What is Activision Blizzard?

According to their annual report, Activision Blizzard ATVI 0.00%↑ is:

Activision Blizzard, Inc. is a leading global developer and publisher of interactive entertainment content and services. We develop and distribute content and services on video game consoles, personal computers (“PCs”), and mobile devices. We also operate esports leagues and offer digital advertising within some of our content.

In other words, they are a video game company. They develop, market and distribute video games and their associated content and services.

If you’ve been born anytime in the past 40 years, you’ve probably played their games before, I know I have. And even if video games are not your thing, you’ve probably heard about some of the games they developed on TV, or spoken about in the papers.

Indeed, many well-known video game franchises, such as World of Warcraft, Call of Duty, Overwatch, etc… have been developed by Activision Blizzard.

That being said, It’s quite possible that the business will not exist a year from now! Not because it will go bankrupt, but because Microsoft, a company which I own and have made a report about in the past, has made an offer to purchase Activision Blizzard at $95 per share.

Given that the company is trading at around $75 per share at the time I’m writing this, this is looking like an interesting yet traditional arbitrage play on a company that would ordinarily slip by me.

With the takeover approved by shareholders, the transaction expected to close in fiscal year 2023, it’s looking like the only thing in the way of a 26% return on an investment into Activision Blizzard is the regulators approval.

This is quite an interesting scenario, and one which has given me some amount of interest in a business which I would ordinarily write-off as another “perpetually overvalued” business.

Business

Strategy

Unfortunately Activision Blizzard hasn’t had a proper investor day in quite a while, and so their materials and presentations are a bit out of date.

The most recent presentation that I could find was this one from 2015. It is a bit outdated, but since the first 3 strategic pillars are still mentioned in their latest annual report, I’m assuming their core strategy hasn’t changed too much.

The core of the Activision Blizzard strategy relies on its 4 strategic pillars:

Expanding Audience Reach

Deepening Consumer Engagement

Increasing Player Investment

Use our scale to create more value

Each of these pillars has specific goals in order to increase revenues, and subsequently net income for the company.

Let’s take it pillar by pillar:

Expanding Audience Reach

The goal here is to effectively acquire more clients, by doing 3 things:

Expand Geographically

Expand Available Platforms

Expanding customer demographics

They’ve certainly been working on this for the past few years. Their games are now primarily sold online, which allows them to provide gaming services in almost every country in the world. They also have some heavy (but criticized) pushes into mobile gaming, alongside their staple console and PC platforms

Additionally they have been regularly releasing games for all sorts of demographics, some to bring back old fans, and some to reach demographics that are otherwise underserved.

Deepening Consumer Engagement

The perfect example here is probably their push into e-sports. Blizzard spent millions in promoting Overwatch as an esport, and for a time it was actually quite successful. Unfortunately this wasn’t the success everywhere, and they’ve since been forced to make massive strategic changes that leave this whole part of blizzards strategy in jeopardy.

They’ve had highs, and they have had lows, but overall in a lot of ways it seems like some of Activision Blizzard's attempts to drive engagement have been rebuffed by fans, and been disliked.

Overall in a lot of ways it feels like over the past decade they’ve lost a lot of the prestige and engagement that they used to have, and perhaps a new strategy is in order here.

Increasing Player Investment

And here is why player engagement has failed.

Activision Blizzard has consistently acted in ways to maximize profit, and that has been noticed by players, and rebuffed.

The latest news of Diablo Immortal costing hundreds of thousands of dollars to get a character fully kitted out are indicative of this drive. They’ve certainly been successful at increasing player investment, but at high costs to their brand value, at a time where they really need to be fixing their image issues.

Reporting Segments

As per their 10-K the company has 4 separate reporting segments:

Activision Publishing, Inc.

Activision delivers content through both premium and free-to-play offerings and primarily generates revenue from full-game and in-game sales, as well as by licensing software to third-party or related-party companies that distribute Activision products. Activision’s key product franchise is Call of Duty®, a first-person action franchise.

Blizzard entertainment, Inc.

Blizzard delivers content through both premium and free-to-play offerings and primarily generates revenue from full-game and in-game sales, subscriptions, and by licensing software to third-party or related-party companies that distribute Blizzard products.

King digital Entertainment

King Digital Entertainment (“King”) delivers content through free-to-play offerings and primarily generates revenue from in-game sales and in-game advertising on mobile platforms. King’s key product franchise is Candy Crush™, a “match three” franchise.

Other

Other businesses not included in the prior 3, including the Activision Blizzard Distribution business that provides warehousing, logistics and sales distribution services to third-party publishers, etc…

These segments are all fairly even in terms of net revenues, with Blizzard being the lowest and Activision the highest:

Overall, given the mind-share that Blizzards titles have on the gaming demographic, it’s actually surprising that it’s the smallest segment, particularly when compared to the less well known “King” brand.

I guess Candy crush really is successful!

Geographical Diversification

Blizzard operates worldwide, and doesn’t seem to break down their revenue by country or region. That said, they do break it down by distribution channels:

Which shows us exactly just how dominant the digital online channels are in the company's distribution strategy.

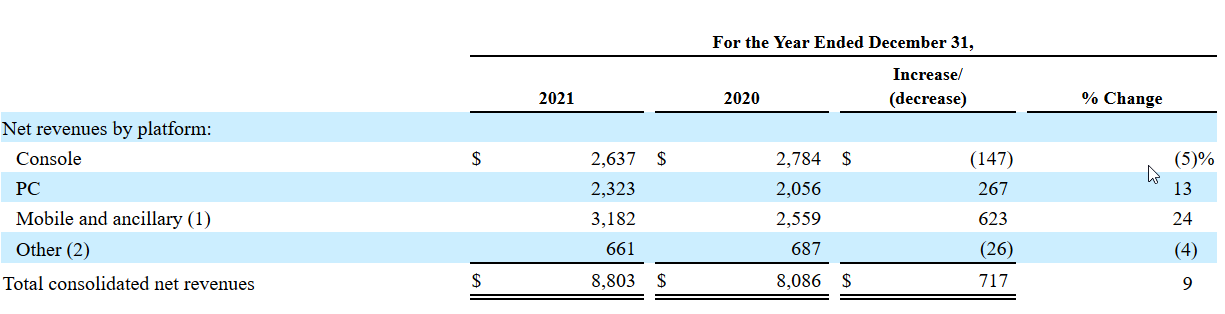

They also give us a lot of data about the platform revenues, where mobile again standout from the crowd a little bit:

Another interesting point to look at is who the core customers are, or better yet, who the key third party distributors are:

This is about what we would expect, though I’m actually surprised at how high Sony is there, especially given the comparatively low percentage of revenue coming in from Microsoft.

It appears Activision Blizzard does a lot more business with Playstation than Xbox!

Finally, let’s take a look at the size of the player base by checking out the monthly active users they report:

That’s quite a lot of people enjoying Activision Blizzard's products and services!

Management

Bobby Kotick has been a Director and Chief Executive Officer of Activision since 1991. Since 2008 he has led the combined Activision Blizzard company.

He’s done a fine job of expanding the business so far, but his sexual misconduct and his violent threats has been on the news a lot, and has brought a lot of unwanted attention to poor company practices in regards to maintaining a safe working environment.

Activision Blizzard's management team needs to go.

But at the same time he can’t go quite yet, at least not until this buyout from microsoft is complete.

Whether the buyout goes through or not it’s clear that Mr. Koticks continued presence in the company will continue to deteriorate both labor relations, and consumer goodwill, and so he should leave.

In terms of insider trading, we can see some buys and some sales. Overall nothing here is particularly concerning, though it is curious that some officers such as the CFO and the Chief Accounting Officer are selling their shares at prices well below Microsoft's offer:

Do they know something I don’t? Maybe.

Or maybe they’re just buying a new house and need some cash, and can’t afford to wait a year for 25% gains.

Risks

Internal Risks

Poor management practices with the management team being a particular liability

Requires consistently high R&D to continue in business

Overly dependent on a few key clients for distribution of their games

External Risks

Worsening Public Relations

Legal action as a result of management failures

Regulatory Action prevents the merger with Microsoft

Fundamental Data

Income Statement

The company's income statement looks fine. They have been consistently profitable, with high margins and steadily increasing revenues and earnings.

All of these are good things, and if you were to put these numbers next to any other companies income statement, they would compare favorably.

That said there are a few bad things to note, first and foremost is the high R&D expenditures. If we take the last year, 2021, as an example, we can see that almost 15% of the company's revenue went into “Product Development”.

This is a huge amount, more than even some heavy R&D focused firms like Johnson and Johnson. When you compare it to a low R&D, low Capex firm like Altria you can really see the difference.

In a way this is inherent to the business, video games have a shelf life, and after a handful of years most games sales and revenues decline to effectively zero.

This means that for a video game company like Activision Blizzard, they need to be constantly coming out with new and improved games, and that costs huge amounts of money.

In a way you can think of this as a business where you need to constantly spend huge amounts of cash into Capex just so you can remain in business. And well… Beware of companies that must spend money like crazy.

It may seem like the company can simply cut its R&D and Marketing expenditure to zero, and Activision Blizzard would suddenly double its earnings, and indeed it may even work for a year or two.

But three or four years down the line, when the company's games are all old and stale you’ll see that revenues will drop like a rock, and you have no new games to replace those revenues.

Revenue Growth

Revenue growth is looking nice and steady, with a 10 year average CAGR of around 7%. Alongside revenue the company's operating income has also increased at a 10% CAGR.

These are really great numbers and almost any company would be happy to grow at 7% annually for a decade.

That said, we can see some ebbs and flows as new games get released and then go stale, so it’s easy to see just how dynamic the company's income can be, and so it’s important to not over pay for these revenues.

Will they be able to carry this growth into the future? It’s unclear, since games can be very well received, or very poorly received, and there’s no clear indications of what it will be before it’s released.

Margins and Earnings

In terms of margins and earnings we can see that although their pre-tax margins have been uneven, they have still managed to maintain them at a relatively high level.

That said, I don't believe that they will be able to maintain those 35% pre-tax margins in the coming years, and I wouldn’t be too surprised if they were to revert to their decade average of around 26%, which is still indicative of a company with some form of competitive advantage.

The earnings per share have also been steadily increasing at a 14% CAGR, well above the revenue growth, mostly as a result of higher margins and share buybacks.

Balance Sheet

Shareholder Equity

I like this, I like this a lot!

The company has kept its balance sheet with a consistently low amount of debt!

In general we can see the steady increase of the book value per share, without a corresponding increase of the amount of liabilities on the balance sheet.

I generally dislike companies that have high amounts of debt, so a capital structure like this is encouraging to me.

Debt Schedule

The company has 2 types of liabilities that will require payments in the future:

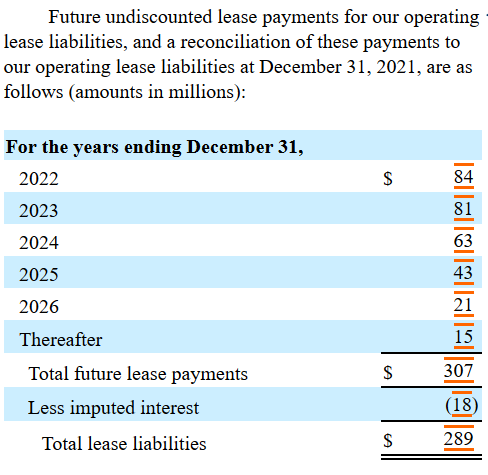

Lease payments

Debts

In terms of lease payments we can see that it’s effectively a rounding error and they have ample cash-flow to make good on their commitments:

For the general outstanding debt debt:

This too isn’t much of an issue. They have enough cash flow to pay off all of these notes, and so I am not worries about any debt cliffs or debt repayments anytime in the near future.

Shareholder Returns

Buybacks

The company has been slightly diluting its shareholders in the past few years, and does not have a general policy of conducting share buybacks.

Indeed, other than in 2013 where they did a one-off $6 Billion share buyback, they have more or less stayed away from returning capital to shareholders in that method.

I actually approve of this, since after 2013 their price to earnings ratio was quite high, and as such a share buyback program would be a waste of cash that could be better distributed via dividends.

Dividends

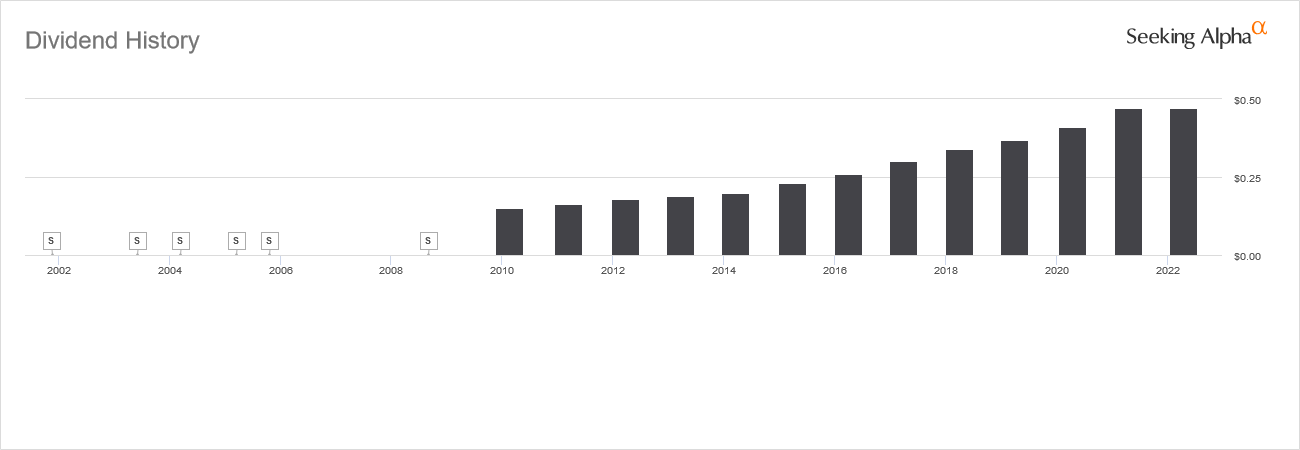

The company started paying dividends in 2010, and unlike most American companies they pay a single dividend a year.

This is quite odd, and I generally don’t like a yearly dividend, since I prefer the more continuous and consistent cash-flow you get from monthly of quarterly dividends.

They had been steadily increasing the dividend every year, but in 2022 off the back of the Microsoft acquisition offer they seem to have simply maintained their 2021 dividend.

I like that they have been returning capital to shareholders, and given the merger on the horizon I won’t hold the dividend freeze against them too much.

Strengths and Weaknesses

Strengths:

Demonstrated willingness to return capital to shareholders

Consistently high margins

Growing revenues

Weaknesses

Huge CAPEX-like expenditures in Marketing and R&D

Regulatory uncertainty

No buybacks

Valuation

As a general rule I don’t like price to earnings ratios above the markets long term average, and the current 22 PE ratio is well above what I would like it to be.

That said, the Price to Book value is surprisingly high, off the back of the lack of debt that the company holds.

The dividend yield and its corresponding payout ratio are also a bit on the low side, which is great for sustainability and possible future growth, but not so great if you’d like some income now.

Key Ratios

Overall everything here is in the green, and about what I would expect from a growing software company.

The thing I like to focus on is the pre-tax margins, which are very healthy, but the other ratios are also pretty decent.

No real red flags!

Standard Valuations

Well this is odd, isn’t it?

Such a big discrepancy between the valuations bodes ill, but let’s figure out what’s going on here exactly.

The main culprit here is the Discounted Earnings number. I’ve been making some changes to the way I calculate that particular valuation, which I hope to make public somewhat soon. What I can tell you however is that the new method I’m using is quite conservative in its assumptions, and heavily punishes high price to earnings ratios.

Even with some very conservative growth rates, I still expect the company to be trading at around $80 per share by 2031, but with a 15% discount rate those $80 are worth only a measly $24 today.

Is this a realistic discount rate though? Maybe, maybe not.

The fact is it’s a very high discount rate, and likely too high. But at the same time I don’t want to blind myself to what can go wrong. The company does have issues, both internally in terms of management and compliance, and externally where their image has been tarnished over the past few years.

With such a high PE, and good but not outstanding growth I feel it makes sense to have a higher than average discount rate to account for these issues.

You may feel differently.

As for the remaining valuations I think they are fine. Yes there is some spread between the 3 year normalized margin to PE method and ben graham's revised values, but overall I think that a fair value of around $95 is somewhat reasonable.

This means Microsoft made a somewhat attractive offer, in which they won’t be losing much money even if the expected synergies don’t end up panning out.

Safe Purchase Value

The average of those valuation methods give us an average long term value of around $85 per share. This is about 10$ higher than its current price, and $10 lower than the Microsoft offer.

While the company is not currently within its “Safe Purchase Price”, it’s also not above its long term value, and indeed it is providing a potential 25% yearly return if the Microsoft merger goes through.

So should we account for that merger? Is it likely to happen? If so, when?

I don’t have any special insight into the regulatory action, however Microsoft has been able to stay out of the limelight over the past decade, and has had substantially good relationships with regulators ever since the anti-trust cases in the late 90s.

I don’t think the company would have made the offer if there was a substantial possibility that regulators would scrap it, but at the same time both I and Microsoft's lawyers can be wrong. It wouldn’t be the first time that a big company would have misread the regulatory environment.

Investment Thesis

Key Points

Activision Blizzard is a growing company with consistent profits

The company consistently returns capital to shareholders

The management team has made some major errors and needs to go

Some of their PR recently has been questionable

The Microsoft merger provides a potentially attractive return in the near future with a clear end state

Even if the merger falls through, I would still own a decent company with limited downside

Decision

I honestly don’t know.

If I owned Activision Blizzard prior to the merger offer I would likely hold it until the merger goes through. After all, if I liked the company as a standalone, then being bought out for a profit would provide me with an attractive return.

The issue is really “What if the merger doesn’t go through?”.

I generally don’t feel attracted to these types of software companies, I feel like the enormous amounts of ongoing CAPEX-like expenses make these companies fragile businesses with built-in expiration dates, exactly the type of business I want to get away from.

But at the same time Activision Blizzard has been around for a long time, and they have a lot of games and franchises that I recognize and like. Clearly they do have something that gives them an edge.

Thinking it through I don’t think I would want to own this company over the long term, there’s just too much required spending that I don’t like, combined with the odd dividend policy. But for a short term play, it’s certainly interesting.

I’m not sure if I want to risk the downside, but I won't set this interesting arbitrage play aside either. For now I will leave my options open, and I will let you know if I end up buying some $ATVI in the future in order to take advantage of this arbitrage opportunity.

My current stance: HOLD