An arbitrage play

The PXD and XOM merger

I’ve been following the Pioneer Natural Resources PXD 0.00%↑ and ExxonMobil XOM 0.00%↑ merger, and so I wanted to discuss it here for a bit.

The Merger

On October 11th, 2023, the companies announced an all-stock merger where shareholders of PXD 0.00%↑ would receive 2.3234 shares of XOM 0.00%↑.

At the time of the announcement this would be worth around $253, though since then the stock prices of both companies have fluctuated since.

So what is the offer now?

Current Prices:

PXD 0.00%↑ - $234.17

XOM 0.00%↑ - $103.87

This means that the merger value would be:

But wait!

We can buy PXD 0.00%↑ for $234.17, so thats some premium available to us!

But wait!

We don’t get cash! We get XOM 0.00%↑ shares! Which means we’re exposed to XOM 0.00%↑ share price fluctuations!

So how do we do this?

We Short XOM 0.00%↑ and go Long PXD 0.00%↑

So then we can expect our returns to be:

Which brings up the cost of shorting.

The transaction is expected to close in the second half of 2024, so I suppose the easiest way to hedge the possibility of XOM 0.00%↑ from going down is by buying a Put option.

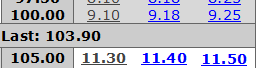

The easiest one is the 2025, 17th January Put, either the $100 or $105:

Unfortunately the cost of that Put, plus any fees, makes it so that this play is more or less dead in the water.

Theoretically the dividends we’d get from PXD 0.00%↑ might make up for it? But it’s a bit of a risk, particularly when we are still taking on the risk that the merger won’t go through.

It’s too bad, but I won’t be moving forward with this play.