Last time we talked about AFLAC, an American Insurance company whose business is focused on the Japanese Market.

We had a look at what the company does, what its performance has been in the past 10 years in terms of earnings, and where we stand now in terms of balance sheet.

All of those things are great to give color to the company, but if we use them to do a little bit of math, we can come up with a somewhat useful valuation that tells us at which prices it might be worth buying this company.

So, let’s try a few different valuation methods, and see what comes out.

Profit Margin to PE Method

This is the method we discussed in a previous post, and can be calculated in a very simple manner:

This is a simple formula that tells you whether or not a company is currently overvalued or undervalued. If the result is above 1, then the company is undervalued, if it is below 1 then it is overvalued.

Of course there’s a bit of a range in which a company might be in, and it would be wrong to summarily dismiss a company just because it is slightly below 1, and a company with a ratio above one might be that way for good reason.

In general though, I’m flexible in this, and consider all companies with a ratio above 0.66.

That being said, we can use this ratio to derive a “current fair value” of the company.

By making a few tweaks to the formula we can get this:

The top formula gives us the fair market cap of the company, and the bottom gives us the fair per-share price.

If you’ll notice, what we are essentially saying here is that the PE at which a company is fairly valued equals the profit margin of that company.

This makes sense, after all if a company is capable of having reliably higher margins, they are probably a better company that will probably be around longer than a company who is barely turning a profit year after year.

Generally speaking I like to be conservative in my valuations, so lets use the 10 year averages for both the profit margins and the diluted earnings per share.

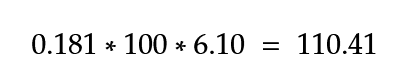

So let’s do the calculations for AFLAC on a per share basis:

So this tells us that the fair value of AFLAC is $100.41 per share, which means that its current price at $51.84 is a steep discount from its fair value.

So in short, our formula tells us that AFLAC is a BUY.

Out of curiosity, let’s do this formula for some of its competitors, to see where they stand.

If they too are trading at a steep discount from what our formula indicates, that might indicate that its not a good way to value companies in this industry, whereas if they are trading at around (or above!) the value that the formula indicates, then perhaps it is in fact a good way to tell what the fair value of a company is.

Prudential and MetLife are some of the largest publicly traded life insurance companies, so lets see what their fair value is according to the formula:

Looking at the 10 year average we can see that both Prudential and MetLife are trading at a steep premium compared to their fair value.

This can happen because the company has grown their profits and margins heavily during these past 10 years, which is why I also did the calculation on their 2019 numbers.

Why 2019? Because Prudential had a bad 2020 and made a loss. Given that it was the first loss in 10 years, and the whole Covid situation which definitely had an impact on them, I decided that the last year before Covid would make a fairer comparison.

The results? Well, the market cap for 2019 for both Prudential and MetLife are both around the value predicated by the formula.

The fact that their Margin of safety is negative when compared to the 10 year average, is indicative that perhaps the market is overpaying for Prudential and MetLife over the long run. Either that, or perhaps my formula is overly conservative.

Either way, from the numbers it still looks like AFLAC is under valued compared to its competitors in the same industry.

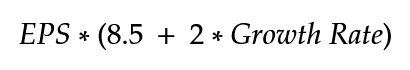

Benjamin Graham Formula

Benjamin Graham is one of the greatest investors of all time with an average investment performance of ~20% annualized return over 1936 to 1956. The overall market performance for the same time period was 12.2% annually on average.

Graham is considered the "father of value investing" and his two books, Security Analysis and The Intelligent Investor, defined his investment philosophy.

In these books he discusses a theoretical formula that could be used to access the value of a company.

While he did not endorse the formula as a fool proof way to access a business, it is still a fairly interesting method of analyzing a stock, and which has a place in a list of other methods to value a company.

The original formula is:

Later, he revised the formula to include the effect of interest rates on the stock market:

For the average bond yield we will use the 5 year average AAA Corporate Bond Yield, and for the current yield we will use the current AAA Corporate Bond Yield.

For the growth rate we will use the 10 Compound Growth Rate of earnings before taxes.

For the Earnings per Share we will use the 10 year average earnings per share.

Those are respectively:

Average Bond Yield: 3.75%

Current Bond Yield: 2.72%

Growth Rate: 1.56%

10 year average Earnings Per Share: $6.10

Using the original formula for AFLAC that gives us a fair value of $52.03, or slightly above AFLAC current stock price!

Using the revised formula, that gives us a fair value of $71.74, significantly above AFLACs current stock price!

What happens if instead of using the average earnings, we use the latest?

Latest Earnings Per Share: $6.67

Using the original formula for AFLAC that gives us a fair value of $56.90, or somewhat above AFLAC current stock price!

Using the revised formula, that gives us a fair value of $78.45, significantly above AFLACs current stock price!

No matter which formula you use, and which data you use, AFLAC seems to be undervalued.

And not only that, this undervaluation is being calculated with a growth rate of only 1.5%, which is around the level of inflation, and the 10 year average for AFLAC.

If AFLAC manages to grow even slightly more than inflation (perhaps with the help of some trade winds off the back of the Covid recovery), then the fair value increases even more.

As far as Benjamin Grahams formula is concerned, AFLAC is under valued.

Discounted Cash Flow Model

A Discounted Cash Flow model is a valuation method used to estimate the value of an investment based on its expected future cash flows.

In other words, it tries to price the value of an investment based on projections of how much money that investment will generate in the future.

Of course such models have two main issues:

A dollar today is not worth the same as a dollar tomorrow.

Projections are by their very nature uncertain.

The first issue is one of inflation as well as competition. Due to the monetary policies of central banks all over the world, inflation is not just a risk, but an inevitability.

This devaluation of cash in the future needs to be accounted for in the present value of the company, after all, if a company makes $1 today, and $1 ten years from now, I will be able to buy a liter of milk with that dollar today, but in ten years I’ll be lucky if it pays for the VAT tax alone!

What this means is that a company that makes money in the future, must have that future money discounted to its present day value.

If we were using the $1 liter of milk example from before, and assuming that the value of the dollar halves in the 10 years that the company operates, then the dollar the company earns 10 years from now, is actually only worth 50 cents today.

In other words, we’ve discounted 50 cents of that dollar, because it was earned 10 years from now.

Naturally inflation doesn’t come all at once, and companies don’t operate only today and 10 years from today, which is why in Discounted Cash Flow models we apply a “Discount Rate” to its expected future cash flows.

The greater this Discount Rate, the less valuable a dollar in future earnings is worth, and vice versa.

This Discount Rate is usually calculated by adding the “Risk Free Rate”, and then adding in the cost of risk intrinsic to the investment.

I will not go into further detail on how to do this, other than to say that it is a difficult task and like all other predictions and estimations is fraught with peril.

If you would like to learn more, I would encourage you to have a look at Professor Aswath Damodarans' class.

He has a fantastic YouTube channel where he uploads the lectures he gives his MBA classes, and where he goes in depth into these subjects, and I feel I would do a poor job conveying the knowledge and wisdom presented in them.

The second issue is similar to the first. Projections are by very nature looking forward, that is, they try to predict something that hasn’t happened yet.

Sometimes that might be easy, after all, I think we’re all fairly confident that the sun will rise in the east tomorrow morning.

The issue comes with things that aren’t as certain, such as economics, and in particular, the business prospects of a certain company.

Part of this risk can be calculated, such as through the Discount Rate we saw above, part of it can be estimated, but ultimately these are assumptions, and assumptions they will remain until the time has past.

All that we can do here is one of two things. We can scrap the whole idea of Discounted Cash Flows, and simply value the company based on what it has on its balance sheet today (which we will get to in a moment), or we can make conservative assumptions in order to give ourselves a larger margin of safety than we would otherwise have.

Let us see then what the formula for the Discounted Cash Flows:

Sounds complicated right?

Well, no worries, luckily nowadays everything is on the internet, so we can simply go to a website that does it all for us, and all we have to do is set the assumptions going it.

The main variables we will be using are:

CAGR in Years 1-5 - How much the company will grow over the first 5 years

Operating Target Margin - What their margins will look like at the end

Year of Convergence - In what year their growth will return to the mean

Sales to Capital Ratio - How much the business will reinvest in itself

For these purposes, we want to be conservative, so that we are pleasantly surprised even in a bad scenario where we miscalculate:

CAGR = 0%

Target Operating Margin = 16%

Year of Convergence = 5

Sales to Capital Ratio = 0.72

If we do the calculations we get:

This results in a final estimated common stock equity of $44 252,35 million dollars, which is equivalent to a Per share estimated value of $64,27.

Mind you, this is assuming that the company does not grow at all, since we’re pricing in 0% CAGR, and that AFLAC will actually become less profitable in the future than it currently is now, since we’re reducing its current margins from the 10 year average of 18% to 16%.

Even with these very conservative assumptions and given that AFLAC is currently trading at $51 we still have a margin of safety of 21%!

As far as our Discounted Cash Flow formula is concerned, AFLAC is under valued.

Net Current Asset Value

If the Discounted Cash Flow Model estimates how much money the company will make in the future, and then tries to price the company based on those imaginary future gains, the Net Current Asset Value model does away with all of those assumptions and uncertainties.

Out of all of these models, it is probably the easiest to calculate and the simplest to understand.

To put it simply, this model values the company as if it would shut down tomorrow morning, pay off all of its debts using whatever it has in the bank, and returns every piece of cash that is left to the owners.

Whatever real estate or other long term assets it may have are not counted towards the valuation, and are effectively just the cherry on top.

To calculate it we simply have to do some subtraction from the companies latest balance sheet from their latest yearly or quarterly report.

We simply take their current assets and subtract from them their total liabilities, for a company like AFLAC, with no inventory or accounts receivable, their current assets is just their cash and investments. This is actually something we’ve already calculated:

In other words, the Net Current Asset Value of AFLAC is 18.2 Billion dollars.

Given the current market cap of 35 Billion dollars, if we go by the Net Current Asset Value model, then AFLAC is overvalued by around 17 Billion dollars.

Now there’s also the long term assets, and those assets do have some value, so this isn’t exactly a deal breaker.

Indeed, most companies generally don’t trade at their Net Current Asset Value, or even their Book Value (which adds in said long term assets). Nowadays it’s very rare to find such a company, though not impossible of course.

This value does mean however, that if the worst were to happen and AFLAC decides to file for chapter 7 Bankruptcy tomorrow, we would still expect to get back around 50 cents for every dollar we put in.

Not great, but not terrible.

Conclusions

While the overvaluation in terms of Net Current Asset Value might seem concerning, ultimately we are not discussing a troubled company on the edge of bankruptcy, and so I will give it a pass there.

The remaining valuation models, from the Profit Margin model, to the Discounted Cash Flow model, passing by both of Grahams formulas paint a clear picture:

Aflac is consistently under valued by the market, and so I should buy the company now that it is below its fair value.

This is generally a good buy indicator, and indeed if you are someone focused on nothing but numbers this is probably enough to convince you to buy in and reap the rewards.

I’m not judging you for this. I too am a numbers guy, and these are the reasons I bought and continue to buy.

But, and I hope I’m not alone here, but I think there’s still something missing… Something that Peter Lynch calls “The Story”.

The Story of the company isn’t something you can measure, but if we spend some time developing and understanding it, we can get a better idea of what has happened to put AFLAC in this undervalued state, and what might happen in the future to bring back up to a fair value.

So that is what we will do in my next post. We will go over the story of AFLAC, find out what happened to it.

We will discover how it became this under valued, why earnings and revenues have been flat, and eventually I hope to find some sort of catalyst that might bring it out of this rut it has been in recently.

Let me know what you think!

And as always, if you have any questions or comments, shoot them on Twitter @TiagoDias_VC or down below!

I’ll see you next time!

Dear Tiago, Thanks for such a thorough explanation, Aflac is an incredible company and is a favourite company of mine. What I cannot understand is where did you get the 0.181 from in the Profit Margin to PE Method. I looked at the KO and PEP example and I still couldn't figure it out. Am I missing something?

Thank You.

Dear Tiago, Thanks for such a thorough explanation, Aflac is an incredible company and is a favourite company of mine. What I cannot understand is where did you get the 0.181 from in the Profit Margin to PE Method. I looked at the KO and PEP example and I still couldn't figure it out. Am I missing something?

Thank You.