Apple Inc.

A Megacap that's growing like a startup... Or is it?

Apple Inc.

What is Apple?

According to their latest annual report, Apple:

The Company designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company’s fiscal year is the 52- or 53-week period that ends on the last Saturday of September.

That’s probably the simplest and most concise, yet accurate, description of a company's business that I have ever seen in an annual report!

Usually I have to simplify and reword the company's description to make it clear to a layperson what a company I'm reviewing does, but in this case it’s as self-explanatory as it can be.

Apple makes smartphones, computers, tablets, and related accessories and services.

This is a massive company with gigantic revenues and profits, and it can be described in one sentence so simple that a 5 year old would understand it.

This is the sort of business I like, simple and straightforward.

Business

Strategy

Apple's strategy is surprisingly hard to come by from their own words.

If you go to their investor relations website you won’t find any presentation explaining it, or even a letter to shareholders from Tim Cook explaining what Apple does and what their plans for the future are.

To be honest, no matter how simple the business might be, and how profitable and shareholder-return-friendly it has been over the past decade, I don’t find this lack of transparency acceptable.

I understand that some companies like to keep things tight to their chests in order to preserve some competitive advantages, but that is no excuse to keep their shareholders in the dark about the basics of the company's strategy.

So, I sent an email to Tim Cook about it.

Mr. Cook has a public email, and from what I hear occasionally responds to queries, so I wrote a short email asking for any investor presentation about their corporate strategy they have, and letting them know that their Investor Relations website is missing key information.

I haven’t heard back yet, but if I do I’ll be sure to let you know!

That said, Apple is a high profile company, and while they have diversified their business into other businesses, their core business is simple and unlikely to change over the next few years:

In reality they have 2 businesses, which work together to create their competitive advantage:

Hardware

Software

The hardware business is their consumer facing products, their iPhones, earpods, Macbooks, etc..

This hardware business is the basis on which their software business rests, and its existence allows them to optimize their software business much more than their competitors like Microsoft, and it's clear that Apple knows this:

This control of not just the software, but of the hardware and the supply chain that makes it is the primary competitive advantage that Apple has, more important even than their renowned consumer loyalty.

And Apple is constantly extending this control and intermixing of hardware and software, most recently with the release of their M1 chips, which although decently performing chips in their own right, become top level chips when used in conjunction with Apple software that the chips have been designed to run with.

And at the same time, the software too plays a role in keeping consumers in the Apple ecosystem in general, and hardware in specific. Apples software generally works best in conjunction with Apple hardware, and some things are just plain exclusive (like iMessage).

The interconnectedness of apples software is famous, and they keep a tight grip on it. There’s a reason why you can’t get iOS outside of Apples phones and tablets, and why, unlike with Android, you can’t install anything that doesn’t go through Apple on those devices.

They keep a tight grip over every step of the supply chain, and customer experience, and as such they can determine the level of quality and consistency that the consumer engages with. This is part of the reason why they have high levels of consumer satisfaction, despite sometimes having inferior hardware and software with less features!

In short, Apple's strategy seems to be:

Control every step of the supply chain

Enabling greater profit margins

Enabling a better product

Enabling an interconnectedness of products

Enabling a consistency in design and performance

Control every step of the customer experience

Enabling a higher quality experience

Enabling cross-selling of products and services

Enabling a continuous engagement of the ecosystem

Enabling a consistency in design and experience.

This strategy arguably started back when Apple was initially founded, though its modern incarnation came to be only once Steve Jobs returned to the driving seat in the 90s, and has been carried on ever since by his successor Tim Cook.

Of course this strategy also has drawbacks, after all, great success in supply chain, and customer experience control invites jealousy from competitors, and most importantly attention from regulators.

Apple has suffered from this in the past, and is suffering from it today, with lawsuits in progress regarding their app store policies, and regulator attention on their hardware and software policies.

This is a problem, and significant regulatory restrictions on these parts could provide worse customer experience and hurt Apple in the process by diluting their competitive advantage.

Reporting Segments

The company manages its business on a geographic basis, and as such recognizes the following segments:

Americas

Europe

Greater China

Japan

Rest of Asia Pacific

These segments however don’t really explain where their business is coming from as well as their 5 product categories:

iPhone

Mac

iPad

Wearables, Home and Accessories

Services

Each of these categories brings in enough revenue to compete with major companies, with the iPhone accounting for over half the revenues.

This reliance on the iPhone has however been decreasing over the past few years, particularly as their services business has begun growing and taking on a more center stage position in their business model

Source: IOCharts

Geographical Diversification

Apple is truly a global company, and its products and services can be found in almost every country in the world.

That said, like many companies, their American segment is the biggest in terms of revenues, with other segments lagging behind:

Management

Tim Cook is the CEO of Apple, and serves on its board of directors. Before replacing Steve Jobs as CEO, Tim was Apple’s Chief Operating Officer and was responsible for all of the company’s worldwide sales and operations, including their supply chain, sales activities and service and support in all markets.

What to say about this man that hasn’t already been said? He came in at the right time to replace a unique CEO, and despite his significant differences in management style compared to Steve Jobs, he not only managed to fill those shoes, but has totally revamped the company in such a way that enormous shareholder value was created during his tenure.

Tim Cook is without a doubt one of the best CEOs of all time, and Apple is a much stronger company with him at the helm than it would have otherwise been.

If only he replied to the email I sent him!

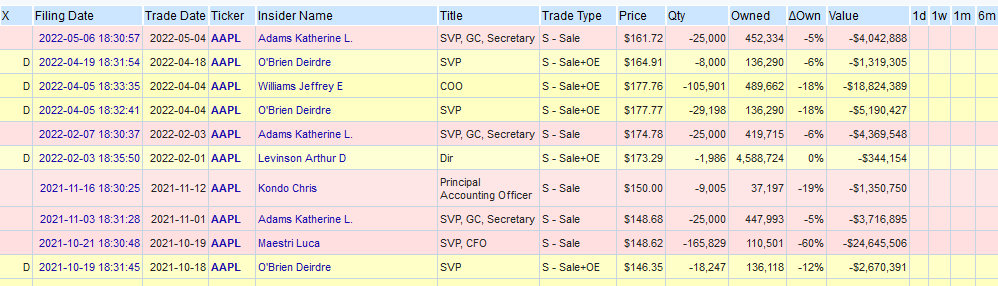

Another thing to note is that insider transactions too are missing the confidence you would expect from the management team. They simply haven’t been buying Apple stock:

This is problematic, since the company has been conducting extensive buybacks, which means the management team knows the company stock is overvalued, and yet they insist on squandering shareholder wealth on ill-advised buybacks!

Risks

Internal Risks

R&D and innovation is a crucial yet fragile core of the business

Key-man risk with Tim Cook

The business model has high CAPEX costs to attain the competitive advantage

External Risks

Regulatory action

Overly tight policies might drive out developers and worsen the product

Control over supply chain may alienate potential partners

Fundamental Data

Income Statement

The company has consistently been highly profitable over the past 10 years, with margins that are significantly higher than most other hardware companies, though slightly lower than software only companies like Microsoft.

It’s clear that their business is growing, profitable, stable and above all has a massive market that they are serving, as shown by revenues greater than many countries' entire GDP!

The R&D expenditures, while high, are only a small part of the company's operating profits, and very sustainable.

Overall this income statement is as good as it gets!

Revenue Growth

Revenue has steadily grown over the period at around 9.9% per year. This is high, especially so when we remember that Apple has revenues of around $300 Billion, so there is really not much more left to grow!

While Apple can expand into new markets, particularly in Africa and India, it’s clear that those markets are poor, and the majority of the population is not financially able to buy a premium product like what Apple sells.

While Apple could try to aim for a less upscale market segment, that would be a mistake since it would result in margin pressure, competition with its own premium products, and would dilute the brand.

It’s clear that they are aware of this, and so any further revenue growth will need to come from middle income consumers becoming high income consumers and therefore being able to afford Apple products. This unfortunately only comes through increased global wealth, and so its future revenue growth will primarily come from global GDP growth, and as such I would expect revenues to grow slower than they have so far.

Margins and Earnings

Once again, all green flags here too!

Steady and high (over 20%!) pre-tax margins and a consistently growing earnings per share that is coming off the back of consistent share buybacks.

Not a lot of companies can grow Earnings per Share at 15% for a decade straight, but Apple is one of them!

Balance Sheet

Shareholder Equity

Like many companies over the past decade, Apple has been leveraging themselves up off the back of cheap debt, and their capital structure has changed from one that prized maintaining low debt levels, to one that is now almost fully funded by debt!

This is not a good thing, and I definitely consider it a black mark on the company!

That said, low interest rates and high returns on assets means that this leveraging up is not as concerning as it would be if the company was a weaker one.

Still, it will likely put downward pressure on the amount of capital that it can return to shareholders in the future, particularly given the increasing interest rates we are likely to see in the next few years!

Debt Schedule

As you can see, Apples debt schedule has no big cliffs, and the company is more than able to make good on its commitments over the foreseeable future.

The only problem they might have is if this debt is floating rate, so let’s take a look at its structure:

As we can see the vast majority of this debt is fixed rate, and unlikely to be affected by rising interest rates.

While it’s true that higher rates mean that new debt will be more expensive, the companies cash flows is more than sufficient to pay for any investment they want to make.

If the worst case scenario happens, and they need to pay off all of this debt as soon as possible, and have no way to refinance it, then all they would need to do is pause share buybacks for 1.5 years, and they’d have enough cash on hand to pay all of this off!

Good business!

Shareholder Returns

This is a table I got from Apple's investor relations website, and it shows a truly extraordinary amount of value being returned to shareholders! Over $650 Billion in all!

Apple has clearly been extremely shareholder friendly over the past few years, and all indications say that they will continue to be that way going forward! Though perhaps we can expect a slowdown in share buybacks in the future as a result of elevated leverage!

Buybacks

Their shares outstanding have been steadily decreasing at a rate of 4.8% per year, which is quite a high level!

The one thing bad I have to say about this is that over the past few years Apple has had quite an elevated valuation, and as such the cash spent making the buybacks would be better spent on dividends!

I’ve said it before, and I’ll say it again!

If your company is trading above a 15 PE, you should be paying a dividend, not doing a buyback!

This is something that really irritates me, and I’m not the only one!

I fully support Chris D’Agnes view here, this is quite frankly a joke! They are sitting on $100 Billion that they are returning to shareholders, and instead of hiking the dividend they are buying back overpriced shares!

And they know they they are overpriced, because their board and management team has been selling their own shares regularly for years! This is mismanagement in an clear attempt to juice up the numbers to make up for a lack of organic growth!

Dividends

Source: IOCharts

As you can see, Apple has paid a steadily increasing dividend since 2012, and its dividend growth has been phenomenal!

Their payout ratio is very healthy, and their free cashflow more than covers their growing dividend!

Strengths and Weaknesses

Strengths:

Fantastic earnings power

Consistent margins

Willingness and ability to return capital to shareholders

Weaknesses

High amounts of liabilities

Overpaying for share buybacks

Scratching the limits of its growth potential

Valuation

Key Ratios

All of these ratios are great, except perhaps the ones related to valuation!

That PE ratio of 28 is above what I like to pay, and the dividend yield is quite low as well!

That said, everything else, from the buyback yield, revenue growth rate and EPS growth rate are fantastic and indicative of a high quality company!

Standard Valuations

The increased role that debt has taken on in the companies capital structure, combined with the high returns on assets makes the book value of Apple into a bit of an outlier in terms of valuation metrics.

All of the other ones though have quite a range of values to them! I usually prefer when all of the values are close, since it gives me greater confidence in my valuation, but still, even the lowest value (the Margin to PE) is above the companies current price!

Safe Purchase Value

Once we do an average of all of these valuation methods, and give the standard 30% margin of safety we get a safe purchase value of around $160, which surprisingly enough is just about where the company is currently trading at!

While the dividend yield is low, the buybacks and historical growth are bringing this value up enough to compensate for it.

Is that sustainable though? What if growth slows down? Should we go for a higher margin of safety?

That’s up to you really, though I usually try to keep things consistent between companies to enable easier comparison, so I won’t mess with the assumptions.

Investment Thesis

Key Points

Apple is a high quality company with:

Huge Brand Value

Fantastic consumer loyalty

Great products

Good margins

The company may suffer from regulatory action which may impact their moat

The company will likely have to dial down their buybacks

The company will likely reduce their topline growth

The company has no meaningful issues with debt servicing or refinancing

Decision

Overall Apple is a high quality business that anyone would be happy to own. They provide shareholders with enormous capital returns, and the staying power and consistency of the business is great!

The only thing that could possibly be used to justify not investing in this company would be their capital structure, though even that is well in the realms of sustainability, and I have no concerns on that end!

So is it being sold at a fair price? Is it undervalued?

By all accounts the answer to that is Yes! The company is undervalued!

But is it likely to remain that way? Personally I have the feeling that revenue growth will stall over the next few years, and so what is currently an undervalued company may actually be fairly valued instead, which isn’t awful, but also isn’t the return we would like to have.

Additionally I have to take into consideration my own portfolio allocation decisions, I’m still in the process of increasing my index allocation to 60% of my portfolio, and so I have a hard time justifying adding on a new position…

My current stance: HOLD

What about you? What do you think about Apple? Are you buying?

Let me know in the comments below!