What is Air Products and Chemicals?

According to their annual report, Air Products and Chemicals is:

Air Products and Chemicals, Inc., a Delaware corporation originally founded in 1940, serves customers globally with a unique portfolio of products, services, and solutions that include atmospheric gases, process and specialty gases, equipment, and services. Focused on serving energy, environment and emerging markets, we provide essential industrial gases, related equipment, and applications expertise to customers in dozens of industries, including refining, chemicals, metals, electronics, manufacturing, and food and beverage.

In other words, Air Products and Chemicals (APD) does exactly what its name implies, they manufacture and distribute air products and chemicals.

While the business model might not “click” at first, given that it is a type of business that isn’t particularly consumer facing, the fact is the products and services that APD provides are used extensively throughout many industries and many companies.

Every time you take a sip of cola, or cook a meal, chances are APD plays a role in the manufacture of the products that you’re using.

That carbon dioxide in Coca Cola didn’t get produced by the bottlers, just like the natural gas used in your stove didn’t get piped straight out of the ground into your stove, all of these things and more had to be extracted, processed, packaged and eventually delivered to the users, and it is in that processing, packaging and distribution that APD makes its money.

The company is the largest supplier of hydrogen, and has leading positions in markets such as helium, liquefied natural gas, and its related technology and equipment.

APD doesn’t just supply the gases, they also develop, and manufacture the equipment needed to process those gases, for example Liquid Natural Gas (LNG) has been in the news a lot recently, and one of the things that APD does is develop and manufacture the heat exchangers needed to liquefy the natural gas.

APDs operations are worldwide, and are of particular interest for the petrochemical industry, both as a consumer of its equipment, and as a producer of the raw materials needed for the gas production that APD engages in.

This means that APD has heavy investments in Russia, and other countries with highly developed petrochemical industries. That of course brings challenges, not just from a PR perspective, but from a business perspective, since the nationalization of the petrochemical industry is something that happens occasionally.

The situation in Russia, and APDs decision to continue doing business there, has already drawn criticism. As has their involvement with the petrochemical industry when it comes to climate change related issues.

Personally I am not too concerned with the moral implications here, I invest to make money, and as long as the return is attractive I will invest in the company no matter what its business is, or who they do business with.

That said, it’s important to know that this can be a geopolitically sensitive industry, and that involves risks and costs that you wouldn’t see in a company like Foot Locker. A shoe store probably isn’t going to get nationalized, but a factory producing a geo politically sensitive product? That’s a whole other story…

Business

Strategy

APD has a really nice investor presentation that explains a lot about the business, do give it a read!

It explains their business, goals, and highlights some of their recent projects.

APD is an established company with a steady and consistent revenue built on the back of its existing infrastructure. It’s this infrastructure that provides them with the leading position in certain markets, and the ability to provide and supply the products and services to its existing clients.

This industry is highly capital intensive and in many ways results in a “winner take all” situation where competitors are quite literally unable to provide alternative supply to the clients.

The reason for this is simple, the infrastructure needed to produce the gases, or to transport them to the client, was built and is owned by APD. This infrastructure is not able to be easily moved, and is very expensive to both create and maintain.

Not only that, but the infrastructure often is only able to serve a single client at a time, so any competitor that offers an alternative to that client will have to make massive upfront capital expenditures just to be able to provide the goods or services in the first place.

All the while APD will still have its infrastructure in place, and is able to reduce prices in such a way that makes any such investment from competitors economically nonviable.

In other words, the capital investment provides a lock-in to customers, which in turn gives the company some form of competitive advantage.

We can see that almost half of their business comes from “on-site/Pipeline” supply modes, these are long term contracts that are very difficult to disrupt.

The same sort of logic applies to their equipment & services supply mode, because APD holds a number of patents here that give them a massive competitive advantage over others.

The same logic however does not apply to their liquid bulk and packaged gas business, since these businesses have no meaningful lock-in, and can be disrupted by both new entrants, and existing competitors.

Another thing to note is that while this “capital intensive lock-in” strategy does lead to steady business that is difficult to compete with, it also means that returns on assets are quite low. Doing some quick math for 2021, we see that they got only a 7% return on capital.

This is quite low compared to asset light companies such as Microsoft which see ROAs of around 18%.

Return on Assets isn’t the be all, end all of company valuations, but it’s still important to know just how much money is necessary for the company to operate. The best companies tend to be the ones that need little capital to get a lot of earnings.

Reporting Segments

The company has 5 separate business segments each with their own production and distribution facilities. These segments are:

Industrial Gases - Americas

Industrial Gases - EMEA

Industrial Gases - Asia

Industrial Gases - Global

Corporate and other

The bulk of sales and earnings are coming from the Americas segment, though the Asia segment is also doing quite well.

We can actually see here the difference in pricing power caused by on-site vs bulk commodities supply mode that we talked about earlier.

If we take a look at the supply mode by region, we can see that Europe, the least profitable of the 3 major segments, is also the one with the lower On-Site business.

Another thing to note is that going forward these segments will change. In November 2021 the company announced they will be separating the EMEA segment into 2 separate segments, one for Europe and another for the Middle East.

Personally I think this is a very good idea, not just because the 2 markets are geographically separated, but also because they serve a very different role in the business, one as a consumer, and the other as a producer.

Geographical Diversification

The company has over 750 production facilities, 1800 miles of industrial gas pipelines, 170 thousand customers, operates in over 50 countries, and has new projects throughout the world.

Overall, while it’s true that the company could make greater inroads in Latin America, Oceania and Africa, it’s clear that the bulk of the world's economic engines are being serviced by APD, and so I’m not too concerned with lack of geographical diversification.

That said, this diversification also brings challenges, like we discussed earlier with their Russian business which is at risk. All the same, their Chinese business may be at risk if diplomatic relations there break down, like they have with Russia.

Management

Seifi Ghasemi is the Chairman, President and Chief Executive Officer of Air Products and Chemicals. He is the one who sets the strategy and policies for the company, develops leadership and meets shareholder commitments.

Mr. Ghasemis tenure has seen the reorganization of the company alongside a major spin-off, as well as higher incomes as a result of increased margins.

Overall there’s nothing in his work that I find objectionable, and by all accounts he’s been doing a decent job.

If we look at insider transactions we can see that although there are no large “cluster buys”, both Mr. Ghasemis and his team have regularly purchased APD shares.

This is quite encouraging because it shows that he and his team have confidence in the business and its future prospects.

Like Peter Lynch once said, there’s many reasons an insider would sell a stock, but there’s only one reason for him to buy, and that’s if he thinks it’s going up!

Risks

Internal Risks

This is a mature industry without easy and cheap growth prospects

The business requires high capital expenses to grow

Failures in implementing projects are costly

External Risks

Their Russian operation might be nationalized in the near future, or the company may be sanctioned

A slowdown in the global economy might impact demand for its products

Highly regulated industry

Heavily exposed to certain commodities prices

Fundamental Data

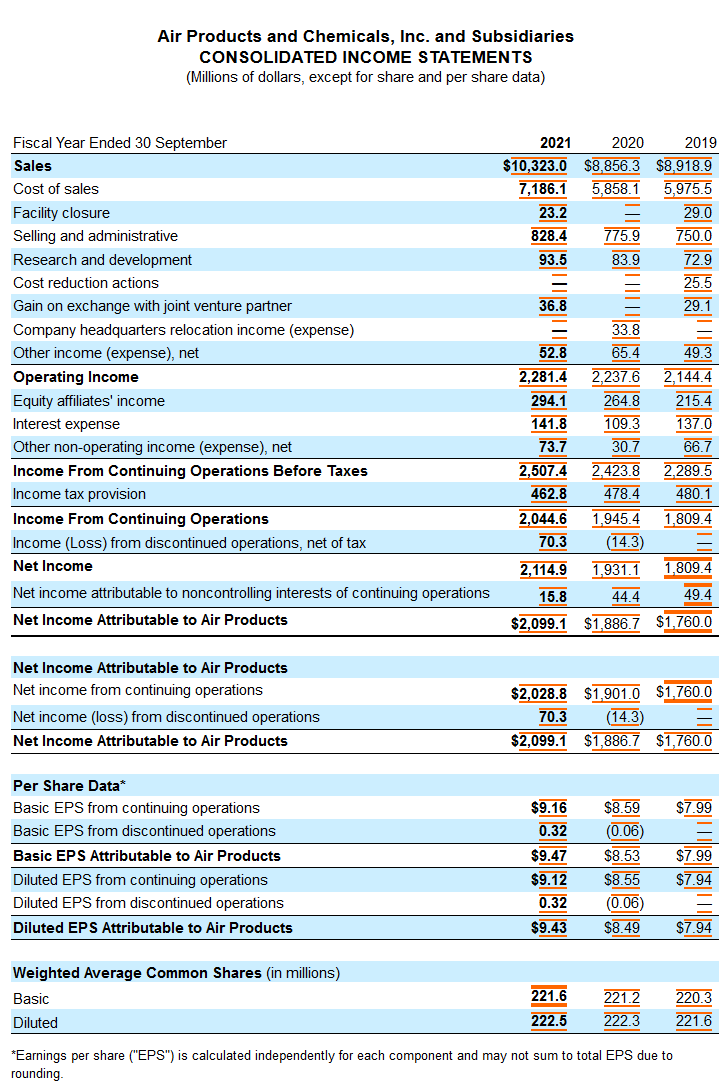

Income Statement

The company has been consistently profitable with quite substantial margins for what at first seems like just another generic commodity business.

It’s good to see that even with the widespread lock-downs in 2020 the company managed to maintain their revenues stable, and in 2021 they grew them tremendously!

Overall this looks pretty good, and is indicative of the sort of company that I like, a high margin business without a lot of interest expenditures!

Revenue Growth

Over the past 10 years the revenue growth rate has been 0.8% annually!

That’s effectively zero, and in fact when you consider inflation it’s arguably a revenue decrease, which isn’t great.

That said, part of the reason for this lackluster growth has been the result of the reorganization of the company in 2015, which included the divestment of parts of the company, including the spin-off of their materials division.

If we look only at their last 5 years, we see that their annual revenue growth rate as actually been around 6%.

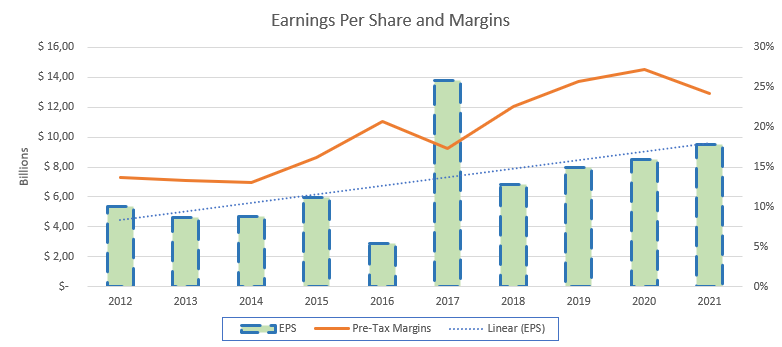

Margins and Earnings

With flat revenues, the only way to increase earnings per share is via buybacks and increased margins.

They’re certainly doing work on the margins, and their business went from a lackluster, low-margin commodity business into a higher quality higher margin business model.

Overall I’m happy with this, and the margins don’t seem high enough to be “reaching for the limit” of what’s doable.

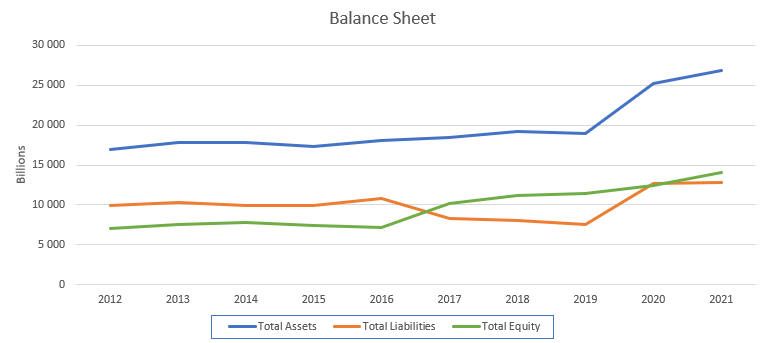

Balance Sheet

Shareholder Equity

I like how the company has kept liabilities more or less flat, and indeed from 2016 to 2019 they’re actually decreased.

That said in 2020 there was a significant increase in the long term debt, and so we need to look into what happened there, and whether their debt schedule and commitments are sustainable.

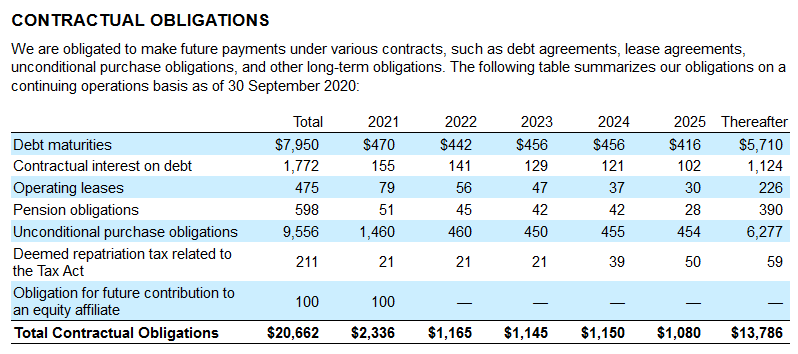

Debt Schedule

Overall their debt obligations aren’t too bad, and there is no major debt cliff coming up anytime soon.

While the total contractual obligations may seem steep, and would eat up about half of earnings every year, the thing to understand is that a significant part of these obligations are “Unconditional Purchase Obligations”, which are essentially goods that APD is obligated to buy in the future.

These are effectively products that the company will process and then sell to clients, so given the long term nature of the business, this is really their COGs over the next few years! It’s actually pretty bullish, since it’s effectively locking in the prices for the raw materials for the products and services they must supply APDs clients in the future!

As a whole I’m not concerned with this since a significant part of these obligations can be paid off with the cash and cash items they have in their balance sheet.

Shareholder Returns

Buybacks

Here we can see that APD essentially doesn’t buy back shares, and indeed they have increased their outstanding shares over the past decade.

If they were significantly diluting shareholders I would be concerned, but since the annual change is less than 0.2%, I’m really not too concerned.

This is neither good nor bad.

Dividends

This is the type of chart that dividend growth investors like to see!

APD is a dividend champion with 39 years of dividend growth, and over the past 10 years they have grown their dividend at an annual growth rate of 11%!

That said this is larger than their 6.6% Earnings Per Share growth rate, which means their payout ratio has been suffering for a while, and indeed right now it’s around 68%.

I can’t see them making a lot more huge dividend increases, since getting that payout ratio higher than it currently is would be dangerous. They will most likely continue to increase the dividend at a rate more in line with their Earnings Per Share growth rate.

Strengths and Weaknesses

Strengths:

Mature steady business

No looming issues

Demonstrated willingness to return capital to owners

Weaknesses:

Dividend growth rate will have to slow down in the future

Slightly high payout ratio

Concerning increase in long term debt in 2020

Valuation

Key Ratios

In general these ratios look pretty good for the business. The only thing to take note of is what we’ve already discussed, the low revenue growth and lack of share buybacks.

I’m not necessarily opposed to owning a no-growth company, though given their performance over the past 5 years, it’s not even clear that APD is such a “no-growth” company.

At the end of the day their EPS growth rate is attractive, and they don’t seem to be on the edge in terms of paying out more than they can afford.

If we recall, substantially all shareholder returns come from EPS growth and Dividends, so assuming the growth rates of EPS hold, we’d expect to get a return of 2.6% + 6.6% = 9.2%

This isn’t ultra high, but it’s also not something to sneeze at… If growth is maintained! If growth reduces, or if there is multiple compression, it’s a whole other story!

So how likely is that to happen? Personally I’m a bit of a pessimist, so I’d say very likely, but you may fall somewhere else.

Standard Valuations

And here we see the issue.

All but one of the standard valuation methods give us values lower than APDs current price.

On the bright side we can see that the various valuation methods give fairly similar results, so I’m not too concerned about being too wrong about any given one being wrong.

Given that we are buying this company for its earnings power, I’d prize the margin to PE method as the most accurate one (it doesn’t hurt that it’s the second lowest!).

Safe Purchase Value

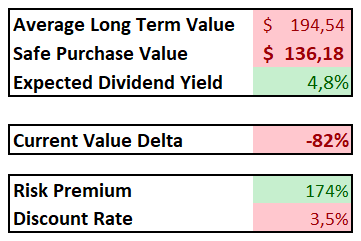

Doing a simple average of the various valuations, and giving ourselves a standard 30% margin of safety, gives us an average long term price of $194 and a safe purchase value of around $136.

This would give us an expected dividend yield of 4.8%, which seems pretty in line with historical averages for mature industries like these.

If you can find the company at around this price, it’s probably worth considering!

Investment Thesis

Key Points

Diversified stable business with good margins

Some sovereign risk is in play and must be accounted for

A long history of returning capital to shareholders

Fairly decent recent revenue and earnings growth

Low chance of default and debt and other commitments are under control

Lack of buybacks mean reduced EPS growth (not necessarily bad!)

Decision

Overall Air Products and Chemicals seems like a high quality company with a sticky product and business that is not easily replaceable by its customers.

While being a part of a mature industry means that growth prospects, and the capital requirements for that growth, are not the best, they still maintain a “cash cow” profile where they can hold steady business and profit margins, and channel those profits to shareholders.

Realistically the only thing I really object to with APD is the price that you currently have to pay in order to purchase it!

I’m not buying right now because it’s too pricey for my tastes, but if you can buy it for under $136 then it will be something I’d be happy buying.

My Current Stance: HOLD

What about you? Do you own APD? Are you buying?

Let me know what you think about the company in the comments below!