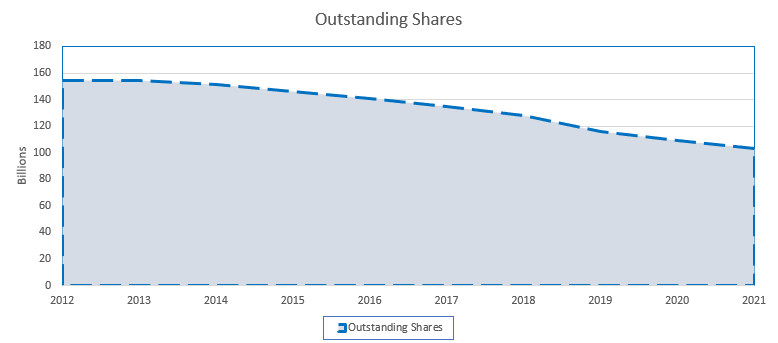

Shareholder Returns

Buybacks

Foot Locker has been consistently buying back stock, at a rate of around 4.4% per year. This is great, and exactly what they should be doing at this stage in their business.

This effectively means that their per-share revenue growth is much higher than the low 4.2% it at first appears to be.

Additionally they have authorized a 1.2 billion dollar share repurchase program, which seems to imply they will be buying back around 40% of all shares outstanding (if they buy at current prices!).

I don’t expect this program to be completed, just like the previous one hasn’t been completed, but I do expect them to make quite a dent, and spend a good 400 million dollars a year in buying back shares.

That amount would be in line with their historical norm, and is something that they can do with the cash they have on hand without jeopardizing their ability to pay off the little debt they have.

Dividends

Source IO Charts

Up until 2020 Foot Locker was a fairly steady dividend grower (with an exception in 2009/2010 where the dividend remained flat).

While dividend cuts are not great, given the circumstances I do believe it was the right move at the time to cut the dividend.

That said, the fact that they have since restored the dividend, and indeed have been increasing it such that their new annualized dividend is greater than in 2019 means that paying a dividend is seen as a responsibility by the company.

This is a good thing, after all, ultimately the purpose of companies is to pay a dividend.

Strengths and Weaknesses

Strengths:

Proven ability and willingness to return capital to shareholder

Fortress balance sheet with no debt

Track record of good decisions when it comes to operating a shrinking business

Weaknesses

Both Short-term and Long-term headwinds that will reduce revenues

Very exposed to a single supplier who is moving away from Foot Locker (NIKE)

Further lock-downs would again jeopardize the dividend, as would an economic crisis.

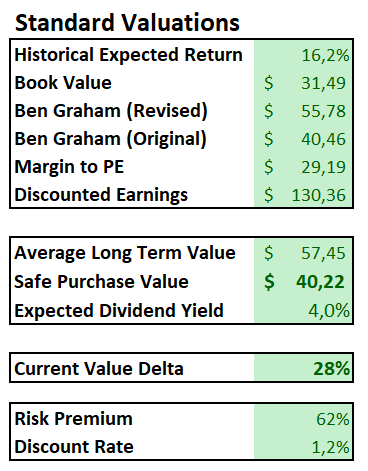

Valuation

Key Ratios

The key ratios all look good, though I suspect that they are being propped up a little bit by the blowout year that was 2021.

That being said, their EPS growth rate, Dividend Growth rate, buyback yields, etc… are all top notch, and I have no complaints there.

The 3 things I would point out as problematic are Revenue growth rate, Pre-tax margins and finally tax rate. We’ve already talked about the first two, and the tax rate isn’t something that the company can really change, so i’m inclined to give them a pass here.

That said…

Just look at that earnings yield!

This company is trading at a 3 PE, which means that if you bought out the entire company, in 3 years you’d have your money back!

This is incredibly cheap, and I suspect that a combination of unusually high earnings off a blowout one-off year, combined with the negative guidance, and the expected reduction of Nike’s business means that the share price has been hit severely.

I think this is probably a wild overreaction since nothing has really fundamentally changed with the company, and even if future earnings will be decreased, I can’t see them going back to 2020 levels (and even if they did, it would still be attractive!).

Standard Valuations

As you can see the standard valuations give us a significantly higher value for the company than what it is currently trading at.

While I do think that most of these valuations are too higher up, as a result of the 2021 outlier, even if we were to use 2020 numbers we would still get values significantly higher than the current share price.

Indeed, the company is currently selling below its book value!

This is a profitable company that is returning substantially all of its earnings to shareholders, and its selling below book value!

This is insane to me, and indicative of a massive undervaluation of the company.

Safe Purchase Value

The “Safe Purchase Value” for Foot Locker is $176, according to my usual valuation metrics.

That said, I don’t really buy this number because it’s severely influenced by a blowout 2020 year.

I think the actual intrinsic value of this business is significantly lower than this, though still higher than its current price.

Let’s change up some of the inputs, and assume that 2021 was just as bad as 2020:

There we go.

Even if we were to buy this company at 2020 levels, that is, without its valuation metrics being biased by 2021, we would still get significantly higher valuations than its current share price!

Indeed even the “safe purchase value” would be close to 40% higher than its current share price!

Personally I think this is a fairly conservative valuation, since it would assume that future earnings and growth would be as bad as 2020, something that I find unlikely.

I’m not sure if 57$ is the correct valuation, but it’s probably in the ballpark given the headwinds the company will be facing in the coming years.

Investment Thesis

Key Points

This is both an asset and an earnings yield play

The company is selling below book value

The company is selling at a very low 3 times earnings

The company has no debt and is unlikely to go bankrupt anytime soon

The company is returning a lot of capital to shareholders via dividends and buybacks

The company will see its business decrease, but not enough to justify this undervaluation

The recent massive price drop is irrational and not justified by the companies fundamentals

This is not a long term investment, but a short to medium term investment until the company is priced closer to its true valuation

Decision

This is not a long term investment.

The profit margins are too thin and the business model too easily disrupted for me to consider owning this business forever.

That doesn’t mean however that the company is worthless, it’s not.

This is a profitable company with no debt that is being sold at well below its true value. Even if we were to assume that the company and its business is going to go through a severe downturn in the next few years, that is, even if we were to assume that its earnings over the next 5 years or so would be in line with 2020, the company would still be attractively priced.

This is a value play, through and through, and I mean to take advantage of this opportunity to load up on a fundamentally sound business at a very attractive price.

If you’ve followed me on Twitter you will know that I bought 100 shares of Foot Locker on the 28th of February for $28.47 per share.

My Current Stance: BUY

What about you? Are you buying this dip?

Do you think I’m making a mistake?

Let me know in the comments below!