Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

Albert Einstein

What is Compounding?

Compounding is the act of reinvesting the returns of your investments.

For example, if you hold a 100$ bond that pays you 5% interest plus the 100$ at the end of the year, you can then invest the 100$ you got back plus the 5$, in interest, you got into another 105$ bond that will pay you 5% interest.

In short, you are reinvesting not just your initial capital (the 100$) but also the return that you got on that capital (the 5$ in interest you got) into a new investment that will provide you a return.

This may not seem like much, but over time it adds up tremendously, and the earlier you start, the greater the effect it has.

How much does it add up really?

Well, the easiest way to check that is to do a little exercise…

Let’s say we have 2 friends, Mary and John.

They’re both 25 and are now starting their working life, having gotten their first job. They both make the same amount of money, and their career is going to be very similar throughout their life.

Mary is quite interested in finance and investing, and so she decides to invest $2000 a year in a diversified, low-cost, wide-market index fund that will return her on average 7% per year.

John isn’t quite convinced that investing is the way to go, and so he will instead use those $2000 to enjoy life while he is still young.

He will keep an eye on Mary, and if it goes well for her over the next 10 years he will begin investing and continue to put in new money for the rest of his life.

Mary will put in new money for 10 years, and afterwards she will leave the portfolio alone, simply reinvesting her earnings every year without putting in any new money.

Before we see the results, I want you to ask yourself the following questions:

Who will have put in more money during their working life?

At retirement age (65), who will have the larger portfolio?

Will that person always have the larger portfolio, or will it change sometime after retirement age?

Think on that carefully, and let’s see if the reality matches your guess.

The results

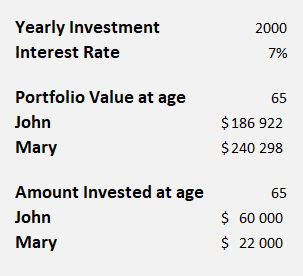

Mary with only 10 years of putting in money, for a total of $22 000 put in will have a portfolio that is over $50 000 larger than John.

This is despite the fact that she put in close to one third of what John put in!

In fact, that portfolio will continue to grow at a rate higher than johns not just while Mary is alive, but well past both of their deaths.

The late compounder will never catch up.

Let’s see their portfolios over time:

And if you want a chart:

How realistic is this?

Honestly? Very.

I didn’t pull these numbers out of my hat, I simply used numbers that make sense to me, and have historically made sense.

The $2000 of yearly investment is achievable by a significant number of people in the developed world, and I chose that number because that is the maximum amount of euros that the Portuguese tax system will reward for investing in a PPR.

If you don’t know what a PPR is, it stands for Plano Poupança Reforma and is a type of self-funded retirement fund available in Portugal.

If you invest up to 2000€ a year in one, you will receive a tax credit up to 400€. This means you’re effectively investing 2000€ while only being out of pocket 1600€!

That credit is reduced with age, hence why Mary chose to stop putting in money once she hit 35.

The 7% return is also realistic, it is the market average return after inflation over the past 100 or so years.

This is not a trick. There is no sleight of hand.

Investing early and often is a head start that is hard to beat.

So just do it!