2025 Annual Report

Worse than the last

Overview

First I want to apologize for not posting more last year.

I have a new job, and unfortunately due to that I’m more restricted in what I can post publicly, in order to avoid conflicts of interest.

I’m still writing down my equity analysis, but for now those will remain unpublished.

What I can publish is my own personal finances, which includes this annual report!

So, lets begin.

Current Portfolio

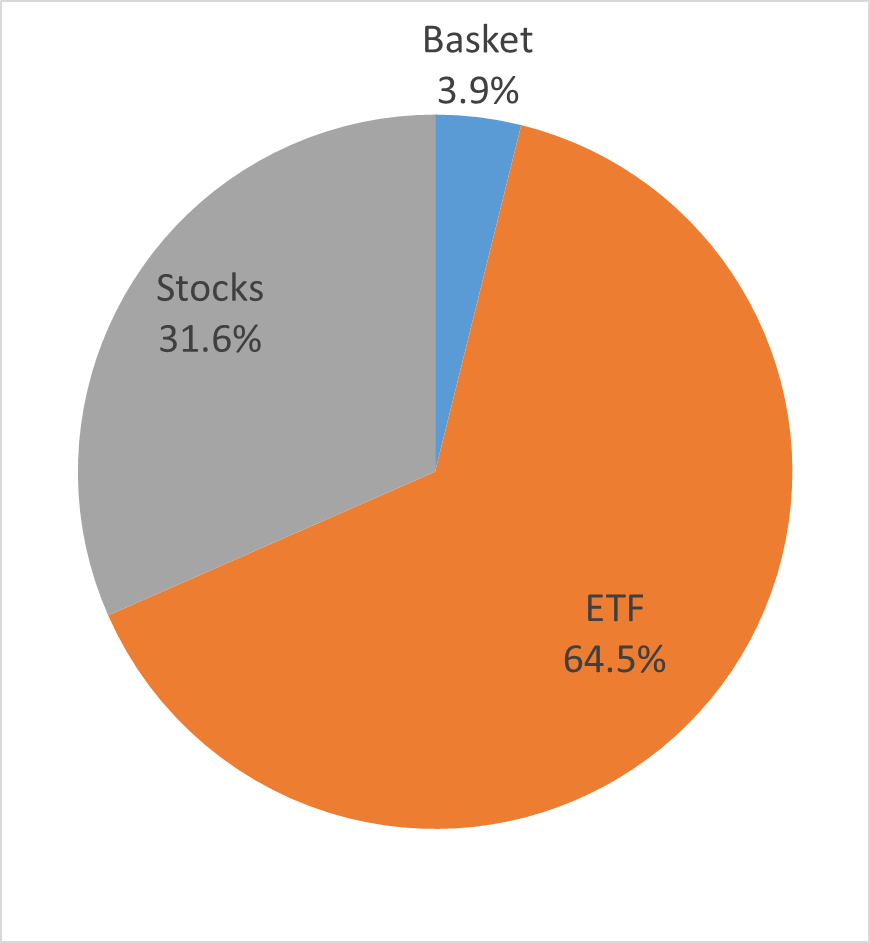

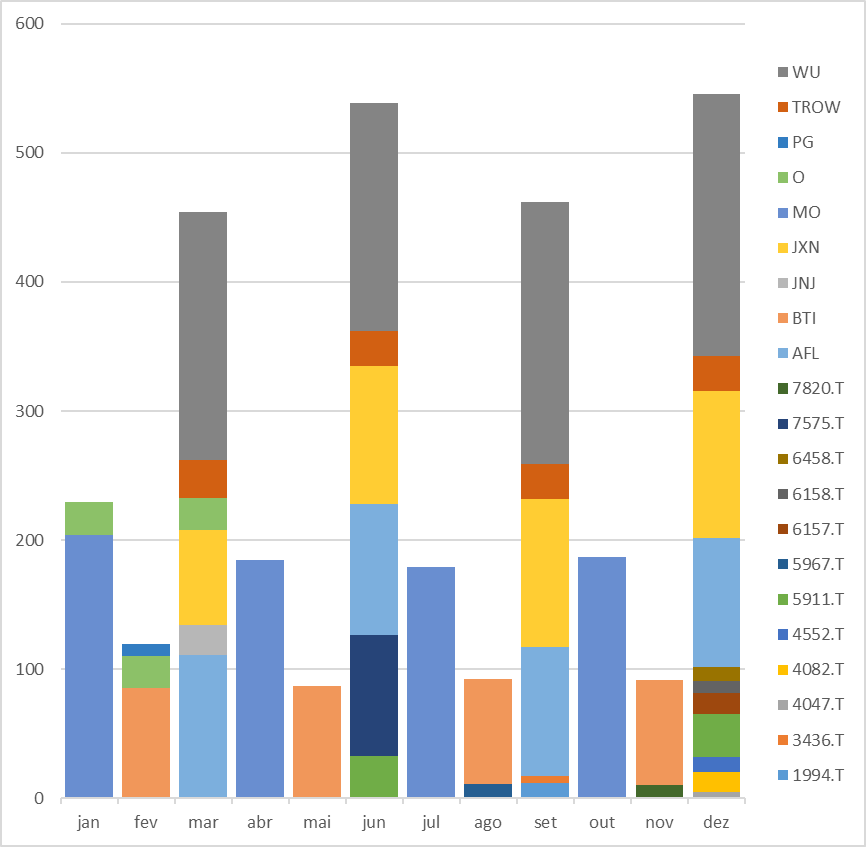

My portfolio had a lot of changes this year, and now it looks like this:

That looks a bit confusing with all those labels merged together, but we can split it into 3 main sections:

The “Basket” is a new thing that i started early this year, and it comprises of 12 Japanese stocks chosen purely quantitatively for their value. I did no in-depth research on them, beyond the fact that they came up on my value screener. This is effectively my attempt at Benjamin Grahams investment strategy, and so far it has worked reasonably well.

The “Stocks” is my usually investments, which i have done in depth research on. There are 9 of them, and I held them all coming into 2025, and you may read about why i purchased them if you go back through the newsletter.

The “ETF” comprises of the 2 ETF that I hold since the beginning of my investment journey, and which I regularly invest into. This is the backup portion of my portion, where I don’t make active choices, and is just a pair of passive index funds (one of which I do not contribute to).

I also got married this year, and so my wife has her own portfolio which comprises only of passive index funds. Her portfolio is not included in any of this.

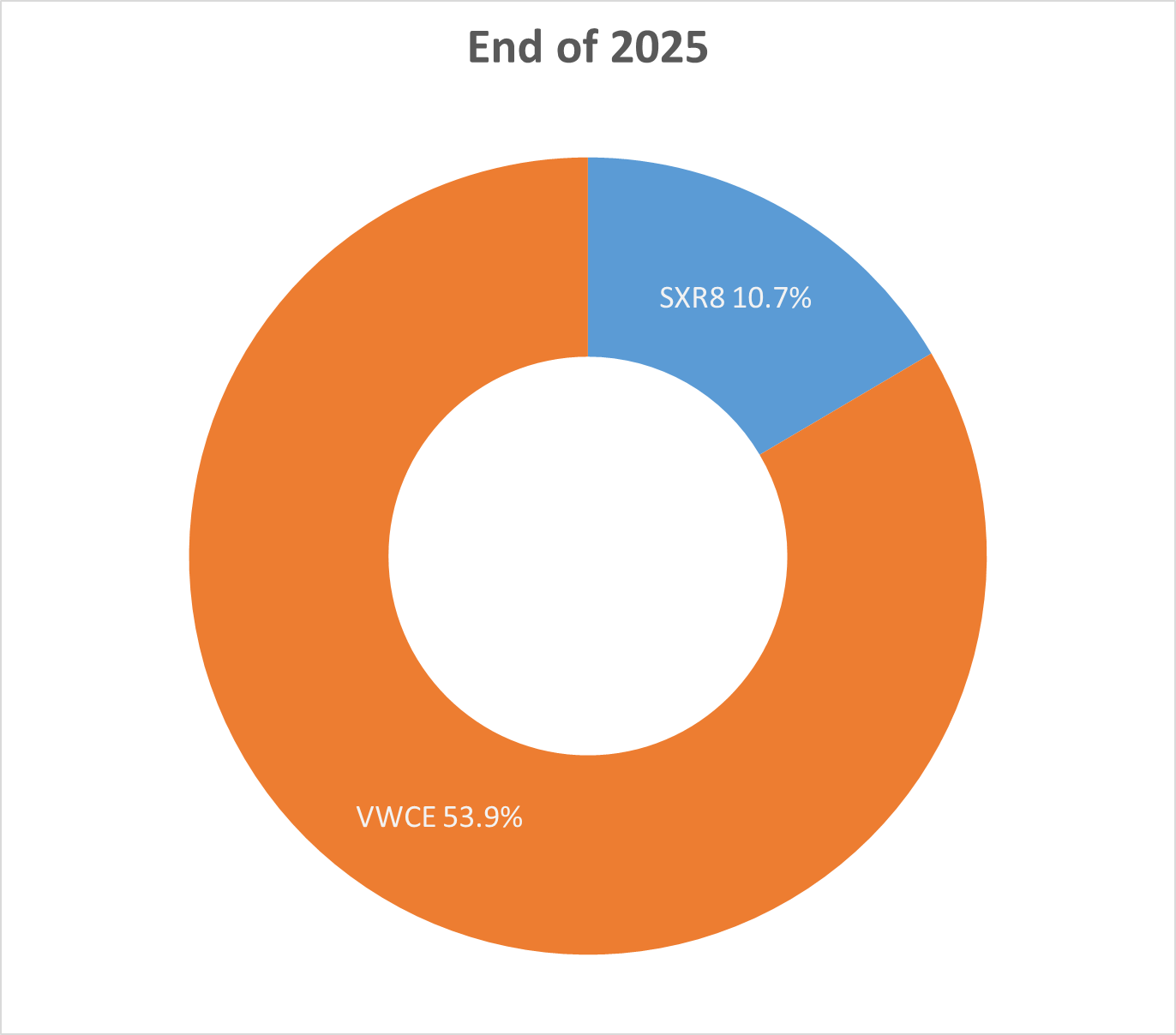

ETF

Nothing much has changed here. I did bring the ETF allocation to close to 65% of the portfolio and I mean to keep it that way.

This isn’t a part of my portfolio I think about, beyond buying new shares of it on a monthly or bmonthly basis.

Like I mentioned previously VWCE is an all world portfolio, and what I use as my benchmark. This is the one ETF I am actively investing in.

SXR8 is a S&P500 index tracker ETF, that i no longer invest in. I prefer the more diversified VWCE, but I don’t want to have to pay taxes on the capital gains for SXR8, and so I haven’t sold it yet. If I need cash to buy a house I will probably be selling this for the down payment.

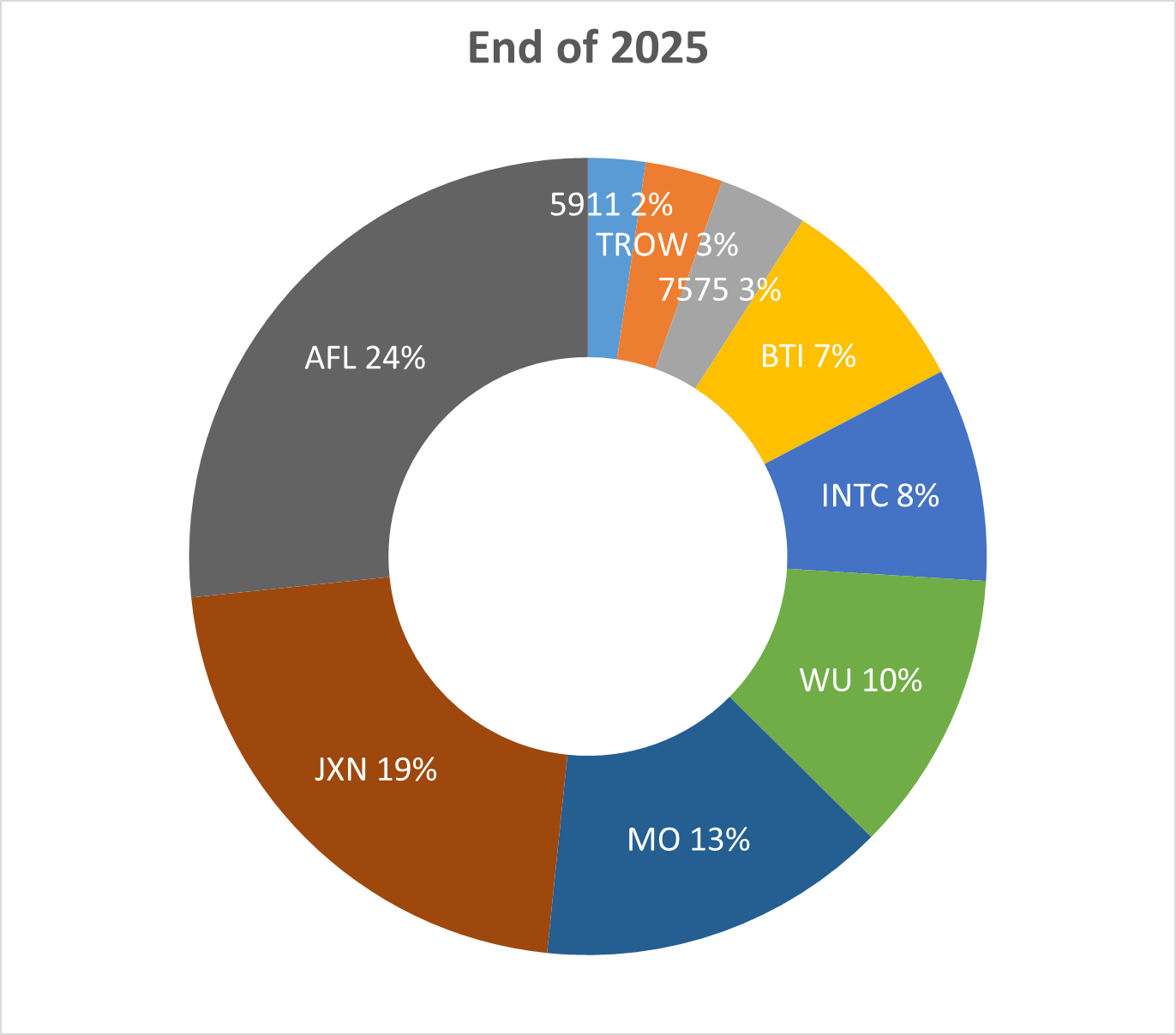

Stocks

These are the long term holds of my portfolio, and the ones I did more research on.

You will find that all of them I have already discussed in previous issues of the newsletter, and that all of them were present in last years annual report.

That said, there are a few changes from the end of 2024, namely:

Bought

LULU

OLVAS

JXN

WU

Sold

LULU

OLVAS

PG

JNJ

O

You may notice I bought and sold LULU 0.00%↑ and OLVAS throughout the year. Both of these were short term holds that either ended successfully faster than expected (LULU) or didn’t turn out as I wanted quickly and I exited for a small gain (OLVAS).

I did write down equity analysis for both of these, but those are sitting in my drafts folder due to the concerns of my work. I may publish them in the future.

Additionally I reinforced my JXN 0.00%↑ (at $86.13) and WU 0.00%↑ (at $8.92) positions.

I also sold a number of puts in the middle of the year, accounting for 530€ in premium collected. Mostly JXN and TROW puts, none of which were triggered.

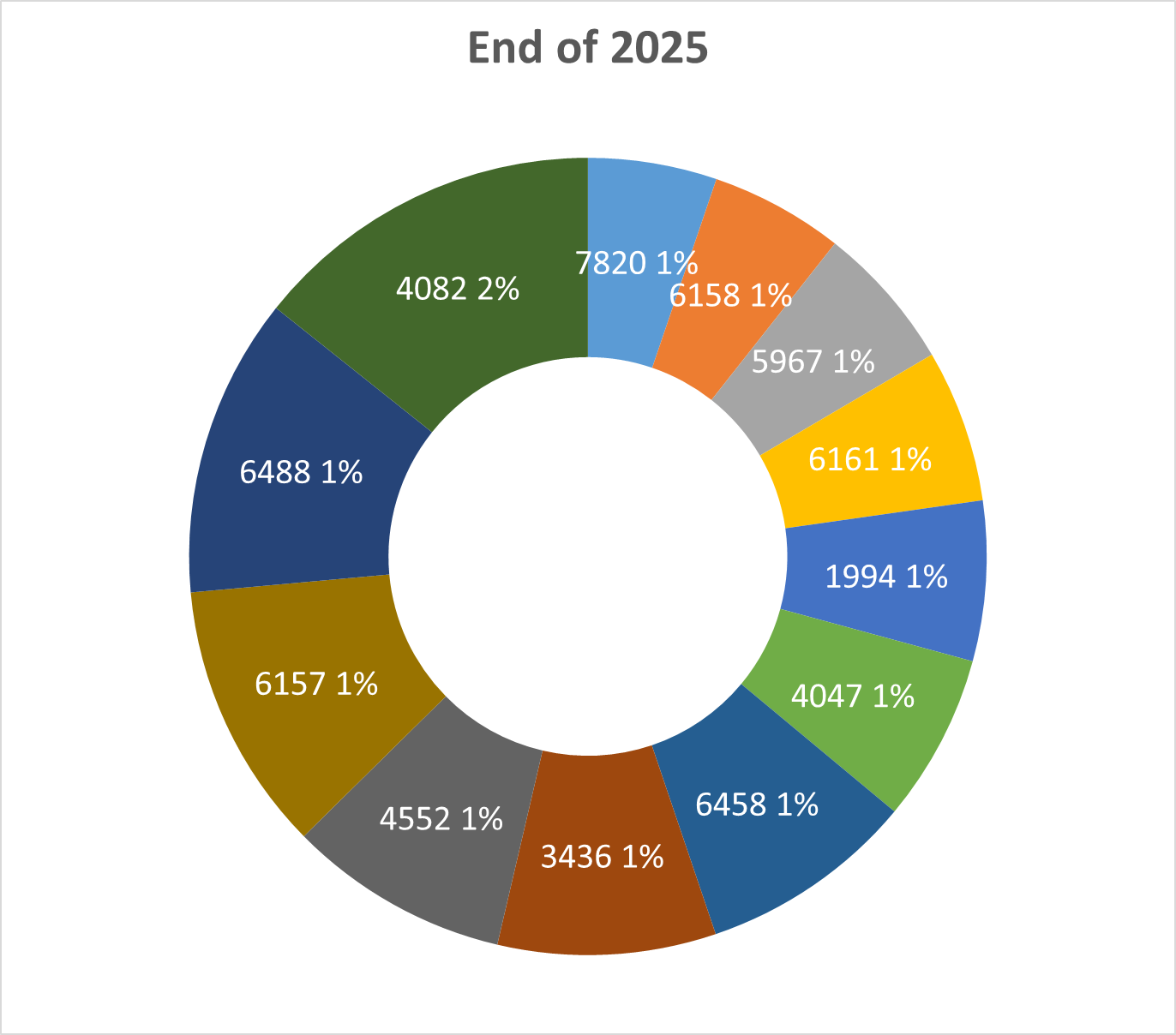

Basket

The basket as I call it is an experiment I am running on purely quantitative investing in the style of Benjamin Graham.

Effectively what I did was download a historical financial record of all Japanese stocks directly from the regulator, and used that to generate a screener and classify each stock as a function of both quality and value.

That gave me a list of 30 or so stocks that were both very cheap, and relatively decent quality.

I then attempted to buy more or less equal amounts of each stock. Due to the high stock price of some securities I ended up with only 12 stocks, which I purchased an equal weight of.

I did little research in each of them, and focused only on the financials.

Nonetheless they have done relatively well with an average return of around 20% since march when I bought them.

I have an (unpublished) newsletter article where I go over this too.

I plan on selling them all in 2027.

Dividends

This year i achieved a new all time high in terms of dividends received, with WU 0.00%↑ JXN 0.00%↑ BTI 0.00%↑ AFL 0.00%↑ and MO 0.00%↑ being particularly high payers.

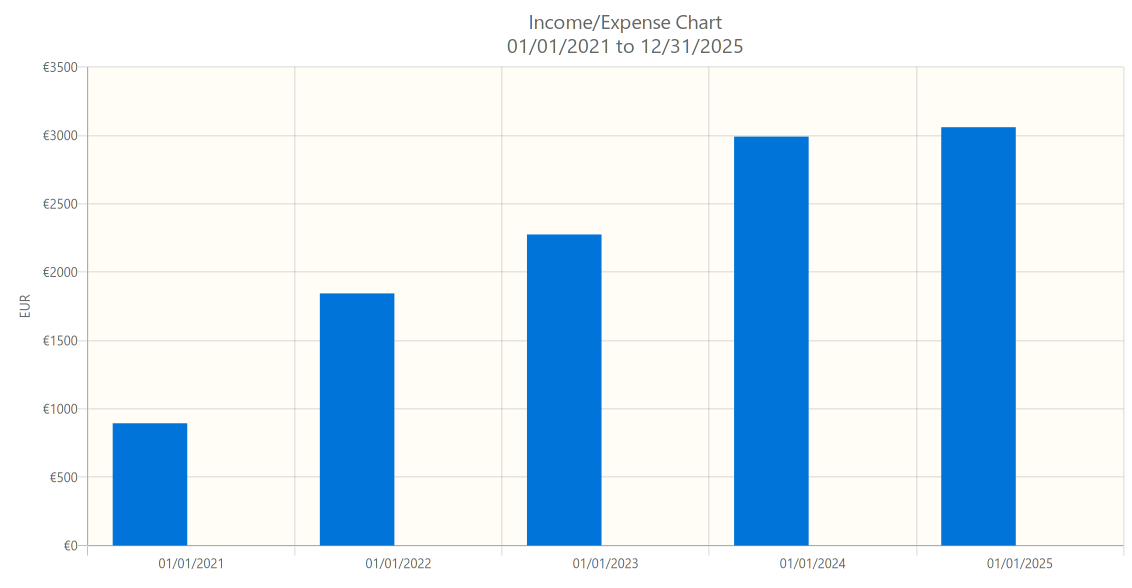

We can also compare this to other years:

It’s only a very slight increase over 2024, but please keep in mind that the Euro strengthened quite a bit during this time, and most of my dividends are in USD and JPY.

Nonetheless I did reach my goal of 3000€ in dividends received per year.

Benchmarking

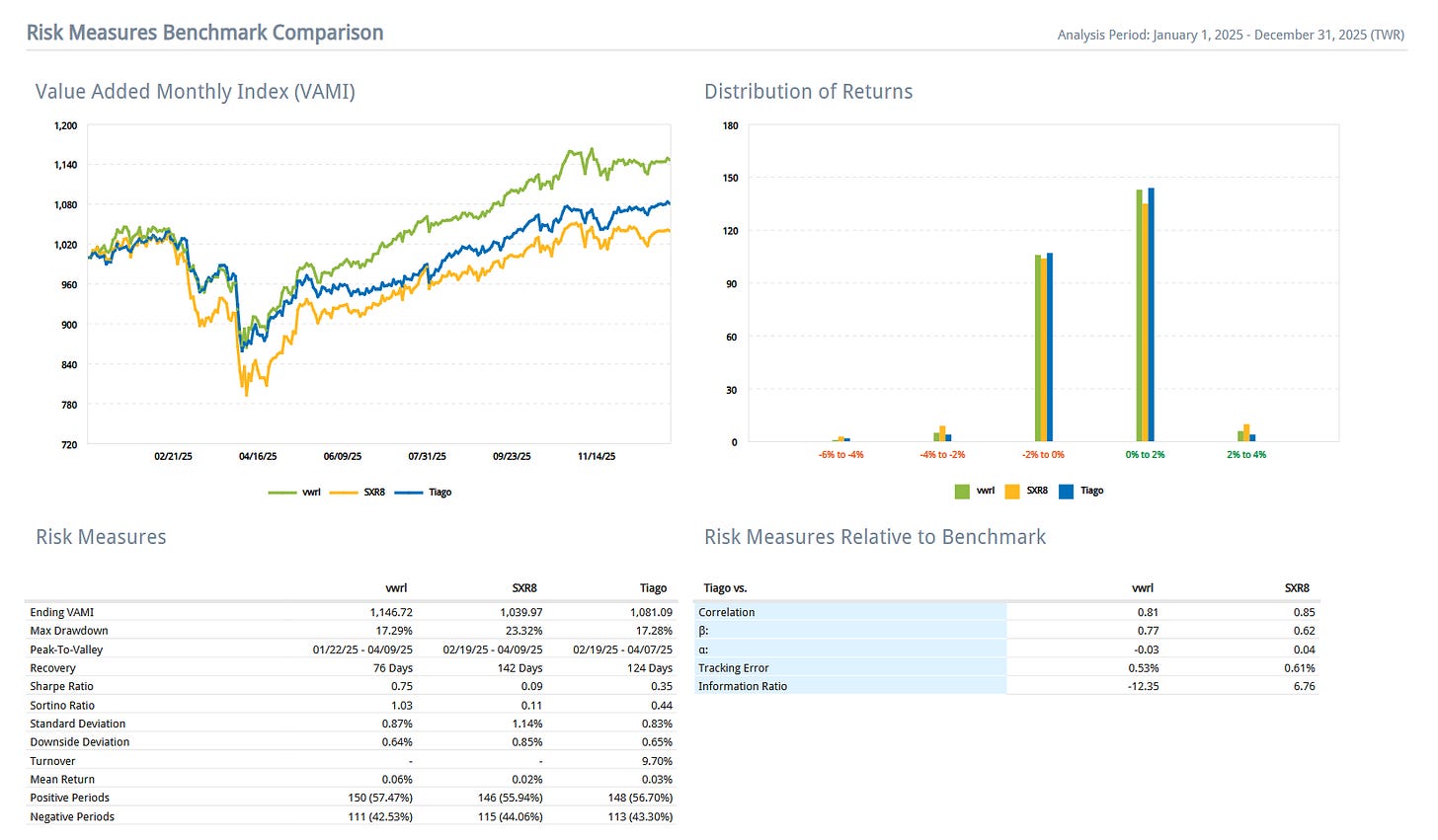

Of course none of this matters without a review of the benchmarks, and the risk taking.

Here is the data since inception:

And for the past year:

Neither of them are particularly different from the indexes that make up the majority of my portfolio for obvious reasons.

That said I am satisfied with the returns I’ve received.

My Goals

Looking back at 2024 I had 3 goals:

3000€ in dividends received

Reverse the under-performance vs my benchmark

Reduce the number of positions in the portfolio

I achieved 2 of them, and only slightly failed in the “reverse under-performance” part.

In fact given that a significant part of that under-performance actually came from the S&P500 ETF I hold…

Going forward I will continue to trawl through Japanese stocks (I’m looking into an interesting one!) and focus on my family for the next year.

For 2026 I will:

Maintain my existing dividend level

Outperform VWCE

Add at least one more position to the portfolio

Conclusion

Once again, I sleep well at night, the portfolio is on track and I’m happy with it.

See next time!