A look back at Altria

Has this cigarette burnt itself out yet?

About a year ago I had a first look at Altria, an American tobacco company known for its Marlboro cigarettes. At the time, I did some valuations and concluded that the business was undervalued, and I subsequently opened a position in the business.

It’s now been a year, the market has tanked and even my Altria shares are only barely in the green. It’s now time to revisit my thesis, see how its played out, and figure out what my next steps should be.

The Thesis

Let’s take a look back at what I wrote a year ago to see what I thought about the company, and what the thesis for it would be:

The company has fantastic operating margins and good unit economics

The company is capable of making good on its debt obligations

The company has recognizable brand, and customer loyalty

The company is returning capital to shareholders

The company is limited in its growth as a result of regulatory pressure

The company will not suffer additional impairments

How has this held up?

Let’s take it point by point:

The company has fantastic operating margins and good unit economics

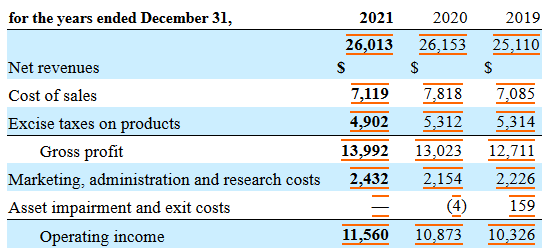

This is still the case, and indeed if we take a look at their latest 10-K:

We can see that their operating margin has even increased comparing to 2020.

When looking at their cashflows becomes clear that this is an asset light business that can really pack a punch in terms of earnings without any major capital investments.

This is a great company to operate and squeeze cash out of, and that hasn’t changed in the past year.

The company is capable of making good on its debt obligations

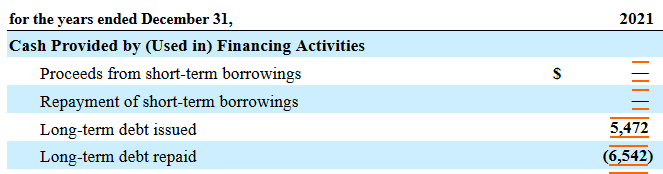

Nothing has changed here, though the company has taken advantage of the sale of one of its subsidiaries to pay off some of its long term debt:

Of course past debt repayments tell us nothing of future ability to repay other debts, for that we need to look at their credit rating and debt schedule:

None of this is particularly concerning.

They have sufficient cashflow to face pay off this debt as it comes due, and still pay their dividend. While it’s possible that share buybacks may have to take a back seat, that’s just fine on my end.

The company has recognizable brand, and customer loyalty

The company has disposed of their Ste. Michelle winery business, but that was never core to the business, and its branding and customer loyalty is questionable at best.

The crown jewel tobacco brands remain in Altrias hands, and with it the customer loyalty they have built up for decades.

Nothing has changed here.

The company is returning capital to shareholders

Well, they have carried on this policy!

Indeed in 2021 not only did they increase dividends, but they also resumed their share buyback program that they paused in 2020!

This is a dividend king, and they seem to have no intention of giving up that crown!

Given its ongoing undervaluation I’m satisfied with the share buybacks as well, though that may change as the business evolves and comes closer to fair value.

The company is limited in its growth as a result of regulatory pressure

This has unfortunately come to pass, and it’s clear that regulatory pressure is stepping with, with President Bidens administration seeking to implement new Nicotine standards.

This is not a good thing, but it’s to be expected, and well within my margin of safety.

I remain hofeul that these regulatory moves will continue to dissuade any would-be competitors, and that they will be delayed and diluted down over time.

The company will not suffer additional impairments

Well, I had to be wrong about something, didn’t I?

They suffered an additional 6 Billion non-cash loss from their equity investments in ABI and Cronos.

This is a huge amount, and even if it doesn’t cost any cash out of the business right now, it’s indicative that something went severely wrong in their equity investments over the past few years.

The bulk of the loss came from ABI, which is actually quite surprising given that they actually made more money in 2021 than in 2020 (though still less than in 2019):

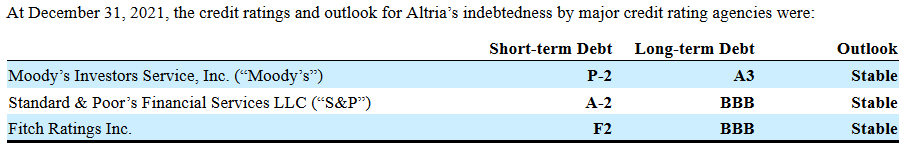

If we have a look at the details though, we can see that this is more or less “lag” from the pandemic:

While I’m not happy with this, it is what it is.

Ultimately I’m happy that the company hasn’t poured in any more cash into these businesses, or any other new ones. I’d like Altria to simply return substantially all of the cash it makes back to me, and not get distracted on these sideshows.

Will there be any more impairments in the future?

Well they still got billions on the balance sheet:

Is that goodwill, intangible assets and investments in equity securities going to get impaired again? I don’t know.

I’d like to say the company has “gotten it all out of the system by now”, but i truly have no idea, and news like these don’t inspire confidence.

That said, ABI is unlikely to be impaired again, and Cronos and JUUL have comparatively lower carrying amounts on the balance sheet:

The future

Overall my thesis remains the same, and other than the non-cash impairments it has continued to play out about what I expected.

It’s core value proposition is:

The company is reliably profitable

It will return capital to shareholders

It was undervalued for the amount of capital it returns

All of these things have remained the same, though the impairments put a big dent in that first item.

For now, I’ll continue to hold the business, and might even add a few more shares in the near future if the price keeps going down.

My Stance: HOLD

What about you? Do you smoke? Do you like Altrias products?

Let me know in the comments below!

I agree with you Tiago. I have a cost basis around 37 USD.

I see around a 20% annual return with the current stock price. The market probably over reacted. Altria might even gain with the ban of JUUL. It's diluting the company's gains and other similar vaping companies might face bans.

For me it's a buy under 40 USD

MO is by far my biggest position and very happy about it. Keep on holding. Adding on serious dips. No regrets!