A look back at 3M

A year later, has the thesis played out?

It’s almost been a year since I wrote my first in depth dive on 3M, and it’s now time for me to review the company to see if my thesis has been playing out, or if anything major has happened to the company that might have impacted its long term prospects.

If you’ll recall, at the time of my review 3M had just jumped up in price to $200 per share, well above my valuation, and therefore I gave it a “HOLD” rating, where I would keep my existing shares but not invest any more.

You can find my initial review here (part 2 and part 3).

The Thesis

Let’s take a look back at what I wrote a year ago to see what I thought about the company, and what the thesis for it would be:

The company will not grow significantly over the short and medium term

Regulatory actions against them will continue to be a drag on performance

This is not an asset play, it’s a purchase purely for the earnings power

Long term debt might become a problem in the future, but they may pay it off if they prioritize that.

There are no major short term dangers.

The fair value of the company is around $150

How has this held up?

Let’s take it point by point:

The company will not grow significantly over the short and medium term

Well, this was the wrong!

I certainly wasn’t expecting that 2021 would be such a banger year for corporate revenues and earnings, and the almost 10% revenue growth that 3M had over the past year was unexpected.

Earnings growth was somewhat smaller, but regardless I got to say that the reopening of the economy in 2021 has certainly helped the company in reach and surpassing its growth prospects.

Will this carry on in the future?

Well, you know me, I’m always a bit of a pessimist so I’m going to say no, this was a unique combination of high demand due to the reopening that won’t be repeated again next year.

If I’m wrong again, at least I’ll be pleasantly surprised once more!

Regulatory actions against them will continue to be a drag on performance

Well, this one I was on the nose!

Unfortunately 3M has been haunted by continuous lawsuits, particularly regarding faulty ear plugs.

This has continued on, and is not likely to end anytime soon.

This is not an asset play, it’s a purchase purely for the earnings power

This was pretty on the nose, and a quick look at their latest balance sheet will show that although shareholders equity has increased, the vast majority of that equity is being “eaten up” by goodwill and other intangibles.

At the end of the day, we’re not buying this for its book value.

Long term debt might become a problem in the future, but they may pay it off if they prioritize that.

Well, it looks like the 3M management team has listened to my concerns and has chosen to prioritize debt reduction for at least a little bit!

From end of year 2020 to end of year 2021, 3M has paid off almost 2 billion dollars worth of long term debt, that’s around a 12% reduction!

They still have quite a high debt load, but it’s good to see them putting some focus on cleaning up the balance sheet!

There are no major short term dangers.

Nothing particularly dangerous has happened to the company over the past year, and looking at their debt profile, nothing too unusual seems to be coming anytime soon.

The vast majority of borrowings continues to be fixed-rate, and given the earnings power of the company, I find it unlikely that they will not be able to pay off those borrowings as they come due.

The fair value of the company is around $150

Well, at the time I’m writing this you can buy a share of $MMM for $148.

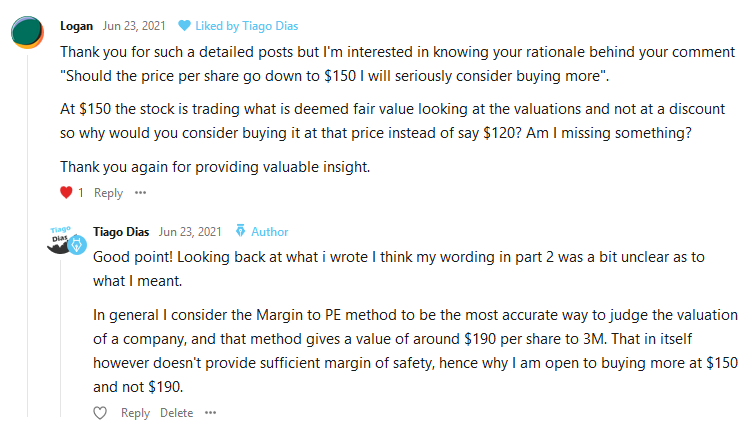

I’d say my target price there was right on the nose, were it not for a comment I posted in that very post:

Logan here was absolutely right, and I have no idea why I said that.

I’m guessing that I got a bit too confused about the multiple values that each valuation model gave me, and just picked the margin to PE model and rolled with that.

That said, nowadays I tend to think that an average of the 5 models (Book Value, Ben Grahams Original, Ben Grahams Revise, Margin to PE, Discounted Earnings) is a better estimate.

Here’s the results of that with the 2021 numbers:

A $178 average long term value is lower than the $190 i mentioned in the comment, but higher than the $150 I mentioned in the article. Add a 30% margin of safety to that, and we get a “Safe Purchase Value” of around $125.

The future

I made a few mistakes here, but I think the core proposition was accurate:

3M is a stable mature company with consistent profits

The company will return capital to shareholders

The price of the company was too high.

All of these things have been shown reasonably accurate.

The price drop is starting to make the company very attractive, though my current capital allocation priorities (indexes!), and a mere “fair value” price point, make further reinvestment into the company difficult to justify at this time.

I’ll keep an eye on the business nonetheless, and if prices drop further to $125 and I have the capital available to allocate to it, I will buy some more.

My Stance: HOLD

What about you? Do you own 3M?

Are you satisfied with the company?

Let me know in the comments below!